Are you the proud owner of an S Corporation?

Are you wondering if you can hire your children without setting up a family management company?

If you want the associated tax benefits, look no further!

In this comprehensive blog post, we will delve into the specifics of hiring your family members in an S Corp.

Plus, discuss the legalities involved.

And reveal a strategic approach that maximizes tax advantages.

By the end, you’ll have a clear understanding of how to set up a family management company.

And most importantly, set your kids up for a strong financial future.

Understanding the Benefits of Hiring Your Children in an S Corporation

With our comprehensive guide, you’ll learn seven powerful strategies to maximize your tax savings while complying with all legal requirements. Whether you already employ your children or are thinking about it, this guide will help you learn what you need to be considering to help you save more.

Before we explore the intricacies of hiring your kids in an S Corp. It’s essential to understand what an S Corporation is.

And how it differs from other entity types such as sole proprietorships or LLCs.

By electing to be taxed as an S Corp, you become an owner of the corporation. And typically pay yourself through payroll.

This structure offers significant advantages.

Only your salary is subject to Social Security and Medicare (FICA) taxes, resulting in substantial tax savings.

Hiring Your Kids in an S Corp: Navigating the Legalities

Questions often arise regarding the legality of employing minor children due to child labor laws. However, as the owner of your business, you are exempt from the minimum age requirements for child employment.

The Department of Labor recognizes this exemption for family businesses owned by parents, including those structured as S Corporations.

It’s important to ensure that the tasks assigned to your child are age-appropriate. And align with the nature of your business. Which offers them a valuable learning experience.

The Best Way to Hire Your Kids as an S Corp

Now that we know it’s legal to hire your children directly at any age. Assuming they can perform appropriate tasks within your business.

Let’s focus on the most advantageous approach.

While you can hire your child directly through your S Corp, this may not yield the maximum tax benefits. To fully optimize tax advantages, a strategic solution is to establish a family management company.

Setting Up a Family Management Company: A Strategic Move for Tax Efficiency

What exactly is a family management company, and how does it work? A family management company serves as an separate entity from your S Corp. It’s responsible for managing your child’s employment within your business.

This company, which can be an LLC or a sole proprietorship. Will allow you to pay your child without incurring Social Security, Medicare, or unemployment taxes. If they are under 18, or unemployment taxes if they are under 21.

While it involves additional steps, setting up a family management company is well worth the effort. To ensure compliance and maximize tax savings for parents.

Maximizing Tax Benefits: Unveiling the Inner Workings of a Family Management Company

To understand the workings of a family management company, imagine it as a pass-through entity. That tracks all the work performed by your child within your business.

This company keeps a meticulous log of dates, tasks, and payments related to your child’s employment. The family management company then invoices your S Corporation for these various services rendered, including any associated fees.

Once your S Corp makes the payment, the family management company disburses the funds to your child. This ensures proper allocation and minimizing tax liabilities.

Analyzing the Tax Benefits: Choosing the Right Option for Your S Corp

When considering the potential tax savings, it’s essential to compare different options. Let’s explore three scenarios.

Option A, which involves not hiring your child. And allowing the income to flow through as profit.

Option B, hiring your child directly through your S Corp; and option C, utilizing a family management company.

By examining the tax implications, you can make an informed decision that aligns with your financial goals.

