If you’re overwhelmed by bookkeeping software like QuickBooks and just want a simple, cost-effective way to track your business finances, this blog post is for you!

Not every entrepreneur needs complex accounting software, especially in the early stages of a business.

With a spreadsheet solution, you can stay organized, monitor profitability, and prepare for tax season—all without breaking the bank.

In this tutorial, I’ll walk you through how to set up your own profit and loss (P&L) sheet using Google Sheets or Excel.

Plus, if you prefer to skip the manual work, I’ve got a ready-made P&L template available that comes with all the formulas and a built-in dashboard.

Let’s dive in!

Why Choose a Spreadsheet Over Software?

Using a spreadsheet is a great alternative if:

- You’re just starting out and don’t want to commit to monthly software fees.

- Your business transactions are simple (e.g., freelance work, digital sales).

- You want complete control over how your financial data is presented.

- You’d rather avoid the learning curve of complex accounting software.

Instead of dealing with expensive subscriptions, you can manage your income and expenses with a well-organized template. And with my template, everything is set up for you—no fiddling with formulas required!

How to Create a Profit & Loss Sheet from Scratch

If you prefer the DIY route, here’s a quick overview of how to set up your P&L sheet.

- Open a Blank Google Sheet

- Or use Excel if you prefer working offline.

- Create three tabs:

- Chart of Accounts – To define your income and expense categories.

- Transactions – To input your bank and credit card activities.

- Profit & Loss Summary – Where the magic happens!

- Build Your Chart of Accounts

- List all income and expense categories, such as:

- Income: Sales, affiliate income, refunds.

- Expenses: Advertising, software subscriptions, office supplies.

- Optional: Use Schedule C categories as a reference (especially helpful for tax filing).

- List all income and expense categories, such as:

- Add Your Transactions

- Manually input or copy-paste your transactions from bank/credit card statements into the Transactions tab.

- Make sure each entry has a date, description, amount, and category.

- Create Drop-Down Menus for Categorizing Transactions

- Use Data Validation in Google Sheets to add drop-down menus for your expense categories, saving time when assigning transactions.

- Set Up Your P&L Summary with SUMIF Formulas

- Use a SUMIF formula to calculate totals for each category, ensuring that all relevant transactions are included.

