Are you currently an Azlo customer or a small business owner who is looking for the best banking online banking business account?

I, like so many small business owners, was heartbroken when we learned the news that my Azlo bank login to Azlo would no longer work.

Our dear Azlo smb banking, the free online business banking platform I had grown to love, was going to shut its doors on March 31st 2021.

That left myself and countless others in a scramble to try to find a new online banking solution for their business.

I quickly went on the hunt – researching and chatting with TONS of different banks to see if I could find another diamond in the rough.

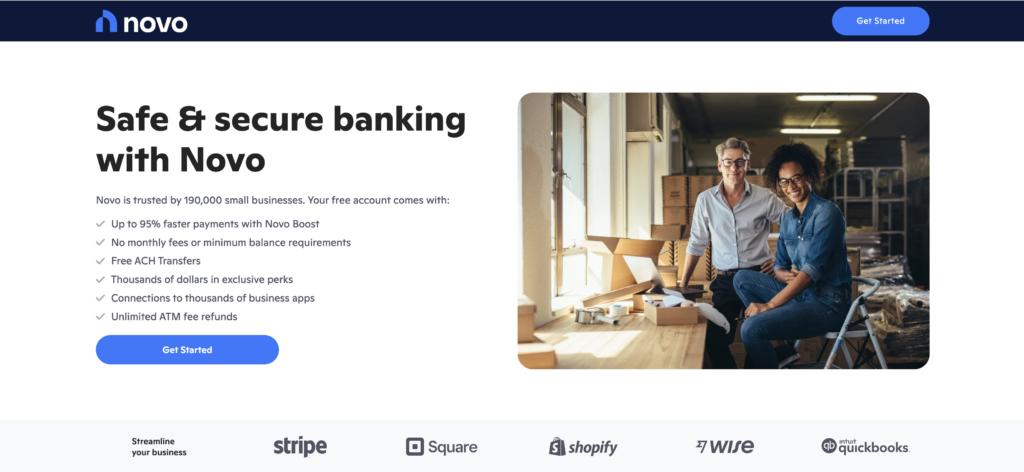

After lots of comparison shopping and over-analysis (my personal speciality), I discovered NOVO and this Profit First Bank to be the absolute best best online smb banking platform that is the most similar alternative to Azlo.

In fact, it just might even be BETTER!

But before I share my full comparison, let’s first talk about why having a business bank account is so dang important, no matter where you are on your business owning journey.

⬅️ Learn even more about the banking accounts I recommend here!

Do You Really Need a Business Bank Account?

Yes!

When it comes to banking, I 100% believe that you have to have a separate business bank account.

Even if you are a side hustler or just starting out, I want you to go get a business bank account, like today!

It is really, really important that it is actually a business “type” account (not just a second personal bank account) because transacting business transactions through a personal account goes against banking regulations (and personally, I’m not looking for my bank account to get shut down for misuse!).

That said, many people avoid using a business bank account because they do have a tendency to come with extra fees and minimums…but NOVO has solved that problem!

Now that we have gotten that out of the way, let’s talk about features.

What To look for in an Online Bank for a Small Business

First thing’s first…what does it cost?

Lots of banks have a per-account fee, or they have minimums you must keep in the bank account.

Many business owners first turn to the bank that they use for personal banking as their first stop for business banking, but the larger personal banks often also are the ones that are most likely to have lots of hidden fees and minimums.

Some even have limits to the number of transactions you can make through your business accounts, with fees assessed for going over or under the limits.

What business owner has time to monitor their bank account that closely to ensure they don’t incur extra fees?

Not me, and I’m pretty sure you don’t either.

Online banking ease of use.

Generally, there were a few questions I wanted to answer:

What is the user interface like? Do they understand online businesses and that we don’t deposit cash like traditional brick and mortar businesses?

Does it easily integrate with other apps like Quickbooks Online, Gusto, and Shopify?

Is it easy to deposit checks directly from your phone?

Who do they work with in terms of a merchant payment processing provider?

Great customer service for business banking.

I also want to make sure that they have good customer service.

When dealing with an online bank there typically are no branches you can pop in and visit – so it is important you are able to reach customer service easily via phone or email.

Best Free Online Business Bank Solution

When I got the news in January 2021 that Azlo was closing my search for the absolute best bank led me to NOVO.

Bank NOVO seemed to really tick all of those boxes of the things that I was looking for in an online business bank to replace my Azlo small business checking account….and then some!

