Running a small business comes with many tough decisions.

One of the first decisions you made was likely picking a legal business structure – and determining how to pay yourself.

Many businesses start as sole proprietorships, partnerships, or limited liability companies (LLCs).

But as the business and your profits grow, you might hear this advice:

You should become an S Corp vs. LLC to reduce your tax bill.

But is an S Corp the key to tax savings?

Let’s explore the benefits of choosing an S Corporation over an LLC to determine if it’s the best choice for you.

S Corp vs. LLC: Which is better?

Consider how an S Corp or LLC could impact your business and pay taxes.

Here’s an overview of each.

What is an LLC?

A limited liability company is a business structure allowed by state statute.

LLCs are popular because they offer limited liability protection for business owners.

If the company faces a lawsuit or other business debts or obligations, the owner’s personal assets typically aren’t at stake.

The rules for LLCs vary by state, but typically they can have an unlimited number of members, and those members can be foreign individuals as well as other business entities.

Unlike a C corporation, LLCs don’t have to maintain corporate formalities, making them attractive to smaller businesses.

Most of our community chooses between an LLC or an S corp, so we will not cover schedule c vs s corp in this blog.

What is an S Corporation?

An S Corp actually isn’t a legal business structure—it’s a tax classification allowed by the Internal Revenue Service (IRS).

Businesses structured as LLCs or C Corporations can make an election with the IRS to be treated as S Corporations for tax purposes.

The IRS caps ownership of an S Corp to 100 individuals, limits ownership to U.S. citizens, and requires that the corporation have only one class of stock

Both LLCs and S Corporations are pass-through entities. In a pass-through entity, the business doesn’t pay a corporate income tax.

Instead, profits and losses “pass-through” to the individual owners. The business owners then pay taxes on the business income on their personal income tax returns.

Pass-through taxation allows the owners to avoid double taxation faced by C Corporation shareholders, which occurs when earnings are taxed at both the corporate level and when paid out to shareholders in the form of dividends.

What are the Tax Benefits of Making an S Corp Election?

One of the main benefits of making an S Corp election is that it can result in lower self-employment taxes—the self-employed person’s version of Social Security and Medicare taxes.

LLC owners are considered self-employed. They don’t receive a paycheck, and the company doesn’t withhold income, Social Security taxes, or Medicare taxes from their pay.

Instead, they receive compensation in the form of draws.

Regardless of how much profit LLC owners take from the business, they pay income and self-employment taxes on their share of business income.

In contrast, shareholders in S Corporations are considered employees of the business and receive a paycheck with income and FICA taxes withheld.

These s-corp shareholders still pay income taxes on 100% of their share of business income, but they don’t have to pay self-employment tax on all of that income—they only pay FICA tax on their salary.

An Illustration of S Corp Taxation:

Let’s look at an example to see the potential tax benefits of making an S Corp election for a business entity.

Gillian owns a creative agency that earns $100,000 in profit.

As an LLC owner, she doesn’t pay herself a salary. Instead, she takes the whole $100,000 out in draws.

Overall, Gillian will owe $15,300 in self-employment taxes—that’s the 15.3% self-employment tax rate multiplied by her $100,000 profit.

She’ll also owe federal income taxes on those profits.

The amount she’ll owe depends on her individual tax bracket and other deductions or credits she might be eligible to claim, but for our purposes, let’s say her effective tax rate is 20%, so she owes $20,000 in income taxes.

That’s a total tax liability of $35,300.

Now, let’s assume Gillian decides to be taxed as an S Corp. Now, she can split that $100,000 profit into two buckets. So she pays herself a salary of $60,000 and takes the remaining $40,000 as a draw.

Here’s what her tax bill would look like as an S Corporation:

| Salary: $60,000 | Owner Draws: $40,000 | |

| Income Tax (20%) | $12,000 | $8,000 |

| Self-Employment Tax (15.3%) | $9,180 | |

| Total | $21,180 | $8,000 |

Now, Gillian’s total tax liability is $29,180. That’s a savings of $6,120 by making an S Corporation election! So every business can save money by being an S Corporation, right? Not so fast.