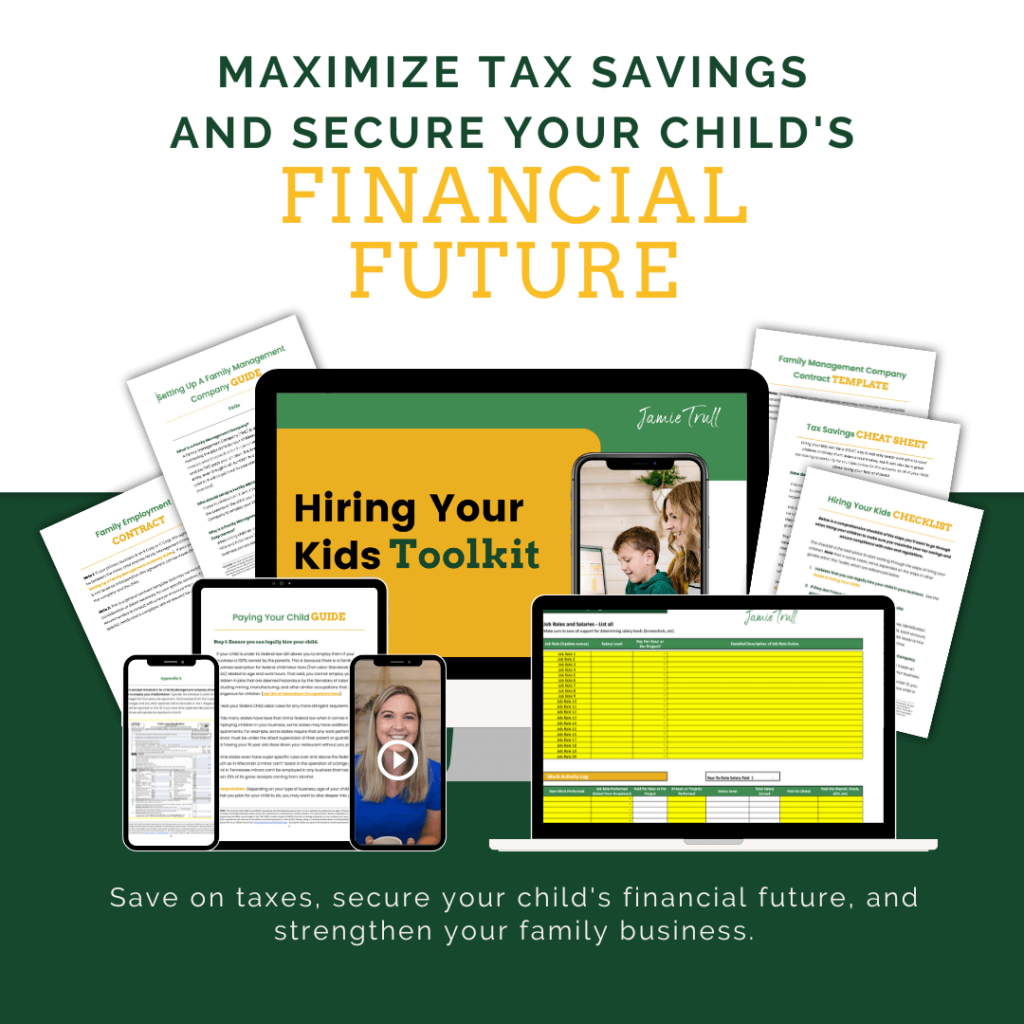

Empowering Your Financial Strategy: Introducing the Hiring Your Kids Toolkit

To guide you through the process of hiring your kids in an S Corp and setting up a family management company, we have developed the Hiring Your Kids Toolkit.

This comprehensive resource provides checklists, guides, worksheets, contract templates, and video lessons. The toolkit covers everything you need to know.

This will empower you to navigate the process with confidence and ensure compliance with legal requirements.

In conclusion, hiring your children in an S Corporation offers significant tax benefits and provides them with valuable work experience.

By establishing a family management company and following this step-by-step process, you can maximize tax savings. And set your kids up for a strong financial future.

Remember to consult the Hiring Your Kids Toolkit for comprehensive resources and guidance throughout the process.

With the right knowledge and tools, you can confidently navigate the intricacies in family life. And feel confident hiring your kids in an S Corp – while optimizing tax advantages.

Thank you for joining me in this exciting exploration of hiring your kids in an S Corp. For further information and access to the Hiring Your Kids Toolkit, visit https://jamietrull.com/kids.

Explore our other informative videos on hiring your kids, such as the myths video. Equip yourself with the knowledge to make informed financial decisions.

If you are already an S Corp or thinking about becoming one see our S Corp Toolbox and reasonable compensation reports for your business here.

The following is a direct transcript from the YouTube video and has not been edited. Please excuse any grammatical errors.

