Wondering how much you should pay yourself as an S-Corp owner this year?

You’re in the right spot. In this 2025 step-by-step guide, I’ll show you exactly how to calculate a reasonable salary the IRS will accept.

And how to do it in a way that’s tax-smart, practical, and easy to document.

You’ll learn:

- What “reasonable compensation” actually means (and why the IRS cares)

- A proven, IRS-accepted “Many Hats” (Cost) Method for setting your salary

- A complete walkthrough with numbers so you can follow along

- How to avoid the most common mistakes that cost owners thousands

- What to do if you’re part-time, seasonal, multi-owner, or having a low-profit year

- Year-end best practices so you stay compliant and sleep better at night

This post is sponsored by RC Reports. All opinions expressed are my own.

Fast Links (resources I recommend)

- ✅ Run your Reasonable Compensation Study (15 minutes, IRS-defensible)

- 🎓 Free S-Corp Salary Masterclass (deep dive with examples)

- 🧾 Need payroll that’s S-Corp-friendly? Check out OnPay (often a signup bonus)

- 🧰 Curious if S Corp status is right for your business and want more tools? 👉Explore the S Corp Toolbox for guides, tax calculators, and compliance resources.

I personally review each RC Reports study ordered through my page, and you’ll get a professional-grade PDF you can keep on file in case you’re ever asked to substantiate your salary.

This post may contain affiliate links, which means I may earn a small commission if you make a purchase through these links at no additional cost to you (in fact, using our links can typically SAVE you money). We appreciate you supporting our small business by using our links!

What is “reasonable salary” for an S-Corp owner?

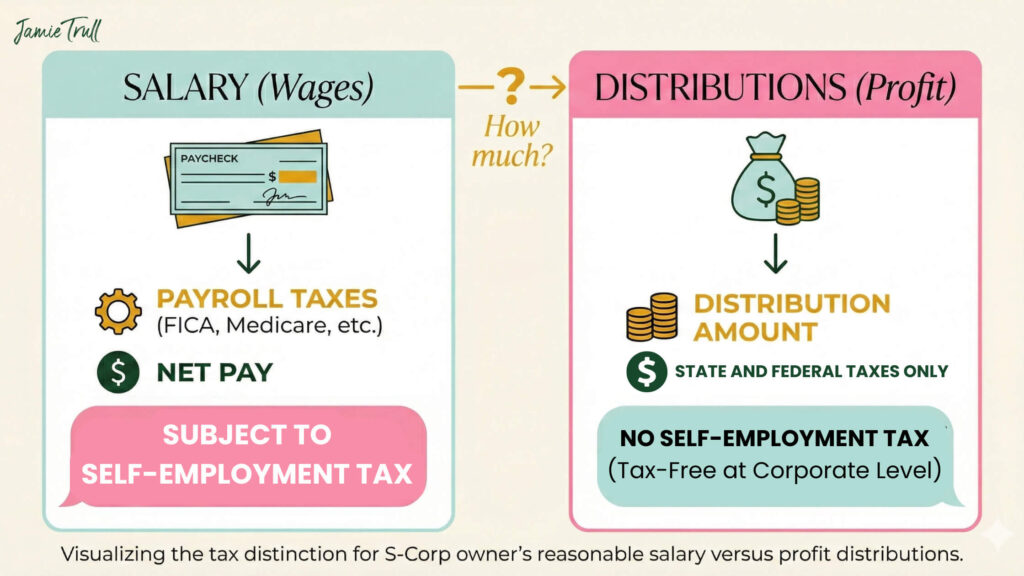

If you’ve elected S-Corp taxation, the IRS expects you to pay yourself W-2 wages for the services you perform before you take any additional shareholder distributions.

Wages are subject to payroll taxes; distributions are not. That difference is why the IRS pays attention.

Reasonable compensation = what you’d have to pay someone else to do the job(s) you currently perform in your business, considering:

- Your duties and responsibilities

- Your skills, training, and experience

- Your time allocation across roles (“many hats” problem)

- Your location and relevant labor market

Skip the internet myths.