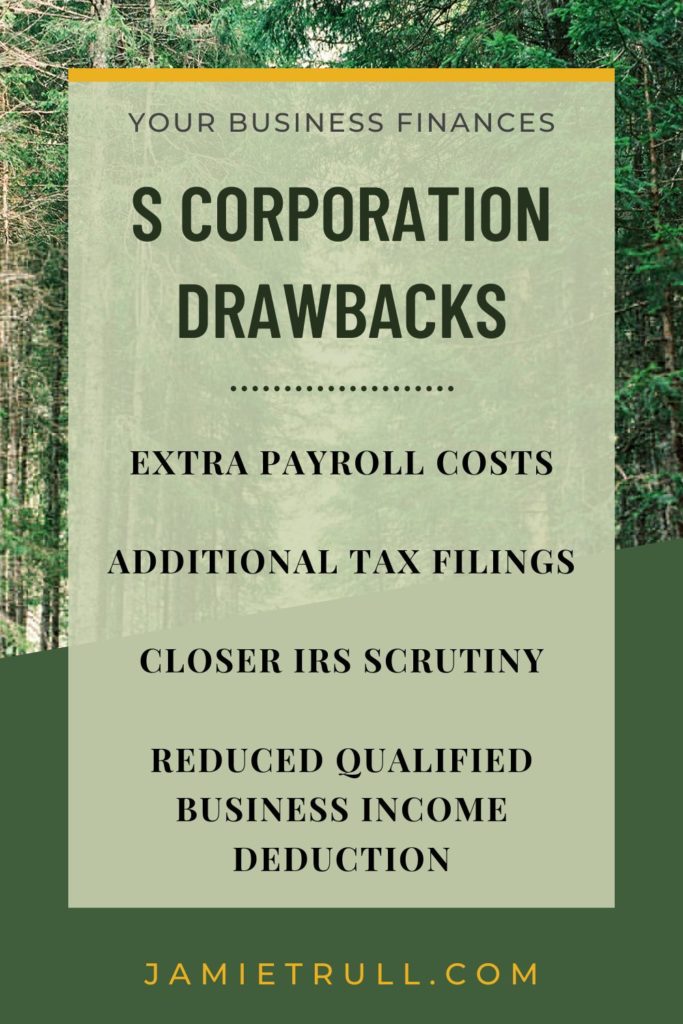

S Corporation Drawbacks

Although S Corps can result in tax savings for some business owners, there are some drawbacks.

And for many small business owners, those drawbacks outweigh the benefits.

So let’s look at some of those downsides.

Extra payroll costs

As an S Corp, you’ll have to run payroll and file quarterly payroll tax returns.

Generally, for most small business owners, this means hiring an accountant or payroll provider.

This can cost anywhere from $10 to $20 per month for one employee to a few hundred dollars per month for full-service payroll for a dozen or more employees.

Additional tax filings

A single-member LLC (one with only one owner) is a disregarded entity in the eyes of the IRS.

This means the business doesn’t file a separate tax return.

Instead, the owner reports business income and expenses on Schedule C, which gets filed with their personal tax return—the same as a sole proprietorship.

As an S Corp shareholder, however, you’ll have to file two tax returns—one for the business and one for you as an individual.

This can result in significantly higher tax preparation fees, whether you use DIY software or hire a professional.

Although S Corps can result in tax savings for some business owners, there are some drawbacks.

And for many small business owners, those drawbacks outweigh the benefits. So let’s look at some of those downsides.

Extra payroll costs

As an S Corp, you’ll have to run payroll and file quarterly payroll tax returns.

Consequently, for most small business owners, this means hiring an accountant or payroll provider.

This can cost anywhere from $10 to $20 per month for one employee to a few hundred dollars per month for full-service payroll for a dozen or more employees.

Additional tax filings

A single-member LLC (one with only one owner) is a disregarded entity in the eyes of the IRS.

