Are you a small business owner who has been confused about bookkeeping software?

I’m Jamie Trull, CPA and financial literacy coach.

I released an informational video that discusses the reasons why someone might need bookkeeping software for their small business.

In the video, I go over what kinds of businesses may not need bookkeeping and accounting software solutions.

As well as how my profit and loss template can be used instead.

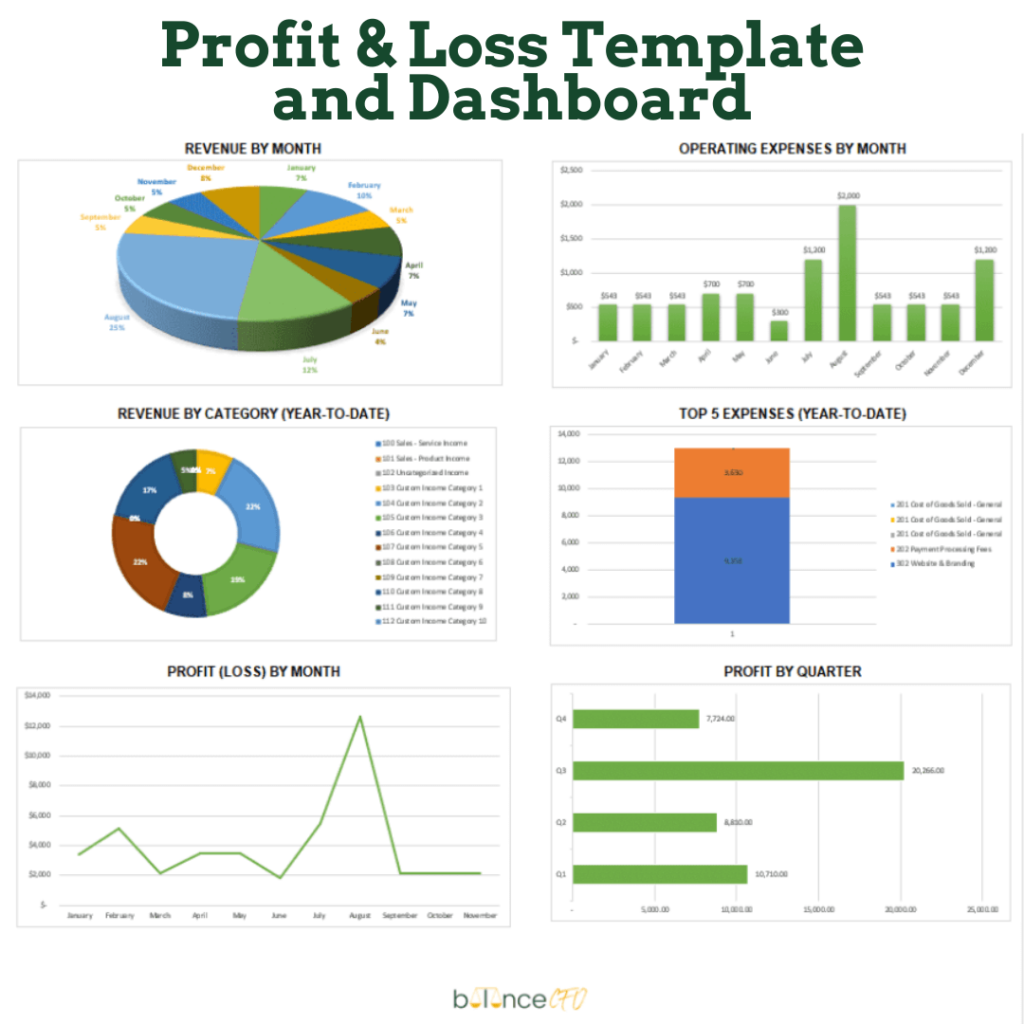

By using my Profit & Loss Spreadsheet, you’ll get easy customization along with automatically pulling data into dashboard charts and graphs to make managing a business easier.

If you do end up needing a bookkeeping system in the future, I recommend QuickBooks Online!

Head on over to jamietrull.com/profitloss now so you can start learning more about this revolutionary spreadsheet today!

Don’t forget to check out even more deals at jamietrull.com/quickbooks if needed later down the line!

Small Business Accounting Software

This transcript has been edited for readability.

