As a business owner, managing your finances efficiently is crucial to the success and growth of your venture. That’s why today, we’re diving into the world of free business checking accounts in this Relay banking account review.

Specifically, we want to focus on online platforms that offer cost-effective solutions.

One such platform that has caught the attention of profit strategist and financial literacy coach, Jamie Trull, is Relay business checking.

In this review, we’ll explore the features that make Relay stand out (phone support, separate accounts, Relay’s mobile app, and more!)

And why it might be the perfect fit for your business banking needs.

Disclaimer:

This blog post contains affiliate links and special promotional offers, and by using Jamie Trull’s affiliate link to sign up for a Relay business account, you not only get access to special deals but also support her in creating more valuable content for small business owners.

Rest assured that this review is based on personal experiences and honest opinions about Relay‘s features and benefits.

Why A Free Business Bank Account Matters

Before we jump into the specifics of Relay, let’s discuss why opting for a free business banking account is a smart move.

If you have been listening to Jamie for a while, then you know that she emphasizes that business owners should not have to pay someone to hold onto their cash, especially when traditional banks often charge various fees.

Free business banking ensures you can keep more of your hard-earned money to reinvest in your business.

Introducing The Relay Business Checking Account – More Than Just a Bank

Relay is not your typical bank.

It’s an innovative online banking platform that partners with an FDIC-insured bank, providing the security you expect.

The platform operates more like a tech company, offering a user-friendly interface, and seamless integrations.

Plus an array of attractive features designed to simplify financial management for small business owners.

Be sure to check out some of the key features listed below or learn more about Relay here.

The Search for the Perfect Banking Platform

When Jamie looked for a banking platform that could cater to small businesses’ unique needs, she encountered Relay.

