The Stimulus bill signed into law on December 31, 2020, included big changes for employers. That could put more money in your pocket! If you’ve retained employees in 2020 and 2021, you are likely eligible for more FREE money. EVEN if you got a PPP loan! Find out if you are eligible for the Employee Retention Tax Credit.

This article has been updated. Through the most recent guidance changes to ERTC that occurred in November 2021.

Be sure to read the full article for an explanation of all of the subsequent updates, changes, and clarifications. All related to ERTC.

Please Note the IRS Announced in September 2023 that it will not process any more ERC claims in 2023. (As they investigate fraudulent claims.) You can still file amended payroll returns to claim the credit right now. They just won’t be processed at this time. Watch my video here on the update: https://youtu.be/XY6x7bFW8Cc

Thank you for visiting! We have loved being able to support so many small businesses in navigating the Stimulus options to them. Here are some resources you may find helpful moving forward:

- ERTC Calculator

- EIDL LOAN UPDATES FOR 2022: CALCULATING EIDL PAYMENTS & INTEREST

- EIDL Calculator

- For even more updated resources for 2023 and beyond, make sure to visit our shop!

What is the Employee Retention Tax Credit?

The Employee Retention Tax Credit (also called ERC or ERTC) was part of the original CARES Act passed in March. The purpose of the ERTC was to give a payroll tax credit. (Social Security and Medicare) to employers who retained employees. Even though they were fully or partially closed or had a big drop in revenue. It didn’t get as much publicity at the time. The original rules stated that you could NOT get both a PPP loan and claim the ERTC. For most employers, the PPP was a better option to get forgivable money to use for payroll and other expenses.

However, with the passage of the December Stimulus bill, all of that has changed. Now PPP borrowers are eligible to also receive ERTC for qualified wages paid to employees if they meet certain conditions. The ERTC was also modified and extended through June 30, 2021. This credit is worth up to $19,000 per employee!

Importantly, this generally does NOT apply to those of you who do not have W-2 employees other than yourself (i.e. solopreneurs).

The ERTC rules are complicated, confusing, and inconsistent, and unfortunately, we are still missing some important detailed guidance from the IRS on how to apply the new rules. That said, if you think you may qualify for the ERTC, you should talk to a tax professional who is versed in the rules (there unfortunately aren’t many), and file a retroactive credit for 2020, and/or make sure to claim the credit for Q1 and Q2 of 2021 if you qualify

How much is the Employee Retention Credit?

If you qualify to take the Employee Retention Tax Credit during a specific period of time in 2020 or 2021, you can essentially reduce the amount of federal payroll taxes (FICA) you pay, equivalent to the total amount of the tax credit (or in the case of 2020, get a retroactive credit against payroll taxes already paid). For 2020, you can get a tax credit worth 50% of each employee’s wages paid during qualified periods, up to a total of $10,000 in wages (i.e. the max 2020 tax credit per employee is $5,000 for the full year). For 2021, you can get a tax credit worth 70% of each qualifying employee’s wages paid during EACH QUARTER, up to a total of $10,000 in wages (i.e. the max 2021 tax credit is $7,000 per employee PER QUARTER).

If you qualify for 2020 AND both quarters of 2021 – that means $19k in tax credits (i.e. a reduction in payroll taxes)! That’s $5,000 for 2020 + $7,000 for Q1 2021 and $7,000 for Q2 2021.

How do I know if I Qualify for the Employee Retention Tax Credit?

This is where it gets tricky. The rules are complicated…and they differ between 2020 and 2021. Overall, whether you qualify and how you calculate the amount is based on 3 things:

-The average number of full-time employees you had in 2019

-Whether you had a quarter-over-quarter gross receipts decline between the quarter and the same quarter of 2019 (i.e. comparing Q2 of 2020 to Q2 2019, and comparing Q2 2021 to Q2 2019, etc). The amount of the gross receipts decline that you must have in order to qualify for the credit varies based on which year you are calculating the credit for.