This means the business doesn’t file a separate tax return.

Instead, the owner reports business income and expenses on Schedule C, which gets filed with their personal tax return—the same as a sole proprietorship.

As an S Corp shareholder, however, you’ll have to file two tax returns—one for the business and one for you as an individual.

This can result in significantly higher tax preparation fees, whether you use DIY software or hire a professional.

Reduced qualified business income deduction

The calculation above doesn’t include the qualified business income (QBI) deduction.

The QBI deduction allows owners of certain pass-through businesses to deduct 20% of their business income.

Now, calculating the QBI deduction is extremely complex, so we’re not going to go into a detailed example of how it would impact the example above.

Suffice it to say that converting part of your business profits to a salary can make an S Corp election less beneficial than it initially looks on paper.

Closer IRS scrutiny

If you can reduce self-employment tax by paying yourself a salary, why not make your salary $100 per year and take the rest in distributions?

Because that arrangement won’t pass the IRS’s “reasonable compensation” test.

The IRS doesn’t like S Corp owners who pay themselves very small salaries just to avoid self-employment taxes.

It expects S Corporation shareholders to pay themselves reasonable compensation for the work they perform.

While the IRS doesn’t have hard and fast rules about what constitutes a reasonable salary, here’s a good starting point:

Ensure your paycheck is comparable to what other employers would pay for similar services.

If your compensation is unreasonable, you might receive an IRS notice.

These notices often assess additional tax, charge underpayment penalties, and add interest to the payroll taxes you missed from setting your salary too low.

S Corporation Election Deadline

If becoming an S Corp is the right move for you, now is the time to take action.

Currently, existing LLCs and C Corporations have two months and 15 days (75 days total) after the start of the tax year to file Form 2553, Election by a Small Business Corporation, and elect S Corp status.

For calendar year taxpayers, that means you have until March 15, 2023, to make the S corp election for 2023.

LLC vs. S Corporation: Which Is Right for You?

While there are potential benefits to making an S Corporation election, it’s not right for every business owner.

Before electing to have your LLC treated as an S Corp, it’s crucial to run the numbers.

Check out our S Corp Toolbox to see if becoming an S Corporation is really the right choice for your business.

Love this topic?

Dive into Jamie’s recent YouTube video discussing the differences between S corporations and LLCs!

Youtube video transcript, edited for readability:

Hello everybody. Jamie Trull here, your favorite financial literacy coach and CPA.

And today we’re gonna be talking about one of the most common questions that I get asked when it comes to business finances.

That is, does it make sense for me to be an S Corp?

We are going to specifically talk about the differences between an LLC vs an S Corp, and talk about how in the world you will know if an S Corp truly will save you money.

Now, the reason that I really like talking about this is because if you go look out on the interweb anywhere, if you go onto social media, anytime somebody asks a question about how to save money as a business owner, how to save on taxes, the number one response that other business owners will give them typically is you should become a small business corporation.

[You might hear things like]

“You should become an S. Corp being an S Corp is amazing. It saved me so much money!”

I think that there is a lack of understanding of exactly what an S Corp is and how it saves you money.

Okay? So I wanna make sure that you go in eyes wide open and don’t just believe the hype.

Let’s make sure that we are fully educated on what all the ins and outs of this are and exactly how it could save you money.

And make sure that you have validated before making the decision to become an S Corp that it will be a good idea for you and your specific business. So, let’s jump in.

Now, first and foremost, we gotta clear up one thing: even though I talk about becoming an S Corp, what we’re really talking about is electing to be taxed as an S Corp, okay?

An S Corp is not a legal entity.

So typically you are either an LLC, right? Or you are a C corporation.

Either one of those can elect to be taxed as an S Corp.

So sole proprietorships can’t directly elect that taxation.

You would have to become an LLC to be able to do that, okay?

So we’re not gonna talk about C Corp in this video.

Most of you are probably watching this trying to understand if you should elect to be taxed as an S Corp as an LLC or not.

