Make sure to research your options.

Some people search for the “best cheap payroll service” but the cheapest payroll service may not get the results your business needs.

Not all companies that handle payroll are created equal.

The best payroll service provider will help you fight the many battles small business face, and you may not find the best weapons in an inexpensive payroll software.

Those battles?

Various payroll processes issues, including late payments, misclassifying employees, and processing incorrect details, to name a few.

One reason is that most still process their own payroll manually and lack the payroll features to do it correctly.

If you’re looking for the best payroll service for s corp entities, you’re in the right place. We’ve also got recommendations for you if you’re an independent contractor or sole proprietor looking for payroll software or searching for a payroll company for freelancers.

Do you need tax filing and unlimited payroll runs?

Today Jamie’s giving you all of the insight you need to choose the best online payroll services from the best payroll software vendors.

Comparing Payroll Services

Your small business can win with the right small business payroll provider.

Up to 25% of small businesses still employ manual payroll processing because it’s more affordable.

Payroll software can be expensive, and since these self-employed business owners don’t have a massive workforce, they don’t see the need to invest in software.

Nevertheless, there are affordable and uncomplicated payroll software solutions you can use for your sole proprietorship or limited liability company

You simply have to choose the best ones. From a focus on sole proprietors to the best payroll processing for s corp businesses, there’s great solutions available for companies of any size.

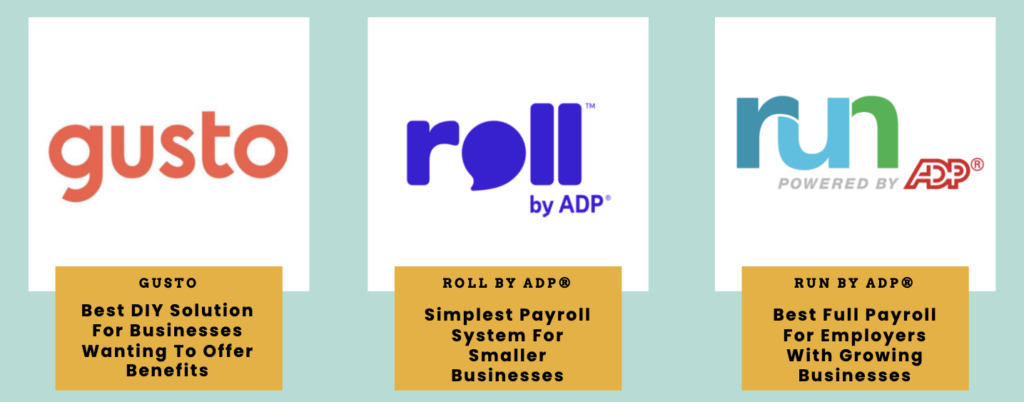

What’s the best payroll software? Here’s our recommendations for the three best payroll providers for your small business.

Payroll issues happen when employers don’t have the necessary systems in place to ensure timely and accurate payment.

Poor communication between employers and employees can lead to misunderstandings about pay cycles, discrepancies in payments or simply forgetting to send out a paycheck altogether.

Without the proper software or processes in place, manual errors and miscommunications can easily occur.

GUSTO: BEST DIY PAYROLL SOLUTION FOR BUSINESSES WANTING TO OFFER BENEFITS

By using Gusto payroll solutions, businesses can help ensure that hard-working teams are always paid on time without compromising accuracy – leading to greater job satisfaction and improved employee relations.

The platform was first launched as ZenPayroll in 2012 and currently boasts over 200,000 business customers.

The platform is easy to use with a straightforward interface.

You can either set up a new business payroll with Gusto or transfer your existing payroll from a different payroll software platform.

It takes a few clicks to have your payroll system running on Gusto.

Due to its customizability, it’s an ideal do it yourself payroll software solution.

For small business owner payroll services, you can use Gusto for full-service payroll and payroll taxes, employee benefits, and hiring and onboarding.

For this, it’s a recommended small business payroll software solution for businesses that want to offer benefits.

The software is also dependable for talent management, insights and reporting, and time and attendance management.

GUSTO TOP FEATURES: Payroll Taxes and More

Here are some of Gusto’s top features:

Full-service payroll

Gusto’s full-service payroll lets you run your business payroll in minutes.

You get a central dashboard from where you can manage all the other features, like payroll taxes.

Notably, the full-service payroll supports paying employees’ salaries, compensation, taxes, and contractors.