-Whether you were fully or partially shut down during the period

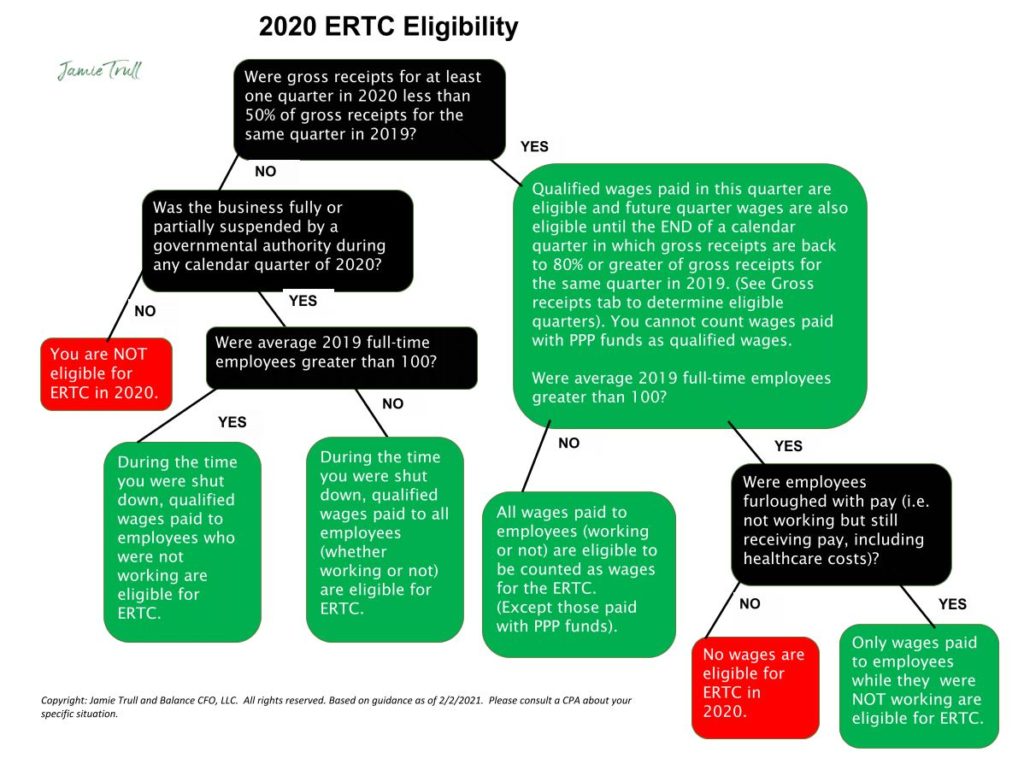

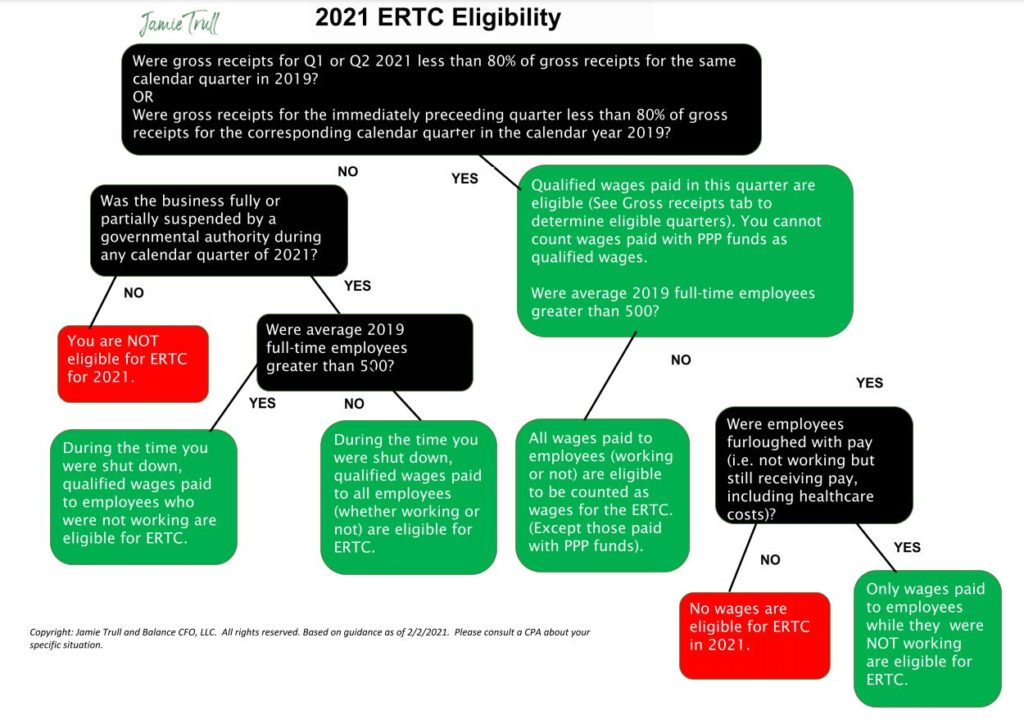

Because the rules are complex, I’ve created a decision tree for you to use in determining whether you may qualify for the ERTC for 2020 and 2021.

Want help determining which quarters you qualify for Employee Retention Tax Credit? Snag my ERTC Calculator here, which will help you determine your eligibility and calculate out your estimated tax credit.

2020 Rules for Qualifying for the Employee Retention Tax Credit RETROACTIVELY

For 2020, to qualify, you must have EITHER:

- Experienced a 50% decline in gross receipts (i.e. revenue drop) for at least one calendar quarter (i.e. Apr-June, etc) of 2020 vs. the same quarter of 2019;

OR

- Had your business fully or partially suspended by a governmental authority during any calendar quarter of 2020

If you can answer YES to either of those, you may qualify for ERTC. Review the decision tree below for details.

2021 Rules for Qualifying for the Employee Retention Tax Credit

For 2021, in order to qualify, you must have one of the below:

- Experienced at least a 20% decline in gross receipts (i.e. gross receipts were less than 80% of previous) for the calendar quarter of 2021 vs. the same quarter of 2019.

OR

- Experienced at least a 20% decline in gross receipts in the PREVIOUS quarter vs. the same quarter of 2019.

OR

- Had your business fully or partially suspended by a governmental authority during any calendar quarter of 2020

If you can answer YES to either of those, you may qualify for ERTC. Review the decision tree below for details.

How Do I Calculate The Amount Of My ERTC Credit?

Once you know you qualify and for which time periods you qualify, you can begin to estimate the amount of the credit by determining what the qualified wages are for each employee paid during the qualifying period.

