Do you find starting a business overwhelming? We created a fun business structure chart to help you get more clear on your options.

With so many business entities to think about, where do you begin?

Many aspiring entrepreneurs give up on their dreams of starting their own business because they feel overwhelmed. They don’t know where to start or what steps to take next.

Don’t worry! Get the helpful information you need right here!

As an experienced entrepreneur and financial literacy coach, Jamie Trull will guide you through the process of starting your own business from scratch.

Read on to figure out what type of business is right for you, develop a plan of action, and stay on track with your goals.

Let’s explore the different types of businesses and their unique structures, so you can make an informed decision when selecting the right one for your needs.

Choosing a business structure

Common types of business structures to consider when launching your venture include:

- Sole Proprietorship

- Limited Liability Company (LLC)

- Partnerships

- Corporations (S-corp vs C-Corp)

- Nonprofit corporations

If characters from “The Office” were a business structure chart …

- Dwight Schrute represents a Sole Proprietorship – because he likes to take the lead and make all decisions on his own.

- Michael Scott personifies a Limited Liability Company (LLC). Always looking out for himself, so forming an LLC would offer him protection from personal liability.

- Jim Halpert represents a Partnership – because he is great at collaborating with others and working together towards a common goal. He even formed two partnerships on the show! (Pam and Darryl!)

- Pam Beesly could represent an S-Corporation. Pam’s organized, efficient, and creative. Plus, an S Corp would allow her to access special tax benefits.

- Oscar would make a great nonprofit organization! He cares for others and would treasure working to benefit those in need.

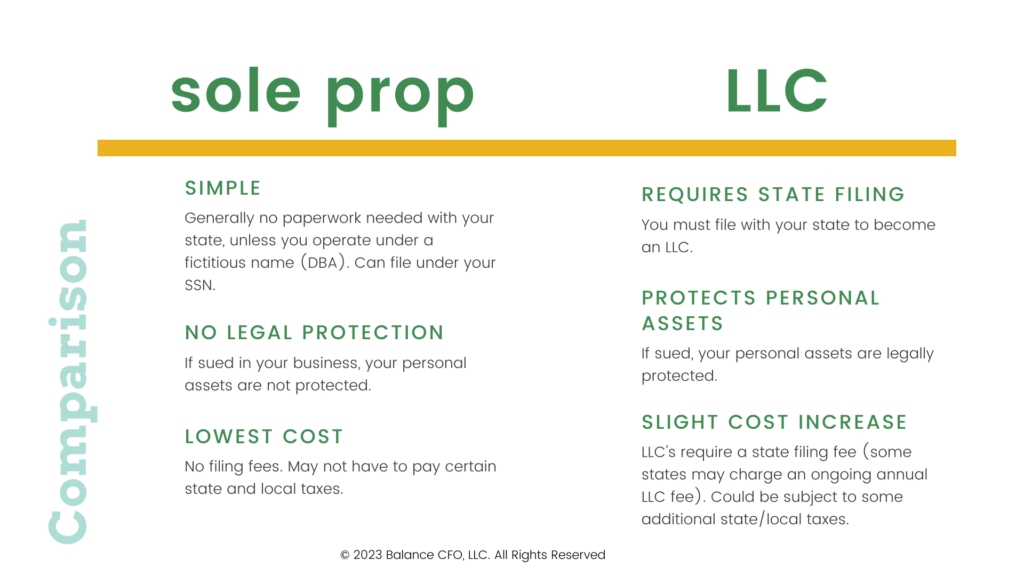

Business structure chart: Sole proprietorship vs. LLC

In this business structure chart, we compare the paperwork required, legal protection provided, and the cost associated with a sole proprietorship and an LLC.

Sole proprietorship

First, a sole proprietor: someone who owns an unincorporated business by themselves. Taxed differently than other types of businesses.

Also known as a disregarded entity. This means that the IRS does not recognize it as a separate entity from the owner.

Additionally, the owner reports all income and losses on a personal tax return.

Limited liability company llc

Next, Limited Liability Companies (LLCs): hybrid business entities. LLCs offer the liability protection of a corporation with the pass-through taxation benefits of a sole proprietorship or partnership.

This means that members of an LLC are not personally liable for debts or obligations incurred by the company and, instead, only their investment in the company is at risk.