So let’s talk about the differences between an LLC and an LLC that elects to be taxed as an S Corp.

Now, the key to understanding whether or not an S Corp election is going to save you money is to understand exactly how you as the business owner pay yourself in each scenario.

That is where the tax savings can potentially come in.

So let’s talk about an LLC without an S election.

An LLC without an S election is going to pay taxes and pay themselves out of the profit in their business.

So profit is revenue minus expenses.

That is what essentially your paycheck is; you are able to take draws out of that amount.

Now those draws are gonna have two different types of taxes on them.

And let me just really quickly clarify the fact that even if you don’t take the money outta your business…

Let’s say you leave it in your business bank account, that profit is still taxable to you.

It is still passed through to you. [I.e. pass through taxation.]

So don’t think that,

“Okay, if I don’t take it out as draws and I just leave it in my business, in my bank account, they won’t tax me on that.”

Your taxable amount equals revenue minus expenses.

So then those owners draws that profit is going to be taxed at two different rates.

The first one is your personal income tax, and that’s when we’re talking about income tax brackets, right?

Remember, it’s kind of a graduated scale.

The more you make, the higher your taxes generally are going to be.

Now, the effective tax rate is not your top-end tax rate.

We’re not talking about those brackets, we’re talking about when you average it all together, right?

What is your actual income tax rate?

Well, effective tax rates can range a ton, but let’s put it in the 10 to 25% bucket.

That’s kind of where most Americans are going to fall.

So generally, you’re gonna have your income tax, but you’re also going to have your self-employment taxes.

That is Social Security and Medicare, and those make up 15.3%.

You’re always gonna pay 15.3% and there’s no amount of income that is not subject to that.

The interesting thing about income taxes is there’s a phase-in.

The first X amount that you make is not gonna have income taxes because of various deductions and things.

The standard deduction that you get is not true when it comes to self-employment taxes.

All of your amounts and profits made are going to be subject to this as an LLC without an S Corp election.

Now it’s time to look at the difference if you do elect to be taxed as an S Corp.

As an S Corp owner, you will still have your total profit.

You will still face taxes on all of that, whether you take it out of the business or not.

Just like if you were an LLC. It doesn’t matter.

Don’t think that you can trick the system and keep it in your business.

Your taxes include the total revenue minus expenses: total profit.

However, you’re gonna be able to take that out in two different types of ways.

So an LLC, remember, we could only take owner’s draws.

Well, when you are an S Corp, you take a salary.

You’re actually putting yourself on the payroll as an employee of your business.

So ultimately what you’re saying is “Part of what I get paid in my business is as an employee of my business.”

That’s a W2 salary.

You’re going to have taxes that are gonna be withheld on that salary just as you would if you were employing someone that wasn’t yourself.

So you come up with a reasonable salary.

Then the rest of that money gets put in the bucket that’s available for owner’s draws.

You can use this to pay yourself a dividend.

Essentially as an S Corp owner, you get paid as an employee in your business

And you’re getting paid for acting as an investor in your business.

And that’s kind of what your owner draws are.

That is why the taxes that you pay differ.

It depends on whether it’s being reasonable salary that you’re paying or its owner’s draws.

So let’s take a look at your reasonable salary side.

The amount that you’re paying to yourself as an employee of your business in W-2 wages, okay?

You are gonna pay income tax, of course, and you’re gonna pay self-employment tax.

Notice this is exactly the same as if you are an LLC.

All of your earnings would be taxed with both of these things.

Your reasonable salary, your W2 wages, they are gonna have both of those taxes as well.

However, when we come on over to the owner’s draws, the only tax you’re gonna have on owner draws is the income tax.

There is no self-employment tax on owner’s draws.

You’ll save that 15.3% on that portion that is above and beyond your reasonable salary

So ultimately you get the opportunity to split your profit up into two different buckets.

Ideally, you will save taxes on one of those buckets.

Let’s look at a quick example because I think examples really, really help to drive this home, and let’s put some real numbers in here.

Say you make a hundred thousand dollars in profit, that’s after expenses in your business, but before paying yourself.