Qualified wages are all wages paid to employees in which FICA taxes are paid (generally all wages and variable compensation paid). Qualified wages also include the cost of qualified health plan expenses paid by the employer. It does NOT include required paid leave under FFCRA or wages paid for paid time off, vacation, holidays, etc. Note that in some cases you can include all qualified wages paid during a quarter, while in other cases you may only be able to claim wages during a time you were shut down or partially shut down. See the decision trees above to determine the wages on which you can claim ERTC in your particular situation.

If you want help to estimate the amount of credit you are eligible for, snag my ERTC calculator to help you out. It could save you THOUSANDS.

How does my PPP Loan impact the Calculation of EMPLOYEE RETENTION TAX CREDIT?

Getting a PPP loan no longer can invalidate your ability to claim the Employee Retention Tax Credit, however, it does reduce the benefits you might be able to get from the ERTC. Ultimately, you cannot claim an ERTC credit on wages that were paid with PPP. That means you likely need to estimate the amount of your PPP loan that was used to pay each employee and back that out of your total qualified wages. This calculation can be complicated, and it’s best to work with a professional to make sure it is done correctly.

We’ve got more financial freebies for you in 2024 and beyond!

– Jamie

What else should I keep in mind?

There are lots of nuances to the eligibility requirements of the Employee Retention Tax Credit. For example, you can’t use ERTC to pay family members (even if they are working employees of your business). As of the date of this article, the ability to claim the ERTC on the owner and owner spouse’s W-2 wages is still unclear.

There are also specific rules around when a business is considered to be “shut down” and “partially shut down” from a qualifying perspective.

