QuickBooks versus FreshBooks: which one is right for YOUR small business?

If you’re a freelancer, coach, consultant, agency owner, or creative entrepreneur, you’ve probably heard both names.

But while they’re both “accounting software,” they’re designed for very different users and workflows.

Choose the wrong one and you’ll pay for features you don’t use (or miss the ones you really need), spend extra hours fighting your books, and potentially wind up switching later.

I’m Jamie Trull, CPA turned financial educator. I partner with both QuickBooks and FreshBooks, and I’ve used them side-by-side to help you make a confident, practical decision.

Below you’ll find a point-by-point comparison, real-world scenarios, and a quick chooser to get you to the right pick—fast.

👉 Want my curated recommendations (and latest deals) across multiple platforms? Head here: https://www.jamietrull.com/accounting

👉 Thinking FreshBooks might fit you best? Lock in the current promo: https://www.jamietrull.com/freshbooks (90% off for 4 months as of today—offers change, so check the page for the latest.)

TL;DR: Who Each One Is Best For

- Pick FreshBooks if you’re a service-based business (freelancer, coach, consultant, designer, photographer, agency) that values simplicity, polished invoicing, built-in time tracking, and clean project billing without a steep learning curve. It’s intuitive for non-bookkeepers and ideal if you’ll be doing your own books (at least for a while).

- Pick QuickBooks Online (QBO) if you’re product-heavy or multi-channel, need inventory, job costing at scale, robust custom reporting, complex sales tax handling, classes/locations, or you’re working with a bookkeeper who lives in QBO. It’s the “Swiss Army knife” with tons of power—and a learning curve to match.

The #1 Mistake Business Owners Make (and How to Avoid It)

Choosing software based on name recognition instead of how you actually work. QuickBooks accounting software is famous, but fame doesn’t equal fit.

Start with your business model, the features you’ll use weekly, and your tolerance for complexity. Then layer in price, scalability, and whether you or a pro will be in the driver’s seat.

Feature-by-Feature Comparison

1) Invoicing & Getting Paid

- FreshBooks: Invoicing is a standout—beautiful templates, easy estimates → invoices, automatic reminders, deposits, retainers, and card/ACH payment options. Project and time entries roll onto invoices in a click, which is perfect for services.

- QuickBooks: Strong invoicing too, and better if you need to invoice for products, manage sales receipts, partial shipments, or tie into more complex workflows (inventory, purchase orders, progress invoicing on big builds).

Best for invoicing simplicity: FreshBooks

Best for product-heavy invoicing: QuickBooks

2) Time Tracking, Projects & Proposals

- FreshBooks: Time tracking is built in on all paid plans. Track by client/project/task, set billable rates, and convert time to invoices instantly. Proposals/estimates are easy. Great for creatives and consultants who bill time or milestones.

- QuickBooks: Time tracking exists but typically requires higher tiers or an add-on. Project profitability is robust (especially with classes/locations and job costing), but setup is more “accountant-y.”

Best for service teams that live on timers: FreshBooks

Best for advanced job costing: QuickBooks

3) Expenses, Bank Feeds & Reconciliation

- Both connect bank/credit card feeds and auto-categorize expenses.

- FreshBooks: Cleaner UI, fewer ways to click the “wrong” thing. Less intimidating for DIY users; easier to keep clean books if you’re new.

- QuickBooks: More granular control, bank rules, and accountant tools. Feeds can be finicky depending on bank, but power users appreciate the options.

Best if you’re doing your own books and want fewer mistakes: FreshBooks

Best if your bookkeeper wants granular control: QuickBooks

4) Inventory & COGS

- QuickBooks: Built-in inventory tracking, COGS handling, purchase orders, vendor bills, reordering, and reporting across multiple channels (with the right plan + Quickbooks mobile app).

- FreshBooks: Not designed for deep inventory. Light product/service lists, but inventory management is not its focus.

Clear winner for inventory: QuickBooks

5) Sales Tax

- QuickBooks: Better built-in options for handling complex sales tax scenarios and multi-jurisdiction setups, especially for product businesses.

- FreshBooks: Fine for simple scenarios; for multi-state product sales at scale, you’ll likely want specialized sales-tax tools regardless of platform.

Best for complex sales tax: QuickBooks

6) Reporting & Double-Entry Accounting

- FreshBooks: Solid core reports (P&L, expense detail, A/R, etc.). You’ll want FreshBooks Plus or higher for a Balance Sheet and full double-entry reporting. Interface is friendly—even financial reports feel approachable.

- QuickBooks: Very robust reporting across all tiers (with increasing customization as you move up). Powerful for slicing data by class/location, project, or item.

Best for approachable, essential reports: FreshBooks (Plus+)

Best for deep, customizable reporting: QuickBooks

7) Payroll & Integrations

- FreshBooks: Plays well with popular payroll providers and time/collaboration tools.

- QuickBooks: Integrates naturally with QuickBooks Payroll and a vast app ecosystem; if you’re building a complex tech stack, QBO’s marketplace is hard to beat.

Best for native payroll integration: QuickBooks

Best for simple, modular stacks: FreshBooks

8) User Experience & Learning Curve

- FreshBooks: “Pick up and use” vibe. If the thought of reconciliations makes you sweat, this is calming.

- QuickBooks: Powerful and dense. Amazing in the hands of a pro; a bit daunting for first-time DIYers without training.

Easiest to learn: FreshBooks

Most powerful once mastered: QuickBooks

9) Accountant Access & Ecosystem

- QuickBooks: Most U.S. accountants/bookkeepers are fluent in QBO.