Rules of thumb like “50/50” or “60/40” salary-to-distribution splits aren’t in the IRS guidance.

They can push you to overpay payroll taxes (or underpay and increase audit risk). U

se a method that maps to your actual work.

Why the IRS cares (and how it affects your taxes)

- W-2 wages are subject to employer + employee FICA (Social Security up to the annual wage base and Medicare), plus potential Additional Medicare for higher earners.

- S-Corp distributions are generally not subject to self-employment tax.

- Because that’s a big tax savings lever, the IRS requires owners who work in the business to pay themselves reasonable compensation first.

Key takeaway: You can absolutely leverage S-Corp tax savings—but only after paying a defensible wage for your actual work.

The Best Way to Calculate It: The IRS-Accepted “Many Hats” (Cost) Method

Most small business owners wear multiple hats—CEO, sales, marketing, admin, service provider, you name it. The Many Hats (Cost) Method recognizes that reality and builds a salary from the weighted market rates for each hat you wear.

Step 1: List the roles you actually perform

Brain-dump everything you do in a “typical” year. Most owners find 5–10 roles (sometimes more). Examples:

- CEO / General & Operations Manager

- Client work / Technical service delivery

- Sales rep & estimator

- Social media / digital marketing

- Customer service & admin

- Billing, AR collections

- Hiring, training, scheduling

- Facilities or equipment maintenance

Don’t skip the “unsexy” jobs. Those lower-rate roles help keep your weighted average realistic—and your payroll taxes down.

Step 2: Estimate hours and location

- The IRS caps the analysis at 40 hours/week (good news if you routinely work 50+).

- Choose your market (city/county) when researching wages—local labor rates matter.

