Wondering if you need an accounting software like Quickbooks Online?

Curious about Quickbooks alternatives?

If you’re still managing your business finances with spreadsheets, guesswork, or a shoebox of receipts, You’re not alone 😬.

But winging it with your money can cost you real time, real money, and real sleep.

As a CPA and financial literacy coach, I’m often asked: Do I actually need accounting software for my small business?

The short answer: maybe not right away. But for most small business owners, the answer quickly becomes YES.

In this guide, I’ll break down when spreadsheets are enough, when to upgrade, and why the right accounting software (like FreshBooks) can completely change how you run your business.

Spreadsheets: When They’re Enough

Let’s start with the good news: if you’re brand new in business with just a handful of transactions a month, a spreadsheet may be all you need in regards to an accounting solution.

You need basic accounting features because you meet the following description:

- A few income payments

- A couple of expenses

- No employees or contractors yet

In this stage, using a simple Profit & Loss template can keep you organized without the cost of a monthly subscription.

I even offer my own template for business owners who just need the basics.

👉 But here’s the key: spreadsheets are better than nothing.

If the choice is between tracking your numbers in a spreadsheet or not tracking them at all, spreadsheets win every time.

They’ll save you from scrambling at tax time.

Still, spreadsheets have serious limitations. Eventually, they’ll hold you back.

Stop the Bookkeeping Guesswork: Take Our Free Quiz And Find Your Perfect Accounting Software

Why Spreadsheets Fall Short

Spreadsheets can’t simulate a customer relationship management or financial management system to:

- Automate data entry or sync with your bank accounts

- Generate professional invoices or send payment reminders

- Track real-time cash flow or outstanding payments

- Catch missed deductions automatically

That’s where accounting software for small business comes in.

Pain Point #1: Not Knowing Where Your Money Is Going

If you’re unsure where your money comes from—or where it’s disappearing to—it’s time for accounting software.

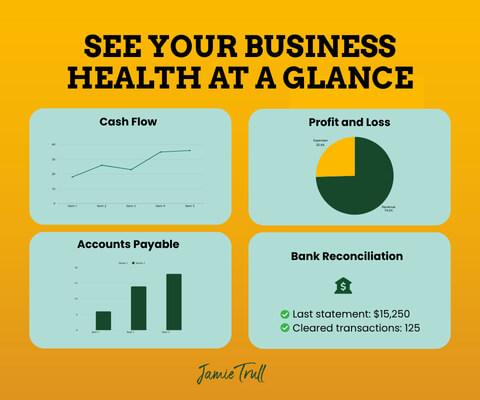

FreshBooks makes this easy with real-time dashboards that track:

- Income and expenses

- Profit & Loss

- Outstanding invoices

- Cash flow insights

👉 Try FreshBooks today and save 90% for 4 full months: jamietrull.com/FreshBooks

Unlike a spreadsheet, FreshBooks keeps your finances organized and helps you plan for the future, not just record the past.

Pain Point #2: Wasting Time on Manual Work

Manually updating spreadsheets, copying numbers from bank statements, and retyping invoices eats up hours you could spend growing your business.

FreshBooks automates:

- Importing bank transactions

- Categorizing expenses

- Sending invoices and reminders

- Collecting online payments (credit card, ACH, etc.)

Less time in the books = more time signing new clients, creating offers, or even taking a weekend off.

Pain Point #3: Missed Deductions and Costly Errors

Spreadsheets make it way too easy to miss deductible expenses or misreport income. Both can lead to paying more in taxes. Or worse, getting flagged by the IRS.

FreshBooks includes:

- Receipt capture

- Expense tracking

- Bank reconciliation

That means fewer mistakes, fewer missed write-offs, and more money staying in your pocket.

Pain Point #4: Struggling to Get Paid

Late or forgotten payments are a huge drain on small business owners. Chasing invoices manually is stressful, and things often fall through the cracks.