In particular, you can pay contractors in more than 80 countries across North America, South America, Europe, Africa, and Asia.

Employee benefits

As mentioned earlier, Gusto is ideal as the best payroll provider for businesses wanting to offer benefits.

You can efficiently compensate your workers with the employee benefits feature; without wasting time and resources.

The software provides licensed advisors to help develop the best benefits package for your small business. In addition, your workers can contact the Gusto support team for any inquiries.

Time and attendance management: Key feature of payroll for self employed small business owners

Time management is crucial, especially for small businesses.

With Gusto, you get simple time tracking tools for accurately monitoring working hours.

Your employees can easily update their work hours, and you can verify their hours with the geolocation option.

Notably, all time and attendance management tools sync with the full-service payroll.

Hiring and onboarding

Gusto makes the hiring and onboarding process seamless.

The software helps you find the best employees and provides support to enable them to start on a good note.

You can create public job posts and offers letters, custom onboarding checklists, and connect to different applicant tracking tools.

Talent management

Just as Gusto helps you hire and onboard the best talents, the software helps you retain them.

You can do this by leveraging the available talent management tools, which are a life-saver for any HR services manager.

You can set up effective feedback and guidance channels, and in the long run, you receive dependable performance reviews.

Integrations for income taxes and more

Integrations are among Gusto’s principal strengths.

The software integrates with different third-party apps, including accounting, business operation, collaboration, and rewards and recognition apps, to name a few.

Some of the most popular integrations available on Gusto include Asana, Clover, Dropbox, Google Workspace, Salesforce, and GitHub.

This makes payroll taxes and other tasks a breeze. You’ll have a trusted partner for self employment tax and tax payments.

WHO/WHAT IS GUSTO BEST FOR? (NOTE THE SELF-EMPLOYMENT TAX AND OTHER TAX LAW FEATURES)

The highlight of Gusto’s features is the employee benefits option.

You don’t get such with many affordable payroll software solutions.

As a result, Gusto is best for businesses wanting to offer employee benefits.

In particular, Gusto makes it easy for businesses to offer employees health insurance management and financial benefits.

You can deploy the no-cost, low-cost, or premium benefit solution.

With the no-cost option, you can leverage the Gusto wallet app, paycheck splitter, cash accounts, renewals, and budgeting & insights.

You can use these features without paying a dollar.

The smart full-service payroll solution also makes Gusto suitable for businesses that need a DIY solution.

You can run payroll as much as you want at no extra charge, and you can use the Autopilot feature or issue Payroll manually with a few clicks.

Furthermore, you can count on Gusto if you must comply with strict tax laws.

The software files your payroll taxes automatically with the right government agencies.

HOW TO GET STARTED WITH GUSTO?

You can try out Gusto with the free demo on the website!

The demo gives you access to all Gusto features but with mock data.

If you’re satisfied with the demo, you can create a real account with a few clicks.

While signing up, Gusto lets you select your business size, with provisions for businesses with 0 – 2 employees.

If you use a different payroll data, the software will walk you through the steps to import your payroll.

Otherwise, the software will redirect you to your admin panel, and you can begin organizing your payroll right away.

GUSTO SPECIAL OFFERS

While Gusto is affordable; you can pay even less in some instances with special offers.

You can get a free $100 VISA Gift Card after you run your first payroll. 🤩🤩🤩

All you have to do to access this special offer is to sign up for Gusto via this offer link.

Once you complete your first payroll, you’ll receive the Visa Gift Card!

You can use your free $100 Visa Gift Card to purchase what you want online or in stores.

The card is valid anywhere Visa debit cards are accepted.

