Payroll, payroll.

Are You Making These Common Payroll Mistakes?

If you’re running payroll or even just thinking about it—there are five major mistakes you need to avoid. These missteps can cost you time, and money, and even get you in trouble with the IRS or upset your team.

I’m Jamie Trull, CPA and profit strategist, and I’m breaking down the five biggest payroll mistakes I see over and over again along with practical, actionable tips to help you stay compliant and confident.

Stick with me until the end because mistake #5 is one even experienced business owners still make, and it could be silently draining your profits.

Mistake #1: Not Setting Aside Payroll Taxes

When you run payroll, you’re responsible for withholding and remitting both employer and employee taxes. That includes:

- Federal income tax

- Social Security

- Medicare

- State and local taxes (depending on where you live)

The Fix:

Treat these taxes like they’re not even yours. Set them aside the moment payroll runs.

Or better yet—use a system that sets aside tax payments automatically.

💡 OnPay calculates, withholds, and files your payroll taxes for you. No more guesswork. No more panic at tax time. Total game-changer.

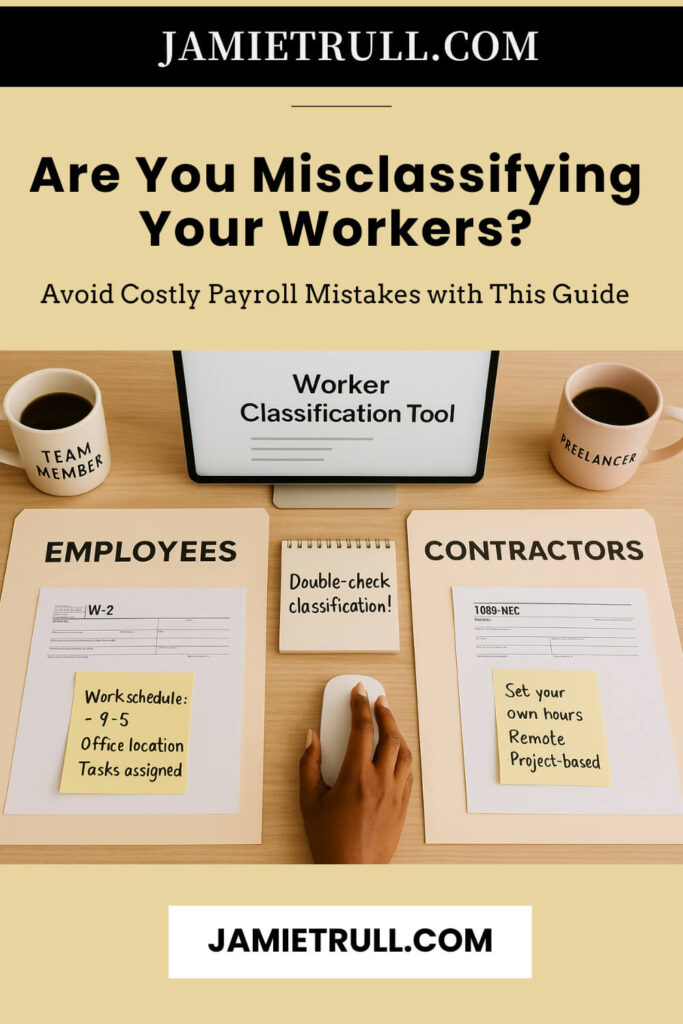

Mistake #2: Misclassifying Workers

This one’s sneaky—and seriously costly.

If you’re treating a worker like a contractor when they function like an employee, you could face steep penalties.

Rule of Thumb:

If you control how, when, and where someone works, they’re likely an employee.

The Fix:

Double-check classification using IRS guidelines or a trusted payroll pro.

✨ Bonus: OnPay makes it easy to pay both employees and contractors, all in one platform. It even handles year-end W-2s and 1099s for free.

🧠 Want help figuring it out? Download OnPay’s free worker classification tool.

Mistake #3: Missing Payroll Deadlines

Late paychecks, missed tax filings, or late deposits? That’s a recipe for penalties.

Payroll isn’t just about paying people—it’s about doing it on time.

The Fix:

Set up alerts, automate filings, and avoid last-minute stress.

🎯 With OnPay, you get automatic reminders and timely processing—even ahead of holidays.

No more missed filings. No more late payments. Just compliance and peace of mind.

Mistake #4: Not Paying Yourself Properly (Especially S-Corp Owners!)

If you’re an S-Corp owner working in your business, the IRS expects you to take a reasonable salary.

Owner draws aren’t enough—you must run actual payroll.

The Fix:

Use payroll software to set up a legit paycheck for yourself—and make sure you’re not underpaying.

✅ OnPay simplifies shareholder payroll and even accounts for fringe benefits like company-paid health insurance.

