A Deep Dive into Ashleigh’s Transformation with Jamie Trull’s Financial Fitness Formula™ Program

If you’re wondering, what is the financial plan in my business? You’re not alone.

In the world of small business, financial management can often feel like a daunting task.

From understanding complex financial statements to making strategic business decisions, the financial aspect of running a business can be overwhelming.

This was the case for Ashleigh, a small business owner who found herself struggling to navigate the financial landscape of her business.

However, her journey took a turn when she discovered Jamie Trull’s Financial Fitness Formula™ program.

This blog post will delve into Ashleigh’s transformative experience with the program, highlighting how it empowered her to take control of her business finances.

The Struggle: Ashleigh’s Financial Challenges

Ashleigh’s story is not uncommon among small business owners.

Despite her passion and dedication to her business, she found herself grappling with her financial management.

She was spending countless hours trying to understand her financial statements, unsure of how to use this information to guide her business decisions.

This struggle was not only time-consuming but also caused a significant amount of stress and uncertainty about her business’s financial future.

The Solution: Discovering the Financial Fitness Formula™ Program

In her quest for a solution, Ashleigh stumbled upon Jamie Trull’s Financial Fitness Formula™ program.

This program promised to provide the necessary tools and education to understand and manage business finances effectively.

Intrigued and hopeful, Ashleigh decided to enroll in the program.

The Financial Fitness Formula™ program is designed to demystify the financial aspect of running a business.

It includes comprehensive modules on understanding financial statements, budgeting, cash flow management, and strategic decision making.

The program aims to empower business owners to take control of their finances, enabling them to make informed decisions that align with their business goals.

The Transformation: Ashleigh’s Journey with the Program

As Ashleigh delved into the program, she began to see a shift in her understanding of her business finances.

The program’s step-by-step approach allowed her to gradually build her knowledge and confidence.

Here’s a closer look at the significant improvements Ashleigh experienced after completing the program:

- Understanding Financial Statements: One of the key outcomes of the program was Ashleigh’s newfound ability to read and interpret her financial statements. This was a game-changer for her. She no longer felt overwhelmed by the numbers and terms. Instead, she could clearly understand her business’s financial health, which gave her a sense of control and confidence.

- Making Informed Business Decisions: With her improved understanding of her finances, Ashleigh was able to make strategic decisions that aligned with her business goals. She mentioned a significant investment she made in her business, something she wouldn’t have felt comfortable doing before the program. This decision was not made on a whim but was a calculated move based on her understanding of her financial position.

- Confidence in Her Financial Future: Perhaps the most significant transformation was Ashleigh’s outlook on her financial future. Before the program, she felt uncertain and anxious. However, after completing the program, she expressed a sense of security about her financial future. She had a clear financial plan in place and knew how to adapt it as her business grew.

The Power of Financial Empowerment

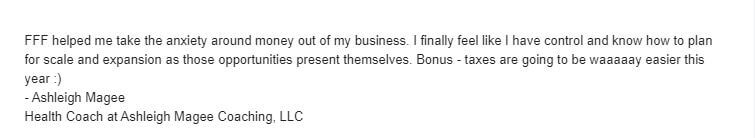

Ashleigh’s experience with Jamie Trull’s Financial Fitness Formula™ program is a testament to the power of financial education.

The program transformed her approach to financial management, turning a source of stress and confusion into an empowering aspect of her business.

She went from feeling overwhelmed to feeling confident and in control.

This transformation did not happen overnight. It was the result of a carefully designed program that provided the right tools and education.

But most importantly, it was Ashleigh’s willingness to learn and adapt that led to her success.

For small business owners like Ashleigh, managing finances doesn’t have to be a daunting task.

With the right resources and a willingness to learn, it’s possible to turn financial management into a powerful tool for business growth.

As Ashleigh’s story shows, understanding your finances can lead to informed decisions, strategic investments, and ultimately, a sense of confidence in your business’s financial future.

If you’re a small business owner struggling with your finances, remember Ashleigh’s story. Consider seeking out educational resources like Jamie Trull’s Financial Fitness Formula™ program.

It could be the first step towards transforming your financial management and empowering your business growth.

Learn more about the FFF program here.

Video Transcript:

This transcript has not been edited or reviewed for accuracy and may contain errors or discrepancies from the original spoken content.

The transcript is offered for informational purposes only and should not be considered a definitive record of the event. We do not guarantee the accuracy, completeness, or reliability of the information provided in this transcript. Any reliance you place on such information is therefore strictly at your own risk. All current Financial Fitness Formula™ timelines and offers can be found at jamietrull.com/fff .