Hello. Hello everyone. Jamie Trull here, your favorite CPA and profit strategist. And today we’re gonna be talking about how to hire your kids in an S Corp. It’s important that we talk about specifically an S Corp.

Because it is a little bit different from perhaps a different entity. So if you’re a sole proprietor or an LLC who has not elected to be taxed as an S Corp, it’s a little bit more straightforward to hire your kids with an S Corp or a C Corp or potentially a partnership. It’s a little bit more complicated, but you absolutely still can do it.

I’m an S Corp. Can I Hire my Child?

So that’s the question that I get on all the time is, can I still do this? Can I still get the tax benefits? Can I still hire my minor child if I am an S-corporation?

And the answer is yes. I actually have an S-corporation myself. My primary business is an S-corporation. However, I am able to still hire my child, get all of the tax benefits and employ him.

Even though he’s only nine years old. Obviously, he does very age-appropriate work in my business. He doesn’t work a ton, but he does like to help me out.

He does come on this YouTube channel from time to time. and so I get to pay him to be able to do that. And I also get to put money into his Roth IRA that I’ve opened for him.

Because he has earned income. So I’m already setting him up for his financial future, which is an amazing thing to do. So we have lots of conversations about money.

Do you wanna check out?

A couple of weeks ago I did a video where he and I literally sat down and talked about money and financial literacy for kids.

And the conversations that I have with him. So if you’re wondering how to talk to your kid, that’s a great place to start.

What is an S-Corporation?

Now, before we get into all the specifics about how to hire your kid in your S-corporation.

Importantly, let’s talk about what an S corporation is. And why it differs a little bit from a sole proprietor or an LLC.

So when you elect to be taxed as an S corporation, that means that you essentially are now an owner of that corporation.

And you’re probably paying yourself via payroll, and you may be paying other employees as well potentially. And then you also are probably taking some form of owner draws.

Or have some profit above and beyond your payroll.

That profit, that owner draw that you’re taking is going to be taxed at a preferential rate. You are going to be saving social security and Medicare taxes on that amount.

Because only your salary is going to have those amounts taken out. So you have income taxes on all of your income, but you only have those Social security and Medicare ie FICA taxes or payroll taxes.

They’re called all different kinds of names, but it’s the same thing. You only have that on your salary, not on your owner draws if you are an S Corp. It’s different if you’re a Sole Proprietor LLC, but if you’re an S Corp, that’s how it works.

Can You Hire a Minor child?

So the other thing that we wanna talk about really quickly before we jump in just to make sure everybody’s on the same page, is whether you can even hire a minor child, meaning a child under 14 or 16 years old because of child labor laws. And the answer to that is you actually can, if you are the owner of your business, Then yes, you can employ your child to work within your business at any age. So here’s an excerpt from the Department of Labor website that says that family businesses are basically an exemption.

Now, you’re not exempt from all the child labor laws, but you are exempt at least from the minimum age requirements for a child working in your business if that business is owned by the parent, which includes S corporations. So now that we know it’s legal to hire your child at basically any age that you want to, again, assuming that they have an actual job that they are able to do in your business, which could be modeling or social media or any number of different things, cleaning your office, administrative work, there are lots and lots of different options that your child could do depending on their age and the things that they enjoy and are good at.

Check out this article to calculate whether an S Corp or an LLC makes sense for your business! ⬇️

What is the best way to hire my kids as an S Corp?

But now that we know that yes, you can hire them, it is okay to do that.

That you’re not violating any kind of federal child labor laws by doing that, we then need to talk about what the best way is to do it.

So can you hire your child directly through your S-corporation? Yeah, you can, but I wouldn’t.

And the reason that I wouldn’t is because you lose a lot of the benefit of hiring your child when you employ them directly by your S corporation.

And that is because there are certain exemptions to taxes that are available to entity types that are LLCs, not S corps or sole proprietors. Okay?

So if you’ve elected to be taxes an S-corporation or maybe you’re a C corporation, then these don’t apply to you. These exemptions for taxes don’t apply to you.

What are those exemptions for taxes? Well, I will show you directly on the IRS website.