🎥 Want to learn how to calculate your reasonable salary? Watch this video

Mistake #5: DIYing Payroll Without a Reliable System

Let’s be honest: manually calculating taxes, cutting checks, and filing forms is a full-time job.

And if you’re outsourcing all of that to your accountant? You might be overpaying big time.

The Fix:

Automate your payroll with a trusted, easy-to-use platform like OnPay.

You’ll get:

- Unlimited payroll runs

- Direct deposit

- Full tax filing

- Contractor and employee pay management

- Year-end W-2s and 1099s

All for a low monthly cost—and way less hassle than DIY.

🛠 Ready to simplify payroll? Claim your special deal on OnPay here

Final Thoughts: No Shame, Just Solutions

We’ve all made at least one of these mistakes—I see them all the time in my community.

The key is to get systems in place that remove the stress, automate the admin, and keep you in compliance.

That’s why I love tools like OnPay—and why I’ve partnered with them to bring you the best offer out there. Currently, you get a $100 referral reward after you run your first payroll by signing up at: https://www.JamieTrull.com/OnPay

If you’re also interested in saving on accounting software, check out my guide to finding QuickBooks discounts.

Still deciding?

Want to compare all your payroll options for your small business?

🔍 Check out my Payroll Software Comparison Guide

This post may contain affiliate links, which means I may earn a small commission if you make a purchase through these links at no additional cost to you (in fact, using our links can typically SAVE you money). We appreciate you supporting our small business by using our links!

Video Transcript:

Please note that the following is a direct transcript and has not been edited for errors or omissions. It is a verbatim representation of the spoken words and may include colloquial language, grammatical errors, or other inconsistencies.

We have chosen to provide the transcript in its raw form to preserve the authenticity of the conversation. We recommend cross-referencing with the original audio or video source for complete accuracy.

If you’re running payroll or thinking about it, this is a video you do not want to miss because even well-meaning business owners are making costly mistakes that could cost them with the IRS or even worse with their team. So today I’m gonna break down the five most common payroll mistakes I see and talk about how you can avoid them.

And by the way, that fifth mistake is one that I see even experienced business owners making, and it could be silently draining your profit. So stick around to the end to make sure you’re not doing that.

Hi everyone. I’m Jamie Trull, your favorite CPA financial literacy coach and profit strategist.

And here on this channel I bring you all the content to help you stay informed, organized and profitable in your business finance. So please make sure to subscribe.

Mistake #1: Not Setting Aside Payroll Tax Payments

So let’s start with the mistake number one. And this is one of the biggest and potentially most costly mistakes that can happen, and that is not setting aside payroll taxes or not calculating them correctly.

When you run payroll, you’re responsible for withholding both the employer and employee portion of tax.

So we’re talking about things like federal income tax, social security, Medicare, and also potentially state and local taxes that you need to be aware of.

Now, if you’re not setting aside those taxes the moment that payroll is running, you could get yourself in some hot water. If you’re doing it this way, once those tax deadlines hit, then you could be in the situation where you are falling behind and you don’t have the money to pay those taxes.

So the important thing is to be proactive and treat that money like it wasn’t even yours to begin with.

Now, if that sounds tedious or hard to keep track of, the very good news for you is that there are lots of tools on the marketplace that can help you with this. Having a payroll system you can trust is going to be key in making sure you do this correctly.

And one of my favorites is OnPay. And the great thing about using a company like OnPay to calculate your taxes for you is that not only are they gonna calculate and withhold all of those taxes automatically, but they’re also gonna file all those required reports.

We’re talking about federal, state, and local payroll reports. And by taking care of all of that for you, that means that you are not scrambling at tax time and wondering how you’re gonna handle these taxes.

Mistake #2: Misclassifying Workers

Now let’s talk about the number two mistake with payroll that I see people making and that is misclassifying their workers. And this is a sneaky one, and I see it all the time.

Now, I’ve done some other content on this channel specifically talking about the difference between an employee and a contractor. And if you are misclassifying that—especially if someone is working like they’re an employee, but you’re paying them like a contractor—that could be a big problem.

Now, the rules in this vary, and some states have even more stringent requirements. However, the general rule of thumb is that if you’re controlling their work, i.e. what they’re doing and how they’re doing their work and the times that they’re doing their work, more than likely that person is an employee.

And the difference here is that for an employee, you’re responsible for withholding those taxes from their paychecks, and also making sure that you’re paying the employer side of those taxes.

On the flip side, if someone is truly a 1099 contractor—please don’t use the word “1099 employee” because that is an oxymoron.

Paying a 1099 Contractor

If you do hire a 1099 contractor that truly is in charge of their own schedule and you do not dictate that, then when you pay those contractors, they are actually going to be the ones that are responsible for withholding and paying both the employer and employee side of those taxes.

