The life of an entrepreneur is full of exciting and rewarding challenges … like determining what is a reasonable salary for an S Corp?

Let’s discuss what the IRS looks out for when it comes to getting your figures just right, as well as the considerations you should keep in mind before setting that reasonable salary bar too high (or low).

Are you considering becoming an S Corporation?

Ready to become an S-corp owner? Or are you already a proud one?

Let’s discuss some common misconceptions around setting your reasonable compensation that can lead astray even experienced financial service providers.

Why “reasonable compensation?”

Reasonable compensation is necessary because when you’re an S corp owner who is working within your business, you are essentially functioning as both the owner and employee.

It’s important to appreciate yourself for being a master of multitasking by fairly compensating yourself with a salary tailored just for you!

S corporations pay payroll taxes and pay income tax

Not only does paying yourself with a consistent W-2 S corp salary frequency help you have a more reliable monthly income, but you can also supplement those earnings with the owner’s draws from pure profit.

You’ll pay yourself what you need and beyond that, the fun really starts!

Because profit distributions above and beyond a reasonable salary are exempt from self-employment taxes, more of your hard-earned money can stay where it belongs: with you.

Why do S corporations keep more of their business income?

S Corporations benefit from special IRS rules that can reduce the amount of self-employment taxes you are required to pay.

By utilizing these strategies, you might be able to ensure your profits are reinvested for a bigger and brighter future!

However … just because it’s a popular business model doesn’t necessarily mean S Corp status is right for you.

You’ll want to consider the full financial impact of your decision – including reasonable salary, taxes, and compliance cost – before taking the plunge.

Setting a Reasonable Salary

Take care to protect yourself, your team, and the longevity of your business.

Setting reasonable compensation is critical to staying compliant as an S Corp, so it’s important that we understand the criteria IRS looks for when monitoring our pay.

It can be tempting to set a salary too high and receive more income each month – but this comes with higher taxes as well!

RC Reports recently conducted a study surveying almost 5,000 accountants and discovered that 77% of them had misconceptions about the IRS’s regulations on reasonable compensation.

Yikes!

This can prove to be incredibly costly for business owners who may not know their service providers are misinformed – it is essential to get this right.

One of the Internet’s top myths: You should follow the 50-50 or 60-40 rules to set your reasonable compensation

Let’s start with one of the worst places to begin your research: a Google search (unless it brought you here of course)!

Are you unsure how to set a reasonable paycheck for yourself?

If so, it’s worthwhile to explore what the experts have identified as potential “rules of thumb” for determining an acceptable split between salary and owner draw.

Many experts will tell you that you can simply split your profit into 50% salary and 50% distributions (or sometimes 60/40).

The 50-50 or 60-40 rules are common recommendations from accountants, but proceed with caution: these “guidelines” appear ZERO TIMES in IRS guidance!

They may be helpful to first estimate if S Corp is right for you, but they WON’T be defensible under IRS audit.

Doing some due diligence now can help ensure that you don’t wind up paying fines and penalties later.

Is the reasonable salary defensible in light of what the IRS requires?

Following the 50/50 “rule” or 60/40 “rule” for reasonable compensation may seem like a viable option, but it is not the most robust way of protecting yourself from IRS audits.

The goal should be to justify your pay based on documentation that can stand up under even stringent scrutiny.

Take an example where you work full-time in your business and make $20K in profit before salary and distributions. If you used the so-called 50/50 “rule”, you would end up paying out half as salary ($10k) & half as distributions ($10k).

However, it would also mean you reasonable salary pays you less than minimum wage, which by nature wouldn’t be “reasonable”.

This split could easily raise eyebrows with regulators; it would be very unlikely you’d be able to come up with adequate support that you’d be able to pay someone else only $10k a year to do the full-time work you do within your business.

3 IRS approved approaches for determining reasonable salaries in your S Corporation

To ensure your S Corporation maintains reasonable salaries and remains compliant with the tax code, consider these three smart strategies.

