A business bank account online allows you to effectively manage your finances and stay agile financially.

Finding the right banking solution that offers essential features and affordability can significantly impact your bottom line.

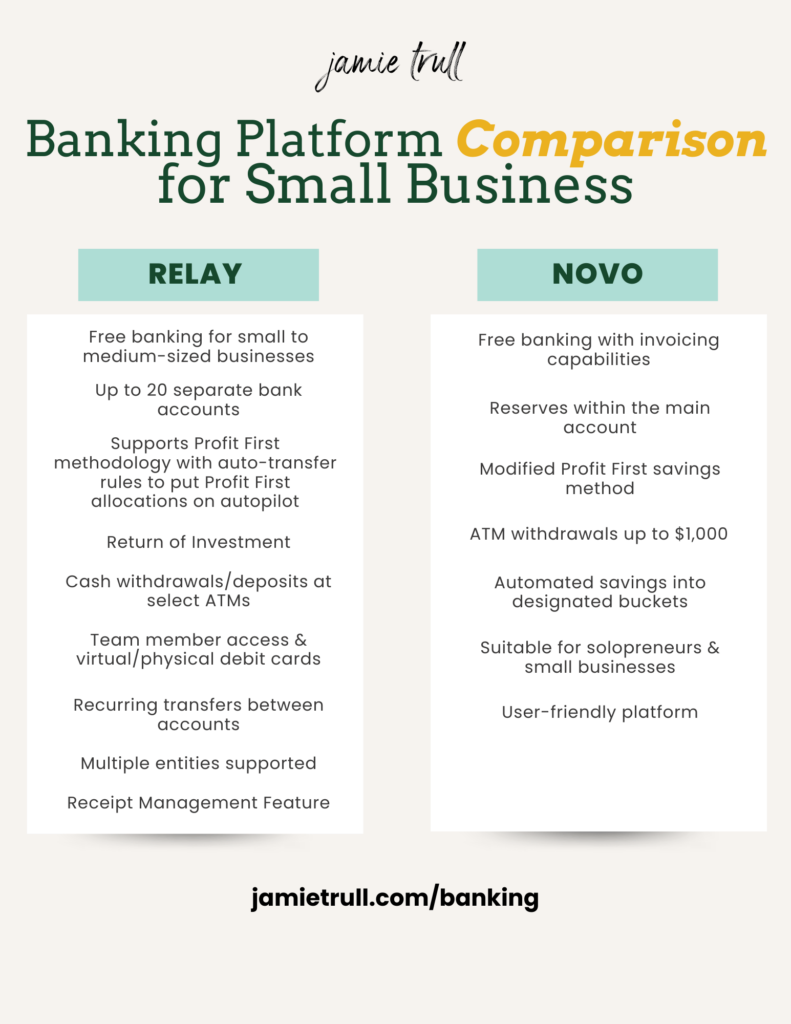

In this comprehensive guide, we will explore the top free business banking solutions – online banks like Relay and Novo – to help you make an informed decision that aligns with your specific business needs.

Whether you’re a startup, freelancer, or small business owner, read on to discover the key features, benefits, and tips for optimizing your small business banking experience with these platforms.

Benefits of Free Business Banking Solutions for Startups:

Startups often face financial constraints and need cost-effective solutions.

Free business banking platforms like Relay and Novo provide a range of benefits to support their unique needs:

Cost Savings: By opting for free business banking, startups can allocate their limited resources to other critical areas of their business, such as marketing or product development.

Essential Features: These banking solutions offer features tailored to small businesses, such as multiple bank accounts, invoicing capabilities, automated savings, and specialized tax tools.

Streamlined Financial Management: Free banking platforms provide intuitive interfaces and integration with accounting software, simplifying day-to-day financial tasks and improving efficiency.

Accessibility: With mobile banking apps and digital platforms, startups can access their business accounts, and manage finances on-the-go, increasing convenience and productivity.