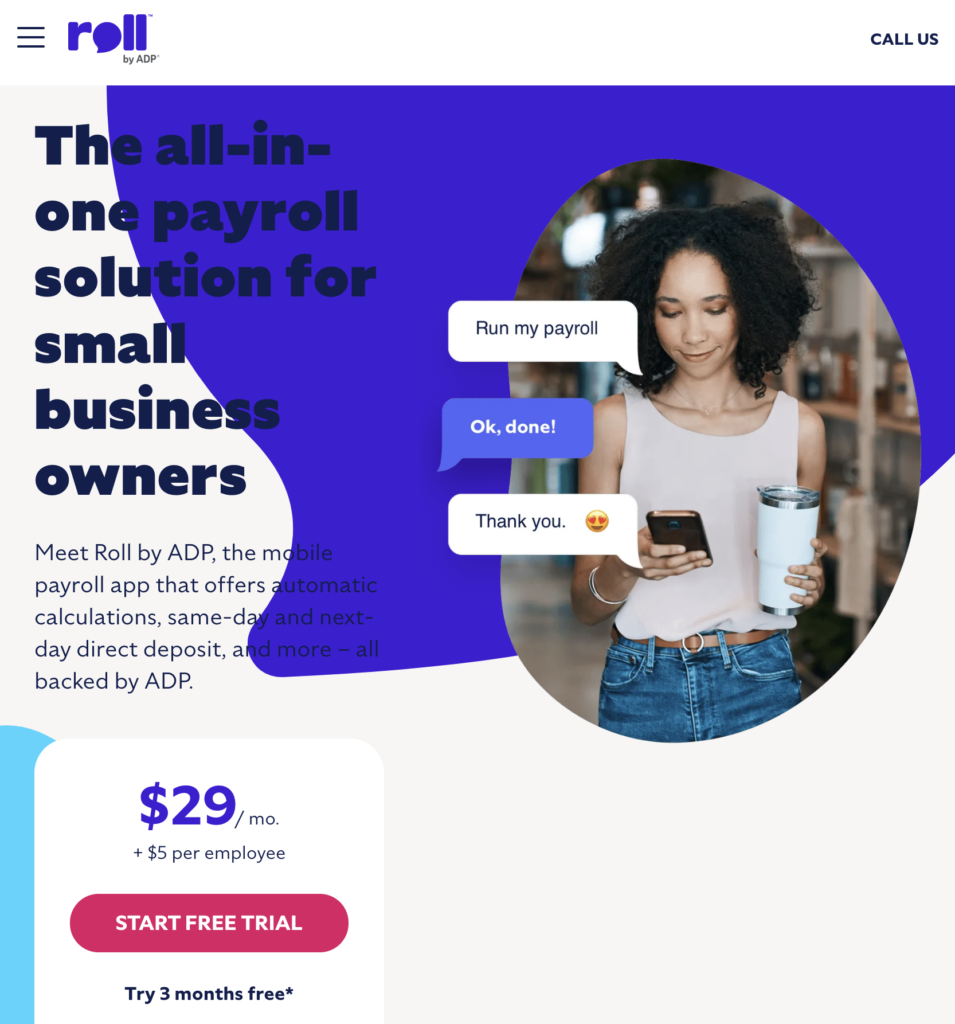

2. ROLL BY ADP®: SIMPLEST PAYROLL SYSTEM FOR SMALL BUSINESSES

Roll by ADP® is self-described as “the all-in-one payroll solution for small business owners.”

Because of its focus on businesses of a particular size, it’s ideal as the best for running payroll of smaller businesses.

Roll by ADP® is available as a mobile app, and notably, it’s available in English and Spanish.

With the app, you can run a payroll in less than a minute, and it works like chatting.

You only need to complete a few tabs as instructed by the intelligent assistant, and that’s all!

The app handles taxes as well, eliminating the stress of manual filing and deposits.

With proactive alerts, you can ensure you don’t miss any payment date or tax deadlines with proactive alerts.

With all these, you can agree that Roll by ADP® is a relatively simple payroll solution.

In addition, ADP payroll fees are affordable, which is natural since it’s exclusive to smaller businesses and sole proprietors.

ROLL BY ADP® TOP FEATURES

Here are some of Roll by ADP®’s top features:

Payroll DATA and taxes management.

“Run Payroll” is all you need to enter in the Roll by ADP® app to run a payroll.

You can seamlessly pay employees in all US states, including full-time, part-time, seasonal, or overtime.

You can always maintain updated paperwork with simple payroll reports and automated tax statements.

Raises and bonuses

Over time, you’ll want to increase employee salaries and issue bonuses. Roll by ADP® lets you do this instantly or on schedule. It supports rapid raises, instant bonuses, off-cycle payments, and garnishments.

Furthermore, the app presents insightful details, so you can easily determine which employee needs a raise or a bonus. Typically, you only need to send the AI assistant a message.

Intelligent assistance

Every Roll by ADP® feature depends on intelligent assistance. In particular, the AI assistant makes it suitable as the best payroll provider for very small business owners that require the simplest solution.

