The Best Business Budgeting Tool for Team Spending Control (BILL Spend & Expense Review)

Feeling buried under receipts, reimbursements, and “who spent what?” surprises? You’re not alone. As your team grows—especially if you’re remote—old-school spreadsheets, manual reimbursements, and shared credit cards start to crack.

Enter BILL Spend & Expense (formerly Divvy by BILL): a modern, free spend management platform that lets you issue employee cards, set real-time budgets and limits, track spending instantly, and sync it all back to your accounting software—without micromanaging.

In this deep-dive review, we’ll cover how BILL Spend & Expense works, who it’s best for, how to roll it out, and the policies that keep your team empowered and your spending under control.

I’ll also walk you through the application process, rewards, and how to qualify for a $500 credit when you start—using my partner link.

👉 Get a $500 credit after you spend your first $500 on the BILL Visa Divvy Card: https://JamieTrull.com/BillSpend

👉 FAQ on application requirements and the card: https://help.bill.com/direct/s/article/5043115

This review is based on hands-on use with my own team. While this post is sponsored by BILL, all opinions and practical tips are my own.

While You’re Here, End the Bookkeeping Guesswork:

Why Traditional Expense Management Breaks

- Reimbursements are slow and messy. Employees float the company for weeks. Finance plays “receipt detective.”

- Shared cards lack control. One unexpected charge can wipe out a budget—or worse, you find out weeks later.

- Spreadsheets don’t scale. Version control chaos, late close cycles, and no real-time visibility.

- Policies live in PDFs. If rules aren’t embedded in the process, they’re not followed.

What you need instead: a single system with budget-based cards, live controls, and automatic accounting sync—so you see spend as it happens and enforce rules automatically.

What Is BILL Spend & Expense?

BILL Spend & Expense combines smart corporate cards (virtual and physical) with budgeting, approvals, and reimbursements—all in one dashboard. You can:

- Issue virtual or physical Visa cards to anyone on your team in minutes.

- Create budgets for departments, projects, events, or vendors—then assign owners and set category rules (what’s allowed, what’s blocked).

- Track spending in real time and freeze cards instantly if needed.

- Reimburse mileage and out-of-pocket expenses right in the same system.

- Sync transactions, receipts, and categories to QuickBooks Online, Xero, and FreshBooks for a smoother month-end close.

- Earn rewards on eligible spend (details below), and with my link, you can qualify for a $500 credit after your first $500 in card spend.

And yes: BILL Spend & Expense is free to use. The cards and software are included.

Who It’s Best For

- Remote or hybrid teams who need controlled freedom to buy what they need—without expense anarchy.

- Service-based businesses and agencies juggling project budgets, client pass-through costs, and travel.

- Startups and growing companies that want approval workflows and audit trails without enterprise price tags.

- Any business tired of receipts in inboxes, missing documentation, and end-of-month surprises.

You don’t need a giant team. I run a five-person company and BILL Spend & Expense has already simplified our process.

Key Features For Expense Control (and Why They Matter)