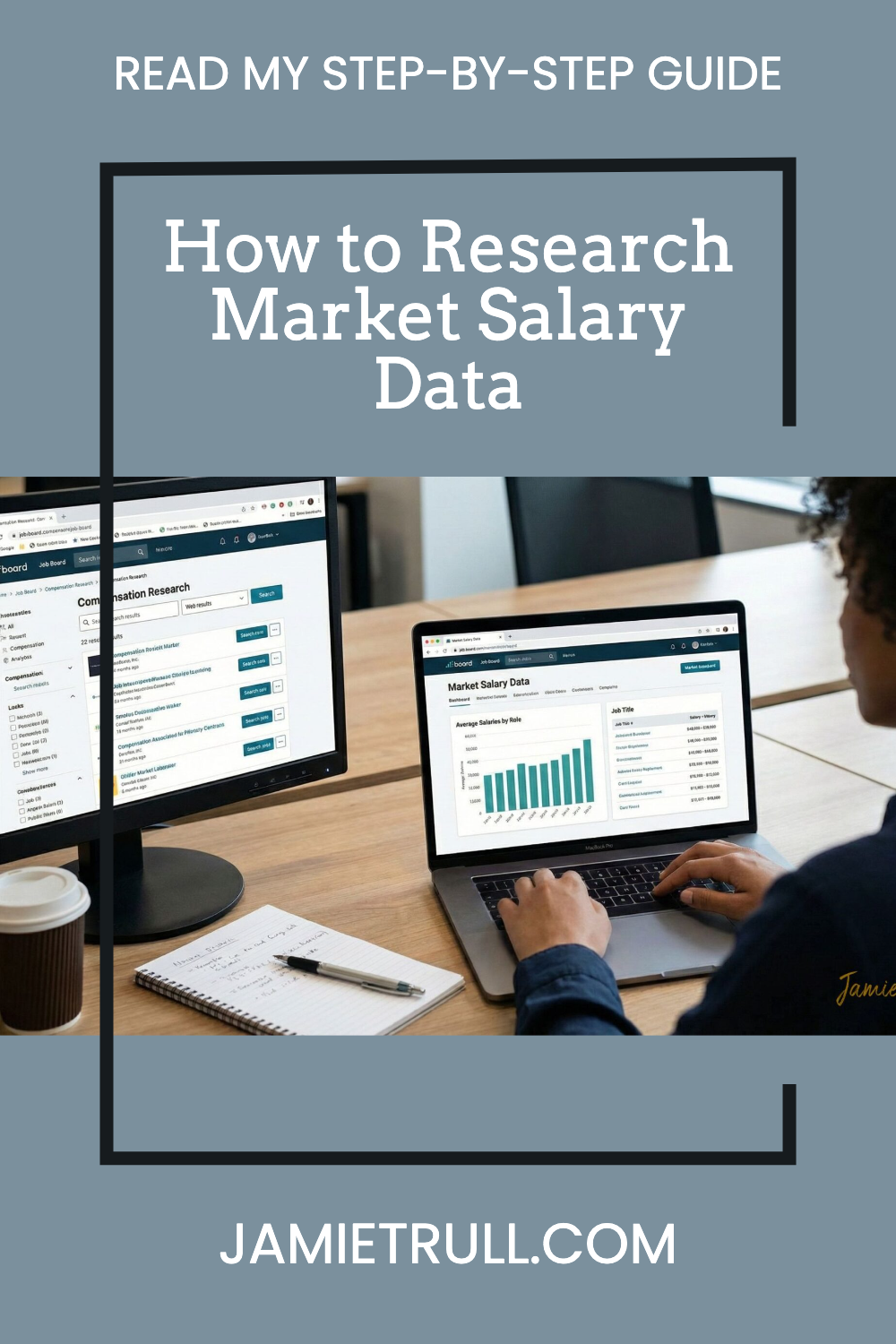

Step 3: Research market wages for each role

Use credible sources (job boards, BLS/OES data) to find a range for each role in your area:

- Entry-level / Low

- Mid-range

- Experienced / High

Tip: This is where RC Reports shines—it has a robust wage database and builds the role library for you so you’re not starting from scratch.

Step 4: Rate your proficiency per role

Are you below average, average, or experienced in each task? Choose a wage point within the range accordingly. Be honest—some tasks you do are outside your expertise (that’s normal). Inflating everything to “expert” can artificially overstate your salary.

Step 5: Allocate your time (percent of total)

Assign a percentage of your working time to each role. All roles together must total 100%. A snapshot might look like:

- 40% client work (technical service)

- 20% sales & estimates

- 15% marketing

- 15% admin & customer support

- 10% management/CEO

Step 6: Compute the weighted average salary

Multiply each role’s annual market wage by your time % for that role, then sum the results. That’s your reasonable compensation.

Step 7: Document everything

Capture:

- The roles selected and definitions

- Wage ranges and sources

- Your proficiency selections

- Time allocations by role

- The final weighted salary and notes

Best practice: Generate an IRS-defensible report (PDF) and keep it with your year-end records. If you’re ever asked, you’ll hand over professional support instead of a guess.

Run a study in ~15 minutes: JamieTrull.com/RCReports

I personally review every study ordered through my link. You’ll get a clean, defensible report that reflects the Many Hats method above.

Walkthrough Example: Lisa’s Landscaping

Let’s bring the math to life.

Lisa owns a landscaping company in Dallas County, TX. She works full-time (capped at 40 hours) and wears many hats:

- Grounds & lawn caretaker

- Landscape designer

- Crew foreman on job sites

- Sales/estimating

- Billing & collections

- Customer service

- General & operations management

Using role definitions and local wage data, Lisa rates her proficiency for each job (some high, some mid, some low), and assigns time % across roles. The software builds a wage for each role and calculates a weighted salary.

Result: The defensible Many Hats study returns an annual reasonable salary of ≈ $60,000.

Now, what if Lisa had skipped the Many Hats method and simply used “General & Operations Manager” for 100% of her job?

- Local average hourly for that role: ≈ $52.87

- Annualized (× 2,080 hours): ≈ $110,000

That’s a $50,000 difference—and at roughly 15.3% combined FICA (simplified illustration; actual FICA splits and wage base apply), that’s ~$7,600 more in payroll taxes every year … for the same business.