With FreshBooks, you can:

- Send professional invoices in minutes

- Accept online payments directly

- Set up automated reminders

I’ve seen business owners recover thousands in unpaid invoices simply by switching to a system that handles collections for them.

Pain Point #5: Not Ready for Growth or Funding

If you ever want to:

- Apply for a loan

- Seek investors

- Hire your first employee

…you’ll need clean, professional financials. Lenders and partners won’t accept messy spreadsheets.

FreshBooks gives you instant access to professional reports like:

- Profit & Loss

- Balance Sheet

- Cash Flow Statements

This makes you look polished and keeps your business future-ready.

👉 Curious how FreshBooks compares to other options? Check out my full guide here: jamietrull.com/Accounting

The ROI of Accounting Software

I get it—paying a monthly subscription can feel like “just another expense.” But think of it this way:

- Catching one missed deduction could cover months of software costs

- Preventing one late payment could pay for the whole year

- The time saved? Priceless.

That’s why accounting software is an investment, not just an expense.

Why I Recommend FreshBooks

For small business owners, freelancers, and service providers, FreshBooks is my top recommendation because:

- It’s intuitive (no steep learning curve like QuickBooks)

- It’s designed for entrepreneurs, not accountants

- It includes dashboards, invoicing, project tracking, and reporting in one place

👉 Save 90% for 4 months and see if FreshBooks is right for you: jamietrull.com/FreshBooks

Final Thoughts

If you’re still using spreadsheets, you’re already doing better than most. But once your business starts to grow, spreadsheets become more of a burden than a solution.

Accounting software like FreshBooks helps you:

- Stay organized

- Save time

- Catch deductions

- Get paid faster

- Prepare for growth

Don’t think of it as another bill. Think of it as the financial backbone of your business.

👉 Ready to upgrade? Start FreshBooks today and claim your 90% discount for 4 full months: jamietrull.com/FreshBooks

And if you’re still deciding, explore my full comparison of top accounting tools here: jamietrull.com/Accounting

Sponsored Disclaimer

This post is sponsored, but as always—we’re only sharing tools and resources we personally use and love. Your support helps us keep showing up and supporting our small (but mighty!) team.

Youtube transcript disclaimer:

Still Using Spreadsheets? Let’s Talk About Accounting Software Like QuickBooks

Still using spreadsheets or a shoebox of receipts to run your business? I get it. But let’s be honest, winging your business finances can cost you real money, real time, and real sleep. So do you really need an accounting software if you’re a small business owner? And what difference does it actually make?

Hey y’all, I’m Jamie Trull, your favorite CPA and financial literacy coach, and here on this channel I make content that helps keep you informed, organized, and profitable in your business finances. So if that’s something you’re interested in, please make sure to subscribe so you don’t miss anything.

But today we’re gonna talk about the real reasons you may or may not need an accounting software and how to make sure that it’s a good investment if you do go that route. And stick with me until the end, because that’s where I’m gonna tell you how to make sure you get your money’s worth and then some from any accounting software that you decide to use.

When Spreadsheets Are Enough (and When You Need an Alternative to QuickBooks)

Now, before we go all in on accounting software, let’s talk about when a good old spreadsheet might actually be just fine. Now, if you’ve been around here for a little while, you know I love me some spreadsheets. Spreadsheets are my love language, so I’m definitely not here to talk you out of using spreadsheets.

However, I do know that there is a time and a place for them, and that the things that they can do aren’t necessarily the same as something you could do with a more advanced software. However, if you’re brand new in business and you just have a couple of transactions a month, maybe you have a little bit of income coming in. You have a few expenses coming out, but there’s really not a ton to be tracking. You may not need a software just yet. It may not be worth the investment to you, and in that case, you might just be able to use a good template that can actually track what you need for accounting purposes and for tax purposes.

And I actually offer something like this to those simple businesses that really don’t need much more than that. If you want my profit and loss template, I linked that down below, and that’s a great place to start when you’re just starting your business. And that’s the thing about spreadsheets. They’re very affordable and an easy way to get started making sure that you’re still tracking your numbers.