Well, hello everybody Jamie here. How’s everybody doing? When you jump on, say, Hey, would love to know who we have here. This is a special time. So we are, we are live at an off time, so we’ll see. We’ll see who joins us, but I wanted to do kind of a special event. So before we get into that, we are live right now on our Facebook page, also on our, in our Facebook group, financial Literacy for Women Business Owners. If you’re not in our Facebook group, I don’t know why not. You need to come on and join us. And we are also live right now on YouTube, on our YouTube channel. So wherever you’re joining us, say hi.

I see Stacy tell me you guys are here. So this is gonna be a little bit different. Oftentimes we’re talking about, you know, financial, finance, accounting, taxes, all things for business owners, or we’re talking about covid relief, which we will be talking about both of those things this week. Don’t worry everybody. But today is gonna be a little bit different.

Introducing FFF Alum Ashley McGee

This is a special event where I’m bringing on Ashley McGee. So Ashley is a former student slash still current student. I feel like my students are my students forever ongoing. It’s ongoing because you guys get to kind of come back and, and take it with everybody else as well, which is great. But Ashley was part of my Financial Fitness Formula program last year.

So for those of you guys just to level set, if anybody doesn’t know right now, open for enrollment. My Financial Fitness Formula program has the doors open. So we opened it last week and we’re closing in two days. We got two days left. So I don’t want anybody telling me they didn’t know it was closing. ’cause I’m gonna tell you guys about a thousand times between now and Thursday that it’s closing, I promise.

But I wanted to bring on a couple of my, my star students from last year. So we rolled out Financial Fitness Formula for the first time last year. So Ashley was one of my students that came into the program. And this program is really all about taking control of your business finances. So it’s all about the strategic side and then also the cash management side of how to really run your business as your own CFO,

right? How to have that confidence if you feel just overwhelmed, if you don’t know what you’re supposed to be doing with your business finances, if you don’t know how you should price your products, well, how to set a budget, right? How to really make the most of your finances in order to be able to, you know, achieve those personal and professional dreams that you have,

which we all have, right? Then Financial, Fitness, Formula is the program for you. I might be a little bit biased, I don’t know, just a little bit biased. And behind me if anybody’s wondering, these are all the wonderful people who have already signed up to be part of Financial Fitness Formula. Let’s go around. So we are trying to hashtag fill the wall.

I kind of like this right now ’cause the screen’s a little smaller, so it looks, it’s like we’re getting there at this point. And so with that, I’m gonna turn it over to Ashley. So I’m gonna ask you a couple questions, Ashley, just about your experience, just to give people a little bit of kind of that behind the scenes sneak peek from somebody who has been through it.

So first, absolutely. Let’s start with an introduction. Who are you? Ashley, tell us a little bit about you and tell us a little bit about your business. Yeah, so hey everyone. I am Ash McGee. I am actually active duty naval officer, and then I have my own business as a health coach for military women.

So I actually,one of the reasons that this is at a weird time is because I work my business before I start my navy working hours, few things Going on, you know, clearly Teleworking, right? ’cause I’m not in a uniform right now. But yeah. So I am super passionate about helping women in the military community basically achieve their healthiest lives. I believe that health is the key to abundance.

And so that’s really what, what my business is. I teach healthy habits in food, Fitness, sleep and mindset to my clients. I love how it all ties into to you being active duty military, you know, the people that you are helping intimately, right? And I, I was that person,right? Like exactly. I started out struggling with my help and then I figured it out. Absolutely. Absolutely. So let’s do a quick flashback to last year before you joined Financial Fitness Formula. Tell us a little bit about where, what you were feeling and then what motivated you to jump on in. Yeah, So I, I had just started building my, my business. Like, I literally, I think I joined FFF and then like a month later filed my L L C, right?

Like, so I, I was right at the beginning of kind of figuring out what I was developing, but I was paying a lot, awful lot of personal debt and I knew that like I had some janky money mindset and so I wanted to, I was really focused on starting a business that had a really solid foundation to include financially. And I wanted to stop feeling guilty and like shame around finances.

Oh yeah, Yeah. And actually like, you know, feel confident that I know what I’m doing. And my husband has a background in like finances and has an M B A. So he’s like, Ooh, do you want me to get a no, I wanna be able to do it myself. I Love that story. I can’t tell you how many people, even in my audience tell me like, oh, my husband’s a CPA, oh my husband’s an MBA and my husband’s a finance person. And they’re like, I don’t wanna learn it from him.