First, there’s the cost approach which requires an evaluation of all tasks performed by each employee – often referred to as the ‘Many Hats’ method.

Then you have the income approach that allows for comparison between projected salary costs against company profitability performance.

Finally, look at taking a market approach and assessing what similar positions in comparable organizations are paid locally or regionally.

Taking any one of these approaches can help avoid costly oversights when setting your pay within your business!

Which method you choose will be dependent on your specific business and duties within that business, as well as the availability of comparable salary and wage data.

Determine Reasonable Salary Method 1: the “cost approach”.

For many small business owners, the cost approach – or ‘Many Hats’ approach – is essential for success.

After all, most of us are expected to shoulder a variety of roles and tasks that we wish we could hire out.

But the reality is, many things on the business to-do list: management duties, admin work and customer service inquiries – it often falls on the shoulders of the small business owner, at least for a while!

Instead of just general duties listed for business operations, this cost approach method encourages detailed insight into day-to-day tasks – even those as mundane and necessary as janitorial services.

This level of specificity puts you in good stead with Uncle Sam so don’t forget to add it all up!

ALL.OF.THE.THINGS!

Any place that you are spending your time in your business, write it down.

From there use salary data and determine how much of your job could be relative to its worth – it won’t always be easy but will provide insight into assigning value as well as pay!

This is the preferred method for very small businesses where the owner performs multiple duties within the business.

Pulling all of that salary and wage data can be difficult (and a bit mind-numbing), but thankfully there is help out there!

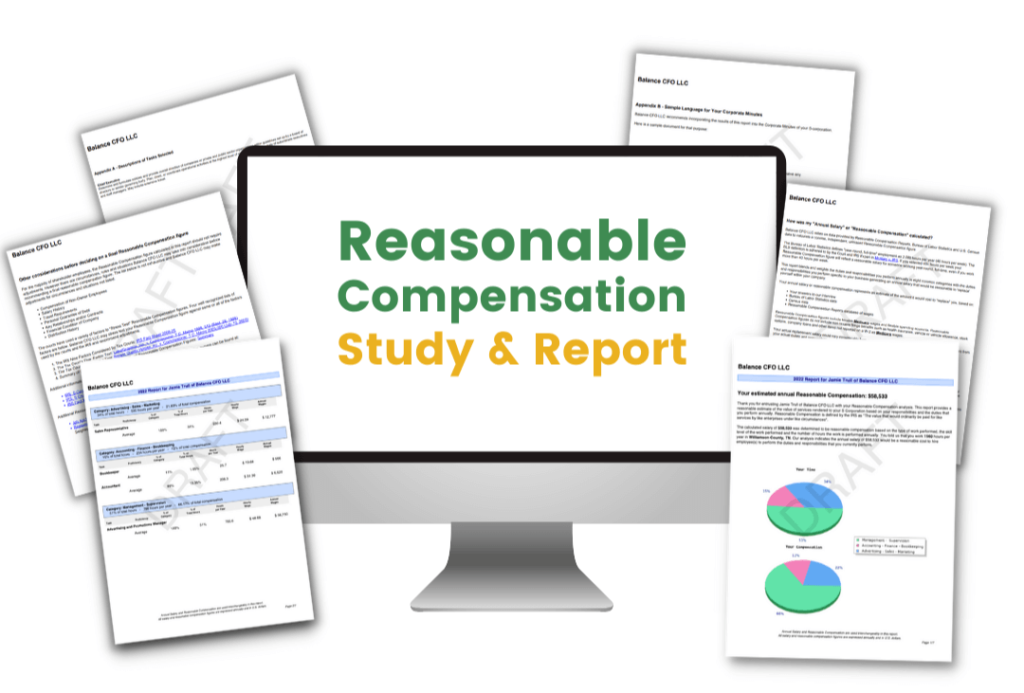

I’ve partnered with reasonable compensation experts RC Reports to provide you with a personalized reasonable compensation study that takes into account your specific job duties, proficiency, and time spent working in your business.