Moral of the story: Using a single high-pay management title can inflame your wage. The Many Hats method gives you a realistic, defensible number and helps you avoid overpaying.

Special Situations & How to Handle Them

1) Part-time owners

If you truly work part-time in the business, use actual hours (averaged across the year). The IRS allows capping at 40 hours if you work more, but if you work less, model that accurately.

2) Seasonal or variable schedules

Average your hours for the full year. You can pro-rate salary if you didn’t perform services for the entire year (e.g., you started mid-year).

3) Multiple owners

Each owner needs a separate analysis reflecting their unique roles and time split. It’s common for one owner to be heavier in operations while the other focuses on sales/finance.

4) Low-profit or loss years

Reasonable comp depends on services performed, not profits. That said, if the business truly can’t pay, you may need a catch-up plan once cash allows. Document why and when you’ll correct. (Talk with your CPA.)

5) What if I don’t perform services?

If a shareholder doesn’t provide services (pure investor), no wage is typically required. Be sure the facts support that—most small owners do some work.

6) Health insurance & other fringes

Owner health insurance added to your W-2 is still part of compensation; structure and deductibility have special S-Corp rules. Coordinate with your payroll provider and CPA.

7) State unemployment, workers’ comp, etc.

Your reasonable comp feeds into state payroll items too. Build your wage with those in mind and price your payroll accordingly.

How to Pay Yourself (Payroll mechanics)

- Set the salary using your Many Hats study.

- Choose a pay frequency (biweekly or semimonthly keeps cash flow predictable).

- Run payroll on time and file 941s, state returns, and year-end W-2s.

- Take distributions separately (owner draws), after you’ve met the reasonable salary for the year.

- Short for the year? You can run a catch-up payroll before December 31 (watch cash, withholdings, and state rules).

Need a payroll platform that plays nicely with S-Corp needs?

** I like OnPay for clear pricing, multi-state support, and smooth filings.

The #1 Mistake I See Owners Make

Paying “CEO rates” for everything.

When you default to a single high-level management title, you end up overstating reasonable comp—and overpaying payroll taxes. The IRS doesn’t require you to be a hero; it requires you to be accurate.

Do this instead: Break your year into actual duties, price each duty at market, assign time %, and compute a weighted average. Then document it.

Year-End To-Do List (so you’re audit-ready)

- ✅ Run or update your reasonable compensation study (annually)

- ✅ Set pay frequency and confirm you’ll meet the salary by year-end

- ✅ Reconcile distributions vs. wages (reclassify if needed)

- ✅ Keep your study PDF with W-3/W-2 and payroll filings

- ✅ If facts change, update the study (new roles, big time shifts, relocation, etc.)

Get it done in 15 minutes: JamieTrull.com/RCReports.

You’ll walk away with a clean, defendable report tied to your roles, time, and market.

Frequently Asked Questions

Can I change my salary mid-year?

Yes—especially if your role or hours meaningfully change. Document the reason (e.g., hired staff, shifted from delivery to CEO duties).

Can I just “bonus” at year-end to hit my number?

Yes, bonuses count as wages subject to payroll taxes. Just ensure proper withholdings and filings before December 31.

Do I have to run payroll before taking any distributions?

Practically, no—you don’t have to pay your entire salary first. But by year-end, you must have paid a reasonable amount for the services performed.

What triggers an IRS challenge?

Very low (or zero) wages alongside consistent distributions, or salary levels that don’t match your role/time. A documented study lowers risk.

Is there a safe harbor % (like 50/50)?

No. Those internet rules of thumb aren’t IRS guidance and can cost you money or increase risk. Use the Many Hats approach.

How often should I revisit my study?

At least annually, and whenever your roles/time/location change meaningfully.