The AI assistant will carry out any task to instruct, and you only need to chat with it. It delivers alerts and notifications, to-do task lists, and performs routine error checks on your payroll setup.

Employee self-service

Your employees can download and use the Roll by ADP® app to manage their payment profiles. With this, they can track their details to ensure it’s correct and get notifications immediately after you issue payroll.

Furthermore, they can monitor their taxes, raises, and benefits info. You’ll need to send your employees an invitation link for them to connect their profiles with your payroll management system.

Contractors’ payroll

Roll by ADP® doesn’t limit you to paying employees but also lets you pay contractors.

Specifically, you can onboard and pay 1099 contractors.

The payroll service separates W-2 employees from 1099 contractors, and you can manage both without stress.

Like the employee payroll, contractor payroll also supports off-cycle payments.

However, Roll by ADP® doesn’t support tax automation, which means contractors will file and pay taxes themselves.

You will need to track and pay self employment taxes, income tax, medicare taxes, and social security taxes.

WHO/WHAT IS ROLL BY ADP® BEST FOR?

If you can define Roll by ADP® in one word, it’ll be “simple.”

Therefore, if you’re a small business that needs the simplest payroll system, you should opt for this software.

Much of it is thanks to the AI assistant and because the solution is easily accessible as a mobile app.

The Roll AI assistant stays on top of all your payroll activities.

If you are an aspiring digital course creator or a self employed individual, Roll by ADP® could be your best solution.

You simply tell it what to do, and it does it.

It’s like chatting with a friend; all you do is type in a message and hit send.

Such a payroll service eliminates the complexities of working with a web or desktop application.

Interestingly, the Roll by ADP® AI assistant learns from your instructions.

Over time, it will adapt and can recommend subsequent instructions.

If there’s any error in your payroll setup, the AI assistant will also identify them and recommend fixes.

HOW TO GET STARTED WITH ROLL BY ADP®?

First, you must download the Roll by ADP® mobile app.

The app is available for Android and iOS devices, and you can download it from their respective app stores. Afterward, you can create an account.

You’ll need to provide details about your business, including your business name, banking account and routing numbers, and employee identification numbers.

These details are necessary so that money gets to the right employee.

Once you complete the registration, you can begin chatting with the Roll by ADP® AI assistant to run payrolls.

Roll by ADP® is a premium payroll provider, although it’s highly affordable.

The platform requires monthly subscriptions, so there are no long-term contracts.

SPECIAL OFFERS FOR ROLLBYADP

As a first-time user; you can use the Roll by ADP® software free for three months before making a payment.

After three months, you can enjoy special negotiated rates, beginning at $24 per month.

This special offer comes at no risks, and you can access all the Roll by ADP® features for the free three months.

Sign up using this special link to get this free three-month offer for Roll by ADP® and negotiated rates offer.

3. RUN POWERED BY ADP®: BEST FULL PAYROLL SOLUTION FOR EMPLOYERS WITH GROWING BUSINESSES

Run powered by ADP® is one of ADP’s flagship payroll systems.

The solution targets small and midsize businesses. As a result, it’s the perfect payroll provider for growing businesses.

Run powered by ADP® has a streamlined and intuitive desktop admin interface.

Managing your payroll setups will be quick and easy. In addition, the platform has a renowned mobile app for employees.

All your workers, both local and international, can conveniently keep track of their pay, work hours, and more.

Aside from payroll, you can also use Run powered by ADP® to manage HR, time & attendance, insurance, worker’s compensation, and retirement.

With all of these, the platform qualifies as a full payroll solution.