Skip the Setup: Grab My Pre-Built Profit & Loss Template

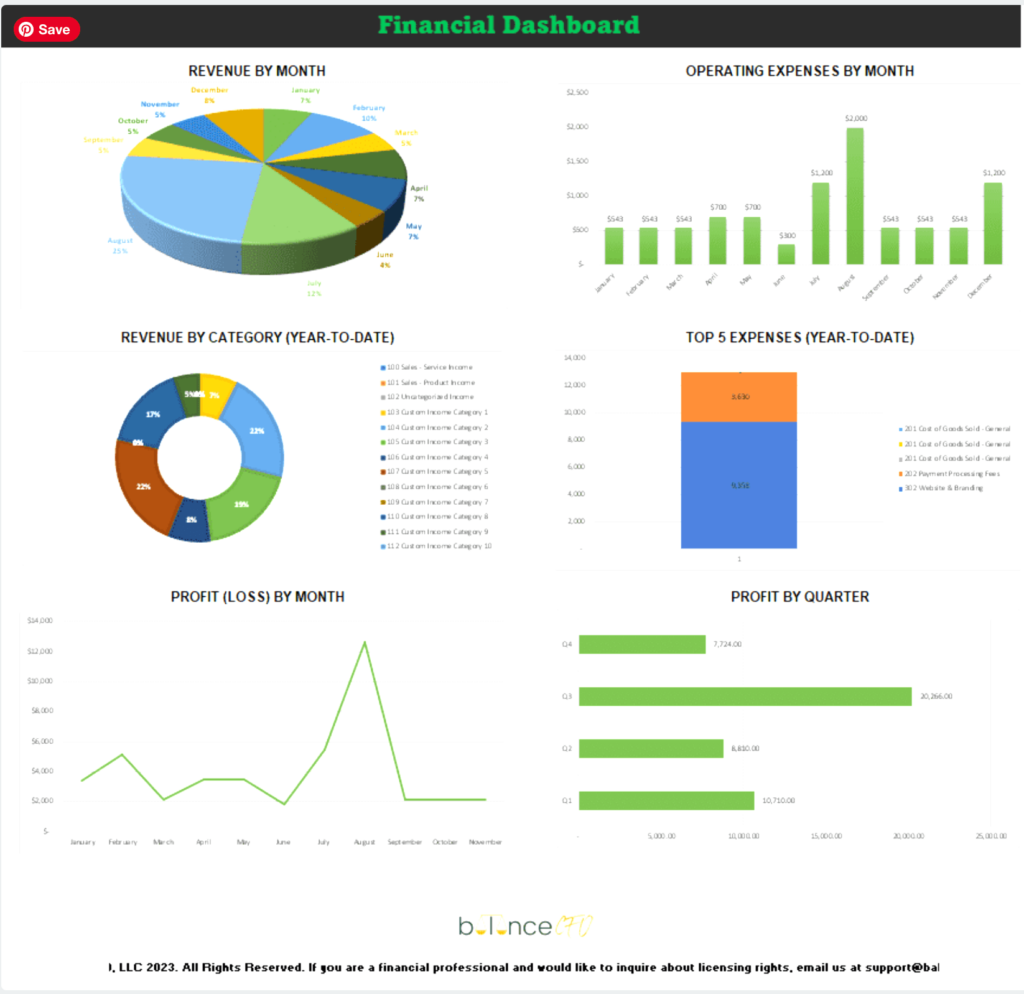

If creating a P&L sheet from scratch sounds like too much effort, don’t worry! I’ve done all the heavy lifting for you. My P&L template is easy to use, fully customizable, and comes with:

❇️ A pre-configured dashboard with charts and graphs.

✅ A monthly summary tab for tracking performance over time.

❇️ Built-in formulas to ensure your numbers always add up.

✅ A customizable chart of accounts so you can categorize transactions as needed.

No need to pay for complex accounting software—just grab my template and get started immediately!

👉 Grab your Profit & Loss Template here

Banking and Bookkeeping Tips

Whether you choose to build your own spreadsheet or use my template, having the right banking setup is crucial.

Keep your business and personal finances separate to stay organized and ensure smooth tax filing.

If you need a reliable business bank account, check out my recommendations for free business banking solutions:

👉 Explore my banking recommendations

Not Sure Which Tools to Use?

If you’re still unsure whether a spreadsheet will meet your needs or if you need accounting software, I recommend exploring the QuickBooks Online options.

For more insights on bookkeeping tools and how to set financial goals for your business, check out some of my other resources below.

- Favorite Tools and Resources: 👉 Explore my favorite tools

Ready to graduate from spreadsheets? Meet the accounting software that does the heavy lifting for you.

Conclusion: Tracking Your Operating Expenses

Creating a profit and loss statement for a self-employed business doesn’t need to be complicated or expensive. With just a spreadsheet, you can track income and expenses, make smarter business decisions, and prepare for tax season without spending a dime on software.

However, if you’d rather skip the setup and get started with a ready-made P&L dashboard, grab my template now and simplify your bookkeeping today:

👉 Get the Profit & Loss Template

Watch the Full Tutorial For Income Statement and Net Profit Tips

If you prefer a visual walk-through, watch the video below for step-by-step instructions on creating your own P&L spreadsheet.

📺 Watch the full tutorial here: How to Start Bookkeeping for Free (Easy Google Sheets Tutorial) and create your own Profit and Loss spreadsheet.

This transcript is a direct copy of the video content. It has been formatted with subheadings for improved readability but does not alter any of the original words spoken.

If you are overwhelmed with all the different bookkeeping software options out there and you’re looking for a super simple way to stay organized, this video is for you. While I often recommend tools like QuickBooks Online, I also know that not everyone needs those bells and whistles—especially when starting out.