Ashley’s Business Finances Story

Like, he doesn’t make any sense. I wanna learn it from you. There’s Just, yeah, there’s just something about like learning it from, you’re being corrected by your spouse. We actually, before we went live talking about, we went golfing yesterday and like I got mad at him ’cause he was like trying to correct my aim and I’m like, it makes me feel like an idiot.

I know how to play golf. That’s why my husband and I can’t go to Topgolf again. Because he tries the whole like, well here’s how you hold the club. I know how to hold the club. Thank you very much. Like even if I don’t, I’m still, I know how to do this. Thank you.

I love that you said janky money mindset firstly. ’cause I love the word janky. And secondly, because I think that is such like knowing that about yourself, right? Like knowing like there’s some weird stuff here. Like I don’t know what’s causing this, but like, there’s some weird stuff here and I need to kind of dive into this a little bit.

It’s actually why, and I’m curious to see, we’ve, we’ve redone Financial Fitness Formula, so even you haven’t seen like what it looks like now. So I’m really excited to roll this out even to my existing members. ’cause we have redesigned it and put so much more into it. But we, one of those things was to make an entire module that really goes to mindset and goal setting.

And I think that that just was foundational where we have to of start here before we get dive into like all the numbers, right? And like before we’re jumping put, before you’re opening up a single spreadsheet, we gotta start with kind of mindset and looking at that and thinking about, you know, what, what has happened, what has gotten us to this place so that we can move forward from it?

’cause right, like guilt and shame, those things suck. Like I tell you what, guilt and shame No, go around here. We don’t, we don’t. Those are like, it’s useless, right? Like feeling shame. That’s a useless emotion. I’ve felt that in many places in my life, but it’s just not, it’s not serving us.

So we’re gonna leave it behind. We’re gonna like put it out to pasture and we’re gonna go move forward. So you jumped in. What was kind of the deciding factor for you to kind of make that move and, and jump into FFF? I mean, so a I had kind of started already following you, right?

So I had heard you on Amy Porterfield’s, you know, online marketing committees podcast, right? And everything you were saying about like what you did and what you believe in, I was like, I like her. So I joined your Facebook group and your email list, right? Yeah. So like, I was already kind of actively like watching you.

’cause that’s a big thing, right? Like we, we have to build up that trust factor and be like, okay, do I connect with this person? Do I trust this person? Do they seem like they actually know their shit? So sorry. Yes. No, you’re good. I don’t think there’s anything children watching this, right? Ear earphones,guys. Yeah, I curse like a sailor is not an exaggeration at all. Even my own coaching, like again, okay, so so that was part of it, right? Like I was, I was already actively watching you and then, and I knew I was also self-aware, right? Like I knew I I needed some financial guidance. Yeah.

So when you rolled out your program, like I, I think I bought the first day, honestly, I, to me it was a no-brainer. I was like, okay, like I like what she’s about. She’s putting out good information. I trust her and this is something that I need. And I, and the price point, I was like,

yeah, I’m in. Yeah. Easy. Yeah, let’s do this. That’s awesome. Yeah, I think that that is the thing. You have to have trust with someone who’s like, with finances, especially. I do think a lot of people have gone through that, that situation where especially women I think like will be in a situation where you just have somebody that kind of does the like, mansplaining thing and it just doesn’t.

You feel like the condescending this, like, I think that that is where, why I started doing what I was doing because I felt like there was a whole in accessible financial education that made sense and wasn’t like, you know, like condescending. You know what I mean? Yeah. Like, I think because that, ’cause that’s ridiculous and that’s not gonna get, and that just plays into the guilt and the fear, right? And the shame. And that’s, that’s, I wanted to help people see the possibilities, right? Like see the hope, see the, be excited, be encouraged, right? Yeah. So I love that that’s what you felt. Yeah.

And actually, I was on your webinar too, and I think that that was actually a, a big thing is I was like, okay, like, because you do, you did bring up a lot of the hope and like, hey, like pay yourself more and like, don’t be afraid of tax season. And I’m like, I want those things.

When Hope For Financial Success Outweighs The Fear

Yes. Because I think I, I mean that is the, that is the thing. There are so many people that market based on fear. There are so many people that market based on like, you know, and, and I think that this is something that happens like in the, in the debt world, the shame, right? Like, you’re in debt, you need to do something about this. And it’s like, no, let’s, can we take it to the place of hope and encouragement and, and positivity. That’s the key. That’s what we all really wanna feel. We don’t wanna feel those like bad negative emotions. We wanna let go of those things. Right? Totally. I love all of that.

Okay, so talking about feelings. So you talked a little bit about the guilt and the shame. Is there anything else you felt with regards to your finances? Like when you thought about it or did you, were you kind of, I know a lot of people in my audience are just like in the avoidance, they’re like, I just don’t even, I don’t even want to deal with it. Oh, yeah. Was that you at all? Yeah. Oh yeah. One, 100%.