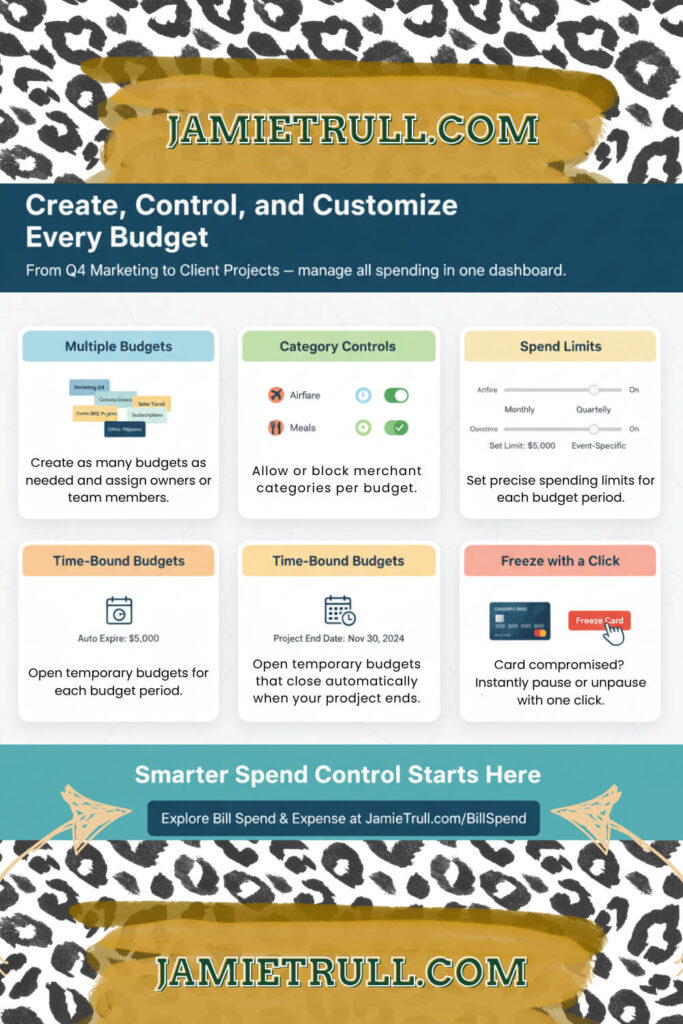

1) Budget-Based Cards (The Control Layer)

Create as many budgets as you need—Marketing Q4, Conference: FinCon, Sales Travel, Client ABC Project, Subscriptions, Office Stipends—and assign owners and members.

- Category controls: Allow/deny merchant categories per budget (e.g., block airfare in “Meals & Entertainment”).

- Spend limits: Set monthly, quarterly, or event-specific limits.

- Time-bound budgets: Open a budget for a project or event and auto-expire it when done.

- Freeze with a click: Card compromised? Pause it instantly.

Unlike “one card to rule them all,” budget-based cards prevent overspend at the source.

2) Virtual & Physical Cards (Instant & Secure)

- Virtual cards for online buys and subscriptions (one vendor per card to isolate risk).

- Physical cards for field work and travel.

- Replace cards digitally in seconds—no waiting for mail for every change.

3) Real-Time Visibility

- Live feeds show who spent what, where, and why—right now, not next month.

- Get alerts for out-of-policy attempts you can approve/deny on the spot.

- See budget burn vs. remaining funds at a glance.

4) Reimbursements & Mileage (No More Side Systems)

Employees can submit mileage and out-of-pocket expenses directly in BILL. You approve, and it’s routed for reimbursement—without clogging spreadsheets or email.

5) Built-In Approvals & Audit Trails

- Multi-step approval workflows by role, amount, or budget.

- Every action is logged—great for internal controls and audits.

- Clear policy enforcement: rules aren’t in a PDF, they’re in the card.

6) Accounting Integrations

- QuickBooks Online, Xero, FreshBooks integrations.

- Map budgets to classes, locations, or tracking categories.

- Enforce receipt capture before close.

- Reduce manual coding and shorten your close cycle.

Rewards, Bonus, and Cost

- Platform cost: BILL Spend & Expense is free.

- Rewards: Earn rewards on eligible spend. On the standard (unsecured) credit line, some reward structures require that you spend at least 30% of your credit limit in the cycle to earn rewards.

- $500 credit: With my partner link, you can qualify for a $500 credit after you’re approved and spend your first $500 on the BILL Visa Divvy Card.

👉 Sign up via https://JamieTrull.com/BillSpend to be eligible.

👉 Rewards/program details can change—see BILL’s official FAQ for current terms: https://help.bill.com/direct/s/article/5043115

Applying: What to Expect (Step-by-Step)

You’ll complete a quick online application.

Here’s the info you’ll typically need:

- Legal business info (entity type, formation date, EIN).

- Financials (estimated revenue, bank connection).