Given the complexities of the calculation, it’s always best to have a professional help validate the calculation and help you claim the credit accurately.

The IRS website has a lot of FAQs on the ERTC, however as of the date of this article’s writing, they had not yet been updated for the changes related to the December 27, 2020 Stimulus bill. Bookmark this link to the IRS information on ERTC, and check back frequently for updates.

March 2021 Updates to ERTC

As of March 2021, ERTC has been extended to include Q3 and Q4 of 2021 using the same rules as the previous quarters in 2021 (see the below November update however where it was subsequently removed for Q4 2021).

Additionally, the March guidance also included some new rules related to Severely Financially Distressed employers (i.e. experiencing a sales decline of at least 90% in Q3 2021 vs. Q3 2019), and Recovery Startup Businesses (businesses with employees other than the owner that began after February 15, 2020 and have annual gross receipts under $1M).

November 2021 Updates to ERTC

To add to the whiplash, the Infrastructure Bill passed by Congress in November 2021 removed the ERTC credit for Q4 2021 for all but Recovery Startup Businesses.

For businesses that had already been reducing their payroll taxes withheld with the expectation of qualifying for this credit, not penalties or late fees will be assessed as long as the under-payment is remedied by the end of the year.

Our ERTC Calculator and spreadsheet have been updated to reflect these changes.

ERTC FAQS

We often get questions sent to us about this calculator and ERTC in general. See below for the answers to our most frequently asked questions.

Why does this calculator allow you to qualify based on the prior quarter results?

See pages 6-7 of this IRS Notice 2021-23 which states that you may elect to use the prior quarter instead of the current quarter to determine eligibility for the credit. Ensure you keep support for which quarter was used in the determination of credit eligibility.

Can I claim my own paycheck or my spouse’s paycheck for ERTC?

While there was some ambiguity on this point early on, it was recently clarified by the IRS that owners of more than 50% of the company and their spouses generally do NOT qualify for ERTC. Other individuals related to greater than 50% of owners also do not qualify. This does not change the worksheet as we had already taken this position in our interpretation of the previous guidance.

Why is it taking so long to get my credit?

The IRS appears to be quite backed up in processing the 941-xs and Form 7200 (to put it mildly). We’ve seen the longest wait times for those claiming the 2020 tax credit via 941-x. However, we have also seen many business owners receive their refunds, so we do think it is worth the wait!

How do I claim the ERTC?

To claim the ERTC retroactively for 2020, you’ll file an amended 941 through your payroll company.

For 2021, you have two options:

- Claim the credit as you file your quarterly 941s

OR

- File Form 7200, which allows you to get the money in advance by estimating the amount you will qualify for. For businesses in need of cash flow to help fund payroll, this may be a good option. Make sure to work with a professional to help you estimate the amount owed.

THINK YOU QUALIFY BUT WANT TO MAKE SURE?

Grab my ERTC Calculator for only $27 (limited-time price). Many of those who have already downloaded it have saved THOUSANDS with this spreadsheet…for the cost of a dinner.

This ERTC calculator will help you:

- Understand the rules to qualify for the Employee Retention Tax Credit, including an easy-to-follow flow chart illustrating the 2020 and 2021 rules, including all of the guidance updates in 2021.

- Determine which quarters you qualify for the tax credit based on gross receipts, as well as when you no longer qualify.

- Estimate the tax credits you might be eligible to take for 2020 and 2021 (yes, even retroactively – there is still time!!)

Once you determine you likely qualify and estimate your credit, it’s time to seek out a professional to assist you with checking your calculation and helping you file the required forms. I don’t recommend DIY-ing this one!

What’s Next?

Want more information on ERTC? Check out our Youtube ERTC playlist which describes the credit and chronicles the recent changes, plus gives you a preview of what you’ll find in the calculator.

Love this calculator. Then you’ll probably enjoy this article about S Corp Tax Calculator Methods!

Learn more about me, Jamie Trull here.

Looking for the best online bank? Check out my recommendations!

Want to add a digital course to your business offerings? Read my review of Amy Porterfield’s DCA!