Yeah. I didn’t, I mean, it, my, my husband would get so mad at me because, so I said like I, I was starting my, my business like, you know, starting over right before that I, I did do network marketing for like two years, right? So we, we had been like filing kind of like business taxes with that and he’d get so mad at me because I wouldn’t track anything all year. And then he’d be like, I need everything for taxes. And I’d be like, okay, give me two weekends and I’d have to like go through, right?

So I just, I just never wanted to deal with it, never wanted to look at the numbers and like, I’m not someone that, like, financial stuff is the most exciting, riveting thing ever. Like, my husband will talk about the stock market and I’m like, oh, you know, so that’s good. Like it’s, yeah.

Learning That Business Finance Is More Than “It’s just not something I was always like early in my early twenties, I was like, I just wanna like pay someone else to like, deal with the things. So I don’t have to, which of course got me into trouble, but, you know, I think That’s so, I think that’s so true though because I think that that, even people who’ve been in business for a while will tell me like, well, I have an accountant, so do I need to do something like, like do I need, and I am really, really big on every business owner, right? Unless you’re like, if you’re making millions and you’ve got a C F O that literally is on staff that you pay to make these decisions, okay? But you still need to be informed,

right? But until that point, like you are the C F O, you’re the ceo E o and I think we all know like, okay, we, we, we are the c e o of our own business. You’re also the C F O. You gotta be able to put that hat on and make the decisions and be confident in those decisions and understand the numbers and use the actual data to make the decisions in your business on pricing and profit margins and be intentional.

Right? And I think that’s the one we’re like, eh, that doesn’t sound like fun. Just that, that sounds like, you know, like, like just we don’t wanna do it. Right? Like it’s easy to shy away from, it’s easy to get pulled into all the other things in business that are more fun. Right? Like, who doesn’t love, I love like learning about marketing. I’m like, I’ll, I’ll listen to every marketing podcast available because that’s fun. Exactly right. The finances part just makes you, you’re like, I don’t know, I don’t know about this. It is, it’s super fun. So I hear that kind of all of the time from people as well. So you’re not the only one.

Okay. Tell us a little bit, you jumped into the program, what was it like when you first kind of joined? How did you, how, how did you feel kind of starting to navigate through the program? Yeah, so I would go through the modules basically on my lunch break.

Yeah. I Remember like you posting on Instagram, by the way, I have a specific memory. You tag me on Instagram and it was you on your lunch break, like watching me like with your notebooks. And I was like, yes, this girl is on it. I love it. Yes. So, but it was, it was such a shift for me, right? ’cause like I had been in all this avoidance, right? And then I started the program and I was just hungry. Yeah.

I, you know, I looked for, I looked forward to the next lesson. I was like, who? Yay, who am I? Like what, what is happening right now? I think at one point actually, I, I know exactly what it was. It was after like getting the like manual spreadsheet that like automatically updates your p and l and everything, which is magic, right? I’m pretty sure I went into the Facebook group and I was like, I tagged you.

And I was like, Jamie is like both a genius and a goddess.I love her forever because suddenly like, it just, it it felt easy, and I felt so empowered. Because I knew, I knew I knew exactly what to do, right? Like yeah. I just, I just had to pull the numbers, like get, you know, download the, you know, the account whatever’s transactions.

Plug things in and then like it told me what to do. Yep. That is that, that’s my favorite thing to do with a spreadsheet because I feel like people who, who tell me like, oh, I don’t like spreadsheets. Right? And I don’t think that was you. I think you were like, I’m cool with spreadsheets. But I think there are a lot of people that are like, spreadsheets?! I don’t wanna deal with a spreadsheet. That sounds complicated. I do all the complicated stuff for you.

And then I’m like putting up, put something here and like highlight a couple places and you can put it in and then it, it works. And so that’s what I try to do with all of the worksheets that are within the program, is make them things that are just kind of plug and play that you can put in a few pieces of information.

I have a little tutorial that goes with all of them. And then it just does the thing and you’re like, oh, okay. That wasn’t, that wasn’t as bad as it. I don’t, I don’t need my calculator. Who has a calculator anymore, by the way? I guess we all, I guess we all carry a calculator around.

But you don’t even need that. You don’t need that at all. Right. It does it all for you. So that, that’s great. I love that feeling. And I love that you, I love the quote, like, it felt easy, right? Like that it just felt, and that’s what I want people to feel is that empowerment that you mentioned.