Put It All Together (and get it off your plate)

The reasonable salary requirement isn’t about paying the government more—it’s about paying yourself accurately for the work you do and keeping the rest as distributions. When you use an IRS-accepted, well-documented approach, you:

- Reduce audit risk

- Avoid overpaying payroll taxes

- Confidently take distributions

- Sleep better at night

Your next right step:

- Run your salary study (and save the PDF)

- Watch my free training to plan salary vs. distributions like a CFO.

- Turn it into paychecks with simple, compliant payroll.

You’ve got this—and I’m cheering you on. 💚

This transcript was generated from the video for your convenience, but it may contain typos or slight errors due to the transcription process. For the most accurate and complete information, we recommend watching the full YouTube video.

How Much Should You Pay Yourself as an S Corp Owner

I wondering how much you should be paying yourself as an S Corp owner this year. Today we’re gonna dive into how exactly to calculate a reasonable salary for yourself step by step so that you stay IRS compliant and tax smart plus stick around until the end because I’m gonna share with you one mistake I see business owners make all the time when it comes to reasonable salary that could be costing you big money. Hi everyone. I’m Jamie Troll, your favorite CPA and. Profit strategist, and if you have elected to be taxed as an S corporation or you’re thinking about it for the current year or for next year, then you’ve probably heard the phrase reasonable salary. But what actually does that mean? And even more importantly, how are you supposed to calculate that? Well, if you’ve been following me for a while, you’ve probably seen other videos that I’ve done about this topic because I have lots of them. And that’s because this is a topic that I have some thoughts about.

Understanding IRS Expectations

A reasonable salary is essentially the amount of money that the IRS expects you to pay yourself out of your business for the work that you’re doing in your business. And that payment is supposed to come before any additional distributions are taken. Now, why do they care about this? Well, because one of the big benefits of an S corporation is that your distributions don’t have any self-employment taxes on them. However, your salary does. So while you don’t actually need to physically pay yourself your full salary before you can take distributions over the course of a year, you do need to make sure that you’ve taken your full reasonable salary. And if you haven’t, you should be reclassing some of the distributions you took as salary instead and paying those taxes. But the big question is what is considered reasonable? Now, of course the IRS is not going to give you exact numbers here, and some of the rules of thumb that are out there are just completely not based in any actual guidance from the IRS and might actually put you at more risk for audit.

Ongoing Compliance: Why Rules of Thumb Can Be Dangerous

So if you’ve heard of things like the 50 50 rule or the 60 40 rule of. Splitting between your salary and your distributions. Know that there is no actual basis in guidance for that, and sometimes that’s actually going to put you at more risk and have you pay more in taxes than you need to. So if the IRS does audit you, here are the things that they’re going to be looking at. They’re gonna be looking at what you would pay someone else to do those similar duties. So what is the market value of the work you’re actually doing in your business? And that’s gonna include things like your experience and your responsibilities, and how you split your time between different jobs in your business. Now if you’re like most small business owners, you’re probably doing multiple different jobs in your business. So you’re wearing many hats.

How to determine reasonable compensation: The Many Hats Method

And the IRS actually has a specific approved methodology that is called the cost method or the many hats method for coming up with reasonable compensation. And that’s the one that I generally recommend to most people. It’s gonna be the easiest to implement and to defend. So ultimately you need to think about it this way. If you were to hire someone to take on your duties, and it might be multiple someones right, because again, you have multiple different duties in your business, what would you need to pay each of them and what role would you be hiring for? So let’s walk through an example step by step. So the first step of coming up with reasonable salary under the Many Hats approach is to actually write down all the duties that you’re doing in your business. What hats do you wear? What roles are you actually filling in your business?

Breaking Down Your Actual Roles

So for example, you might see yourself as the CEO, but if part of what you’re doing is administrative or maybe you’re doing marketing as well, or you’re actually servicing clients, right, then you’re not actually just the CEO. And if you were to say you were the CEO and look up reasonable salary for A CEO, you’re gonna be paying yourself quite a bit of money and having to pay payroll taxes on all of it. So that’s why it’s really important to dig deeper. When you’re doing this process, you actually wanna think about what are those various roles that fall underneath what you’re doing now. I usually find that most business owners have at least five to 10 roles, if not more in their business that they’re doing. And regardless of whether you would actually hire someone for that job, you’re gonna wanna think about what job you would hire for.