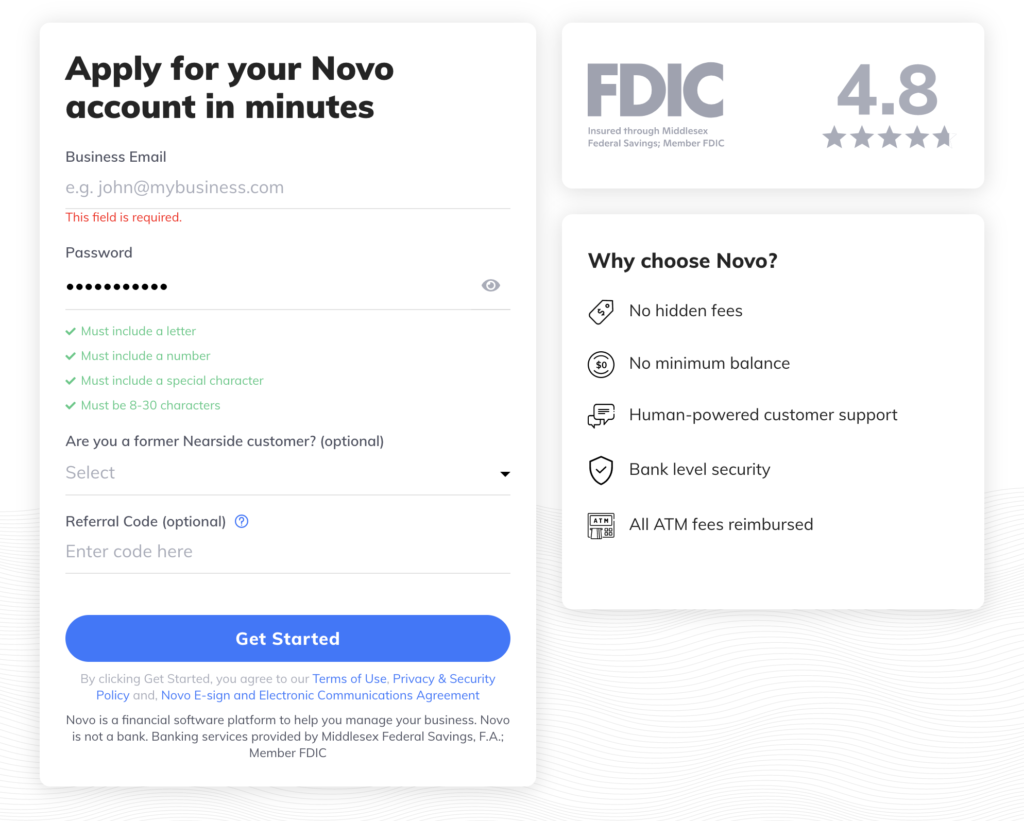

- It is free. Completely, 100% Free business checking account. No monthly service fee.

- It is simple. It took me maybe five minutes to set up an account as it was really streamlined and easy to do and all online.

- Easily deposit checks online.

- I didn’t have to pick up the phone. The few questions I had about the bank were answered lightning fast via email (over the weekend no less!)

- They have a feature where you can set aside money into a separate “Reserve”… This is HUGE for those of us who like to set aside our tax money or other business savings so that we don’t inadvertently spend it! More on that below.

Similar to Azlo, online banks do not have branches that you would go to, but you can do everything that you need to from your banking app, right?

That is another bonus with NOVO! I love the really easy interface on their app.

It integrates with QuickBooks and Gusto payroll and Square and so much more…all the things!

Azlo Account – NOVO Comparison: Business Checking Account

Top Features NOVO Offers For Business Checking Accounts

There were a couple of things that really got my attention about bank NOVO (besides no monthly maintenance fees or minimum balance requirements!) and dubbed it the best bank for me.

1. NOVO Reserve

NOVO has an envelope function similar to Azlo.

Truly, I was so excited to see these business tools!

(NOVO is the only other business banking I could find that offers this!).

In NOVO, it’s called a Reserve account and it’s actually a fairly new functionality.

At this time, they are just rolling it out in beta. I’ve been told everybody who comes over from Azlo is getting access to that ability.

Currently, I typically use a Reserve account for taxes but some people use it for saving for their business.

This is similar to having a business saving account. Which allows you to put some money aside – out of sight out of mind!

It is really useful to be able to divide that money out and not spend it within the same checking account without having to open up an entirely separate account.

I just love the Reserve functionality, I’ve already set mine up for taxes.

That’s how excited I am about that.

I’ve heard they are also hoping to roll out MULTIPLE Reserve accounts before long!

That would make all of you Profit First fans happy!

Buh-bye multiple bank accounts!

Looking for the best payroll provider for your self employed business?

⬅️ Check out my recommendations here!

2. Their customer support for your business banking account.

Another key point: I love to see good customer support in business banking.

Each Azlo business checking review was a huge selling point for me. I analyzed each azlo bank review to get insights on whether or not Azlo would fit our needs.

I emailed a number of different online banks to try to get the additional information about their business checking account offers and have a conversation with them.

As soon as I did, bank NOVO was the one that reached out fastest.

We literally went back and forth several times over the course of a couple of days. I got responses immediately.

As someone who is looking to be able to recommend a bank, I love to see a strong customer support presence.

Thankfully, I can safely say NOVO is top notch in that department.

I am already signed up for NOVO and loving it!

So much so that I’ve become a business banking partner of theirs to help spread the word!

