Yvette’s Financial Fitness Formula Success Story

Meet Yvette, the proud owner of the Law Office of Yvette Saddik Jimenez, an immigration law firm based in the vibrant city of Los Angeles, is no stranger to small business successes.

Today, Yvette shares her inspiring journey of transformation from a lawyer with little financial know-how to a financially empowered business owner.

Join us as we delve into her struggles, the turning point that led her to success, and how her encounter with Jamie’s Financial Fitness Formula™(FFF) changed her life for the better.

Facing the Challenge of Organization and Financial Clarity

Before discovering Jamie, Yvette was no stranger to business challenges.

While her law firm was afloat and income was coming in, she lacked a clear understanding of her finances.

She admitted that she wasn’t aware of some of the financial lingo and had difficulty tracking her business’s performance.

Despite being a lawyer, Yvette fell into the common misconception that lawyers weren’t supposed to handle numbers.

This hindered her from grasping the essential financial insights necessary for business success.

Small Business Success Stories: The Desire for Guidance and Empowerment

Yvette realized that she needed more than just basic financial knowledge.

She sought guidance, a mindset shift, and a supportive community to empower her journey as a business owner.

She acknowledged that running a law firm wasn’t solely about managing legal cases but also about knowing the ins and outs of business and finances.

Discovering Financial Fitness Formula™: The Turning Point

Enter Jamie’s Financial Fitness Formula™, a self-paced educational program tailored to business owners seeking a better understanding of their financials.

Yvette decided to take the leap, hoping to achieve clarity, efficiency, and profitability for her business.

Jamie’s relatable teaching style, bubbly personality, and enthusiasm for helping business owners instantly resonated with Yvette.

The program provided her with a solid foundation in financial literacy, demystifying complex terms and concepts in a way that was approachable and understandable.

Yvette appreciated Jamie’s emphasis on education, empowering business owners to take charge of their financial destinies.

The Profound Impact of Financial Fitness Formula™ for Small Business Owners

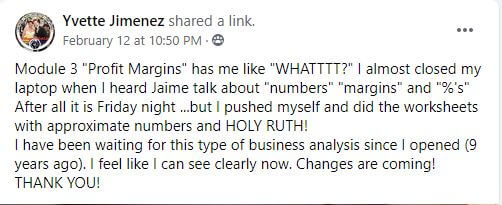

The impact of the program was transformative for Yvette.

Armed with newfound financial knowledge, she now knew how to analyze data, understand profit margins, and make data-driven decisions for her business.

As a result, she could focus on the cases she loved while ensuring they were profitable, leading to increased efficiency and better work-life balance.

Overcoming her previous mindset hurdles, Yvette learned to embrace the roles of CEO and CFO.

She embraced the understanding that she could run her business effectively without having a financial background or degree.

She felt empowered and confident, consistently growing as a business owner.

Gaining Clarity and Forecasting the Future

Yvette now had the tools to forecast her business’s future more effectively.

With accurate data at her disposal, she could make informed decisions and set specific financial goals.

The program taught her to use spreadsheets and tools within the program to evaluate her cases, resulting in a clearer focus on profitable cases that aligned with her passion.

Empowering Others and Shaping the Future of Small Businesses

The positive impact of FFF extended beyond Yvette’s business.

Armed with her newfound financial knowledge, Yvette was now better equipped to mentor others starting their own businesses.

She had become a mini financial virtuoso, providing valuable insights and guidance to aspiring entrepreneurs.

Time with Family and Achieving a Harmonious Balance

Yvette’s success story wasn’t limited to financial achievements alone.

As a mother, she now had more time to spend with her daughter, a priceless gift.

FFF enabled her to craft a harmonious balance between work and family life.

She realized that time was precious and embraced the mantra of “happy lawyer, happy client.”

Successful Business Story Conclusion

Yvette’s journey from lawyer to financially empowered business owner is a testament to the transformative power of education.

And the importance of understanding your business’s financial health.

Through Jamie’s Financial Fitness Formula™, Yvette conquered her fears, learned to analyze data, and achieved a new level of clarity and confidence in her role as a business owner.

With a thriving law firm and more time to spend with her family, Yvette embodies the true essence of a successful businesswoman.

Her story serves as a source of inspiration for aspiring entrepreneurs, reminding them that with the right guidance and determination, they too can achieve financial freedom and a harmonious work life balance.

Learn more about the program here.

Video Transcript:

This transcript has not been edited or reviewed for accuracy and may contain errors or discrepancies from the original spoken content.

The transcript is offered for informational purposes only and should not be considered a definitive record of the event. We do not guarantee the accuracy, completeness, or reliability of the information provided in this transcript. Any reliance you place on such information is therefore strictly at your own risk. All current Financial Fitness Formula™ timelines and offers can be found at jamietrull.com/fff

“Not a Numbers Girl” Type of Business Owner

I don’t come from a family that had a lot of money, so I never knew a business owner. I didn’t, you know, when I would tell my family that I would gonna, was gonna hire an accountant, they would laugh and be like, well what are they gonna count?

There’s always this joke about lawyers not knowing math or lawyers not knowing numbers.

And so I think I just fell into that. I couldn’t tell you how many hours I was working on a case. I would just give you like an approximate timeline.

It’s just not a very smart way to run a business. I was embarrassed that I didn’t know just even some of the lingo.

And so having my daughter really made me want to become more educated in my finances with my business because I really want to try to be there as much as I can.

She’s now three, they grow so fast. Financial, Fitness, Formula is for me, it’s a foundation of wealth.

She really broke down finances in a very easy way.

And after I started learning some of the words, some of the lingos profit margins, words that like, okay, I heard, but I didn’t know how it could apply to me,

Personal small business successes and emotions

I felt very empowered. I felt like, okay, I can actually figure this out.

The most positive thing that I gained out of the program was the fact that I know that I can make more money and work less.

There was these cases that I was gonna just stop doing and the reason I was gonna stop doing them is because they don’t bring in much per case.

And I always thought that me liking these cases was more of a like a charitable thing. Like in other words like I’m just so passionate about this that I don’t care if, you know, I don’t make as much money as I probably should be making.

But once I broke it down using the the spreadsheet, I realized that this, these were one of the most profitable cases in my office that was just like a explosion of my brain.

Like, oh my God, I can actually do something that I love and get paid more for it.

Now it’s like I wanna kind of shoot for opening specific types of cases. And the reason being is because there’s data behind it.

The people that I’m helping get a happy lawyer, happy lawyer, happy clients, felt like a completely different person.

Like this year when it came to my taxes, like you should have seen my emails and my conversations. I think everyone around me was like, okay, what happened to this chick?

You know, on those forms where they say relation to business or who you are, I would always just put lawyer, managing lawyer, right?

Owner.

I now put like CEO and I do it really proudly.

The money I invested was totally worth it. Totally. I do have more time now to spend with my daughter.

She’s starting preschool soon. It’s something you can’t put a price tag on.

Time is just so precious and I think just realizing time, my time is so precious.

Thank you for teaching me about numbers and, and allowing me to say that I am a a lawyer.

Numbers girl.