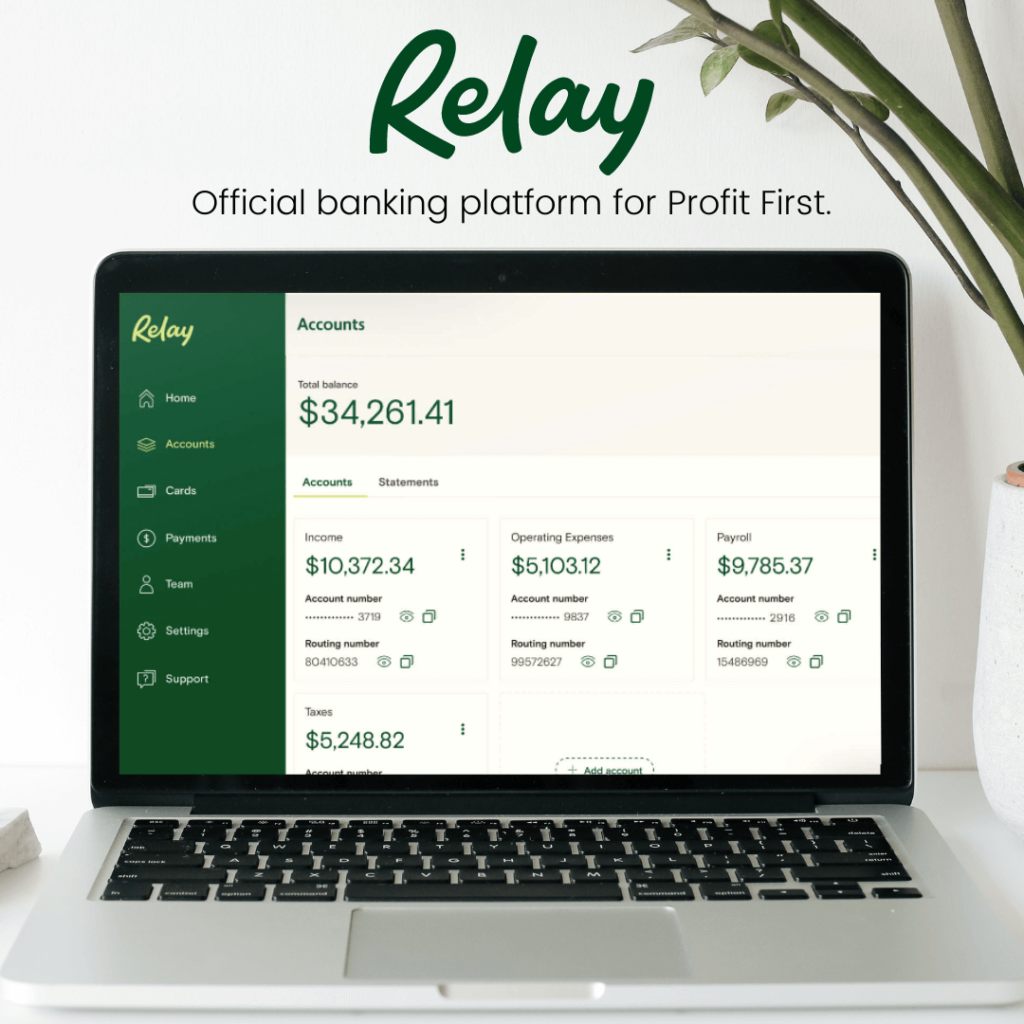

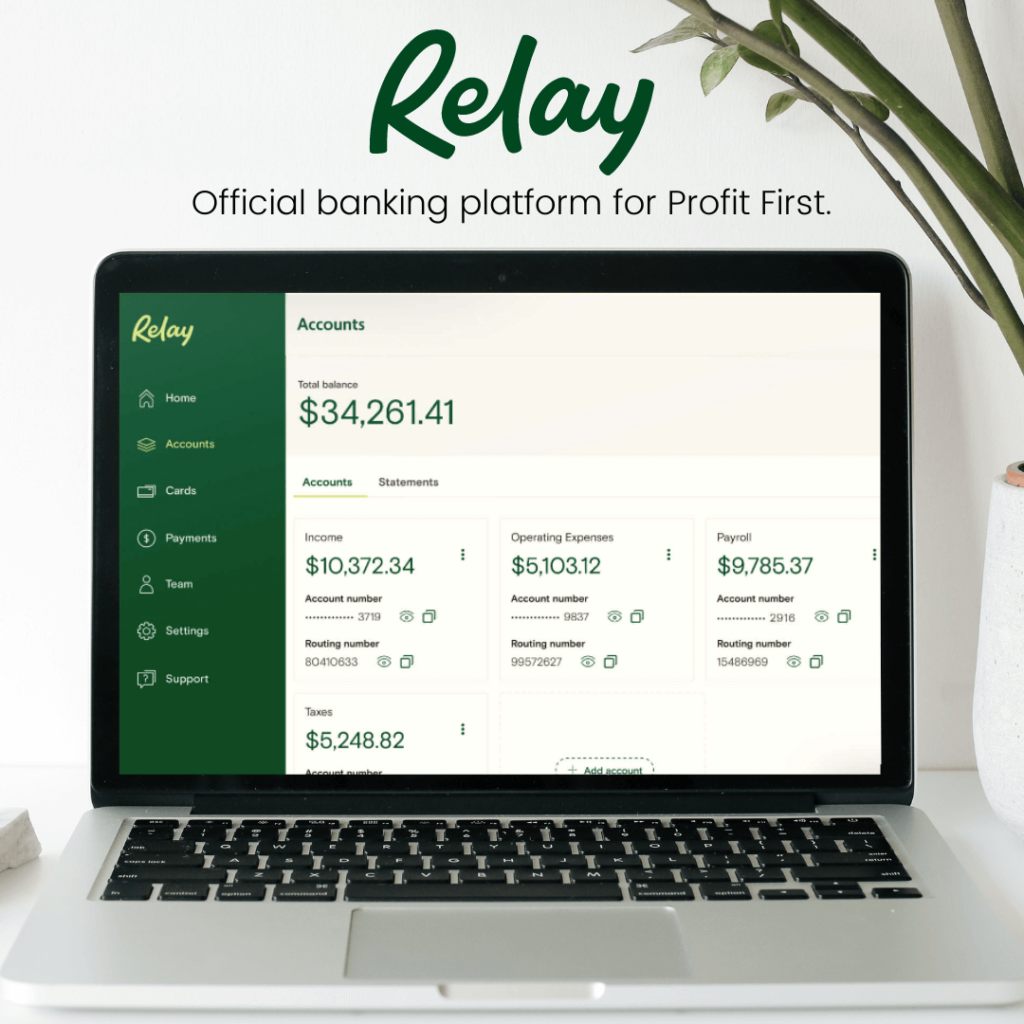

Initially, it lacked some crucial functionality, but recent updates and an official partnership with Profit First caught her attention.

Profit First is a financial management system that recommends using multiple bank accounts for various expenses.

Relay facilitates this process with ease.

Relay supports Profit First methodology with auto-transfer rules to put Profit First allocations on autopilot.