- Owner details for anyone with ≥25% ownership (standard “Know Your Customer” compliance).

- Authorized signer details (often you).

- Credit check: BILL may do a soft pull (commonly via Experian) on the business and the authorized signer to determine credit eligibility and limit. A soft pull does not impact your personal credit score. If you freeze your credit, temporarily thaw Experian before applying.

Eligibility, underwriting, and terms vary. See the official FAQ for current requirements: https://help.bill.com/direct/s/article/5043115

Secured vs. Standard Credit Line

After approval, you may see options:

- Standard (unsecured) credit line: Traditional business credit line. Rewards may require spending ≥30% of your credit limit per cycle.

- Secured credit line: You place a cash deposit to secure a credit line and earn rewards from day one.

You can often adjust your limit later as your needs grow.

How to Roll Out BILL Spend & Expense (Proven 10-Step Plan)

- Pick a pilot group (2–5 people across departments).

- Design your budget tree: Start with Operating, plus Marketing, Travel, Events, Subscriptions, and Client Projects.

- Set category rules per budget (allow/deny merchant types).

- Issue cards (virtual for online purchases/subscriptions, physical for travelers).

- Define approvals (e.g., ≥$1,000 requires finance + budget owner).

- Enforce receipts (mobile upload at point-of-sale; reject noncompliant expenses).

- Turn on reimbursements for mileage and legitimate out-of-pocket costs (with policy caps).

- Map accounting (budgets to classes/locations/tracking; vendors to categories).

- Train the team with a 30-minute live walkthrough and a 1-page policy.

- Review weekly for the first 30 days (budget burn, exceptions, receipt completion) and iterate.

Policy Templates You Can Copy

A) Subscriptions Policy

- Each subscription gets its own virtual card labeled “Vendor – Team – Purpose.”

- Owner must confirm renewal 15 days before auto-renew.

- Cancellations require ticket + screenshot.

B) Travel & Meals

- Airfare/lodging via approved vendors only; daily meal cap per diem; no alcohol on client-billed budgets unless pre-approved.

- Receipts uploaded within 24 hours via mobile.

C) Stipends & Supplies

- Monthly stipends for WFH essentials routed through “Office Stipend” budget with category restrictions.

D) Conferences & Projects

- Create a time-boxed budget (open date → close date).

- Freeze cards automatically at close; reconcile and archive.

E) Reimbursements

- Mileage at current company rate with origin/destination.

- Out-of-pocket expenses over $50 require pre-approval unless emergency.

Keep policies to one page each—simple rules get followed.

Real-World Use Cases That Save Money (and Sanity)

- Stop subscription creep: Assign each SaaS to a single virtual card. If you cancel, the charges die with the card—no more mystery renewals.

- Events on budget: Spin up a “Conference: [Name]” budget with cards for the team; auto-close post-event.

- Client pass-through costs: Create client-specific budgets and tag expenses for clean billing.

- New-hire success: Issue a capped card on Day 1 for setup costs; expand after 30 days.

- Vendor trials: Use short-term virtual credit cards with low limits that auto-expire.

Month-End Close: Faster with Fewer Headaches

- Automated feeds to QBO/Xero/FreshBooks reduce manual coding.

- Required receipts and category rules create cleaner data.

- Budget vs. actual views tighten forecasting and accountability.

- Result: Shorter close, fewer surprises, better cash planning.

Track these KPIs monthly:

- Receipt completion rate (target ≥95%).

- Budget variance (actual vs. plan by budget owner).

- Cycle time to close (shrink it month over month).

- Policy exceptions (approve or update the rule).

FAQs (Quick Hits)

Is BILL Spend & Expense really free?

Yes—the platform and cards are free to use.

Will applying hurt my credit?

BILL may perform a soft credit pull (commonly through Experian) for underwriting. A soft pull does not impact your personal credit score. See FAQ for current details: https://help.bill.com/direct/s/article/5043115

What if I’ve frozen my credit?

Temporarily thaw Experian before applying, then re-freeze after.

Can I earn rewards?

Yes, rewards are available on eligible spend. With a standard (unsecured) line, some reward structures require spending ≥30% of your credit limit per cycle. Terms can change—check the FAQ.

What accounting systems does it integrate with?

QuickBooks Online, Xero, and FreshBooks (among others). You’ll map categories during setup.

How do I prevent off-policy spend?

Budget/category rules + per-card limits + real-time freezes. The control layer lives on the card.

What about mileage and reimbursements?

Submit and approve right inside BILL Spend & Expense—no separate tool required.

Common Mistakes (And How to Avoid Them)

- One giant budget for everything. Create specific budgets (by department, project, or vendor) to prevent bleed.

- No owner assigned. Every budget needs a single owner with accountability.

- Letting receipts slide. Enforce app-based uploads at point-of-sale; no receipt, no reimbursement.

- Manual subscription sprawl. Use one virtual card per subscription to kill zombie renewals.

- Policy PDFs only. Put rules into the card with category blocks and limits.

Final Verdict: A Clear Upgrade for Modern Teams

BILL Spend & Expense reporting hits the sweet spot: real control without micromanagement, employee autonomy without chaos, and clean books without the month-end scramble. If your team spends money for the business—and you’re ready to move beyond spreadsheets and reimbursements—this is one of the most impactful upgrades you can make.

- Issue cards in minutes (virtual and physical)

- Create budgets with live category rules

- Track spending in real-time

- Reimburse mileage and out-of-pocket smoothly

- Sync to your accounting and close faster

- Earn rewards on eligible spend

- Free to use, with a potential $500 credit to get started

👉 Start here to qualify for the $500 credit after your first $500 in card spend: https://JamieTrull.com/billspend

👉 Check current FAQs and requirements (application, rewards, limits): https://help.bill.com/direct/s/article/5043115

If you’re tired of “Where did this charge come from?” and “Can you send the receipt again?”, give your team a smarter system. Your budgets—and your brain—will thank you.

Transcript: This transcript was generated from the video for your convenience, but it may contain typos or slight errors due to the transcription process. For the most accurate and complete information, we recommend watching the full YouTube video.

Simplify Expense Management for Small Businesses

Are you feeling buried under receipts, reimbursements, and team spending surprises? Well, you’re not alone. And what if there was a better way to manage all the chaos without the spreadsheets, micromanaging, or awkward “who spent what” conversations?

Hey everyone, Jamie Trull here, your favorite CPA and financial educator. And on this channel as always, I love to talk about tools that can help you run your business better. And today that solution is Bill, formally known as Bill.com.

From Bill Pay to the Bill Spend and Expense Platform

You likely have already heard of Bill, especially when it comes to where they are a leader — bill pay. That is where Bill started and it really grew its empire. Millions of businesses have either paid or been paid via Bill. There’s a very good chance that you’ve actually gotten paid by Bill and maybe didn’t even realize it.

Today, I’m really excited to talk about Bill’s newer platform, which is called Bill Spend and Expense. This platform is all about tracking, controlling, and streamlining your team’s spend in real time — and it’s totally free to use. I just started using it with my team and I am loving it so far.

Why I Love Bill Spend and Expense for Expense Management

Now, this video is sponsored by Bill. However, I am actively using this platform and all of the opinions I’m talking about here today are my own. And one great thing about getting to partner with Bill is that that means I get to offer you some exclusive perks — including a potential $500 bonus when you get started.

If that sounds good to you, listen up. I’m gonna tell you all about Bill Spend and Expense, but if you want to check it out on your own, definitely use my link: jamietrull.com/billspend.

Expense Bill Spend: A Smarter Way to Manage Corporate Cards

So, what is Bill Spend and Expense? Think of it like having a smarter way to issue corporate credit cards, set clear spending rules for your employees, and keep everything organized — without having to constantly chase receipts and reimbursements.

This system gives you access to business credit, no matter the size of your business. You can set up different budgets (for conferences, divisions, or projects), assign owners, and create approval workflows.

You can block or allow specific categories within each budget and issue as many virtual cards as you want; you can even freeze cards instantly and monitor spending in real time.

Real-Time Visibility Into Team Spending

As a CPA, one of my favorite features is that Bill Spend and Expense syncs directly with your accounting platform, including QuickBooks Online, Xero, and FreshBooks.

You can track spending live, eliminating the need to wait for reimbursements or have awkward expense conversations.

In addition to corporate card expenditures, you can also reimburse employees for out-of-pocket expenses like mileage.

Who Bill Spend and Expense Is Perfect For

At first, I thought this was for larger businesses with tons of employees. But once I saw how it worked, I realized how beneficial it would be even for my company with just five employees.

It’s free to use and ideal for:

- Growing teams

- Remote-first environments

- Agencies and startups managing multiple projects

- Service-based businesses with team expenses

Basically, if your team spends money on behalf of the business, this tool is for you.

Empowering Teams Without Losing Control

You can empower your team to pay for things on your behalf while still maintaining full control. You’ll have clear real-time visibility into what’s being spent, when, and why.

You can ditch spreadsheets, eliminate messy reimbursement processes, and streamline everything — making life easier for you and your employees.

And yes, it’s completely free.

Earn Rewards With the Bill Corporate Card

If you’re a points and miles person like I am, you’ll love that you can earn rewards on employee spending. You can earn cash back or travel points for every dollar spent.

That $500 bonus I mentioned? You’ll get it once you’re approved and spend your first $500 on your Visa Divvy card — just make sure you use my link: jamietrull.com/billspend.

Getting Started With Bill Spend and Expense

When you use my link, you’ll land on the bonus page. You’ll fill out a short form to request a demo and start the application process.

You’ll need your:

- Legal business information and formation date

- Financial details and bank account connection

- Information for any owners with 25% or more ownership

- Authorized signer info (that’s probably you)

Applying for a Corporate Credit Limit

Because Bill Spend and Expense includes the Divvy credit card, they’ll need to do a soft credit pull — meaning it doesn’t impact your score.

They’ll check your business and personal credit to determine your credit limit.

Quick tip: if your credit is frozen (like mine was), you’ll need to unfreeze your Experian file before applying.

Eligibility, Application, and Credit Approval

Before you provide personal information, Bill Spend and Expense will ask about your revenue, credit score, and cash balances. This helps determine if you’re a good fit before proceeding.

When asked for “entity type,” select your legal entity (for me, that’s LLC). Bill integrates with all major accounting software, which is one of the biggest advantages for your financial operations.

Approval times vary, but mine came the same day.

Choosing Between Secured and Unsecured Corporate Cards

Once approved, I was offered two options:

- A standard credit line (unsecured)

- A secured credit line, which requires a deposit but gives automatic cash back

I chose the standard credit line. You can still earn rewards if you spend at least 30% of your limit each month.

You can adjust your credit limit at any time — I started with $5,000, but was approved for more.

Setting Up Your Expense Card and Account

After signing up, you’ll see your confetti screen 🎉 confirming activation. Then, follow the setup guides to connect your accounts and start using your expense cards.

You’ll also notice a section for Payables and Receivables, which links back to Bill’s flagship tools for accounts payable (AP) and receivables automation.

Managing Bills, AP, and Vendor Payments

If you handle vendor bills, client invoices, or accounts payable, the original Bill Pay platform may also save you hours of manual work.

It’s a great add-on for anyone tired of juggling payments and spreadsheets.

Streamline Your Financial Operations With Bill Spend and Expense

I hope you found this video helpful. If you have questions about Bill, drop them below. And if you decide to sign up for Bill Spend and Expense, make sure to use my link to grab that $500 bonus when you spend your first $500.

Thanks for joining me — and I’ll see you next time!

Ready to stop the end-of-month scramble?

Discover the accounting solutions that turn your receipts into ready-to-file reports: