If you’ve ever wondered, “How Many Business Bank Accounts Should I Have?” you are not alone.

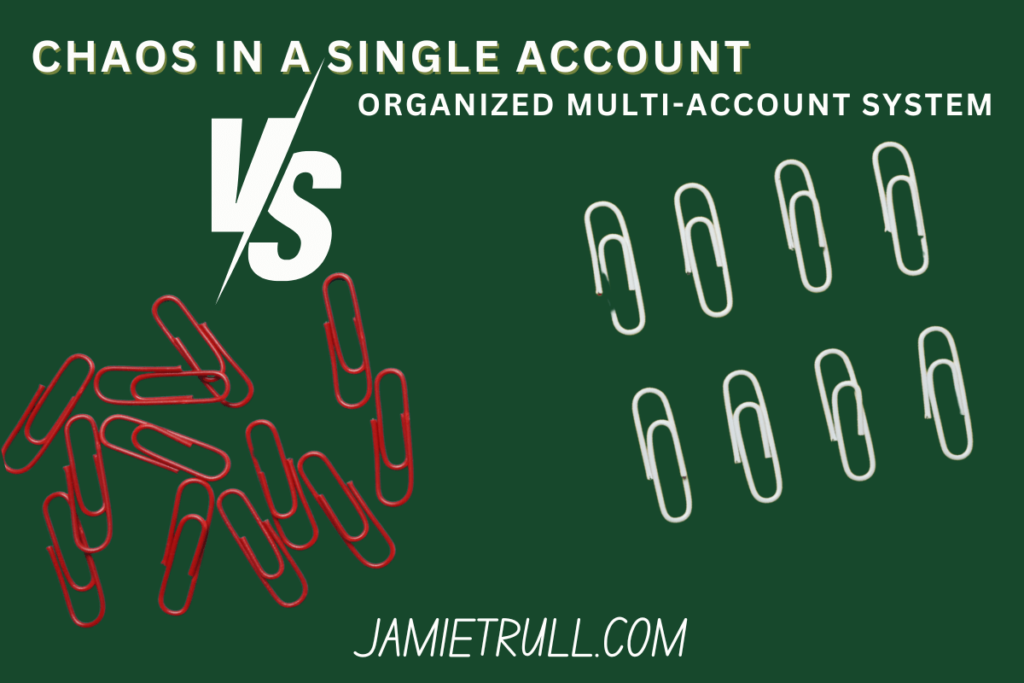

Managing all of your business finances through a single checking account can cause chaos, leading to disorganization and missed opportunities for savings. To take control of your business cash flow and prepare for growth, it’s essential to implement a five-account banking system.

This approach helps you budget effectively, save strategically, and set aside money for taxes and emergencies. In this post, we’ll break down the five essential bank accounts for business success and show how Relay Financial can simplify the process.

This post is sponsored by Relay. All opinions expressed are my own.

Why You Need Multiple Business Bank Accounts

Managing finances through one account leads to mixed expenses and unintentional overspending. With a structured multi-account system, however, your funds are allocated for specific purposes, making it easier to stick to budgets and grow your business strategically.

By splitting your business income into multiple accounts, you can avoid accidental overspending, ensure you save for future expenses, and always have money for taxes when needed.

The 5 Essential Bank Accounts for Business Success

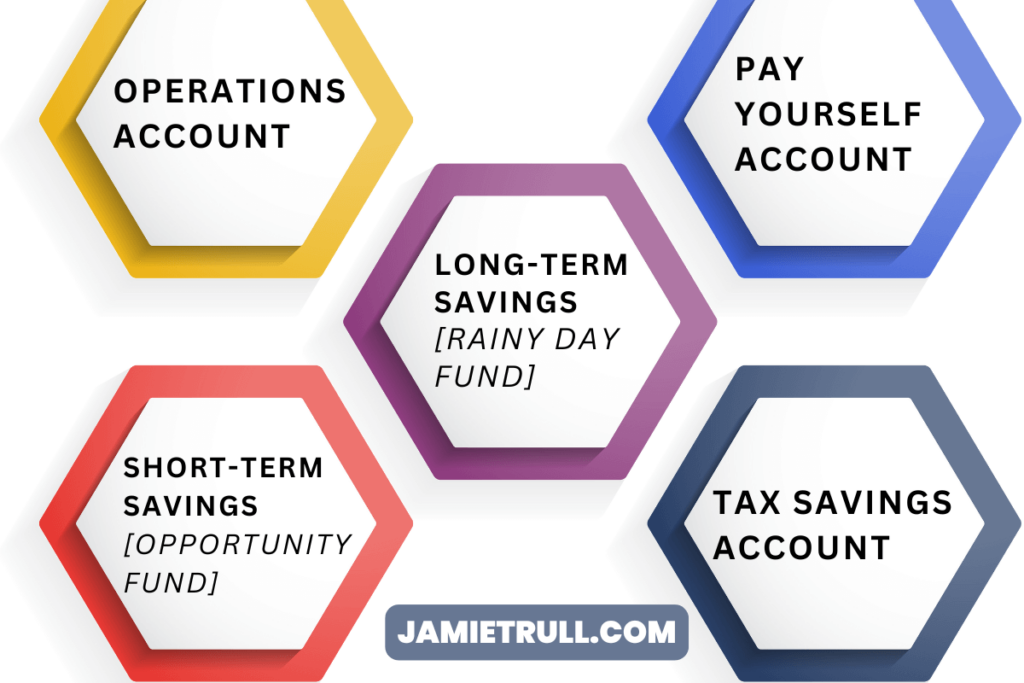

1. Operations Account

Your operations account is the core of your business finances. It’s the account where all revenue is deposited, and from which regular expenses—such as payroll, rent, and software subscriptions—are paid. However, keeping all your money in one place often tempts business owners to spend without planning. That’s why you need the other four accounts to divide your funds with purpose.

2. Pay Yourself Account

A pay-yourself account ensures that you take regular distributions from your business profits without dipping into funds intended for other expenses. This account should be used to transfer a set percentage of income, or a fixed amount, to pay yourself at least monthly.

Having this separation allows you to track how much profit is available for personal use and ensures that you’re paying yourself consistently without hurting the business.

3. Long-Term Savings (Rainy Day Fund)

Your rainy day fund provides a safety net during slow months or emergencies. Jamie Trull recommends building up 1 to 3 months’ worth of essential operating expenses. This fund ensures that unexpected dips in income won’t disrupt your ability to meet expenses.

Consider placing your rainy day fund in a high-yield savings account to earn interest while it sits unused. This way, your money works for you even during quiet periods.

4. Short-Term Savings (Opportunity Fund)

An opportunity fund is used to save for strategic business investments—such as hiring new staff, running ad campaigns, or attending conferences. Having this account ensures that you’re ready to act when growth opportunities arise without dipping into your operations account.

Saving for short-term goals separately helps you determine whether you can afford specific investments at any given time. If your opportunity fund is low, it’s a clear signal to wait until more funds are available.

5. Tax Savings Account

Taxes are an inevitable part of running a business. To avoid stress at tax time, set aside a portion of your profits each month into a tax savings account. This way, you’ll always have money ready to pay quarterly taxes or cover any unexpected tax liabilities.

Even after paying estimated taxes, any leftover funds in this account can act as a bonus at the end of the year. The key is saving consistently so tax payments never take you by surprise.

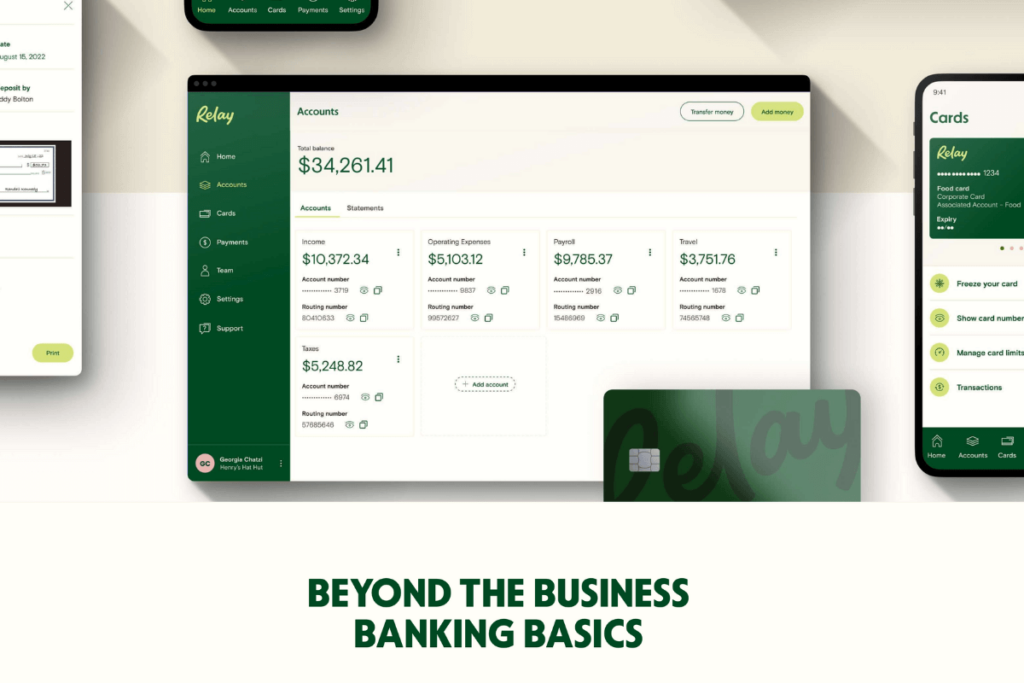

Managing Multiple Bank Accounts Easily with Relay Financial

Setting up and managing five or more accounts might sound daunting, but Relay Financial makes it easy. Relay offers free business banking with the ability to open up to 20 individual checking accounts, each with its own routing number.