Researching Market Rates

So for example, if you’re doing a lot of social media marketing in your business, maybe you would hire a social media marketer. Right. That would be a role that you would hire for. Whether you would or not is not the question, but we’re trying to figure out what those roles are that you’re actually filling so that we can do the next step. And that next step is figuring out what you would pay someone if you were to hire them for that specific role. Now, again, it doesn’t matter whether you actually would hire someone for this, we’re just trying to get a market rate that it would cost you. If you were to divvy up yourself and hire a bunch of different people with different expertise, now this can be a challenging part because it is gonna require some research and you’re gonna wanna document your findings.

Income tax considerations: Competency and Salary Ranges

So if you’re searching for various different roles, you can go look on job posting sites like Indeed to. See what types of salaries those are paid. It’s best if you can look in your local area, especially if you would need to hire locally. But again, you may have to just use whatever information you can get. There’s also the US Bureau of Labor Statistics that has some information that you could take from, so ultimately you’re gonna want to research what that role. Would cost you. Now, when you go through that process, you’re probably gonna realize that the range of salaries is pretty wide, so where are you supposed to take from? And that’s step three, figuring out what your specific competency level is.

Time Weighting Your Roles

Such that if you were to hire someone with a similar competency level. In that specific role, how much it would cost you. So for instance, if you consider yourself average, let’s say at this social media marketing role, then you would pick from the middle of the range. However, if you have various different certificates, degrees, this is something you’ve done for a while, you’ve got lots of experience, you might need to pull from the higher end of the range that you find. Or if you have no idea what you’re doing when it comes to social media, you’re fully self-taught and it’s really not your forte. Maybe you would pick from the lower end of the range because you’d be hiring someone with less experience. Now, once you’ve gone through that process, you’ve listed out all your roles, you’ve done the research to figure out what you would pay someone for each of those, and where in the range you would pick from based on your competency, then you need to do step four.

Creating a Weighted Average For an S Corp Reasonable Salary:

Which is ultimately to create a weighted average. So in order to do that, you’re gonna have to figure out what percentage of your time you spend on each of those different activities. And of course it’s gonna vary. So you’re gonna wanna think about in a normal year, exactly what kind of split could you expect to see. So for example, maybe 10% of what you do is administrative, 20% is marketing, 40% is actually servicing clients, right? You’re gonna make sure that for all of those roles, it adds up to 100% of your time. And then as a last step, you’re ultimately going to multiply the various different salaries that you came up with, times the percentage of your time you do that. And add it all together to create a weighted average, which is your salary.

Business owners: Using Software to Simplify the Process

Now, if your head is spinning a little bit and you’re wondering, how in the world am I supposed to do all of that, that seems like a lot of work. How can I do this in an easier way? Well, let me walk you through how I actually do this. Thankfully, there is an amazing software system that I partner with that actually can help you walk through this step by step, and it already has. All of the data included. Now, I encourage you to stick around and watch this tutorial. I’m gonna walk you through, even if you do intend to DIY, this because this is gonna show you exactly how to calculate this out.

Software Walkthrough Example

So let’s jump on into the software. Alright, so the example we’re gonna use is Lisa’s Landscaping. So Lisa owns a landscaping company and she’s trying to figure out what her S Corp reasonable salary is. So in the software that I use, I partner with RC reports for this. The very first step here. Is to essentially determine how many hours you work per week. Now, on the plus side, many of us business owners probably work over 40 hours a week sometimes, and so the max, however, for the IRS calculation is 40 hours, which is a great thing that’s gonna help cap our salary a little bit. Now, if you’re not working full-time in your business and say you average about 20 hours, you’re gonna pull that here.