Hello, hello everyone. Jamie Trull here, your favorite CPA and financial literacy coach.

And today we’re gonna be talking about whether you need bookkeeping or cloud based accounting software.

So one of the questions I get all the time from people is, do I need bookkeeping software or when do I need bookkeeping?

The best accounting software … may not be software at all!

Software isn’t always necessary.

Maybe you’ve tried a bookkeeping software before for your small business.

It felt overwhelming and had way too much in it that you didn’t actually need and weren’t using. And you felt like the learning curve was crazy.

Now, many of you know that I do advocate for QuickBooks online.

I do love QuickBooks online, but there are instances where you may not need something like that and there may be a better solution for you.

And I’m gonna tell you what that solution is at the end.

Online Accounting Software for small businesses: why you need the best accounting software.

First I want to talk about when you actually do need a bookkeeping software.

Then I’m gonna give you some of the circumstances in which maybe you don’t.

I’ll give you some cheaper alternatives than paying for a monthly software fee.

That may be better suited for you and your business right now.

Okay, so let’s quickly jump into some of the scenarios in which you really do need a bookkeeping software system.

So you can determine if this applies to you or not.

The first reason you would need a bookkeeping software: you are an S Corp or a C Corp.

Why?

Because if you are an S Corp or a C Corp, you don’t want to just be using a spreadsheet or something like that to track your finances.

You need to be doing double entry bookkeeping.

And what that means is that you are also not just having a P&L, but you are having a balance sheet that is being created by the transactions that are occurring in that software.

You need a balance sheet for your business.

So that’s one of the things that’s really hard to create on our own is a balance sheet.

That’s where a software can come in handy because it’s gonna track your equity balances, which is necessary.

Again, you have to track the basics when you are a corporation.

So there are some additional things like that.

You can’t just track a P&L if you are those entity types.

Are you ready for upcoming S Corp Tax Deadlines?

⬅️ Get all the info you need here!

You depreciate assets.

Now the second reason that you would need a bookkeeping software of some kind is if you have assets that you depreciate.

Again, that’s the situation in which you need to have a balance sheet.

So if you have assets like large assets that you’ve purchased machinery, maybe you have a car that is actually in the name of your business, maybe you have some high dollar technical equipment.

If you are putting on your balance sheet, i.e, it is an asset and you are depreciating it over time for taxes, then yes, a software is gonna be best suited for you because it can track all of that really detailed.

Tracking the accrual method with manual data entry is hard.

That is a hard thing to be tracking manually and you probably don’t wanna go down that route.

The third reason that you would wanna be using a bookkeeping software is if you use the accrual method of accounting.

What does that mean?

Well, the accrual method of accounting, you would know, first of all if you use the accrual method.

If you aren’t sure, you probably use the cash method of accounting, which means that your income is recognized when you get the cash and your expenses are recognized when you pay the cash.

You need to keep track of money that you owe and money that people owe you.

So you don’t have to worry about accounts receivable, accounts payable as far as your accounting goes.

So if you do have to track accounts payable, accounts receivable, and that is your method of accounting that you’re using for tax purposes for the accrual basis, then yes, a software is probably gonna be the best bet for you.

You owe money (debts) or need inventory management.

Number four, if you have debt or inventory, software is going to be best for you as well.

Now, I’m not talking about small amounts of inventory that you can kind of manually handle.

But if you are an inventory based business, then you are probably going to want to have a software that can help you with that and then integrate with your accounting software to make things easier.

[That also goes if] you have any kind of debt or other liabilities.

Again, that’s a reason that you would need to have a balance sheet that it would show up on.

So inventory is an asset on your balance sheet. Debt is a liability on your balance sheet.

So if you have anything that really needs to be tracked on a balance sheet, then you’re gonna wanna use some form of accounting software to track that.

You have a large volume of transactions.

Now, the next reason that you probably are gonna wanna software is if you have a large volume of transactions.

Manual tracking via a spreadsheet can work if you don’t have tons and tons of transactions.

If you’re making hundreds of sales in a month or have tons and tons of different expenses, then it’s gonna make sense to have a software system.

[It will] help you by automating a lot of that work by being able to create rules and take a lot of the manual effort out of it.

You process sales tax transactions.

And the next reason is kind of related, but it’s more related to the complexity of your business.