Tax Exemptions for S Corporations

So you can see here on the IRS website, there is a whole section about children employed by their parents, and it says that if the business is a parent’s sole proprietorship or a partnership in which each partner is a parent of the child. Now sole proprietorship here also is going to include LLCs that have not elected S-corporation because those are taxed the same. So that’s important to clarify because I know that’s not always super clear when we’re talking about entity types. So in that case, it says, payments for the services of a child are subject to income tax withholding regardless of age.

We’re gonna talk about that here in a minute. But yes, they will be subject to income taxes. There are some ways around that too. But the second part is where you really wanna focus. It says, payments for services of a child under age 18 are not subject to social security and Medicare taxes.

If the child is 18 years or older, then payments for these services to this child are subject to Social security and Medicare. So if they’re under 18, no Social security and Medicare if they’re employed directly by a sole proprietorship or an L L C. And then the last one says, payments for services of a child, underage 21, are not subject to federal unemployment Act tax.

Do you know when your S corp taxes are due? #igotchu ⬇️

Deeper Dive into Taxes when you hire your kids

So that means you don’t have to pay any [inaudible] tax at all if you, your child is under 21. So the taxes they have to pay depend on their age. If they’re under 18, there are no social security, Medicare or unemployment taxes. If they’re under 21, there are no unemployment taxes. But if you keep on reading, you’re gonna see a little bit more.

So if the business is a corporation, a partnership, unless each partner is a parent of the child or an estate, then you’ll go on to read that payments for services of a child are subject to income taxes withholding.

Well, we already knew that that’s true for everybody. Social security taxes, Medicare taxes, and FUTA taxes regardless of age. So that sounds pretty dang discouraging, doesn’t it? When you read that, it sounds like uh oh. Great.

Now that I’m an S Corp, I am missing a lot of the benefits that I could have by hiring my minor child.

Tax Strategy for Hiring Your Kids as an S Corp: Benefits of Family Business Structures

But you’re in luck, my friend, because I’m going to tell you that, I won’t call it a loophole because it really isn’t. It’s a fully, fully available to anyone strategy that you can use to still employ your children legally, fully, fully, legally. And they can save on taxes.

Now, real quick to talk about income taxes, this said that yes, your child is going to have to pay income taxes or be subject to withholding for income taxes, is the way that it’s worded regardless of their age, and regardless of the fact that you are employing children legally in your own business.

However, remember that your child is going to be taxed at their rate. Your child’s income does not roll into your tax return. They have their own taxes that they would have to pay.

Now, if you are going to be paying them occasionally, right? If you’re not going to be employing them full time, which would be pretty difficult to do with a minor child, right?

Then you can pay them up to $13,850 a year with $0 in federal income tax on that. And the reason that you can do that is because that is the current standard deduction for a single filer.

So $13,850, the tax rate on that is 0%. If they make a little bit more than that, they’re only gonna be taxed on the amount that they are paid above that, and it’ll still be at a pretty low rate, probably quite a bit lower than the rate that you would have to pay on that income.

So why, yes, technically you still have income tax withholding potentially on this. In a lot of cases, your kid isn’t gonna have to pay any income tax at all on the amount that they make.

Checking Standard Deduction Amounts Annually

And remember, those standard deduction amounts change every single year. So check what it is. Just go into Google and put standard deduction, single filer 2020, whatever, 2024, 2025, whatever year you’re watching this.

And it’s gonna give you the current standard deduction amount for the IRS.

Other Taxes S Corps Pay for Employees

So that’s great for income taxes, but what about these pesky Social security, Medicare and unemployment taxes? So why is it that sole proprietorships and non corporations get to have these great benefits where their kids don’t have to pay those?

But if you have an S-corporation or a C corporation, then your kid does. That doesn’t seem really fair, does it? It’s kind of silly. I agree. But that’s just how the rules are written.

However, however, the way around this is to create a family management company.

What is a Family Management Company?

Now, this is not some kind of crazy, you know, thing that’s gonna get you audited, right? These are very, very common to create family management companies. What the heck is a family management company? Well, it’s basically an LLC or a sole proprietor that you set up that is not going to be taxed as a corporation and is going to serve as the management company.