Identifying Job Duties

And again, if you are inconsistent in how much you work, remember this is coming up with an annual salary, so you’re gonna wanna look at it. Averaged out over the year, how many hours do you work? So let’s say that Lisa’s working full-time in her business, then you’re gonna select your location as well, so that when it pulls the data on these job duties, it’s pulling local data. So we’re gonna say that Lisa lives in Dallas County, Texas. Now, here’s the great thing about using a software like this is that it can help you come up with some of those starting common job duties that a lot of different companies and business owners have. So you can determine if you do maintenance. Uh, she can basically determine if this is something that she does well.

Expanding and Reviewing Tasks

She is a grounds and lawn caretaker, so we can add that as maintenance. And she does do some repair work as well. So occasionally if something breaks, she’s gonna do a little bit of repair work and she might not have remembered that. But going through this process helps her recall. What all her job duties are. So we’re gonna add that one as well. Then we’re gonna go to the administrative, well, what exactly does she do? So she actually does quite a bit of customer service work and even a little bit of admin assistant work for marketing. She tends to do a lot of the research when it comes to marketing, and she’s their main. Sales representative.

Tasking and Proficiency

She’s the one going out and giving quotes for finance. She does have a bookkeeper, so that’s not something that she does, but she handles most of the billing and invoicing and the collections. So we’re gonna add those as well. And we’re gonna go through each of these again. She does employee training too, so when you go through this, you probably will realize exactly how many things you actually do. Now, she doesn’t do a ton. Information technology, there’s no inventory that she’s managing. And then it comes down to management. And here’s the thing, right? She probably would’ve said general and operations manager.

Lower salary strategy: Avoiding Overclassification

And I’m gonna show you, if she had done just that, what that would would come up with. Now what I love about this system is that when you try to put something like this, it’s gonna remind you that this is gonna come with a higher compensation. So anything from the management duties. So you wanna make sure that it actually aligns with what you’re doing, right? And you wanna make sure you have allocated out all of those other lower level tasks, because that’s gonna help keep your salary from getting really high. And remember, higher salaries equals more taxes. So let’s say we’re good with it, we’re gonna proceed and add that anyway.

Final Calculations and Audit Defense

Now, if you’re ever unsure, you can actually go and read exactly what that job duty is. So if you just hover over these, it’s gonna tell you what they are. So again, you’re gonna wanna pick the closest representation. It may not be perfect, and that is okay. This is all about estimation. Now, if you’re wondering though, what about all the other tasks, right? My business maybe isn’t actually represented here. The things that I’m mainly doing in my business aren’t showing up on any of these. That’s okay. These are more the things that you are doing. Working on your business, and then we’re gonna get to how to find more of the specifics of what you do in your business.

IRS audit documentation: Time Allocation and Reporting

So a lot of people might be worried that they have a very technical job, and it’s not gonna show up here. I’m gonna show you where you’re gonna find them.

So that’s actually gonna come in the next step. Step three is actually business tasks, and this is where you can enter in a task name. For Lisa, she actually designs a lot of the landscapes.

So I went ahead and just put in some key words that help me find various different roles that could fit for her.

Again, things like putting in landscape as a landscaper.

This is exactly what she does, a ton of landscape architecture, so we wanna make sure that we’re adding that.

Review Results and Tax Impact

She also serves as the foreman most of the time for her clients.

So she we’re gonna add that as well. And you can see that you can put in various different things here that are gonna help you find those more specific tasks.

And the great thing is this database is massive.

So again, while it may not have. Everything. It’s probably going to have tasks that are similar to what you do in your business.

So it’s just a matter of searching around to find something that fits as close as possible.

Then we’re gonna come over to the tasking and proficiency.

Income tax impact: Final Thoughts on Reasonable Salary

So like I said, we need to figure out, okay, how proficient are we in that?

If we were to hire someone of our similar caliber for this role.

What would we have to pay them? W

here in the range is it gonna pick that salary from the low end, the high end, or the middle of the range?

So I always caution people, you don’t need to put, I know we all love, sometimes I get reports that are all, you know, on the high end, and we need to remember that it’s okay that some tasks in our business we’re not trained for, we’re just doing them because there’s no one else to do them.