Key Features of Relay

Free and Transparent

Relay stands out for being genuinely free, with no hidden fees or minimum balance requirements.

This means you can focus on growing your business without worrying about unnecessary costs.

Customizable Account Management

A notable feature is the ability to create multiple accounts (up to 20) with unique names, numbers, and routing information.

This allows for easy separation of funds and streamlined expense management.

Auto Transfer Rules

Relay lets you automate your money management with auto-transfer rules. You can set maximum balances for specific accounts, and excess funds will be automatically moved to other accounts.

Just like the Profit First methodology encourages you to set rules.

Virtual and Physical Debit Cards

You can create up to 50 virtual or physical debit cards for various purposes. This feature enables convenient online payments.

You can also determine which account the debit card amount’s charges will draw from.

Team Member Access

If you have a team managing your finances, Relay lets you grant various permission levels to team members or external advisors.

This ensures better control over your business’s financial activities.

Signing Up for Relay

Getting started with Relay is a breeze.

Simply navigate to the Relay website using Jamie Trull’s special affiliate link to benefit from exclusive offers.

The signup process involves filling in essential business information, scanning your ID for verification, and awaiting approval (usually within 3-5 days).

However, some users have reported faster approvals, as in Jamie’s case.

When you sign up and fund your account, you can email Jamie’s team at [email protected] and claim your free gift from Jamie!

Learn more about this offer here.

Keep scrolling after this article to watch Jamie’s full video about the process of signing up for Relay business checking.

You can also click here to visit YouTube.

Why Relay Stands Out

Jamie Trull has been using Relay for several months and has been impressed with its functionality and customer service.

The platform’s integration with the AllPoint Network of ATMs also allows for easy access to cash when you need it.

Relay caters to small businesses with its array of features.

Novo, another excellent option, might be more suitable for slightly larger businesses.

Feel Empowered In Your Finances

If you’re a small business owner seeking an efficient, free banking solution that empowers you to manage your finances with ease, Relay might be the perfect fit for you.

With its customizable account management, auto transfer rules, and team member access, Relay offers an impressive array of features to streamline your financial management.

Give it a try and see how it can enhance your business’s financial efficiency.

Are you interested in exploring more free business banking account options?

Or additional online banking platforms tailored to your business needs?

Visit JamieTrull.com/banking for detailed comparisons and the latest information to help you make informed decisions about your financial management tools.

The transcript below is machine-generated and has not been edited for errors.

Hello, hello, Jamie Trull here, your favorite CPA and financial literacy coach.

And you know that I love to be constantly researching new tools that can be helpful to business owners when it comes to managing their finances.

So today we are specifically going to be talking about free business banking accounts.

Mostly those are going to be online small business banking, but they’re going to be ones that cost nothing because I do not believe that you should have to pay someone to hold onto your own cash flow.

Banks are making money off of that cash anyway, so they don’t need to be charging monthly fee from us as consumers as well.

Now, a lot of the big banks out there, you may use them for your personal banking, but a lot of times they charge for their business banking.

There may be actual fees to even have the account, or perhaps you’re paying in the form of having to keep certain minimums or have transaction limits, things like that.

What I love about these online banking platforms is that they aren’t necessarily banks per se, but they do partner with an FDIC insured bank.

Your money is FDIC insured just like any other bank. But these banking platforms function more as tech companies.

They have really great interfaces, really great integrations, lots of awesome features that you get.

I am a big fan of these banking platforms and I don’t consider them any less safe than using a big bank because again, your FDIC limits are still the same as they would be at any other bank.

So when we talk about free business banking for small businesses, what are the things that I look for?

Well in general, of course, number one, that it’s free. That it’s truly, truly free, that they’re not going to have random different monthly fees, that you’re going to end up accumulating over time, right? That it is truly free business banking.

So that is number one. I also really like the ability to be able to manage your money by separating it out into different buckets.

That is something that’s really, really important to me.

Something that exists on the personal side for a lot of different banks, but is surprisingly hard to find when it comes to business banking.

That is something that is very, very important to me. And I spent a long time a few years ago looking for a bank that would fit the bill.

Many of you have seen the content that I’ve done on the Novo Banking platform, which I still love and I still use, which has the ability to put your money into reserves.

But I have a new recommendation now for a blanking platform that I have been playing around with, and I’m ready to bring it to you and let you all know about it too.

So it is quickly vying for the top spot in my opinion, and I love some of the functionality that comes with it.

It really just depends on what you need.