This allows you to organize your funds by purpose—whether for operations, savings, or taxes.

Relay also enables automated transfers. For example, you can set up a rule to move a percentage of every payment you receive into your tax savings account. This automation ensures that money is allocated to the right places without manual effort.

Bonus Offer: Open your Relay account using this link, deposit your first $100, and receive a $50 bonus within 14 days

Bonus Accounts to Consider

Depending on your business, additional accounts may provide further clarity and financial control:

- Inventory Account: For product-based businesses, this account ensures you always have funds available for purchasing stock.

- Sales Tax Account: If you collect sales tax, separating those funds ensures you don’t accidentally spend money meant for remittance.

These bonus accounts help keep your finances organized and ensure compliance with tax authorities.

Relay Disclaimer

**Relay is a financial technology company, not a bank. Banking services and FDIC insurance are provided through Thread Bank, Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

This video is proudly sponsored by Relay Financial. However, all ideas and opinions expressed are entirely my own and are not influenced by any sponsorship arrangements. While Relay Financial has graciously supported this content, the views presented are genuine and independent. Out of respect for our viewers, we only collaborate with companies that we truly believe in. Thank you for watching and supporting the sponsors who make these videos possible.

This is an unedited video transcript. Please excuse any grammatical errors or conversational quirks.

Video Transcript: The Five Essential Bank Accounts for Business Success

Introduction

As you and I both know, business expenses can get complicated. And if you’re trying to manage everything through just one checking account, it can get super messy fast. Expenses are mixing with income, and it’s really tough to prepare for the future and really save or stay on budget.

What if I told you that having the right mix of accounts can increase your profit and make your life a heck of a lot easier? I’m breaking down the five essential bank accounts that you need in your business to stay organized and efficient.

Hi, I’m Jamie Trull, your favorite CPA and financial literacy coach. I’m super passionate about giving you all the tools you need to stay informed, organized, and profitable in your business. If you’re thinking, “Jamie, five bank accounts sounds super overwhelming,” stay until the end.

I’ll tell you about the research I’ve done into banks and platforms that can make this easy and give you my recommended resources for managing multiple accounts.

1. Operations Account

The first and probably most obvious account is your operations account. If you only have one bank account now, it’s likely serving as your operations account. That’s where your income goes and your expenses come from.

I use one primary account for most of my income and expenses, but the key is: the money doesn’t stay there. If everything stays in one account, I’d probably be tempted to spend it.

Having one big bank balance makes it harder to prioritize long-term goals—it just gets spent fast.

2. Pay Yourself Account

The second account you need is the pay yourself account. Yes, I recommend a separate account where you move money from your operations account to pay yourself. You can base this on a percentage of income or profit and transfer money at least once a month (or more often, like twice a month).

This isn’t your salary—it’s your profit, the portion you take out as a business owner. If you have multiple owners, set up a separate pay yourself fund for each owner to track their distributions clearly.

3. Long-Term Savings (Rainy Day Fund)

This third account is your long-term savings or rainy day fund. This is for unexpected dips in income or emergencies—basically, a cushion for when things get tough.

It’s ideal to save 1 to 3 months of operating expenses in this account. You could even put it in a high-interest savings account, but the key is to not touch this money unless absolutely necessary.

4. Opportunity Fund (Short-Term Savings)

The fourth account is for short-term savings, which I like to call an opportunity fund. This account is for planned expenses—like a new hire, an educational program, or a marketing campaign—that will help you grow your business.

The beauty of the opportunity fund is that it helps you act quickly when opportunities arise without dipping into your operations budget. If the money isn’t there, you wait until it is.

5. Tax Savings Account

Finally, you need a tax savings account. This is where you set aside a portion of your profits each month to cover your estimated taxes and avoid unpleasant surprises at tax time.

Even if you’ve paid your quarterly taxes, saving extra in this account ensures that if you owe more than expected, you’re covered. And if you over-save? You get a nice little bonus back.

Bonus: How Relay Bank Simplifies Managing Multiple Accounts

I know managing five or more accounts sounds overwhelming, but Relay Financial makes it easy. With Relay, you can open multiple accounts with individual routing numbers, all for free.

You can even set up automatic transfers between accounts to stay on top of your savings goals without manual effort.

If you want to give Relay a try, use this link to open an account. Once you deposit your first $100, you’ll receive a $50 bonus.