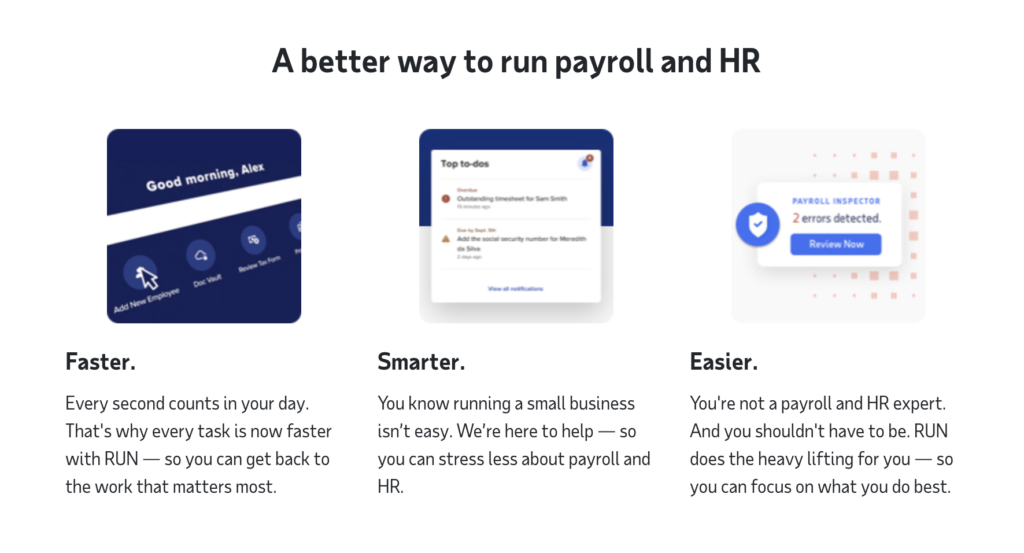

RUN POWERED BY ADP® TOP FEATURES

Here are some of Run powered by ADP®’s top features:

Fast and enhanced payroll.

Run powered by ADP® provides a personalized dashboard from which you can quickly run payrolls.

You can run payrolls by simply following step-by-step instructions.

With the Run & Done feature, you can completely automate the payroll process, and Run powered by ADP® also features flexible payment options.

Furthermore, you can depend on 24/7 support from certified payroll experts if you have any issues.

HR management

Run powered by ADP® comes with an intuitive HR management tool suite to help you grow your business.

The suite centralizes all your employees’ records, making it easy to onboard and offboard employees.

Notably, you can seamlessly create resources to assist your workers. For instance, you can create an employee handbook or discount program.

The HR management suite further includes other employee assistant services.

Tax compliance

Tax rules can be complex to follow for expanding businesses, but Run powered by ADP® makes it uncomplicated.

The software will automatically calculate tax deductions and issue them to the right regulator.

Thanks to the AI-powered error detection feature, you’ll always identify and correct payroll mistakes on time.

Add-ons and integrations

Run powered by ADP® offers more functionality with its many integrations.

You can connect the payroll solution with third-party HR, business, POS, insurance, time tracking, and retirement solutions.

Notably, you can integrate with any app in the ADP® marketplace.

Run powered by ADP® offers more functionality with its many integrations.

You can connect the payroll solution with third-party HR, business, POS, insurance, time tracking, and retirement solutions.

Notably, you can integrate with any app in the ADP® marketplace.

WHO/WHAT IS RUN POWERED BY ADP® BEST FOR?

Run powered by ADP® is recommended as the best full payroll provider for employers with growing businesses.

If your business is gradually progressing from small-sized to medium-sized, you should opt for ADP® Run.

It’s a versatile solution that’ll work for you if you need more than the basic payroll tools.

In particular, you should use Run powered by ADP® if you conduct international business.

The payroll system offers one of the best tax compliance services, ensuring you don’t have problems with international tax rules.

Furthermore, Run powered by ADP® also incorporates a suite of HR tools, which makes employee guidance and training more straightforward.

As a growing business, you’ll have far more employees than a starting small business.

Hence, you’ll need more advanced HR tools, which you get with ADP Run.

HOW TO GET STARTED with RUN POWERED BY ADP®?

You can register for Run powered by ADP® via the web or the mobile app.

The same applies to your employees.

During the registration process, Run powered by ADP® will send you a temporary password.

The password is exclusively for registration, and you must change it afterward.

If registering as an admin, you must choose the services you’re interested in.

You can choose between payroll, HR, time & attendance, insurance, worker’s compensation, and retirement.

Notably, you can choose multiple services.

Next, enter your company details, including name, number of employees, email, and address.

Run powered by ADP® will recommend the best pricing option for your business from the details you provide.

A representative will contact you to discuss an ideal solution in most cases.

LOOKING FOR SPECIAL OFFERS from RUN POWERED BY ADP®?

Run powered by ADP® has different packages from which to choose.

Irrespective of what package you choose, you can get three months free with this special offer.

The special offer is available if you sign up via this link.

You’re eligible for the free three months special offer if it’s your first time using Run powered by ADP®.

SO: WHICH OF THE ABOVE BEST RATED PAYROLL SERVICES IS THE BEST PAYROLL PROVIDER FOR YOUR BUSINESS?