Then, at tax time, profits and losses pass through to each member’s personal tax returns.

So, if you’re looking for flexible liability protection and a straightforward way to manage your taxes, an LLC may be just what you need!

Partnerships

A general partnership exists when you haven’t formed an LLC, but have more than one owner. A general partnership has no personal liability protection.

If you’ve formed an LLC for your partnership, you are considered to be a multi-member LLC.

In both cases, you are considered a pass-through entity and are taxed at the individual level and not the entity level.

It is recommended to have an operating agreement for a partnership or multi-member LLC to lay out the ownership structure and other important details of the relationship.

The operating agreement serves as a contract between all members. The agreement establishes the rules and regulations that govern the company’s internal operations.

Moreover, this includes outlining the management structure, addressing voting rights and responsibilities, establishing member contributions and distributions, detailing how profits will be allocated, and setting out dispute resolution processes.

S corporations

Next, when it comes to corporations, there are two main tax classifications: C Corporation and S Corporation.

C Corporations typically tend to be bigger businesses or businesses that have a lot of shareowners. If no other tax election is elected, C Corps will be subject to double taxation as they are taxed at both the Corporate and the individual level (i.e. they are not pass through entities by nature).

Both LLCs and C Corporations can elect to be taxed as an S Corporation. This helps C Corp owners avoid double taxation and can help LLC’s save money in self-employment taxes.

We focus on educating our community about S Corporations. S Corps allow business income to be reported directly on each owner’s individual tax return – thus avoiding double taxation.

S Corporations avoid self-employment taxes on any profit that exceeds their reasonable owner salary. This can save up to 15.3% in taxes on a portion of the S Corp profits.

After the 2018 Tax Cuts and Jobs Act, the calculation of tax savings as an S Corp became much more complicated with the addition of the Qualified Business Income Deduction (QBI).

It is best to get a detailed independent assessment of the potential tax savings, including the impact of the QBI deduction, before electing to be taxed as an S Corp.

Nonprofit corporations

Finally, Nonprofits don’t need to worry about paying taxes – but they do have to make sure to remain compliant with their tax classification status!

Nonprofits have a Board of Directors and not official owners, and there is no way to share in the profits of a non-profit (however you can pay yourself a salary for the role you perform in the business).

Just think: you could use your nonprofit status to help those in need and take advantage of special funding opportunities and tax benefits.

How are business debts handled under different business structures?

Depending on the legal structure of the organization, there different ways commercial debts will be handled. Here’s a general summary:

Sole proprietorship

Under a sole proprietorship, the owner and the business are regarded as one and the same, and any debts that the business accrues are the owner’s personal obligations.

All of the company’s debts and legal responsibilities are the owner’s responsibility.

Partnership

Depending on their ownership position in the company, each member in a partnership is individually liable for the debts of the company.

This means that all partners are responsible for any debts incurred by one partner.

LLC

An LLC is a distinct legal entity from its owners.

In most cases, the LLC’s members, or owners, are not held personally responsible for the obligations of the company.

Members could, however, be held personally responsible for the debts in some circumstances, such as when they directly guarantee a loan or when they commit fraud.

S-Corporation

Like a company, an S corporation has its own legal identity apart from its owners. There are a few situations in which a corporation’s shareholders may be held personally responsible for its obligations.

A shareholder could be held personally responsible for the debts, for instance, if they directly guarantee a loan or commit fraud.

To fully understand the effects of various business structures on debts, it’s always a good idea to speak with a legal expert.

It’s crucial to note that the specific rules governing corporate debts might vary by state and country

Frequently Asked Questions about business entity types:

What are the 5 most common types of businesses?

Sole Proprietorship

Partnership

Corporation

Limited Liability Company (LLC)

Non-profit Organization

What are the 4 most common types of business structures?

Sole Proprietorship

Partnership

Corporation

Limited Liability Company (LLC)

What are the three major types of businesses?

Sole Proprietorship

Partnership

Corporation

Which business structure will you choose?

Choosing the right tax classification for your business can be a difficult decision.

It’s important to research and understand the pros and cons of each option in the business structure chart before making a decision.

Ultimately, the right choice will depend on your business needs, so it’s best to seek advice from a qualified tax professional in your state.

Interested in learning more about S Corps, including how to stay compliant and when it makes sense to become one? Check out our S Corp Toolbox.