Alright?

That’s a hundred thousand dollars that are profitable to you that you can pay out to yourself and owner draws.

Now again, let’s say that your effective income tax rate is around 20%.

(That is very much an estimate.)

Your personal income tax rate may be close to that or nowhere near that, I don’t know your specifics, but we’re gonna go with 20% just for the purposes of this discussion.

That’s $20,000 in income tax on that a hundred thousand dollars.

Now, we come over to the self-employment tax side, 15.3%, that’s $15,300, right?

So we can quickly see that in this example, this very, very, very simplified example:

You’re gonna have $35,300 in taxes that you would have to pay if you were an LLC.

So let’s see, would it make more sense maybe to be an S Corp?

Let’s do this back-of-the-envelope calculation and then I’m gonna tell you why back-of-the-envelope calculations are not my favorite and not specifically reliable.

But let me just give you an example for now.

So S Corp election example: the same 100k profit as before, but now we get to split it into two buckets.

Now you are going to have to make sure that you can support your reasonable salary

That’s really, really key.

A lot of people try to make this as low as possible, which does make sense because that means you’re gonna pay less in taxes, right?

However, you have to be careful and you wanna make sure that that amount is defensible, that truly represents what you would pay somebody else to do the work that you do in your business, which is both a science and an art.

Now, figured out what your reasonable salary is, let’s say you put $60,000 in your reasonable salary bucket, $40,000 in your owner draws bucket, and …

You’re trying to figure out exactly how much taxes you’d have to pay

Well, again, going down the left side, we’re gonna look at income tax of 20%

That’s $12,000. Just on your reasonable salary portion.

And self-employment tax of 15.3%, which is $9,180 just on that reasonable salary portion.

But that’s not all the taxes we have to pay.

So when we come over to the owner draw, we can see that the income tax, again at 20% is $8,000.

So when you add those two income taxes together, they’re the same as the income tax.

We would pay it as an LLC, you’re not gonna save anything in income taxes as an LLC

However, when we compare the self-employment tax, we can see that we actually save quite a bit: $9,180 versus $15,300!

That’s a savings of $6,120 using the back-of-the-envelope method.

So you might be looking at this and saying, well, doesn’t it make sense to pretty much always be an S Corp?

Aren’t you always going to save money on taxes?

And nope, not necessarily.

There are a lot of caveats to this. I am actually not really a fan of this back-of-the-envelope calculation from the standpoint of making the fully informed decision to become an S Corp.

And there are a lot of accountants out there and lawyers who do the calculations still like this

It’s really not giving their clients a full picture of really what the cost and benefits are.

And oh, by the way, this calculation doesn’t take a lot of different things that impact your taxes into account that could impact the determination of whether you would actually save money or not.

So a few of those things that a calculation like this does not take into account?

The qualified business income deduction.

I am sure as heck not going to be doing a full tutorial on that here because it is confusing!

(A deduction introduced back in 2018 with the passage of the Tax Cuts and Jobs Act.

So what that did at that time: introduced this crazy calculation related to qualified business income that has all these different phase-outs.

And all of these different considerations basically be able to give small business owners the opportunity to save more in taxes.

But it’s super, super complicated!

It could potentially make it where an S Corp isn’t as beneficial as it might otherwise look on paper.

Now, when accountants run this, you wanna make sure that they are using that information.

You want to ask them whether their assessment is more of a back-of-the-envelope or whether it includes the qualified business income deduction.

The other consideration that can really impact whether an S Corp makes sense for you is your retirement contributions.

If you have a retirement account that you are contributing to, it can impact what your total allowable contributions are based on the type of plan that you have.

That can also impact whether or not it makes sense to be an S Corp.

And there are lots of other things related to your personal tax situation and any other income you might make and any other deductions you might have that could influence whether an S Corp is right for you.

Sometimes we forget to talk about the fact that the self-employment tax actually does phase out after a period of time, okay?

Social security is going to phase out, so it’s not like you’re gonna pay it forever and ever and ever.