And just that it feels easy. It doesn’t feel like this weight anymore, right? It doesn’t feel like you’re biting off this huge chunk. And that’s why I really wanna make the program super step by step. Like just do this, then do this, then do this. Right. Because I think the world of financial information is like, Yeah.

And you’re like, but I don’t know what I mean. And I think if I remember correctly, like one of your bonuses was like, which, like, which business entity should you create? Yeah. Right. So like that’s why, like, that was another one of the reasons, another one of the reasons about, right. Because I was like, oh, that’s a thing I need to figure out. Yes, Yes. Absolutely. Knowing like what business entity are you the right business entity, right? Yeah. I love all of that. And I do wanna add too, right? Like I really appreciated that while you gave like recommendations like, hey, if you want software, here’s what I use.

But that I didn’t, it wasn’t something that I had to do. Right? Like I’m still using the, like I don’t use QuickBooks or anything. Like I’m still using the manual tracking because frankly I don’t have a big enough volume in my business to really need to pay for QuickBooks. Yeah. But yeah, so like I just, I appreciated that you had all these tools built,

built in. I didn’t have to learn something new. Like I know how Excel works and you did all the magic. So like it Yeah, it was super easy. I I I still use them like literally updated ’em last week. So, And I think that’s really key when it comes to financial information. ’cause I think sometimes where we fall off right, is like when you try to fit into somebody else’s mold.

And so that’s why with Financial, Fitness, Formula, I like to give options because what we need may not be the same thing as what somebody else’s needs. And the most important thing is that you stick to it, honestly. Like there are many different things that you could do to implement this process.

And I’ll give you kind of those options. Not in like an overwhelming way, but just in a, are you more a person that wants to do stuff on an app? Do you wanna do stuff on a spreadsheet? Do you, like what is something that you specifically are going to be able to stick with? Yes. Because I think that that’s where we fall.

We’re like, oh, somebody told me about this great budgeting app. And we try and we’re like, why is this not working for me? I don’t know. And that’s ’cause it’s not how your brain works, right? It’s not how you think about things. It’s not something that you will keep up with even though somebody else will. And so I think that’s important to kind of, again, not overwhelm with choices, but have a few different options built in such that, you know, you can, you can build something that is right for you.

I’m really big on that because I think a lot of times people pick up a book or they pick up something and, and they try to do it and they’re like, I don’t know why this isn’t working.

And it’s because it wasn’t a system built for you, right? Yeah. It wasn’t something that was built based on how you process information. Okay. So let’s talk about what the biggest change. So we, we talked about how you felt before, let’s talk about the after, right? Like how do you feel now with business finances after going through FFF?

Yes. Well a like my husband last week was like, Hey, we need to file taxes. I’m like, everything’s done. Was he like, but I Was like, all the, all the transactions are are yeah. Catalog and everything good. It’s all done. And he’s like, So I mean that was an amazing feeling. And I mean, it’s just like, so I just launched a new program, right? So more income coming in, right? And to be able to like literally sit down and be like, okay, like I know exactly how much it costs to run my business every month. Just, you know, from web, website, web, web, website, website and, and all that stuff, right? So like, and you know, contractors and things that I, people I pay, right?

So I’m like, okay, I know exactly how much I need in, in my accounts to run my business. I know exactly how much I can put towards advertising, how much I can put towards. And like, since I’m still active duty, all my, me paying myself is paying off business debt. My goal is to be completely debt free when I leave the Navy and start working my business full time. So I got my personal debt paid off this year. Yay. That’s fun. Celebrate. So I, I, I just finished paying off actually all my personal debt. So next that’s awesome.

Next chunk is business debt. But it, it’s just, it’s like I’m not afraid of the numbers anymore and it, it gives me guidance for okay. Like, you know, if I do want to, well actually I’m looking at like hiring a coach to look at like webinar stuff, right? Like I know exactly how much I can invest back into my business as well.

Yay. Yes. That’s exactly, that is such an important thing to have that already known because I think sometimes we’re just guessing sometimes we’re like, I don’t know, can I afford this? And that was always the question I got when I would go into businesses as their C F O,

They’d be like, I want to do X, Y, Z or I wanna get a coach, or I wanna do, can I afford it? And I’m like, well, Let’s It, it depends. And so when you create a system, you already know the answer to that, right? Yes. You already know the answer and you know, when you know, is this a good decision? Is it not a good decision? You don’t have to sit there and hem and haw and,

and, and think about all the things and try to like dissect it a million ways and overanalyze, right? That’s, that’s really the goal too, is just that clarity. So, I love that. Okay, so resources you found most helpful and I need you to show the binder you showed me before we jumped on here.