They’re gonna manage essentially your children on payroll. So the entire purpose of that entity, it’s almost like just a holding company, and it is basically going to be responsible for managing the work that is done by your child. So you do have to go and set up a new entity for this. Again, can be a sole proprietor, it can be an LLC.

Step one of setting up a Family Management Company

You’re gonna wanna go and get an EIN and really actually create what this is. You can call it whatever you want, I call mine the Trull Management Company. So whatever you want to call it, you can call it. And ultimately, the entire role of that is going to be to manage your kid, and you as the parent are gonna be the sole owner of that.

So this is the way that you will be able to pay them. And remember, if you’re paying them from a sole proprietor or an LLC, then you don’t have social security, Medicare or unemployment taxes if they’re under 18 or you don’t have unemployment taxes if they’re under 21. And it’s really worth the extra step and the little bit of extra work if you know what you’re doing to set this up properly.

So how exactly does a family management company work?

Well, the way that that’s going to work is that it is going to track all the work done by your child. So that management company, i e you, right? Is going to keep a tracker, keep a log where you are logging everything that your kid does in your business and the amount that you’re paying them for that work and the dates that you did it and everything else.

Invoicing Services as an S Corp

And then what’s gonna happen is it’s actually going to invoice your S Corp for that amount. So again, it’s kind of like this pass-through entity.

You’ve got this entity, you set it up, you get a bank account for it, and then you invoice your S corporation in this instance for the amount that you’re gonna pay your child, plus any other fee is like potentially payroll fees if you’re paying for a payroll provider or something like that.

So you are going to invoice the S Corp, the S Corp is going to pay the family management company, and then the family management company is going to pay the child. And again, any potential other expenses that they may have related to that payroll.

Now you might be wondering, is this really worth it? I already have payroll set up for my S corporation.

Can’t I just put my kid on that payroll and make it a lot easier?

Well, let me put some numbers to this because I always think that that’s helpful to figure out whether it’s worth jumping through a few little hoops in order to do this the best way possible. So here’s what you’re gonna wanna do.

Let’s say that you have a profitable business and you’re trying to decide between option A, which is to do nothing and just not hire your kid, not pay them anything, and instead, let that money flow through as your profit and be taxed on that, right? That’s option A.

Option B is you hire your child directly through your S corporation or option C, you set up a family management company and pay your child through that.

Let’s look at option A

So let’s look at option A. Let’s just say we’re gonna use that $13,850 as an example here to say, if you were to decide to max out what you could pay your child without any taxes at all without any income taxes, that would be that 13,850, which is the standard deduction, that $13,850 if you went with option A and just let that flow through as profit in your business, depending on your effective tax rate, you would be taxed probably somewhere between five and $6,000.

Let’s look at option B

Now, let’s move to option B, which is employing your child directly through your S-corporation. If you do that, they have a 0% tax rate for income taxes, right? Because they are going to just be using that standard deduction, and they will, however, have to pay Social Security and Medicare as will you have to pay the employer portion, and you’ll also have to pay that federal unemployment.

Altogether, those taxes are going to end up being about $2,500. So still less than what it would’ve been for you, less than half actually, of what you would’ve had to pay if it was your profit, if you gave it to your kids. So that’s great. You’re already shifting that income into a lower tax bracket.

Let’s Look at Option C

However, if you go with option C and do a little bit of extra work, set up that family management company and pay them through that, that same $13,850 would be tax free assuming they were under 18. So that means $0 in taxes.

Review the Options

So option A, you’re paying five to $6,000 in taxes. Option B, you’re paying about $2,500 in taxes, or option C, you’re paying $0 and they’re paying $0 in taxes. How amazing is that?

So when you look at it that way, you could see that maybe a little bit of effort can go a very long way. Now, it probably goes without saying, but I’m gonna say it anyway, that there are a lot of things that you wanna make sure that you get right in this.

How to set up a Family Management Company Properly

And a lot of people do this the wrong way. So when you are trying to set this up, you wanna make sure that you have all the proper documentation that you need, all of the proper contracts that you need, everything you need to make sure that you are doing this by the letter of the law.