So it’s okay to be average or below average or even low in certain tasks.

Conclusion and Resources

And remember, this is for IRS purposes, not for marketing purposes, right?

Your clients are not going to see this.

They’re not going to judge you about it.

So make sure that you’re not accidentally inflating your salary and therefore your taxes by going really high here.

And this is also the step where you’re gonna figure out how much percentage of your time are you spending on this.

Right.

So there is a time allocation part of this.

We’re gonna allocate out the 40 hours a week that we do.

Now, I’ve started going through this and the cool thing about this report is as you do this, it’s going to show you the split.

So again, we wanna get to 100%.

Avoiding Costly Mistakes

It’s not even gonna let you go to the next task until you get 100% here.

So, because I’ve only got 72, I’m gonna go back and adjust some of these that I’ve put in and add a little bit of time to each of them.

So I just finished off the report.

It literally took me less than 10 minutes to do, and now it has actually given me an estimated reasonable compensation.

And not only that, it has given a lot of information in here.

We have some great charts and graphs, which I’m an accountant. I love some charts and graphs that show you the split out.

IRS audit readiness: Overpaying vs Proper Analysis

But it’s also gonna show you all the detailed data.

And again, if you are ever under IRS audit, this is what you want to be able to hand over, right?

We don’t wanna say, oh, I came up with my salary because of the 50 50 rule or the 60 40 rule, or something like that. We wanna hand over something that shows, we have put some thoughtful analysis into coming up with that number.

Now there’s one more thing that I wanna point out here as well, because this isn’t just about having IRS ironclad documentation in case you’re ever audited, although that is a great thing.

Business owners: Final Example and Tax Savings

It’s also about making sure you’re not overpaying your taxes.

So one thing I see a lot of people doing is, let’s say they’re doing this on their own, and rather than go through this detailed analysis, they are picking, let’s say the general and operations manager.

So in this case, let’s say Lisa just said, okay, I’m a general and operations manager. For a landscaping company, what should my salary be?

Right?

And if we go look at this report, we can see that the average hourly wage for that is the highest one on that report. The hourly wage for that job is $52 and 87 cents.

Overpaying Taxes with the Wrong Role

It would’ve come up with a salary. Hopefully y’all can see that of $110,000 or so, right? Versus the roughly $60,000 that this report came up with. So what does that mean exactly?

Remember, reasonable salary is what we need to pay ourselves before we’re paying out those distributions.

So we need to make sure we have enough to pay our full reasonable salary. Well, that’s an extra $50,000 in reasonable salary that we would be taking.

And if we take that extra $50,000 times, the 15.3%, again, this is a back of the envelope calculation, but it can be really helpful for illustrative purposes.

That’s an extra $7,600 in taxes or so, right? So again, you’d wanna do a full calculation to see, but it’s gonna be significantly.

Higher of a tax burden if you just took that one role and researched it. So sure, it’s an easier way to come up with the amount, but you’re gonna be significantly overpaying in taxes.

And all of this is why I highly recommend going through this process, getting an actual report. It is gonna be useful for so many reasons.

RC Reports

Now, if you’re interested in getting one of these reports, then definitely go to jamie troll.com/rc reports. Some accountants charge into the thousands of dollars for this.

I do not, and I personally review each and every. One of them. So if you want to get my personal insights on this and have access to this amazing platform to be able to run your own reasonable compensation study in 15 minutes or less, I highly recommend going and checking it out.

And if you’re an accountant or bookkeeper watching this, and this is something you would love to have for your clients, definitely reach out and we can talk about how we can partner up. You can find all the information down below.

Now if you wanna dive deeper into S Corp payroll and tax strategy, I do have a full free masterclass that you can sign up for right now at jamie troll.com/salary.

And while you’re here, you might be interested in this video next, which talks all about the hidden costs of having an S corporation.

Thanks so much for watching, and don’t forget to like, subscribe, and comment below. I’ll see you next time.