’cause I’m dying about this binder. Okay. I, okay. And like, I’m, I’m one of those people, like I need to like print things out and write ’em down. Like y’all, I have two planners, I have two paper planners. I have a weekly slash monthly and I have a daily, so I Probably have six planners within like my reach right now.

Okay. Yeah. So you understand, right? Yeah. So I have, this is like my, my business resources binder. Like it has like even, you know, my like l l C information printed out, but like literally the first page is my habit tracker for my finances Tracker. More things need to be checked off there, but I’m like, yeah, it’s, it’s on the to-do list for this week. But then I actually have this is, I have a section which is literally, it’s FFF my yay. And it’s like stuff that I found helpful that I wanted to be able to refer back to. I love that it’s a whole section in here. Yeah, I love that. So that’s the,

that’s also the goal, right? Resources that last that are gonna help you while you’re going through it, but they’re also things that you’ll use and be able to refer back to whenever you need them. So that’s, yeah, that’s the great thing about having the lifetime access is that I’m not gonna take away, I’m not gonna like shut it down on you and take it all away.

If anything, I actually continue to improve it and put out new materials and new resources and all of that kind of stuff. Look, you’re not the only one. I can’t see who this is, but Yes, thank you. It’s an Obsessive amount. I have an obsessive amount of planners. Like it’s, it’s bad. So I get it, I get it.

So we make everything printable so you can, there are resources, that’s the great thing. There’s video, but then we have a lot of guides and checklists and not in an, again, not in an overwhelming way, in a step-by-step way, but things that expand on it where if you wanna learn more, we, we have a whole guide on a lot of these lessons to kind of give you even more kind of clarity around your own specific situation.

So I love that you’re still using them and I love that they’re just like right there for you. That makes me happy. Okay, so I’m gonna give you last chance to say anything else that you want to say and then I’m gonna ask you whether you would recommend FFF. I’m hoping the answer is be like really weird if you’re like, nah, it’s not a very good program.

Y’all should not buy it. Any, any last thoughts that you have about it? Or for people who might be kind of on the fence thinking about it, but they’re not sure if this is the right time for them? What Would you say? Man? Yeah, I mean, at the end of the day, if, if you have any, if you don’t feel like 100% solid in your finances, like even if you’re like, ah, like I feel okay, like I jump in because it, it’s just night and day between like not really being sure, you know? And like my mom’s a banker, like I was raised in like the back room of a Bank of of America. Like I’m not kidding.

So like I was always exposed to this stuff and I think that’s honestly where a lot of my weird money mindset came from. But there, there’s a total difference between like being like, I think I kind of got it to like 100% percent blah, 100% sure. Like yes. Like I know how to do this. I have money coming in, I know exactly where it’s going.

And like I said, like when I started, I actually didn’t really have money coming in. I was kind of just, you know, building things up. And I’m super excited to go back through now with my business that’s, you know, way different in a financial situation than it was at the start to like dig back in and see the new tools and things like that.

So the fact that you can revisit it, I think is also really crucial. So regardless of where you’re at in your business, if you’re just starting, if you’ve been in business for years, I think really anyone that isn’t like 100%, like I know everything about finances ever. Like you can probably benefit from this, this program. I love It.

I love it. Good, good. I’m glad that you recommend it. So we have some questions and I, I do. So I’m now, okay, so first I’m just gonna tell you guys a little bit more about the program. We, we have the lessons and the modules and the resources, all of those things. We also have a Facebook group.

You don’t have to be on Facebook to actually get the value from it. We’re gonna be putting all of those Facebook lives also into the course platform, making them all searchable this year. How awesome is that, Ashley? They were not searchable last year. They’re gonna be searchable. So if you’re like, I don’t wanna sit through all these que q and a lives,

I’m gonna search for the answer to the question that I have. It’s just gonna pop up exactly in the video where it, where I talk about it, you know, and, and go from there. So I’m excited about some brilliant of things, which is gonna be, make it so much easier I think for people to get the answers to their questions.

I’m gonna go be doing q and as twice a week with everybody in the group to answer all the questions. We’ve got community pods this year, so you should have in a community pod too, Ashley, we’d love to have you. It’s gonna be, you know, kind of participant led pods that will help keep people accountable as they go. Love it through the course.

So we’ve got some of these fun things that I’m excited to try out. And so I will say, okay, so that, for those that are thinking about it, I, I’ll give you the link, it’s Jamie Trull dot com slash buy. You can go there and check out all the information right now. Couple of announcements. We have six i p programs left.