If your business has any complex types of transactions like sales tax or anything like that, that could be a reason that you would wanna have a software to help you track all of that.

So if there’s anything that’s a little bit more complex about your business, then a bookkeeping software’s really gonna help you in that case.

You have employees with W-2s.

And the last reason that you may wanna use a bookkeeping software is if you have employees.

Now, that’s not necessary, but I do find it a lot easier [to use accounting software] if you have employees.

That means that your business has some level of complexity to it.

So it may be best to be tracking that in a more formalized system like a bookkeeping software.

Now that one’s not exactly a requirement, but I do find that it is helpful if you are a business that has actual employees, W2 employees.

You probably do wanna have a bookkeeping software that you can integrate with your payroll processor, that’ll just make things a lot easier on you.

Why you might not need small business accounting software

Now, let’s talk about when you might not need a bookkeeping software.

And as an accountant, you know, obviously I am a proponent of bookkeeping softwares, but there are instances where it really might be overkill.

Your small business is new.

So first of all, in the very beginning of your business, you probably don’t need to get started immediately with software.

You can, but for instance, if it’s just you doing some service work for some clients, you may be able to get by just tracking that really closely and having a system to track it.

You need the basics, but not advanced features.

Figure out what your needs are first.

Then you can find a system that’s gonna work for it down the line. Once you have grown a bit.

And scaled a bit and really need to have something a little bit more complex.

You have low sales volume.

Another reason that you may not need a bookkeeping software is if you have really low volume.

Maybe you only make a couple of sales a month and they’re really easy to track on your own and you don’t have a lot of other things going on that you need to track.

That might be absolutely fine to track in a more manual way and avoid that recurring cost every single month for a bookkeeping software.

Your accounting services needs are simple.

Another reason you might not need a bookkeeping software is if your business just isn’t very complex.

[A] solopreneur doing some service work [doesn’t] have a lot of these complexities that other businesses do.

It definitely might be overkill to have a system with all these bells and whistles that you’re never gonna use.

You don’t wanna learn about [those accounting tasks] and just feel confused.

So that could absolutely be a reason that you don’t need to go the route of a software.

You’re not comfortable with accounting software as an accounting solution.

And finally, this is a good reason to mention as well, if you are just not a software person.

If you know it’s not for you, if you find them confusing, if you know you won’t keep up with it.

If you don’t wanna dedicate the time to learning the system or that’s just not how your brain works, don’t do it.

Just because other people are doing it doesn’t mean you have to do it that way.

And again, as long as you don’t have some of these more complex needs, you can do it your own way for as long as you want to.

The best way to track inventory, sales and finances without accounting software.

So if that’s you, what’s the best way to track without using expensive bookkeeping software?

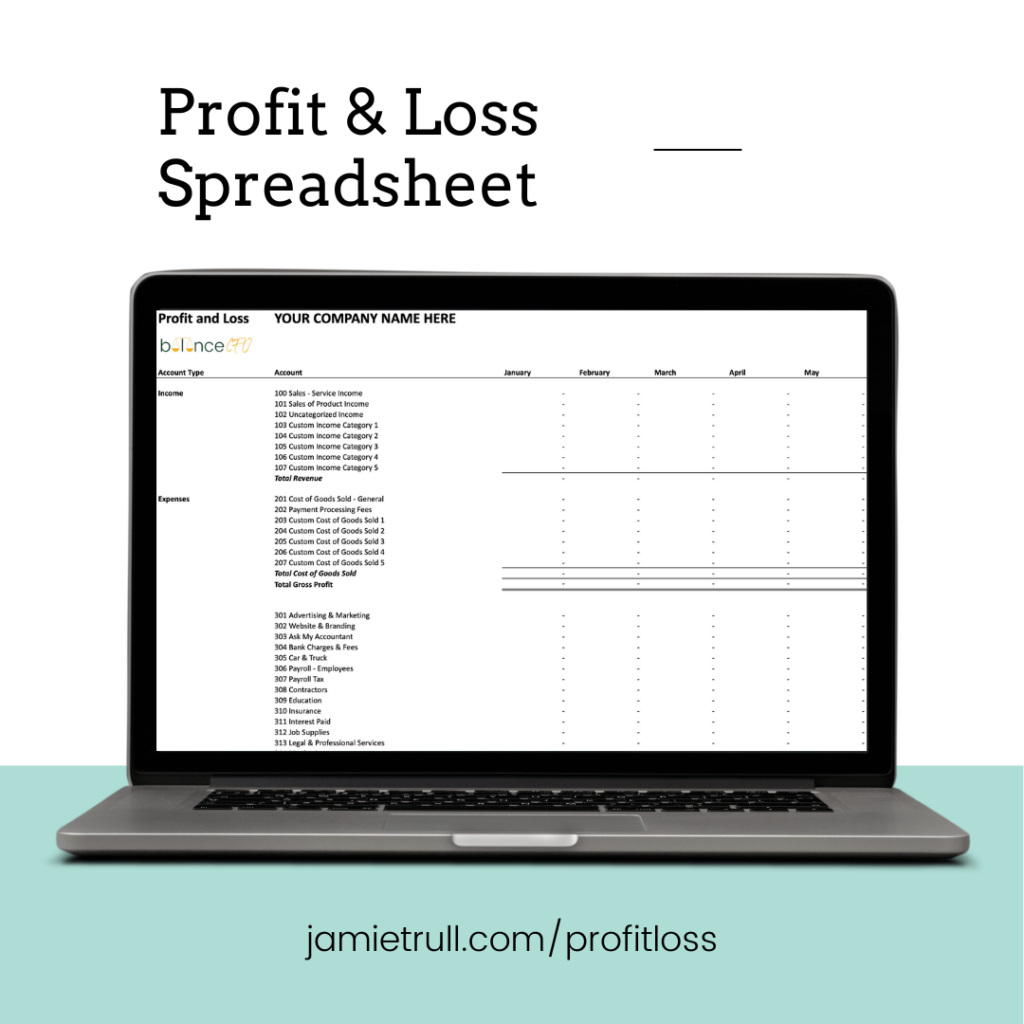

Well, turns out I made something for you.

So I’ve been working on this for a while. I’ve been asked for this over and over again.

I’ve made income and expense tracking easy for you.

I have had a version of this, but I actually increased it and made it way more valuable!

Track your income and expenses and create a P&L for tax time that your tax preparer is going to love you for!

You’re also gonna have a dashboard to see some of those really important metrics in your business and to be able to keep an eye on what is going on.

Bookkeeping is not just for tax time!

I’m a really big proponent that the reason that we are doing our bookkeeping is not just for taxes.

In fact, that’s the second reason to be doing bookkeeping.

We don’t always think about it that way.

But the first reason is because that is a treasure trove of data about what is going on in your business.

[Bookkeeping] gives you information about what you might need to tweak, how things are going, and all of the important other financial reporting aspects you need to be keeping tabs on.

Get my accounting solution template for small businesses.

So that was why it was really important to me to go ahead and integrate this into a template that you can get for a low cost.

This is not a recurring subscription.

You buy it one time and it is yours to keep forever.

No more cloud-based softwares that forces you to pay a monthly fee that racks up over the years.

An accounting spreadsheet (one-time fee!) for less than two months of accounting software options.

Take control of your business finances with my P&L spreadsheet!

This is a one time fee that is less than the cost of even a couple of months of one of these softwares.

So go check it out, JamieTrull.com/profitandloss.

I’m gonna pull it up really quickly here just so that you can see it.

And see if this is something that you would want for your business and would work for you.

I’m gonna show you a little bit of the functionality really quickly here.

An included P&L dashboard with the template.

Okay, so right now I am in the P&L dashboard that is within this P&L template.

And you can see it’s gonna show you lots of awesome charts and graphs, and these are automatic, these are gonna be automatically created based on the data that you put in.

So you’re gonna be able to easily see things like your revenue by category, your top expenses, operating expenses by month, revenue by month, and lots of things about profit as well.

Get a quick snapshot of your most important accounting tasks

So this is really gonna give you a quick snapshot into the most important things about your business.

Simply based on the data that you already put in.

It’s also gonna create for you a summary P&L.

So this is gonna give you a P&L by month.

You’re also going to be able to get your p and L for the full year to date.

Ready for you when it’s tax time!

So that’s going to be really useful when it comes tax time.

And you’re also going to be really easily able to compare your performance for month-over-month.