Choosing the Right Free Business Banking Solution:

When selecting a banking solution for your small business, it’s essential to consider various factors.

Here are some key points to evaluate:

- Account Features: Assess the specific features offered by each platform, such as the number of bank accounts allowed, invoicing capabilities, savings automation, and tax tools. Prioritize the features that align with your business requirements.

- Transaction Fees: While these banking solutions offer free accounts, be mindful of potential transaction fees, such as ATM withdrawal fees or international transaction charges. Understanding these fees will help you make informed decisions.

- Integration Capabilities: Consider the compatibility of the banking platform with your existing accounting software or other business tools. Seamless integration can streamline financial management processes.

Comparing the Best Free Business Banking Solutions: Relay and Novo

Let’s dive into the details of each banking solution and explore their unique features and benefits.

Relay: Streamlined Banking for Small and Medium-Sized Businesses

Relay stands out as an exceptional choice for small and medium-sized businesses of any entity type.

With up to 20 separate bank accounts, Relay enables efficient cash flow segregation and bill payments.

Its support for the Profit First methodology ensures better bank balance accounting, helping businesses prioritize profit allocation.

Additionally, Relay offers cash withdrawals and deposits at select AllPoint+ ATMs nationwide, providing convenient access to funds.

With user-friendly mobile and web interfaces, robust security measures, and integration with popular accounting software, Relay empowers businesses to manage their finances effectively.

Bonus: Relay is the only official partner of Profit First, and can be used for owners with multiple businesses!

Visit Jamie.com/relay to get my partner offer AND your free gift!

After you fund your business account email our team at support@balancecfo.com for a free gift from Jamie!

Novo: Versatile Banking Solution with Invoicing Capabilities

Novo caters to businesses in need of free invoicing capabilities.

Designed for solopreneurs and small businesses, Novo’s user-friendly banking platform simplifies financial management, even for non-financial professionals.

The ability to separate funds into reserves within the main account and automate savings into designated buckets helps businesses stay on track with their financial goals.

It’s important to note that Novo allows ATM withdrawals of up to $1,000, collaborates with third-party platforms for enhanced functionality, but does not support cash deposits.

Bonus: If you spend more than your available balance, Novo will pull money from your Reserve accounts (in the order designated by you) to prevent overdraft charges.

Visit https://jamietrull.com/NOVO to see our current partner offers!

Read more about my experience with Novo!

After you fund your business account email our team at support@balancecfo.com for a free gift from Jamie Trull!

Tips for Effective Financial Management with Free Business Banking Solutions

To optimize your financial management with these free banking solutions, consider the following tips:

Utilize Multiple Bank Accounts: Take advantage of the multiple bank account feature offered by Relay to segregate funds for different purposes, such as operating expenses, taxes, or savings.

Leverage Invoicing Capabilities: If your business requires invoicing, leverage the invoicing capabilities of Novo to streamline your billing processes and ensure timely payments.

Automate Savings: Use the savings automation features provided by Novo to set aside funds for reserves, taxes, or retirement savings automatically. This will help you stay on track with your financial goals.

Integrate with Accounting Software: Connect your free banking platform with your preferred accounting software to streamline financial data management, eliminate manual entry errors, and gain real-time insights into your business finances.

Choosing the right small business checking account is crucial for small businesses aiming to optimize their financial management processes.

Relay and Novo are top contenders in this space, each offering unique features and benefits to cater to different business needs.

Evaluate your requirements, consider factors such as account features, transaction fees, and integration capabilities, and select the platform that aligns best with your business goals.

By utilizing these free banking solutions, startups and small businesses can save costs, streamline financial tasks, and improve their overall financial management efficiency.

Empower your business with the right banking solution, and take control of your finances with ease.

Please note that this blog post contains affiliate links. By clicking on these links and signing up for the mentioned online banking services and solutions, you support the maintenance of this blog at no additional cost to you.

Frequently asked questions about opening a business checking account

Can I set up a business bank account online?

Yes, you can absolutely set up a business bank account online. Many banking platforms allow this, including Relay and Novo.

You’ll likely need to verify your identity, including uploading pictures of your driver’s license or other form of identification.

For an example of how to open a business bank account online, see this video for a full walkthrough of opening an online business account with Relay.

When setting up a business bank account online, it is important to understand the minimum balance requirements associated with the account before submitting your application.

In most cases, banks will require that you maintain a specific minimum balance in order to keep your account open and continue receiving services like check writing and business debit card support.

It’s best to research these requirements ahead of time so that you’re sure you have enough funds available in order to limit any suspension of services due to lack of funds.

Once your application has been accepted online following submission, all accounts will also be subject to verification procedures including identity checks and other security measures required by law for compliance purposes prior to allowing access.

Additional documents may need signing as well if one-time requests arise during this process as part of anti-money laundering legislation or other related laws.

Once these steps have been successfully completed (which can take between 1-10 days), then full access into your new online banking portal is granted.

What bank should I use to open a business account online?

Several online banking partners exist for opening a business checking account online.

We discussed our top three recommendations in detail within the article above.

One great option is Relay. Another strong choice is Novo.

Both of these banks have the capability necessary to set up a small business checking account securely and conveniently online. However, we recommend Relay and Novo for free business banking. They are reliable options that we’ve used personally and love!

Are you ready for upcoming S Corp Tax Deadlines? Find out more ⬇️

Should I use an online bank for my small business?

Using an online bank for your small business can certainly be a viable option.

You may find that using an online bank could save you time and money in the long run.

One of the most important factors to consider when choosing an online bank? is that it is a member of the Federal Deposit Insurance Corporation (FDIC).

This insures that, in case of mishaps like cyberattacks or data breaches, up to $250,000 of customer deposits will be protected.

Not all FDIC members are eligible for this coverage. Make sure your chosen institution meets the qualifications before signing up with them.

Another thing to note about choosing an online bank is that there may be differences between traditional banking fees and those associated with their digital services.

Many banks offer free checking accounts or waived certain services if minimum balances are met. This might not necessarily apply with their internet-based counterparts.

Research any fees associated with these accounts and see if they fit within your budget before making a commitment.

Finally, check out interactive features such as bill pay options or mobile access apps available from different banks. Some have great tools which enable users to transfer funds quickly and securely without needing debit cards etc.

Others may focus more on keeping customers informed about upcoming changes in banking regulations etc., in order to best serve their interests.

Ultimately pick what works best for you!

What is the easiest bank account to open online?

When it comes to the right business checking account and selecting the best business bank account to open online, there are several important factors to consider.

Many online banking platforms take only a few minutes to sign up for, and can be activated within 1-3 days.

Recently I opened an account with Relay in under 5 minutes. My account was open and functioning the same day.

You’ll want to have all of your business information. This includes your LLC paperwork if you are an LLC, and your EIN.

The business information needs to match exactly with what your paperwork says in order to prevent delays.

Finally, you’ll likely also need to upload your social security number or another form of identification, so make sure to have that handy as well.

TLDR? Get the online banking, business checking account Cliff notes:

We compared two top free business banking solutions for startups and small businesses: Relay and Novo.

Benefits of free business banking solutions online include cost savings and essential features tailored to small businesses. Those include streamlined financial management, and accessibility through mobile apps and digital platforms.

Key factors in choosing the right banking solution: account features, transaction fees, and integration capabilities.

Relay is suitable for small and medium-sized businesses.

They support the Profit First methodology, and offers free transactions, cash withdrawals and cash deposit options at select AllPoint+ ATMs.

Novo caters to solopreneurs and small businesses. They feature free invoicing capabilities, automated savings, and a user-friendly platform. (But does not support cash deposits.)

Tips for effective financial management: utilize multiple bank accounts or reserves. Leverage invoicing capabilities, automate savings, and integrate with accounting software.

Stay up to date on our latest resources and recommendations for banking platforms at JamieTrull.com/banking.