That is it. We started with 50, now there are six left. Those are gonna be sold out asap. Those also come with a QuickBooks online cleanup. So I’m not gonna go into that in a lot of detail, but if you are like, oh, my 2020 books are a mess and I don’t, I want to get to that point where Ashley is, where she’s like, here’s all my stuff. Well, we can take care of 2024, you our, one of our preferred vendors, cube Pros is going to literally do that work for you if you get the v I P program and then you can focus on how to make 2021 better. So it’s gonna be amazing and I wanna make sure you guys get in on that.

’cause literally there are six left that they’re gonna go, they’re gonna go and they’re worth a lot. So check that out, JB Trull dot com slash buy. And then the other thing, so somebody just asked this question and so I wanna, I, I wasn’t gonna mention this to y’all, I wasn’t gonna mention it yet, but since whoever this, I want somebody to tell me who this Facebook user is.

If, if you give Streamyard permission to see your name, then I, then I can see it when I pull you up. But, so I added a new bonus. I wasn’t gonna release it till tomorrow, but you guys who are on this live, I will give it to you if you, if you go ahead and purchase while you’re on the live, then we have a bonus that is all about cashflow. So I’m gonna give you my cashflow template, which is my cashflow forecasting template with, with walkthrough on how to, how to use it and everything. It’s one of my most popular templates. People, people always talk about that one as being the one that really helped them.

And I have an improve your cashflow guide. So it’s a guide on different ways you can think about improving your cashflow. You’re gonna get that guide as a bonus as well. So I’m really excited about that. That was kind of a new ad that we put in. We do talk, we talk a lot about creating your cash plan, your profit plan is what I call it, and how to manage your, your cash and how to kind of create a plan that works for you where you can kind of allocate that profit to the things that are really gonna help you.

Like Ashley says, she knows, okay, here’s how much I have to invest in my business. Yeah, that’s, That’s the magic spreadsheet that that like the profit plan is like, Yeah, this is amazing. It does it all. And you’re like, oh, okay, here’s how much I can pay myself. Here’s how much, and you just have a plan, right? That’s the, that’s the profit plan. So I really want you to jump in on that, but I am gonna be, that is gonna be a bonus that’s coming out.

So I’ll just release it today, y’all, if you buy it today, you get the bonus today too. And I’m gonna look and see, let me know if any of you guys have questions. Okay? So ask me any questions that you have about it. We’re gonna do another live tomorrow with one other member of FFF from last year. So that’s gonna be exciting.

So I want you here for that. That’s at my normal 10:00 AM time slot. But we close on Thursday, you guys, Thursday is like, is it, and we’re closing for a while. We haven’t opened in a year. This is the first time this program has been open in a year. So we don’t know when we’re gonna be opening again, but it won’t be anytime soon because I do walk through, you know, we drip the course content out week to week so you’re not getting the whole course at once because that would be really like, whoa, a lot. So we, we drip it out week to week and we’re there with you in the Facebook group and we’re there answering questions. I’m there helping you guys out.

So if you have questions, let me know. Yes, I agree. Lori, hang on, I’ll put your comment over here. Yes, the searchable feature, we’re pretty excited about that because I think that that will help just being able to easily find answers to your questions. And regardless of what type of business you are, we have a lot of businesses, we have businesses that are newer, like Ashley, we have businesses that have been around for a while and are like, I just need to get more strategic. I need to have a plan, I need to really dial in my profit margins, I need to understand this stuff. And let’s see, so I’m gonna talk to this Michelle.

So Michelle says, I don’t understand anything about finances. I’ve tried classes before, but really afraid I will take this class and still be, so I walk through it with you. So here’s the thing. If you are feeling i’ll an I’m gonna answer every single dang question, I don’t care if I never sleep, hopefully that’s not the case. But I, but my goal is literally in the q and a is to answer all of these questions.

So if you’re getting stuck anywhere, I think sometimes when we take programs and we get stuck, it’s because we don’t have the level of support that’s really needed. And so that’s something I think with finances especially that is necessary. It’s also why I really like the idea of the community pods we’re doing now. Because you can find a, a community pod that’s similar businesses to yours and talk about these things and actually, you know, number one, build friendships, which is amazing, but also really work through that together too. So I’m gonna be there, you can get in a community pod, like we’re gonna have actual support to help you through this process. And so I feel like you’re gonna feel different at the end of this. I really like, that’s my goal for everybody.

You put in the work, if you get in there and you do the modules and you action it, which I’ve told people I would put like maybe like about three hours a week. Would you say that’s probably a, like relatively from a timeframe perspective if that Max Yeah, yeah. Like yeah, like I said, it’s not, it was like, it’s not like A whole day or anything. You’re not, you know, it’s, it’s, so what I say is like about three hours a week and you’ll be golden three hours a week, we’ll give you time to go through the modules to go through the PDFs and checklists to, to action all the action items, right? That’s all. So that can be like a half an hour a day ish, right?