It even comes with a CPA review for observations and suggestions, including looking for potential tax-savings opportunities.

Check out the personalized Reasonable Compensation Study and Report.

Determine Reasonable Salary Method 2: the “market approach”.

It may be wise to look into the market rate for any roles your business requires, as this is often seen as a fairer way of setting salaries when hiring.

Market research can help you establish what an arms-length payment would be and ensure that salaries are fair between both parties.

Although the market approach may seem easier, it often results in a higher pay than if you used the cost approach.

This is because you are generally saying all of your time goes into one role, likely managerial or above, which come with higher salaries.

It’s simpler and more straightforward to document this way – but it won’t yield optimal savings on taxes when compared to other approaches like the ‘many hats’ method.

Determine Reasonable Salary Method 3: the “income approach”.

If you find yourself at a dead-end in search of data (which is unlikely), the income approach may be able to provide some useful insights.

This can offer an alternative route when both market and cost approaches are unavailable.

To ensure your salary is appropriate under this method, you’ll need to generate profits that would be satisfactory for external investors.

Essentially, so long as an external investor would be satisfied with the return they are receiving, it is assumed that the salary being received is appropriate.

Unfortunately, it could prove difficult to accurately explain this decision to an IRS agent due to their usual analysis techniques; particularly when dealing with smaller businesses.

Where to get some reputable help to determine compensation agreements

If you’re feeling a little overwhelmed, don’t stress!

I’ve partnered with RC Reports to help you out, who happens to be THE go-to in the accounting industry for reasonable compensation data and studies.

The reports use a proprietary system that allows them to pull precise information from a range of sources.

They then put it through their formula to determine compensation so that companies can create accurate salaries.

This level of detail is sure to impress even your toughest auditor!

Check out all the details here.

How does the report determine reasonable compensation?

Many times, the IRS has questioned a reasonable salary when it comes to documenting job duties pulling accurate salary data.

This report uses the ‘Many Hats’ approach to provide a detailed breakdowns of salaries depending on proficiency levels so that your compensation is accurate.

As an example, there was once a case involving a small business owner who set her own reasonable salary at $40k only for the IRS to counter – claiming it should be closer to $67k.

Thankfully she had a detailed study available to support her calculation and position – and was able to avoid $10k in fees and back taxes that would have resulted had they reclassified her income.

Let’s recap how to determine compensation for your S corporation’s payroll

Set up your reasonable salary with data to defend it. Make sure your method is IRS approved and well documented, including comparable salary data.

Your best bet is to get an outside study performed so that you have rock-solid support as you determine reasonable compensation.

If you’re in the market for a reasonable compensation report that is IRS defensible without having to do it yourself, visit JamieTrull.com/rcreports.

Get a report that is customized and personalized to you and your business.

Not sure if an S Corp is right for you?

Make sure to also check out my S-Corp Toolbox – a bundle that helps make the decision easier, and guides you through the tax savings calculation and how to make the election yourself.

The best part? No expensive (and boring) consultations with a CPA to drain your time and energy!

Frequently Asked Questions From S Corp Owners

These are the top questions that I get on this specific topic of reasonable salary for S Corps.

Do I have to pay myself a reasonable salary?

If you work actively in your business, yes, you are required to pay yourself a reasonable salary if you are an S Corp owner.

The only exception to this is if you don’t have the earnings to pay yourself your salary from your business – though in this case you won’t be able to pay yourself any profit distributions until you’ve paid your reasonable salary (including past years’ salaries that weren’t paid as well).

Everyone has a different risk tolerance, however if you are audited and haven’t paid yourself a salary for work you performed in your business but you DID take money out in the form of distributions, the IRS will undoubtedly hit you with a salary reclass AND fines and penalties to boot.