This girl only recommend products that I use myself and love!

Just head over to Jamie Trull.com/NOVO. I hope to see you over at the best bank!

Looking for more?

Join in on the conversation in my FREE online community: Financial Literacy for Women Business Owners. Don’t let the name fool you – ALL are welcome to join. https://www.facebook.com/groups/financialliteracyforwomen

Learn about more of my favorite things for small business owners here https://jamietrull.com/jamie-s-favorite-things

Stay up to date on our latest resources and recommendations for banking platforms here.

Video Transcript

Please note that the following is a direct transcript and has not been edited for errors or omissions. It is a verbatim representation of the spoken words and may include colloquial language, grammatical errors, or other inconsistencies. We have chosen to provide the transcript in its raw form to preserve the authenticity of the conversation. We recommend cross-referencing with the original audio or video source for complete accuracy.

Hey everybody. Jamie here at your favorite financial literacy coach and profit strategist. And I wanted to do a quick video today about business banking. So I’m often asked about the things that I recommend to business owners that they use. Obviously we’re always looking for things that are a good deal and also have great functionality. So here we are.

We’re going to talk about business bank accounts, which you guys, you do want to have a business bank account. Okay. So even if you are a side hustler, even if you’re just starting out, I want you to go get a business type bank account. It is really, really important that it’s not just a personal type bank account that goes by banking regulations. Okay. So you want to make sure that you are using a business type bank account.

Now I love the kind that are free. I recommend a free business making a lot of people like to go with the bank that they use for personal banking, but personal banks, aren’t always best for business banking. Oftentimes they cost money. They might have minimums. You might have a certain number of transactions you have to have, or limit on the number of transactions you can have, or possibly even a limit on the number of transactions in an out and transfers that you can do. So I don’t like any of that.

(Btw, do you have questions about QuickBooks Desktop or looking for an alternative?) This article is for you! ⬇️

So when I’m looking for a business bank account, I’m looking for simplified, I’m looking for easy and I am looking for free. Okay. So I used to use as low. Some of you may have also been using as low.

We have just heard in January of 2021, they announced that as low as actually no longer going to exist anymore. So I went on the hunt and I went and talked to a bunch of different banks. You guys to see who would be a good fit. And what I found was the absolute best bank that was most similar to as low, and even has a few things that I like better than as low was bank Novo.

So it’s kind of similar in how it sounds too. So that was kind of interesting, but bank Novo seemed to really tick all of those boxes of the things that I was looking for. It is free. You guys is free, it is simple. It took me maybe five minutes to set up an account. It was really streamlined and easy all online.

I didn’t have to pick up the phone. I ended up to go to a branch or anything like that. It’s all online banking. So similar to as low, you’re not going to have necessarily branches that you would go to, but you can deposit checks online.

You can do everything that you need to from your banking app, right? So it has a really easy interface on the app, which I loved. And I just thought it was really easy to use. It integrates with QuickBooks and Stripe and square and all of the things that you want to see integrations with.

And a couple of other things that really got my attention about bank Novo. Okay. So number one, they also have an envelope function and that is something that I was so excited to see.

So they call it reserves and as it was called envelopes, they call it reserves.

It’s actually a fairly new functionality. So they’re right now, just rolling it out in beta. But everybody who comes over from as low is getting access to that ability. So you’re going to be able to set up a reserve account. I typically use it for taxes.

Some people use it for saving for their business, right? To have a business savings account, to put some money aside. It is really useful to be able to kind of segregate that money out and not spend it within the same account without having to open up a separate bank account to put that money into in order to not spend it. So I love the reserve functionality.

I’ve already set mine up for taxes. I’m really excited about that. Now, the other thing that I really loved about bank Novo, the second thing that I thought really put them above the rest was their customer support. I love to see good customer support. I emailed a whole bunch of different banks to try to get additional information and have a conversation with them.

Bank Novo was the one that reached out super fast. And literally we went back and forth several times over the course of a couple of days and I got responses immediately. And so for me, as someone who is looking to be able to recommend a bank, I love to see a strong customer support presence. That was something I was really excited about.

So right now, Novo has a deal specifically for as low customers that are moving over, but you may be able to even get the deal otherwise. So I want to make sure you go to my link. Go to https://jamietrull.com/novo to make sure you can get your hands on this deal. Okay. So what the deal is is that essentially for the first 90 days, you have a Novo account, everything you pay on your debit card, right? That’s all of the normal business expenses you probably already have. You will get $25 back for every thousand dollars you spend that’s two and a half percent cash back for 90 days on a debit card, a debit card, you guys, right? I think that is fantastic.

So I’m going to use it obviously to pay all of the bills that I need to pay anyway, and rack up some extra money in return, right? So who, how is that? Not, not a win-win so I am definitely already signed up for Novo. I only recommend things that I actually use, and I recommend that you do the same so that you can get in on this deal.

So again, Jamie Trull dot com forward slash Novo. And I hope to see you over there.