Today, I’ll walk you through how to create a Google Sheets profit and loss (P&L) template for free! Stick around, and by the end of this video, you’ll know how to build your own template to track your business finances. And if you’d rather skip the setup process and grab a pre-built P&L dashboard (with all the formulas and design done for you), head over to:

Let’s dive right into Google Sheets!

Step 1: Set Up Your Chart of Accounts

- Open Google Sheets (or Excel, if you prefer).

- Create a new tab called “Chart of Accounts”.

- Use this tab to organize income, expenses, and non-P&L items like transfers or owner contributions.

- Example Categories:

- Income: Sales, Affiliate Income

- Expenses: Advertising, Software, Office Supplies

- Non-P&L Items: Owner’s Draws, Bank Transfers

- Example Categories:

Tip: Refer to your Schedule C tax form to see what types of categories you’ll need for tax reporting. This will help ensure you stay organized when tax time rolls around!

Step 2: Create a Transactions Tab

- Add another tab named “Transactions.”

- Create columns to track:

- Account Name: Which bank or credit card account the transaction is from.

- Date: The transaction date, not the payment date (for credit cards).

- Description: What the transaction was for.

- Amount: The total of the transaction.

- Category: This is where you’ll assign the appropriate category using a dropdown menu.

Step 3: Add Dropdowns for Easy Categorization

To make the Category column easier to use, we’ll add a dropdown:

- Select the cells in the Category column (drag down several hundred rows to allow for future entries).

- Go to Data → Data Validation and choose Dropdown from Range.

- Link the dropdown to your Chart of Accounts tab, so you don’t have to retype categories each time.

- (Optional) Use color coding for income and expense categories to make the spreadsheet more visually organized.

Step 4: Import Transactions Automatically

Instead of manually entering every transaction, you can download a CSV file from your bank or credit card account:

- Log in to your bank or credit card account and download transactions as a CSV file.

- Copy and paste the data from the CSV file into the Transactions tab.

- Ignore any default categories assigned by your bank—they may not align with your accounting needs.

Step 5: Use SUMIF Formulas to Create the P&L Summary

Now comes the fun part! On the Chart of Accounts tab, next to each income or expense category, use a SUMIF formula to automatically sum the relevant transactions:

Example formula:

mathematica

Copy code

=SUMIF(Transactions!E:E, “Sales Income”, Transactions!D:D)

- Lock ranges using dollar signs (e.g., $E$5:$E$500) to avoid errors when copying the formula down to other rows.

This will allow your P&L summary to update automatically as you add new transactions!

Step 6: Handle Transfers and Non-P&L Items

Transfers (like paying off a credit card from a business account) should not show up as income or expenses. Instead, they belong in the non-P&L category.

- Example: Mark transfers between accounts as “Transfer – Bank to Credit Card.” This ensures your P&L stays accurate.

Why Use This Template Instead of Software?

This spreadsheet is perfect for simple businesses or those just getting started. It’s:

- Free to set up.

- Easy to use without advanced accounting knowledge.

- Flexible—you can customize it however you like.

But if you want to save even more time, I highly recommend grabbing my ready-made P&L template:

👉 Get the Profit & Loss Template

Bonus Tips for Smooth Bookkeeping

- Separate business and personal accounts to avoid confusion.

- Need a free business bank account? 👉 Check my banking recommendations

- Keep your transactions up to date—update your spreadsheet monthly or quarterly to stay organized.

- Use my favorite financial tools and resources to streamline your bookkeeping process:

Tracking your business finances doesn’t have to be complicated or expensive. With a simple Google Sheets profit and loss template, you’ll have everything you need to manage your money, make smart business decisions, and prepare for taxes.

If you’d rather skip the DIY and want a more polished solution with built-in formulas, summaries, and visual dashboards, grab my P&L template here:

Or, if you need something more robust, check out my video comparing QuickBooks options.

Thanks for following along! If you found this helpful, make sure to like, subscribe, and comment below to let me know what other tutorials you’d like to see.

Looking for more strategic recommendations to maximize your profits?

Check out these articles: