financial literacy coach & Profit Strategist

Jamie Trull

Are you relying only on your business bank account to “do your books”? I love a good modern banking platform (I use Relay), but let’s set the record straight: banking ≠ bookkeeping. Your bank keeps score of cash moving in and out. Even basic bookkeeping tells the whole financial story. A story that includes the […]

read now

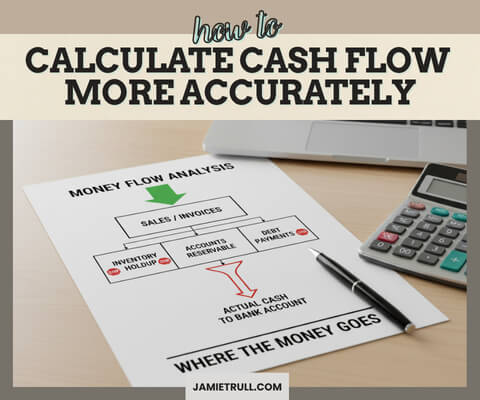

You’re booking clients. Revenue is growing. But your bank account is still whispering “nope.” If that sounds painfully familiar, you are not alone. The truth? Revenue ≠ profit, and profit ≠ cash in the bank. Until you build a simple, reliable cash management system, your business will always feel like a high-stress juggling act—no matter […]

read now

Your cash flow vs profit scenario: your P&L says you’re profitable… but your bank account says “yikes.” If that sounds familiar, you’re bumping into one of the most misunderstood truths in business: profit and cash flow are not the same thing. Understanding the difference (and managing both) is the line between constant money stress and […]

read now

Relay just rolled out a tiered pricing model for 2025*—and if you bank on Relay (or you’re Profit First-curious and want multiple business bank accounts), you’ll want to know what changed, what didn’t, and how to choose the right tier without overpaying. I’ve used Relay for years because it makes cash management and envelope-style banking […]

read now

Think Profit First has you covered? Not quite. If you’re still running your business from one account—or even if you’ve set up the classic Profit First buckets and feel like something’s still missing—this is the guide I wish I’d had years ago. I’m Jamie Trull, CPA & financial educator. I’m a huge fan of systems […]

read now

If you’re a small business owner desiring better business budgeting techniques, you might feel like money comes in and disappears just as fast. Maybe you’re constantly wondering, “Can I pay myself this month?” — you’re not alone. Managing cash flow, budgeting methods for taxes, and consistently paying yourself is one of the hardest parts of […]

read now

Let’s be honest — finding the best bank account for business purposes can mean a journey of trial and error. Most business banking platforms are clunky, expensive, and a total headache. That’s why I was so excited when I found *Relay, a modern online business banking solution built with entrepreneurs in mind. Today, I’m sharing […]

read now

If you’ve ever wondered, “How Many Business Bank Accounts Should I Have?” you are not alone. Managing all of your business finances through a single checking account can cause chaos, leading to disorganization and missed opportunities for savings. To take control of your business cash flow and prepare for growth, it’s essential to implement a […]

read now

Many small business owners experience irregular income—one month’s profits soar, while the next month, business slows to a crawl. This unpredictability makes it difficult to plan, pay bills, hire staff, or reinvest in your business. It is crucial to account for all the money coming in before planning expenses, ensuring that fixed and essential expenses […]

read now

Running a business brings both freedom and responsibility, and one of the biggest questions business owners face is: How much should I pay myself? Finding the right balance between personal income and business growth can feel daunting. In this article, we’ll walk through how to pay yourself as a business owner, using insights from Jamie […]

read now