Depending on your business needs, you can opt for any of the three best payroll providers listed above.

- You should use Gusto if you want to offer benefits,

- Roll by ADP® if you require the simplest solution, and

- Run powered by ADP® if you’re a growing business.

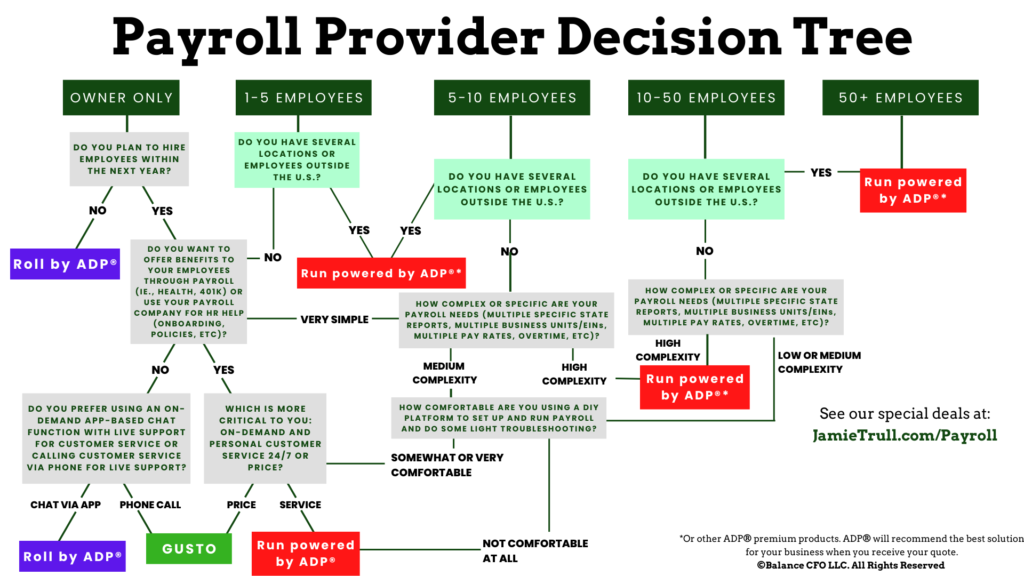

You can use the payroll provider decision tree below as a guide to ensure you choose which provider fits perfectly for your small business:

Following the above decision tree is simple and straightforward, and will identify the best payroll provider for your business!

First, you pick the current size of your small business.

Next, you answer the related questions with a yes or no.

Ultimately, you’ll get a recommendation between Gusto, Roll by ADP®, and Run powered by ADP®.

Here’s an example:

Suppose you’re a small business with 5 – 10 employees.

In that case, you need to answer the questions, “Do you have several locations and/or employees outside the US?”

If your answer is yes, you should use Run powered by ADP®, which means you’re an employer with growing businesses.

If your answer is no, you need to answer the subsequent questions until you get to the end of the tree.

SUMMING IT UP: OUR SPECIAL OFFERS FOR PAYROLL SERVICES

Here’s a rundown of the special offers you get from the small business payroll providers discussed in this article:

After completing your first payroll, you can get a free $100 Visa Gift Card when you use our link to get started with Gusto here.

You can get three months free with special negotiated rates starting at $24 a month when you get started with Roll by ADP® here.

You get three months for free when you sign up here with our link.

Use the special links provided by the three payroll services to claim the offers.

THE BOTTOM LINE WHEN CHOOSING THE BEST PAYROLL PROVIDER

Ultimately, a payroll solution will help you process calculations and deductions quicker, work out paychecks, reward employees with benefits and raises, and reduce the complexity of paying taxes.

In simpler terms, it’ll make doing the small business finances of your business easier, even when you’re seeking out top rated payroll services for 1 employee.

With the review and payroll provider decision tree in this article, you should be able to pick the best payroll provider for your small business.

Combine that decision with our special offers and you can earn and save money on the best payroll provider for your business!

LOOKING FOR MORE INFORMATION ON MANAGING YOUR BUSINESS FINANCES?

Check out all our recommendations and specially negotiated deals, including our AH-MAZING offer for QuickBooks Online on our full Favorite Things List!

Wanting to expand your financial literacy and get weekly training videos, tips and tricks for managing your business finances?

Subscribe to my YouTube channel here to get the latest!

Want to know why I DON’T recommend Quickbooks Self-Employed? Get the juicy deets here! ⬇️