It’s always best to play by the rules…but that doesn’t mean you need to overpay!

Are there any drawbacks to setting a low (or no) reasonable salary?

Trying to avoid paying fair wages may seem like an attractive option, but be warned; the IRS knows this “trick” and will make every effort to ensure that all salaries paid by businesses are considered appropriate under audit conditions.

Remember, a lower wage also has serious implications for your future financial security – social security benefits are calculated based on wages paid in while working.

If you don’t adequately pay into them now, when retirement comes around there will be less money available than you might want or need.

Each individual should assess their own present-day needs versus long term goals and make the decision which takes priority accordingly.

What if I’m not profitable in my business?

As an S corp owner, you are required to pay yourself a reasonable salary for the work you do for the business.

This is because as an employee of your own company, you must be compensated for your labor just like any other employee.

However, if your business is not yet profitable, it can be challenging to determine what constitutes a “reasonable” salary.

An unprofitable business is not likely to benefit from being an S Corp, as the tax benefits only kick in when your total profit being paying yourself exceeds you reasonable salary in your business.

In this case, you may want to consult with a tax professional or financial advisor who can help you make an informed decision based on your specific circumstances.

It’s important to note that failure to pay yourself a reasonable salary could result in penalties and additional taxes from the IRS.

That’s why it’s crucial to ensure that you are meeting all legal requirements related to compensation as an S corp owner.

Read more about choosing the right business structure for your business and compare an LLC vs. S Corp.

Transcript: Your Guide to S Corp Reasonable Compensation

Transcript edited for readability.

Hi everyone. Jamie Trull here, your favorite CPA and profit strategist.

And today we’re gonna be talking about a reasonable salary for an S Corp and specifically how to set your reasonable salary as an S Corp owner.

What types of things should you be considering? What is the IRS looking for when it comes to reasonable compensation? How does the IRS tell you to calculate reasonable compensation?

All of those things.

So whether you are considering becoming an S Corp, or you already are an S Corp owner, then this video is for you.

And we’re also gonna talk about some of the myths with regards to setting your reasonable compensation that even a lot of financial service providers are perpetuating.

Now, real quick of course, before we jump into all the nitty gritty talking about reasonable compensation, let’s start with why.

Why do we need to pay reasonable compensation to begin with?

Well, that is because if you are actively working in your business as an S Corp owner, you are technically an employee of your S Corp, and therefore, you have to pay yourself a paycheck for the duties that you are performing within your business as an employee.

Now, that reasonable salary should be paid out through payroll.

It’s a W2 salary. You should have taxes withheld from that just like you were a normal employee of your business.

And then in addition to that, you can take out the owner’s draws. So your owner’s draws are gonna come out of profit above and beyond a reasonable salary.

That is where the tax benefits kick in.

As an S Corp, if you pay yourself a reasonable salary, you’re gonna have all the taxes, income taxes, self-employed, taxes, everything taken out of that.

But if you pay yourself, in addition, if you’re paying yourself owner’s draws above and beyond that reasonable salary, there is no self-employment tax being taken out on that.

Why? Because that is considered essentially income for investing in your business versus working in your business.

And weirdly enough, the IRS actually has preferential rules for passive income versus active income.

However, that is where the tax savings come in as an S Corp.

So if you don’t have enough, if you’re not making enough profit in your business to support your reasonable salary, it probably doesn’t make sense to be an S Corp.

So, let’s talk about how to set that reasonable salary.

And the things that we need to keep in mind are, of course, making sure that it is an IRS defensible, reasonable salary.

If you are audited, they will look at this and will want to see support for it.

So let’s talk about what the IRS is gonna be looking for, but we also wanna be setting our reasonable salary with tax savings in mind.

We never want to be setting our reasonable salary higher than we really need to, or higher than really is reasonable because then we’re paying more in taxes than we need to.

Again, remember, we save 15.3% on every dollar that we take out as draws versus salary.

So that’s why it’s so important to support your reasonable salary, but also make sure that you are not setting it higher than it really needs to be.

Now, let’s really quickly dispel a couple of rumors, a couple of myths.

First and foremost, about setting reasonable compensation.

And this is important to say, because even service providers may be giving false advice to their business owners, and the business owners may not be aware of that.

And that’s why it’s really key that we get this right.

So a company called RC Reports, which is a company that specializes in reasonable compensation, did a study of almost 5,000 accountants.

In that study found that 77% of them were misinformed as to what the IRS considered to be good support for reasonable compensation.

And that’s not great for the end business owners who aren’t aware that their CPA may be misinformed.

Even if you go to Google, you’re gonna find tons of things that talk about the 50-50 rule or the 60-40 rule for setting reasonable compensation.

It’s important to know these are not rules, they do not show up anywhere in the IRS guidance, but what they’re really talking about is these kinds of rules of thumb that people have adapted over time for setting reasonable compensation.

And it’s talking about the split between your paycheck, the amount you’re paying in reasonable compensation and your owner draws.

So, a lot of accountants will tell you if you set it either 50-50 or you know, 60-40 in favor of salary, that in general, you’re probably fine.

Now, I will say that this may be an effective way to analyze your reasonable compensation, but it’s not the best way to actually set a defensible reasonable compensation.

It’s a good way to gauge, okay, does this seem like it makes sense?

Is the IRS likely to challenge your approach?

But in the case that it is that kind of rule of thumb is not going to be defensible in case of IRS audit because the IRS is gonna wanna see the actual support for that, right?

So let’s say you work full-time in your business and your total amount that you are making in profit before paying yourself is $20,000 and you decide to do the 50-50 rule.

So you’re paying yourself $10,000 in salary and $10,000 in owner draws.

Well, more than likely, even though you followed this 50-50 rule of thumb, more than likely if the I R S came in and were to audit you, they would say, actually, all of that needs to be a reasonable salary.

And the reason for that is that nobody who works full-time in your business, if you were to hire somebody else, would come in and work a full-time job for only $10,000.

That’s under minimum wage.

And so they would say that salary is not reasonable even though you split it 50-50.

So you have to be careful with those rules of thumb.

They can be useful when you’re maybe estimating what your reasonable salary could be, maybe when you’re determining whether S Corp makes sense for you.

But if you are becoming an S Corp or already are one, you wanna have more defensible proof than that.

So what does the IRS approve as ways for coming up with a S Corp reasonable salary?

Well, there are three different approaches, and we’re gonna talk about each of them, but one of them, I’m gonna talk about a little bit more than the others.

The three we’re gonna talk about include the cost approach, (aka the Many Hats approach), the income approach and the market approach.

So let’s talk about each of those.

Now, the one that I recommend and that I think is usually most useful when it comes to business owners that are in true small businesses.

So maybe you are the only employee of your business, or maybe you have a few employees, but typically the one you’re gonna wanna use in those situations is the cost approach.

Also called the Many Hats approach, meant for business owners that wear multiple different hats in their business.

As a small business owner myself, I know that is absolutely true for me.

I have multiple different roles that completely range in the things that I’m doing in my business and my day can have all different types of roles that I am doing.

Some that are more higher level management type duties and some that are a little bit more admin type duties.

As much as I would love to be able to hire out all of those things that aren’t necessarily realistic for a lot of small business owners.

So you’re probably doing a lot of different things. The way that this approach works is you’re gonna write out all the different duties that you do in your business.

I’m talking about at a detailed level, the more detailed, the better, including even janitorial services you might be doing around the office, all of those things, any place that you are spending your time in your business, you wanna write those duties down.

And then you are gonna apportion out the amount of time, up to 40 hours a week.

If it’s above 40, don’t worry about it, but we’re gonna take up to 40 hours a week and apportion that to these different tasks.

And they come up essentially with a percentage allocation between all of those tasks on essentially you can do a weekly basis, a monthly basis, an annual basis.