For them, it’s considered self-employment taxes because ultimately they’re considered to be self-employed, not employed by you.

Now you can understand why some companies would maybe want to hire contractors versus employees because there are less taxes and administration to worry about.

However, it really is about the nature of the job, and you wanna make sure that you are in compliance.

Now, if you’re unsure, make sure to check the regulations with the IRS and also your State Department of Labor, which again, may have more specific rules for when somebody needs to be deemed an employee.

Now this is another area where the right payroll provider can really help, and this is another reason that I love OnPay.

One cool thing about OnPay that you don’t get necessarily in every payroll provider is the ability to pay both employees and contractors even in the same payroll run.

Or because you get unlimited payroll runs in a month, you can handle them separately and run as many different payrolls as you want to.

And another really cool thing is that OnPay is gonna handle all the year-end requirements like W-2s and even 1099s for your contractors for free. That’s all included within the package, which again, is not true for all payroll platforms.

And by the way, if you’re unsure if you’re doing this correctly and wanna check how you are categorizing your workers currently, then definitely check out the free worker classification tool that I have attached in the description down below.

Mistake #3: Missing Payroll Deadlines

Mistake number three is missing payroll deadlines. That is something you do not want to do, and that means things like your paycheck due dates.

You do not wanna miss paying your team.

You also don’t wanna miss those tax deposit due dates or those quarterly and annual filings. So there are lots of different due dates to stay aware of when it comes to payroll.

And unfortunately, even small delays can really rack up the interest and penalties over time. So you wanna make sure you have a system that is going to remind you when those payroll taxes are due and make sure that they are filed correctly.

Now you can go through the process of setting up your own calendar reminders to remind you to file all of the forms, but a good payroll software solution should take most of this work off of your plate.

In OnPay, for example, you get automated reminders before it’s time to run payroll, and even reminders to tell you that a federal holiday is coming up and ask you if you want to process early.

And of course, as for tax deposits and filings, they also will handle all of that for you so that you don’t need to worry about it.

Mistake #4: Not Paying Yourself Correctly

Now, let’s go to payroll mistake number four, which is not paying yourself correctly—especially if you are an S Corp owner.

As an S Corp owner, if you’re actively working in your business, the IRS does expect you to pay yourself a reasonable salary for the work that you are doing within your business.

And if you’re skipping payroll or not paying yourself enough, that can be an IRS red flag and it can lead to back taxes that you may have to pay later on in time if you’re audited.

Now, if you wanna know more about this, make sure to watch this video on screen next, which is all about how to set a reasonable salary for yourself, even if you are the only employee in your business.

So just make sure you set this up properly. And remember, it’s not a luxury to pay yourself in your business—especially if you are an S Corp owner. You do need to be on payroll and doing all the withholding just like you would for any other employee.

Now to avoid these issues, I highly recommend that business owners put themselves on payroll and use a payroll provider like OnPay to actually pay themselves in their business.

And the great thing about OnPay is that you can do this even if you’re the only employee.

And another thing that I love specifically about OnPay when it comes to being a shareholder on payroll is that it can handle any of those taxable shareholder fringe benefits that you might have to worry about, like accounting for a company-paid health insurance.

Mistake #5: DIY Payroll Without a System

And finally, mistake number five and honestly, probably the most exhausting one is trying to DIY your own payroll without a reliable system.

Now I see business owners all the time who want to save money, go the route of DIYing their payroll taxes, and honestly, it is just not a good idea—especially when there are so many great options out there available for a low cost.

Trying to manually calculate these taxes, file all the forms, write the paychecks—that is a full-time job y’all. I don’t know about you, but I don’t have time for that. I am sure you don’t either.

And if you are paying an accountant to do this for you, you’re probably paying a heck of a lot more than if you were to just use a reliable payroll service.

That’s why I highly recommend using a payroll service like OnPay, because they’re gonna handle all of that at a low monthly cost—way less than if you had to hire someone to do this for you.

And the great thing is that it’s really easy to use. So even as the small business owner, you can run your payroll in minutes a week or manage your business finances with ease.

I don’t know about you, but I am a huge fan of automation and reducing headaches, so I definitely recommend trying it out.

Ready to Learn More About OnPay?

And if you’re interested in knowing more about OnPay and want to grab my special referral bonus for joining through my link, then go to https://jamietrull.com/onpay.

That is my partner link that’s gonna get you the best deal and a referral bonus just for signing up.

And if you’re thinking about trying out OnPay but aren’t really sure if it’s right for you, definitely watch this video next where I give you my full insider review of OnPay when I demoed it myself.

You can also check out more resources around payroll in the link in the description below, and make sure to like and subscribe and I’ll see you next time.

Bye everybody.