So if you take a look down, you’re gonna be able to see all your expenses.

Easy view what operating income was and have all of that really easy to see.

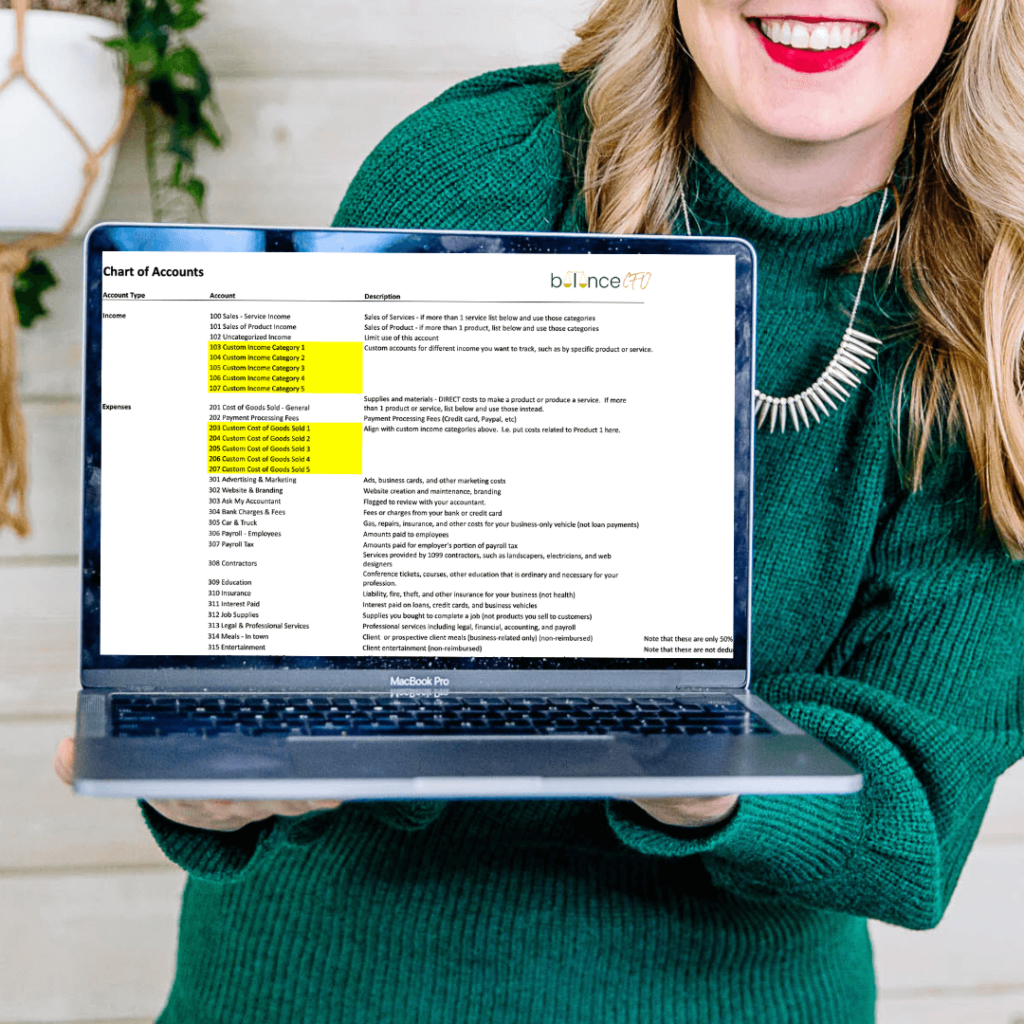

And the great thing is you can totally customize your chart of accounts.

You can make it whatever you want.

Easily customize your chart of accounts.

You can add in custom income categories or custom goods sold or custom expenses to make sure that you can track everything that you need to separately track.

And it’s really easy.

There is a video that’s going to show you how to use this and how to input everything.

But basically you are gonna input this.

A video walkthrough is included to walk you through the accounting features.

We will show you how to do it from just downloading a CSV file from your bank.

Or, from actually just keying in the information on each individual tab for your income and expenses for that month.

And then everything will automatically pull into the summary p and l.

So you’re gonna be able to choose the categories based on the ones that you put into the chart of accounts.

Everything is going to automatically pull in here and then create your dashboard for you.

A one-time cost to replace unnecessary small business accounting software!

So again, this is a one time cost for you, and you will have all of your information at your fingertips in order to make the best decisions for your business.

Be totally ready for tax time.

What if I realized I need the best accounting software for small businesses that’s available?

Now, if you watch this video and realize, actually, maybe I do need software, because of your entity type or the complexity of your business.

I want to tell you that I do recommend QuickBooks online and you can go and check out all of the different deals that I’ve negotiated specifically with QuickBooks.

They’re the best deals you can find at JamieTrull.com/Quickbooks.

Now, importantly, if you go the route of a software, definitely use QuickBooks online and not something like QuickBooks Self-Employed.

I have a whole video about why I don’t recommend QuickBooks self-employed.

But to boil it down, QuickBooks Self Employed won’t give you the functionality that you need.

If some of those things in the beginning of this video applied to you, there’s no balance sheet, there’s no double entry accounting.

It’s a glorified spreadsheet that doesn’t even have some of the capabilities of this spreadsheet here.

Like customizing your chart of accounts – and you’re gonna have to pay for it every single month.

Ready to get the best accounting solution for your small business?

Better to get a one-time cost for an awesome spreadsheet that you can use for your business that is more customizable.

Versus something like QuickBooks Self-Employed.

So thanks for being here.

Again, go check out I’ve got some deals specifically right now as I’m recording this video on my profit and loss template.

So thanks for joining me again.

Click the link on the screen right now to go check out that profit and loss template and see if it’s going to be right for you.

I will give you a whole tutorial on how to use it, and it’s super easy for any business to be able to employ.

Thanks for being here, and I hope to see you next time.

Frequently Asked Questions: Small Business Accounting Software

Do I need a bookkeeper if I use QuickBooks?

It really depends on the complexity of your business, the size and scope of your finances, and how much effort you are willing to invest in understanding bookkeeping.

If it is a smaller business or one with simple finances, then QuickBooks may be sufficient for basic bookkeeping tasks.

On the other hand, if you have a larger business with more complex finances or need additional services such as tax advice or auditing services, then it would be best to hire a professional bookkeeper who can help manage your books and provide sound financial advice.

Bookkeepers specialize in keeping up-to-date records of all financial transactions and are skilled at spotting discrepancies.

They also understand different accounting methods that may benefit businesses in certain situations such as year-end tax preparation or setting up employee payroll systems.

Furthermore, hiring an experienced professional leaves less room for mistakes due to inexperience which could result in losses down the road.

Ultimately it comes down to the type of business you run and what other support services might be needed beyond QuickBooks software capabilities.

Along with how comfortable you might feel attempting to navigate complicated financial matters yourself without help from experts.

Is bookkeeping necessary even for a small business?

Bookkeeping is absolutely necessary for any small business. It helps to keep track of the financial health of a business, as well as taxes and compliance.

Bookkeeping is essential in order to ensure accuracy throughout the entire life-cycle of financial transactions.

Keeping detailed records can help you make sound decisions for your business and plan ahead for future expenses or investments.

Additionally, bookkeepers are able to record all revenue and expenses properly so that you can accurately assess your bottom line, which in turn will be used when filing taxes each year.

Furthermore, proper bookkeeping creates an official paper trail documenting every transaction within the business from start to finish—including receipts, invoices, payments received or paid out—which serves as proof in case of an audit from the IRS.

Not only that but good bookkeeping practices also allow small businesses access to credit lines they may need down the road at banks or other lenders if their cash flow becomes strained during times of growth or slow sales; without accurate books detailing income/expenses it will be almost impossible for most lenders to offer a loan due to lack of trustworthiness regarding one’s finances.

A common mistake among small businesses is trying to do their own books themselves.

however this often leads them into more problems due to lack experience with accounting rules and regulations they may not know about unless continually updated on such topics via professional development courses (ex: tax law changes).

Therefore it’s highly recommended that even smaller sized companies consult with an accountant who specializes in providing specific services like payroll management and tax filing preparation instead since this ensures everything is done correctly while saving time and money freeing up resources needed elsewhere by leaving such crucial tasks in professionals hands when time allows.

By having reliable bookkeeping procedures implemented regularly within a company there won’t be any surprises later down the line due diligence has been performed upfront resulting confidence security stability run smoother operations overall no matter what size entity running!

Why do we need bookkeeping software?

Bookkeeping software is an invaluable accounting tool used for any business to manage and maintain accurate financial records.

It provides businesses with a comprehensive system for tracking and managing their income, expenses, profits, losses, assets, liabilities and other important financial aspects of their operations.

The need for bookkeeping software is especially critical in today’s technology-driven economy. Many businesses are moving away from traditional paper-based bookkeeping processes to more efficient digital methods such as online software programs or other cloud based software-based platforms.

Bookkeeping software allows businesses to monitor all of their finances more closely while reducing overhead costs associated with manual labor-intensive paperwork systems.

Bookkeeping software can also help protect your business against potential errors due to human miscalculations that could be costly when it comes time to present taxes or financial reports.

Having accurate books on hand make the task of filing taxes much easier – saving you both time and money in the long run.

Finally, bookkeeping software offers great flexibility as well as powerful analytic capabilities that allow users to dig deeper into specific transactions or look at data by category over longer periods of time than paper ledger entry permits.

Additional features such as access control protocols can also ensure greater security among those who have permissioned access – a must for businesses dealing in sensitive customer information or handling larger sums of money regularly.

In short: Yes, using bookkeeping software is often necessary for any modern business looking to succeed in an increasingly digital world.

However, if you only need a profit and loss and simple reports, my P&L Spreadsheet is the perfect fit for you!

Is it possible to do your own bookkeeping?

Yes, it is possible to do your own bookkeeping.

This involves keeping a detailed record of all the financial transactions that take place within a business or organization, which includes tracking income and expenses, as well as balancing accounts and preparing necessary tax documents.

One of the most important aspects to doing your own bookkeeping well is being organized. It’s essential to keep documents in an orderly manner so they are easy to find when needed.

You’ll also want to create a process for categorizing different types of transactions so you can easily assess where money is coming from and going out. Additionally, monitoring inventory levels and tracking customer payments goes hand-in-hand with proper bookkeeping practices.

Having the right software tools in place will help streamline the process significantly by automating data entry tasks such as inventory tracking, debit/credit transactions or generating reports for managing finances throughout the year.

Popular programs like QuickBooks or Sage Business Cloud Accounting provide features like budgeting capabilities, invoice generation, payroll processing and more that enable businesses of all sizes to efficiently manage their finances without needing specialized training for personnel members tasked with bookkeeping duties.

Regularly reconciling accounts is another crucial element for successful self-bookkeeping because it enables you to make sure everything adds up correctly on both sides – incoming monies versus outgoing expenses – while ensuring consistency between business bank accounts, statements & internal records.

Additionally, having accurate books helps build trust with vendors while providing an organized basis from which appropriate decisions can be made based on data rather than guesswork (e.g., cost savings opportunities).

Overall, doing one’s own bookkeeping takes dedication but done properly provides reliable financial data, insight & guidance that makes running a business easier overall while allowing organizations to put funds into growing their operations rather than paying an external accountant!

TLDR: High-level Summary of accounting software needs for small businesses.

In this blog article, Jamie Trull, CPA, and financial literacy coach, discusses the need for bookkeeping software in small businesses.

Reasons for needing bookkeeping software for small businesses:

- If you are an S Corp or C Corp.

- If you have assets that need depreciation.

- If you use an accrual method of accounting.

- If you have debt, inventory, or other liabilities that require tracking on a balance sheet.

- If you have a large volume of transactions.

- If your business has complex transactions like sales tax.

- If you have W2 employees (not a requirement, but helpful).

When you might not need even a free accounting software:

- If you’re starting your business and have very low volume and complexity.

- If you have low transaction volume and simple transactions.

- If you’re not a software person and don’t want to invest the time in learning a new system.

As an alternative, Jamie recommends her profit and loss template.

Find the small business P&L Template at jamietrull.com/profitloss.

Jamie demonstrates the functionality of her profit and loss template, which includes automatically pulling data, easy customization, and a dashboard with charts and graphs.

If you decide you need accounting software for your small business after watching the video, Jamie recommends QuickBooks Online (not QuickBooks Self-Employed).

You can find the best deals at jamietrull.com/quickbooks.