But my new (almost) favorite, we’ll see, we’ll see how it plays out, is going to be the Relay Banking Platform.

Now the great thing and the reason that I really found out about Relay, I looked at it before, but previously they didn’t have some of the functionality that I was looking for, and recently they’ve added and really expanded onto that functionality and they’ve also partnered officially with Profit First.

If you are looking for a Profit First friendly banking, right, that’s not going to have a whole bunch of fees that you’re gonna be able to open actual separate bank accounts in a very easy way to manage.

I know one of the issues, and if you haven’t read Profit First is a book by Mike Michalowicz and it talks about how to manage your money in your business by using multiple different bank accounts that are for various different types of expenses in your business.

You’re basically taking it and putting it into these envelopes essentially.

And then you’re going to be spending just the amount that you have in that specific envelope.

I will put at the end of this video kind of a walkthrough of how I actually signed up. I did it in less than five minutes and I got approval the same business day.

So that was awesome. It was super painless and easy. And so I’ll show you how to walk through that at the end of this video. But really quickly, I’m gonna show you the inside.

I’ve been playing around a lot with it, so I wanna show you the inside of Relay to give you an idea of what it looks like.

Now, real quick, before we keep going here though, I do wanna tell you that if you want to check out Relay more, I would love, love, love it if you would use my affiliate link.

You can also find different bank comparisons, so if you wanna look at other banks, then you can go check that out over on JamieTrull.com/banking, and you’re gonna see special deals that you can get by using my links as well.

So definitely if you’re thinking about signing up for any of these, make sure to go through my affiliate links.

Okay, so here you can see the inside of Relay for the company that I have set up under this.

And right now I have only created one account, but I’m gonna show you that it’s super easy to create new accounts. So look here, I just went to accounts.

I’ve got my $101 that I put in here to start my account. Now I can just click add account and I can create a name for it.

Let’s say I want this to be taxes. I can create that account. And look, that bank account is already created and showing up here.

It has its own account number, its own routing number.

It is a fully separate account from my relay business checking account.

The great thing there is I can go in, I can see what’s going on over here,

I can get separate statements, separate details for this account, and I just love the ability I can move money easily between them and I can set up auto transfer rules. I love auto transfer rules.

It is already pre-programmed with all the accounts you would need for Profit First. Or you can put up your own maximum balance rule.

If you wanna set a maximum balance for one of your checking accounts, excess amounts will be automatically moved to one or more checking accounts.

There’s a lot of different things that you can do and you can customize it. So if you’re not using Profit First, but you wanna use something similar, you can use this rule.

You’re gonna enter in your auto transfers, how often you want to do it, how much you want to keep in the accounts you’re transferring from.

And look at this, you can even put where you wanna transfer excess balances to. So I love the customization of this. I love that you can put it on autopilot.

I’m a really big fan of autopilot when it comes to managing finances in general.

I just think it makes things a lot easier. And then coming over here, you know, once you’ve created all the accounts that you want and you can have up to 20, which I think is amazing as well.

When you come over here too, you’re also gonna have cards. So any account you make, you’re going to be able to get a card for.

You can also create new cards that you want for yourself or for your team, which is really neat. And you can have a physical card or just a virtual card that you can use.

That will have all the information you need to be able to make any kind of online payments that you want to do.

You can determine which account the charges on that card are going to draw from.

I think that’s super cool too.

So you don’t have to kind of play the Shell game where you’re moving cash around all the time. You can actually take the money out of the account that you’ve created for that purpose. And the other feature that I love here that is different from Novo is the fact that you can add team members.

So, this is great if you have a bigger company, if you don’t wanna be the only one who is managing the finances, if you want help, you can very easily add a new team member and there’s a lot of different permission levels, so don’t worry about, you don’t have to give them access to be able to do everything.

They can have potentially even read only access or they’re a card holder, potentially you can determine that. And same thing for any advisors, accountants, things like that.

Usually for those types of people, you don’t want too many people having access to actually be transferring money. You wanna make sure that you have good controls over that.

So you know, external accountants, things like that, it may just be read only access that they have for when they’re reconciling your accounts or things like that that you don’t have to worry about sending them your bank statements every single month so that they can do your reconciliations.

They can log in and get that information themselves, which is a great time saver for you as well.

Now real quick before I sign off, I promised that I’m gonna show you how to set up this relay account.

Literally, you’re gonna see this in about two minutes. So it took very little time and although it said that it would take three to five days to determine whether or not I was approved for an account. But I got approval the same day.

Now I will say I did get a weird email after I had put in all the documentation saying that there were things that were missing from my application and I went in and nothing was missing.

So if you get that email and it, you think you put everything in, you probably did.

And even still that same day, I got approval for my account and could log in and start setting things up. So that was really exciting.

If you want to get started with this, if you’re ready for your new online business banking account, then here’s the walkthrough to get that set up again.

Go to the link from JamieTrull.com/banking and then find the Relay link to navigate there.

And you can follow along with these steps. So when you navigate it to the Relay website, you’ll notice they have a great Trustpilot score.

You can take a look down through to just see more information about it. Including the fact that you can have up to 20 individual Checking accounts, no account fees, overdraft fees or minimum balances, 50 different virtual or physical debit cards. I mean, there’s a lot of great stuff.

Definitely take a look through here to get a feel for all the benefits of Relay.

And then we’re gonna walk through exactly how to sign up. Of course, you’re gonna have to fill in some of your information here.

I’m not gonna show you mine, but then we’re gonna walk through the different steps.

You’re gonna put in your owner information.

Your type of business is gonna go in here, of course. You’re gonna put in all of your information on yourself and your personal address.

Then you’re gonna put in your business information.

So make sure that the legal business name matches up.

That’s a critical piece. Put in your EIN, your industry, your number of employees, your monthly revenue, all the information about your business.

They’re gonna use that to determine some of your limits and different things like that. When it comes to your business bank account. And then you’re gonna put in your business address. Again, make sure that matches up with all of your incorporation paperwork if you have it.

Again, if you’re a sole proprietor, then you wouldn’t have this. And then there’s gonna be a step to go through your ID and verification.

So you’re gonna actually scan this. You’re gonna be able to load your ID up so that this can really quickly verify that you are who you say you are.

And then once you’ve done that, it will send you that verification code to the phone you put on file. You’ll just put that verification code in and you are basically done.

Now you’re just going to be waiting for it to save your progress.

Then it’s gonna go to the final steps where it’s gonna tell you that your account is being reviewed.

So overall, I’ve been playing with Relay for a couple of weeks now and I really do like it now.

I don’t have a long experience with it. I’ll be sure to report back if I see any kind of drawbacks or shortcomings with it. But so far I think it’s kind of awesome and I’ve had really good experience with customer service as well.

And the other great thing about it too is that if you need access to ATMs, they have that they are a member of the All Point Network of ATMs.

Where you can go and withdraw cash or potentially even deposit cash if it is an ATM that allows that.

You could go and look and look up all points to see if there are any near you. That’s something you probably wanna know if you deal a lot in cash, but I love that, that ability too.

A lot of people avoid online banking because of this issue with cash.

They do have a solution for that. So I’m a really big fan.

Again, I love these business banking platforms, these online business banking platforms. I think that they’re a great option for small businesses that want to manage their finances with ease.

They have a lot of really cool technical things that they can do. And so I’m a big fan, so if you have questions about Relay, let me know. Again, I am playing around with this and really enjoying it so far.

If you have used Relay, please, you know, post down below and let me know. I’ve not given up on Novo. I still really like Novo as well.

I’m using that on the other side of my business and have been really, really happy with that. It’s a little bit simpler. I could see it being for maybe slightly bigger businesses.

If you have a team, Novo may be best suited if you, you know, have a pretty small business.

Maybe it’s just you or you know, up to maybe a couple of contractors or a couple of employees. But you don’t have overly complex needs.

I think Novo is great as well. And Novo allows invoicing. I have not seen Relay have as of yet: invoicing features that are built into the banking platform.

If that’s something that you need, that’s just something to know about it. Want more detailed comparison of the pros and cons? And to find the right banking solution for you?

We’ve created a comparison with the big banks or credit unions and which route you should go depending on your needs. Definitely go check out JamieTrull.com/banking.

Again, we also have special deals and things that you can get just for using our affiliate links.

It helps to support my business and I really, really, really appreciate it. This allows me to make more content and spend more time researching these awesome tools for you. If there are other tools you want me to research, let me know.

I’m always looking for ideas. So definitely put those in the comments down below as well. Thanks again so much for being here.

Want to find out more about free business banking accounts and online small business banking that’s best for you? Go check out all that information and I’ll see you next time!

*Relay Disclosure: Relay is a financial technology company, not an FDIC-insured bank. Banking services and FDIC insurance are provided through Thread Bank and Evolve Bank & Trust; Members FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.