So if the question is a spreadsheet or nothing, go with the spreadsheet. It’s going to be so much better than not tracking anything at all, and then having to scramble at tax time.

Why Accounting Software Beats Spreadsheets for Growing Businesses

But here’s the thing, spreadsheets, as much as I love them, can only go so far. A spreadsheet can’t send an invoice. It doesn’t really automate anything and it’s not gonna alert you when somebody hasn’t paid. They also aren’t gonna sync with your bank accounts, track your cash flow in real time or spit out really helpful reports that can help you make decisions in your business.

Accounting software, especially these days, is gonna offer you way more than just a profit and loss that you’re gonna use for tax time. Accounting software will help you actually run your business.

How to Know When It’s Time for Accounting Software (and Which One to Choose)

So to figure out if an accounting software might be right for you, let’s dive into a few pain points first. And if any of these are pain points that you’re feeling, it could be an indication that it is time to take the leap and actually get an accounting software.

Pain Point #1: Not Knowing Where Your Money Is Going

If you don’t have a clear organized system where you can track when your money is coming in and how much and when your money is going out and how much, and have good line of sight on what’s happeninG. Not just in the past, but so that you can look at it for the future and be prepared.

Then it might be time to have accounting software help you with that.

Missed expenses, lost invoices, and guessing at your profit is a recipe for confusion and disaster. And you probably know that if you handle it this way, it just means stress come tax time. Getting a handle on where your money is going is so important, and not just for taxes. It’s important for your business and knowing what is happening so that you can make better decisions.

Why FreshBooks Is One of the Best QuickBooks Alternatives

Now when you are first getting into accounting software and you’re looking for something that is approachable and has great features that really fit what you need, I highly recommend FreshBooks, especially if you are a service-based entrepreneur or a freelancer.

FreshBooks can give you way more visibility as to what is going on with your money. And one thing I’ve heard from a lot of QuickBooks users is that it can be confusing, especially if that’s your first time using accounting software. And FreshBooks, thankfully, is a lot more streamlined and easier to use.

With FreshBooks, I find that there’s a lot less of a learning curve than if you go to something like QuickBooks Online. And as much as I love spreadsheets, I might love dashboards even more. And FreshBooks gives you a dashboard of all the things that you need to know about in your business so that you have that visibility.

So it’s gonna tell you what’s going on with your profit and loss, but it’s also gonna track other things like outstanding invoices and really give you a picture of the financial health of your business.

In my experience, disorganization of finances is one of the biggest sources of stress in a business. So if you can get a plan together and use a system that helps you organize things in a really manageable way, that is a major win.

Save Time With Automation and Essential Features

Now let’s talk about pain point number two, and that is wasting time on manual work. So maybe you are organized, maybe you’re using a spreadsheet and you are updating that regularly and creating your profit and loss. So you do have the visibility at least about your profitability, but you might be spending a heck of a lot of time manually making those updates.

Spreadsheets are manual by nature, and sometimes can be easy to break, and that means mistakes are inevitable. Hand typing numbers, copying and pasting from your credit cards or your bank statements—none of that is probably how you wanna spend your Friday evenings.

With a good accounting software, it can automate so much of that. It can pull in things from your bank statement so that you’re not having to manually key anything in. And if you use a system like FreshBooks, you’re also going to be able to automate lots of features such as collections of invoices, making payments, and expense tracking, which means less time on all the admin and more time for growing your business.

Now, if you wanna see more in depth on some of the cool features that FreshBooks has related to things like invoicing and project tracking, I did a whole video tutorial showing you all about it here in this video. So go check that out next.

Prevent Missed Deductions With Bank Reconciliation

So now let’s talk about pain point number three, and that is missed deductions and costly errors. Manual systems are going to make it way easier to miss some of those deductible expenses that you could write off for tax purposes. They also make it way more likely that you misreport income, which we don’t wanna do ’cause we don’t wanna get on the IRS’s bad side.