That’s, that’s not that much time lunch break to be able to make a big difference in your finances. Yes. And, and Jamie can I, can I just comment that on that too? Yeah, right. Like being free of that fear is so amazing. Like, it is like, oh, weight being lifted off your chest,

right? Like I had that fear too and I was really afraid, like my, my business is like my get outta the navy and support my family plan, right? So I was really afraid that if I didn’t figure this out, that I would cause financial ruin for my family, right? That’s, that’s a big heavy weight to be holding onto.

Yeah, and to be free of that is just such a wonderful, amazing feeling. I love that. And that’s the thing, right? Is that I think we, we, the fear you, you hit on it, right? I, and I get it. Like, I, I absolutely we’re in a, we’re in a place where, you know, a lot of people are still struggling from covid and so I, I sell from a place of integrity, so I’m not like, go mortgage your house and buy my program. Like, that’s not what I want people to do. But I do know that people that can are in a place where financially they can’t afford it.

They’ve, they’ve got the money, they can do it. They’re just like, I don’t know if this is gonna be worth it. If you put the work in, right? If you put the work in, you’re gonna get a return that’s greater than what you put into this. I can, I mean, it, you just will, you just will.

And like I said, I’m there with you the whole way. So if you’re getting stuck anywhere, I can help you along to make sure that you are getting that return on your investment. And I, I do, I do think that sometimes we come from that place, but think about like what if it’s kinda like the, what if it doesn’t work out when we sit in that place of like, what if it doesn’t work out? But what if it does though? What if it makes all the difference, right? Right.

You kind of have to weigh the like pluses and minuses of what if it doesn’t work out? Well, firstly, I have a 14 day money back guarantee by the way as well. So if you get into it, right,

if you get into it, it starts when the program drops. So the first module will drop next Monday, 14 days from next Monday. Which means you get to actually see the first three modules before if you’re like, this is not gonna work for me, you can get your money back if you just show me like, hey, I put some effort and it’s not gonna work for me, or this isn’t right for me, you get your money back. So there’s not, so if you’re coming from that place of fear, then maybe that, maybe taking it up and saying, okay, well I’ll do this and, and I will feel better knowing like there is a path to getting my money back if I needed to.

You’re not gonna need it. But, but I have it there just in case. Just to, just to make you guys feel better about it. Let’s see. So somebody asked, I can’t see your question or I can’t see your face, but do you address or have tips about the lack of predictability in, in forecasting with Covid? My cashflow forecast usually has an element of historical sales.

I try to get operational costs below it with Covid, it is up and down. It is up and down. And so I think that within the profit plan we come up with ways for sort of, you know, looking at saving for when you have good months, how do we use that to then kind of put money aside for those bad months?

So we can’t necessarily predict, right? We can’t necessarily predict, but what we can do is prepare. So that is where we do our best to predict. But even in the absence, knowing like right, how much can you really predict Covid, the, the key though is to prepare for what’s next, right? The key though is to have, have a, a process that works for you where you’re continually having part of your money set aside to prepare. And so that’s what we walk you through. When you get to kind of the end when you do your profit plan, that’s what you’ll have is kind of that preparation for whatever is to come. Because I think we all know, right?

Like Covid, like holy cow, it just kind of came outta nowhere and I think we all learned a lot of lessons. We’re still learning a lot of lessons, but really a, a key among them is we gotta be better prepared for anything at this point, right? We don’t wanna be like, where it’s great if you can get government funding. We don’t wanna have to rely on that in order to keep going.

And so the better prepared we can be for anything, for anything, the better off that we’re gonna be. So, okay guys, well I am gonna let Ashley go ’cause she has given us so much of her time. I’m so glad to have you here. I’m gonna like literally chop up and put you, you gave me so many good quotes, so, so definitely take a look. Jamie Trull dot com slash buy if you want to take a look at the program. Oh, let’s see. I’ve already gotten, let’s see, so Dana joined us. Yeah, that’s awesome. So yeah, take a look at all the information and I really want to make sure that you guys get your questions answered.

So also email us at support@balancecfo.com if you have questions about the program. Remember we close in two days Thursday, close on Thursday and then can’t get in. So jump in if, if you’re interested. Okay, Ashley, we will see you next time and bye everybody. Bye. Have a great, what day is it? Tuesday? It’s usually Wednesday.

Tuesday? Yeah. Tuesday, yeah. Pretty sure.