If you make over a particular amount and that amount changes every year, it’s going to phase out.

So that’s another reason that the back-of-the-envelope calculations just are not accurate.

The other things I always want to tell business owners, when they are told that S Corp is going to be the thing that will save them all the money…

Even if it’s true, which it very well could be. I’m not saying S Corp can’t save money.

It definitely can in the right situation.

But you also have to think about the trade-offs and those trade-offs are typically gonna be in the areas of compliance.

If you are in S Corp versus when you were just in LLC, now you have to run payroll for yourself, right?

And withhold taxes. Now you have an extra tax filing that you’re going to have to do.

You’re gonna have to figure out what your reasonable compensation is, and you’re gonna have to be able to defend that

To the IRS if you are audited.

So you’re gonna have to have actual documentation of how you came up with a reasonable salary because the IRS is always looking for people setting their reasonable salaries far too low.

And let me just tell you, PSA here, don’t ever set your reasonable salary to zero because that is a massive audit red flag.

A lot of the people out there who talk about saving tens of thousands of dollars as an S Corp, it might be because they’re not actually paying themselves a reasonable salary at all.

So yeah, they’re probably saving a ton on self-employment tax, but it’s also illegal.

Now, I know if you’re watching this channel, it’s because you wanna do things right.

You wanna do things right!

So I do recommend that at a certain point, probably around the time that you’re getting to 60, 70,000, $80,000 in profit in your business, it’s a really good time to start looking at this more in-depth and deciding whether or not you wanna make that tax election.

Now, I do recommend doing the election by March 15th each year.

So if you wanted to do this for 2023, you probably wanna be looking at it now, okay?

You probably wanna be deciding if you’re going to make this change, because once you make that change, now we’re talking about getting set up on payroll and all of those other compliance things that you need to do.

Now, if this sounds overwhelming, don’t run away because it definitely can be worth it for the right person.

But one of the things I’ll caution you against is taking the advice of someone who doesn’t know your specific situation and isn’t taking all of these things into account when they are advising you.

And sometimes accountants, I love my fellow accountants not to say anything bad about them, but sometimes accountants might advise you to do this sooner rather than later.

In part, because they have a little bit to be gained by you being an S Corp in terms of additional tax filing fees and running payroll for you and doing reasonable compensation reviews.

All of those things cost money.

An accountant might have something to gain by recommending S Corp status to you

So make sure that you are informed.

I’m a really big fan of business owners empowering themselves, and that’s why I have an education-based company and not a service-based company.

I kept getting asked this question: I kept getting people asking me specifically to do an analysis of their business to determine if S Corp is right for them.

I created a product where you can empower yourself with all the knowledge that you need about S Corps

So we’re gonna go even deeper here around the different compliance requirements, and what you need to know in a crash course all about it.

What’s really great about this new S Corp toolbox that I am just coming out with right now is the fact that it’s also gonna give you all the resources that you need to determine if it’s right for you.

You’ll be able to do an accurate calculation that takes into account all of these things that we’ve talked about today

[You will] determine what your tax savings really could be.

It’ll help you figure out what your reasonable compensation should be so that you can accurately do these calculations as well.

Then we’re gonna give you a checklist of all the things that you need to make sure you have in order, like payroll, workers comp, and all the potential things for you to think about once you have elected S Corp.

We’re gonna show you how to do the election yourself for free!

All of that comes in this S Corp toolbox!

It’s all the tools that you need to learn about S Corp, decide if they’re right for you, elect to be taxed as an S Corp, and then be able to be compliant with all the rules and regulations and make Uncle Sam happy.

So if you’re nodding your head right now saying, yes, this sounds amazing, and I would absolutely love this for a fraction of the price of what you would pay a CPA to do this analysis for you, then go check out JamieTrull.com/S-Corp-toolbox.

I really want you to take a look at all the amazing things that you are going to be able to get just by jumping in and taking advantage of our special offers.

I hope you found this helpful, and I’ll see you next time.