Using an accounting software like FreshBooks can help you stay organized, keep accurate records, and avoid costly mistakes with features like bank reconciliation, receipt capture, and expense tracking. FreshBooks makes it easy to minimize errors and have peace of mind come tax time.

How the Best Accounting Software Helps You Accept Payments Faster

Pain point number four: struggling to get paid faster. Y’all, we all want to get paid faster. We wanna bring that money in sooner, and unfortunately, using a spreadsheet doesn’t really help us with that. We’re going to have to manually chase any invoices and be checking up on things constantly to make sure that we collect the money that is due to us.

Nobody wants to have to manually be sending out notes to clients who forgot to pay invoices or struggling to get paid on time or waiting for checks, and without a system to manage all of that, things can very easily fall through the cracks.

I have worked with business owners before who literally had not collected certain invoices and they were over 180 days late. But the great thing is with a system, you can actually send professional-looking invoices, accept payments in the form of bank transfers, ACH, or even credit cards, and even set up automated reminders—and you can do that all within FreshBooks.

Those are all features that you’re not gonna get from a spreadsheet. You’re gonna be doing all of that manually and probably spending a lot of time doing it if you don’t have a system that can help you out.

Financial Reports, Accounts Payable, and Growth Readiness

Pain point number five: if you are not using an accounting software, you are probably not ready for growth or funding. If you wanna apply for a loan, take on investors, or even see if you are ready to hire an employee, you need clean, accurate, real-time financials.

Manual books can’t give you all of the different up-to-date financial reports that you can get from a system, and they definitely don’t look professional enough for what lenders and partners are going to be looking for.

So with FreshBooks, you’re gonna have access to all of that real-time information. You’re gonna be able to pull tons of reports—a balance sheet, a profit and loss, and so many other reports that your investors or partners would want to see. And that’s gonna eliminate the need for any kind of manual calculations or trying to come up with something if you’re going in for funding. That will all be ready at your fingertips.

And that’s why even as a solo entrepreneur or if you’re just starting out, accounting software really isn’t just a nice to have—it can be a game changer.

How to Choose the Best QuickBooks or Best QuickBooks Alternatives

Now, I know what some of y’all might be thinking: “Jamie, I would love to use an accounting software, but how do I justify that monthly cost?” Remember, any kind of cloud-based platform is probably going to have a monthly cost associated with it.

But remember at the beginning when I said that actually using accounting software can help you save money? Here’s the thing: you need to look at it more as an investment, not just an expense. And like any good investment, it should be providing you a return. If invoicing software helps you save just one missed deduction, one late fee, or prevents even one invoicing error that delays payments, it could pay for itself many times over, and that’s what I’ve seen time and time again.

And that’s not even counting the time you will save by using an accounting software. And that’s time that you get back that can be used to sign new clients, create new offers, serve your current clients better, or heck, take a dang vacation for once.

The Business Case for Enterprise Resource Planning (ERP) and Beyond

So instead of thinking of it as just another subscription to pay for, try thinking of your accounting software as a tool that helps you actually save money and save time in the long run. And coming back to our discussion of FreshBooks, it’s designed specifically for small business owners who wanna spend less time on finances and more time doing the things that they love.

If you’re ready to take back control of your business finances and control of your nights and weekends, then definitely check out FreshBooks. The great thing is that they offer a range of plans so you can easily find one that fits both your needs and your budget, and if you wanna be able to save even more, my partner link right now will save you 90% for the first four months. So it’s a great way to try it out and see if FreshBooks is right for you.

And if you’re thinking, okay fine, you convinced me: an accounting software is right for me.

But I wanna do a little more digging on my own to see what a good fit is, definitely go check out jamietrull.com/accounting where we compare some of the top accounting platforms out there and help you decide what is best for your specific business. If you’re also interested in payroll solutions, check out our overview of the best payroll providers for small businesses and self-employed individuals.

Thanks so much for watching, and if you like this video, please make sure to like, comment, and subscribe. I’ll see you next time.