Overall, you want to talk about what you do in a normal year as it relates to these different tasks, how much of your job is spent there?

And then what you can do is go out and find comparative salary data for each of those different job duties.

So that is where it gets a little bit tedious, we’ll say, where it might not be the most exciting thing in the world, but you can go dig into salary data.

There are various different US Bureau of Labor Statistics or other websites like salary.com, things like that that you can research.

You can go look at open positions and find what they would pay specifically in your area.

Now, this can take some time, obviously, but it’s gonna be the best support for if the IRS audits you.

If you can say, here is this big report I did where I researched all these different job duties and averaged them all together and came up with my reasonable salary.

Here you go, IRS, they’re probably gonna scratch their heads a little bit and be like, wow, okay.

But that is gonna be really defensible support if you can say, here’s the actual job duties and what roles those are.

And I’ve averaged out my time to figure out what my total reasonable compensation should be.

Now we’re gonna talk about a quicker way to do that that will save you time and also be even, suffice it to say, there is help if you need help doing this, and I’m gonna give you some resources for that in a little bit.

But I do wanna cover the other two methods in case that one doesn’t make sense for you.

Maybe there isn’t equivalent data out there, which in the world of data that’s typically unlikely, or maybe you really only have one role in your business that you do.

And if that’s the case, if you have essentially one or maybe two roles in your business that you do, then it may make more sense to go research just that one role and figure out what you would pay somebody in an arms length transaction if you were to hire them to do that role on your behalf.

Now, that is called the market approach, but here’s why I don’t love the market approach.

As much as that seems easier to just say, okay, well I’m the CEO of my business, I’m gonna go look and see what I would pay a CEO.

Well, that’s almost always going to turn into a higher reasonable compensation than if you had used the cost approach, ie, the many hats approach.

And that’s because now you’re saying that you bucket all of your time into this one role.

It’s probably a pretty high level, at least managerial role, which would require you to pay a higher salary to someone if you were to hire them, and therefore it’s going to turn into a higher reasonable salary.

So it’s simpler, easier to document, absolutely, but it’s not gonna max out your tax savings in the same way it could if you really took the time to do the many hats approach.

Now, if there really is not any data available for you around any of these, if you can’t do the market or the cost approach for some reason, which is really unlikely, by the way, there is a third approach.

The income approach.

I don’t really recommend it, and it’s a little bit nebulous, but ultimately it talks about as long as the return that an investor would get.

So as long as you’re generating a sizable profit and an investor, an outside investor who is unrelated would be happy with that return, that ultimately they’ll say, well, your reasonable salary is reasonable and therefore it’s fine.

So that one is a little bit more difficult to really prove. And again, that’s really only gonna be feasible and make sense if you don’t have access to this other data.

And I think it would be really difficult to actually explain to an IRS agent because that’s not usually how they’re gonna look at it, especially if you’re really running a small business.

So I typically recommend, you can probably tell for most small business owners, I think it’s gonna make sense to do the cost approach, i e the many hats approach.

Now, thankfully, thankfully, thankfully there is help with this.

And I’ve partnered with RC reports who I mentioned earlier, who is the premier company when it comes to reasonable compensation studies and reports.

They have access to all the data. They have a whole proprietary system that pulls all this data, including by location.

So that you can come up with a super ironclad, defensible, reasonable salary that if ever audited, you could present to your auditor.

And they will probably be absolutely floored that you actually have that level of detail.

It’s gonna give you all the salary breakdowns for all the different job duties that you have.

And it even is gonna get into things like proficiency level where you can adjust those things in order to get your reasonable compensation and not pay more taxes than you need to.

And I will tell you, there have been lots of times where the IRS has challenged reasonable salary and what has happened is they might come and say, well, you’re a manager and this is what I would determine your reasonable salary to be.

There was a specific case that went forward where there was a woman who owned a small business who set her reasonable salary at about $40,000 and they came back and said,

Nope, your reasonable salary is actually $67,000.

But they were just looking at maybe one or two different job duties. Two determined that and she was able to come up with a full report to give them to say, here is how I could support this.

Here are all the different job duties that I do and what I would pay somebody else to do those job duties for me, and here’s what it averages out to be.

And it ended up standing under audits.

So what could have cost her an additional $10,000 plus in back taxes and fees and penalties ended up being completely fine and defensible because she had that in her back pocket.

There is something so useful if you are setting your reasonable compensation, especially if you don’t wanna set it super duper high so that you don’t get, you know, in trouble with the audit.

If you want to defend a reasonable compensation that’s not gonna require you to overpay in taxes, you want to have that report so that you can produce it if you ever need to.

And even if you never need to, you still have rock solid support when you’re trying to decide what the best reasonable salary is for you in your business.

And even if you never have to actually produce this report, if you’re never audited, it’s still super valuable to have because now you know what to set your reasonable salary for your business and you can be confident that you’re not paying more in taxes than you need to.

So here’s your shortcut to determine what is a reasonable salary for you.

You’re in the market for a reasonable compensation that is IRS defensible and that you have all the support for without spending hours and hours and hours of trying to compile yourself.

Then you want to go check out JamieTrull.com/RCReport.

You will receive a report customized and personalized to you and your business. It looks a little something like this. Okay?

The charts and graphs will show you exactly how everything lays out based on what you input into the system.

It will pull all the wage data for you, and it will compile all of that information together in this beautiful report that if the IRS does come knocking, you can hand it right over to them and say, here you go and have a nice day.

And the best thing about it is you’ll take the survey and I will review your results and give you any kind of tips or things to think about or potential changes.

With the mindset of what’s gonna be IRS audit defensible and also what’s gonna make the most sense from a tax perspective, because we don’t wanna pay more taxes than we need to right now.

I will say that this report is probably best for those who are already S corporations or are probably going to be electing S corporation status soon.

Now, I do have another product that you can grab as well called the S Corp toolbox if you’re still trying to determine if S corporation is right for you.

And on that page, you will see a bundle where you can get both the toolbox which has all of my tools and learnings about being an S Corp and how to elect it.

As well as this reasonable compensation study for a little bit of a cheaper price.

So go check that out as well, especially if you are still trying to decide if S Corp is right for you.

Now, real quickly before we wrap up, I also want to address two things. Two questions that I get a lot as it relates to S Corp.

Two things to think about when setting a reasonable salary.

The first is, do I have to pay myself a reasonable salary? What if I’m not profitable in my business?

Well, the IRS can’t make you pay yourself a reasonable salary.

However, if you are paying yourself draws from your business, then you do need to be paying yourself a reasonable salary. They will reclassify those draws to reasonable salary if you don’t.

So it really only impacts if you’re taking money out of your business but not paying yourself a reasonable salary.

They know that trick and they will reclassify that under audit.

And the other important thing I think that is critical to this conversation is to know that it’s not always just about setting the lowest defensible reasonable salary you can to save on taxes.

Remember, that’s also potentially gonna have an impact on you when you retire because those wages calculate your social security benefits.

So if you’re not paying into social security, that means you’re gonna be able to take less out later.

For some people, that matters a lot.

For others that might not matter as much, and you may prefer just to maximize your cash now and worry about it later.

But that’s just something to be aware of when it comes to S corporations.

And it can also affect things like your retirement contributions.

So you just wanna be aware of what the impact of setting your reasonable salary is going to have on things like that.

So thanks for joining me.

I hope you got a lot of valuable information when it comes to reasonable salary.

And I’m gonna continue to be putting out videos about S corporations and when it makes sense for you. I’m in the middle of a series about it right now.

So make sure to like and subscribe if this is something that’s interesting to you! So you don’t miss any of my future videos.

And I will see you next time.