financial literacy coach & Profit Strategist

Jamie Trull

Many business owners find themselves looking for a Quickbooks alternative for the desktop program in 2025. Understandably, this kind of big switch makes many of us nervous. It can be hard to keep up with the ever-changing world of accounting, especially if you’re using QuickBooks Desktop. So what’s happening? QuickBooks Desktop has slowly been phased […]

read now

There are a lot of great reasons to switch from QuickBooks to Xero Moving accounting systems is a critical business decision that demands accuracy, not guesswork. This guide provides the definitive, step-by-step roadmap for successfully migrating your financial data from QuickBooks Online to Xero, ensuring data integrity and a smooth transition. This process is about […]

read now

As a small business owner, you may not know about the best business banking accounts available online (for free!) And it may be tempting to use your personal bank account for your business transactions because it seems easier to get started. However, maintaining a separate business checking account offers numerous business tools and advantages. Long […]

read now

Are you the proud owner of an S Corporation? Are you wondering if you can hire your children without setting up a family management company? If you want the associated tax benefits, look no further! In this comprehensive blog post, we will delve into the specifics of hiring your family members in an S Corp. […]

read now

You might think that Quickbooks Self Employed makes sense for your business. At the onset it looks good. I mean, it’s QuickBooks brand, and it’s the cheapest option. As a self-employed business owner, I know you want to take managing your finances from complex and time-consuming to simple and fast. But there are numerous tools […]

read now

Thinking about switching payroll providers and considering OnPay Payroll? I just ran my first payroll with OnPay—for my actual business—and I’m sharing everything: what went smoothly, what surprised me, and what to double-check to avoid costly mistakes. As a CPA and small-business owner who’s used multiple payroll systems over the years, I went into this […]

read now

This Xero vs Quickbooks breakdown is for the small business owner. I’ve created a real-world, CPA-level breakdown of how these platforms feel in everyday use, what actually matters for small businesses, and what surprised me when I switched. I’ll cover interface, collaboration, bank feeds, reporting and analytics, pricing and value, support, standout features (like Xero’s […]

read now

Are you relying only on your business bank account to “do your books”? I love a good modern banking platform (I use Relay), but let’s set the record straight: banking ≠ bookkeeping. Your bank keeps score of cash moving in and out. Even basic bookkeeping tells the whole financial story. A story that includes the […]

read now

Thinking about switching software for payroll but worried it’ll be a pain? You’re not alone. In this comprehensive guide, I’m sharing exactly how I moved my business payroll over to OnPay — step by step, screen by screen — so you can see what actually happens behind the scenes. Whether you’re coming from Gusto, QuickBooks […]

read now

Wondering how much you should pay yourself as an S-Corp owner this year? You’re in the right spot. In this 2025 step-by-step guide, I’ll show you exactly how to calculate a reasonable salary the IRS will accept. And how to do it in a way that’s tax-smart, practical, and easy to document. You’ll learn: This […]

read now

If you’re contemplating S Corporation salary vs distribution and asking yourself, “Did I pay myself properly this year?”, you’re not alone. Many business owners struggle with this, especially S Corp owners who need to balance tax efficiency with IRS regulations. In this guide, we’ll dive into how to pay yourself properly, the concept of reasonable […]

read now

Thinking about switching payroll providers, but worried it’ll be a total nightmare? Same. I’ve advised countless clients on payroll, yet I still dragged my feet when it came to switching my own system. I finally decided to do it. And what I discovered surprised even me: when you choose the right partner, switching is far […]

read now

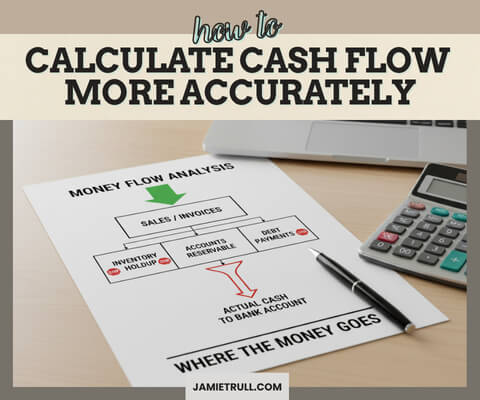

You’re booking clients. Revenue is growing. But your bank account is still whispering “nope.” If that sounds painfully familiar, you are not alone. The truth? Revenue ≠ profit, and profit ≠ cash in the bank. Until you build a simple, reliable cash management system, your business will always feel like a high-stress juggling act—no matter […]

read now

Ready to automate invoicing because you’re tired of sending invoices at midnight, chasing late payments, and wondering which clients still owe you? Thankfully, there’s a better way. Invoicing can be 90% automated with the right setup. So you spend less time billing and more time building your business. In this guide, I’ll walk you step-by-step […]

read now

Your cash flow vs profit scenario: your P&L says you’re profitable… but your bank account says “yikes.” If that sounds familiar, you’re bumping into one of the most misunderstood truths in business: profit and cash flow are not the same thing. Understanding the difference (and managing both) is the line between constant money stress and […]

read now