Because what you don’t want is the tax man to come in later on someday and say, you didn’t do this correctly. Now you owe me a bunch of money.

So if you wanna do this the right way, then I actually have created a whole toolkit just for people like you. It’s called the Hiring Your Kids Toolkit. We are just now launching this. It is out for pre-sale right now as I’m recording this.

About the Hiring Your Kids Toolkit

I don’t know if our pre-sales still going on when you’re watching this, but regardless, go check it out, https://jamietrull.com/kids and go see all the things that we have to offer, because within this toolkit, it’s literally the A to Z. We have checklists, we have guides, We have worksheets, we have contract templates, we got it all. There are video lessons to explain this in more detail.

And we specifically have a video lesson just for setting up a family management company and a guide just for that. And we talk about how to even go further and open up a Roth IRA for your child so that you can make them a millionaire off of only a few thousand dollars that you might be putting in. Now, I promise you, it’s possible we have a calculator in there that shows you how.

So if you wanna set your kid up for their financial future, And you wanna save on taxes, this is the perfect opportunity for you, and I want you to go grab it. Okay? I want you to go grab it so you have all the tools to do this and to do it right. Thank you so much for joining me. Go check out some of my other videos about hiring your kids, like the myths video I did last week, which is super helpful as well. And go check out the Hiring Your Kids Toolkit at https://jamietrull.com/kids which is available now. See you soon.

Frequently Asked Questions About Family Owned Businesses

Can Sole Proprietorships Hire Family Members?

Yes, sole proprietorships can indeed hire family members. Hiring family in a sole proprietorship can even lead to certain tax advantages, especially when hiring children under the age of 18. The IRS has specific guidelines on this, and understanding them can make the process smoother.

When you hire a family member in a sole proprietorship, the wages paid must be reasonable for the work performed, and standard employment practices must be followed. This includes maintaining accurate records of work performed and wages paid. It is recommended to pay payroll for a family member just like you would for any other employee of your business, and you should issue them a W-2 at the end of the year to substantiate the amounts paid.

How Are Income Taxes Impacted by a Family Business?

Family businesses can generally save on taxes if they are set up properly.

Family businesses are able to take advantage of certain deductions, credits, and strategies to minimize tax liability. For example, employing family members can lead to a deduction for reasonable wages paid, and may allow you to shift income from a higher tax bracket (yours) to a lower tax bracket (your family member, especially a child).

Understanding the specific tax implications of your family business model is crucial, and there are several “watch outs” when it comes to setting this up properly for the best tax savings. For a detailed walkthrough of how to do it, check out the Hiring Your Kids Toolkit, which has everything you need to stay compliant AND save taxes.

Do You Get a Child Tax Credit if Your Child Works in a Family-Owned Business?

The child tax credit is typically available to parents or guardians of children under 17. If your child works in a family-owned business, it doesn’t necessarily disqualify you from claiming the child tax credit, as long as other eligibility criteria are met.

What is a Family Management Company?

A Family Management Company (FMC) is a specialized legal structure that families can use to employ their children within the family business.

This is typically a structure used by S Corporations and C Corporations so that they can maximize the tax savings when hiring their children.

By creating an FMC, parents are able to provide legitimate employment opportunities for their children, complying with all relevant legal and labor requirements such as proper employment records and tax withholdings.

The structure also opens up the possibility for tax advantages, allowing families to shift income from higher to lower tax brackets, depending on how the FMC and employment agreements are structured.

In addition to the financial benefits, employing children through an FMC can serve as a valuable educational experience, teaching them about business, finance, and work ethics.

It’s important to note that setting up and managing an FMC is a complex process that often requires professional guidance to ensure legal compliance and to maximize the potential benefits.

However, if your child earns substantial income from working in the family business and therefore provides more than half of his or her own financial support during the year, it may impact your ability to claim the credit.

Note that in this context financial support considers costs such as housing, food, transportation, etc. In most cases, a child working in a family-owned business won’t impact their eligibility for the child tax credit.