- FreshBooks: Growing pro network; FreshBooks can connect you with a certified pro if you prefer. Many accountants are happy to work with what you choose.

If you’re hiring a bookkeeper day one: Slight edge to QuickBooks

If you’re DIY and may outsource later: Either works; FreshBooks is friendlier to start

10) Mobile Apps & On-the-Go Tasks

- Both handle receipt capture, basic invoicing, and expense entry.

- FreshBooks: More intuitive for time + invoicing on mobile.

- QuickBooks: Broader feature set; some tasks feel more “desktop-y.”

11) Pricing & Value

Pricing changes often (and QBO has raised periodically). Generally:

- FreshBooks tends to be more affordable for similar service-based needs and includes things like time tracking on lower tiers.

- QuickBooks packs more advanced plan features, but you’ll typically pay more—especially as you climb tiers or add payroll.

👉 Check FreshBooks’ current promo (often 90% off for 4 months): https://www.jamietrull.com/freshbooks

👉 Compare multiple platforms and current deals: https://www.jamietrull.com/accounting

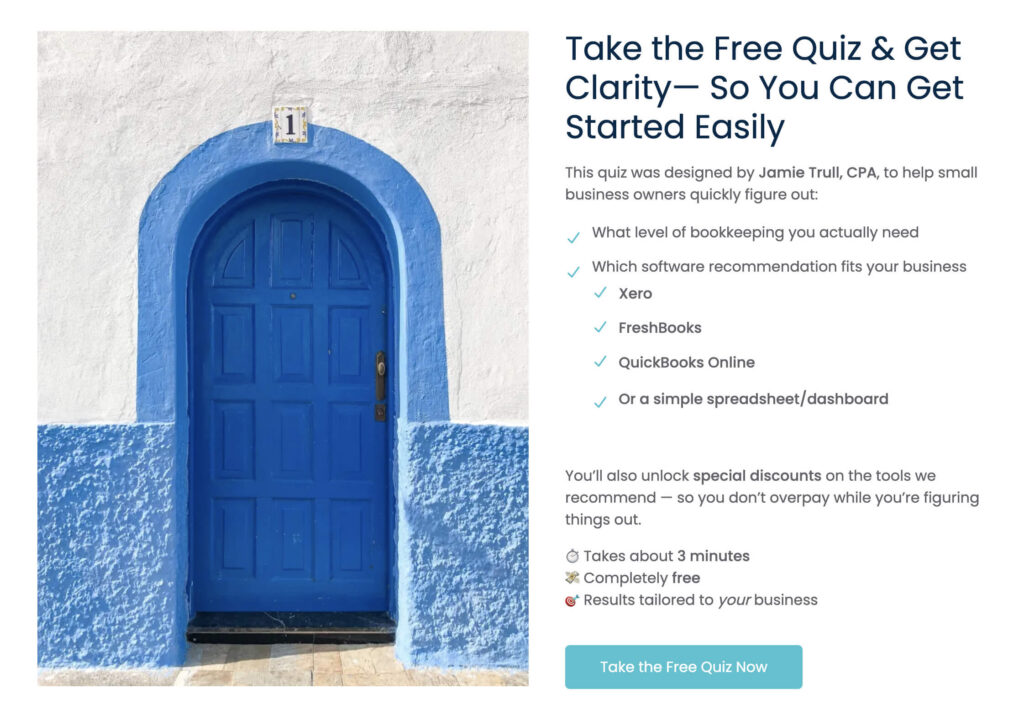

Find Your Bookkeeping Solution In Under 3 Minutes:

Scenario Guide: What’s Right for Your Business?

“I’m a freelancer/coach/creative. I invoice for time, retainers, or packages.”

Go FreshBooks. You’ll love time tracking, project billing, automatic reminders, and clean reporting without the overwhelm.

“We’re an agency with contractors. We bill projects and need easy time → invoice.”

FreshBooks for the field/team; it keeps delivery and billing tight. If you add heavy job costing or complex reporting later, reassess.

“We sell products (or hybrid products + services), track inventory, and manage purchase orders.”

QuickBooks. It’s built for inventory workflows and deeper sales tax.

“I’m DIY now, but plan to hire a bookkeeper soon.”

Either is fine. If you want the easiest daily experience, start with FreshBooks. If your future bookkeeper is adamant about QBO, consider starting there.

“I’ve got complex reporting by department/location/class, and external systems.”

QuickBooks. You’ll leverage classes/locations, advanced reporting, and app marketplace depth.

FreshBooks vs. QuickBooks: Strengths You’ll Notice in Week One

FreshBooks strengths you’ll feel immediately

- You’re sending better invoices faster (and getting paid faster).

- Time entries roll into invoices without copy-paste drama.

- The dashboard actually makes sense if you’re not an accountant.

- Fewer “how did I break my bank rec?” moments.

QuickBooks strengths you’ll feel immediately

- You can handle almost any accounting use case with the right setup.

- Inventory and purchase workflows are there when you need them.

- Your accountant will likely nod approvingly and start building custom reports.

Switching from QuickBooks to FreshBooks (If You Choose Simplicity)

Worried about the move? It’s less scary than you think. Here’s a 1-hour migration plan many small service businesses can follow:

- Export from QBO: customers, vendors, chart of accounts, products/services (if needed), open invoices/bills.

- Create your FreshBooks account (use the promo if it’s active): https://www.jamietrull.com/freshbooks

- Import customers and items.

- Connect bank/credit card feeds and set opening balances as of a clean cut-over date (e.g., 1st of next month).

- Recreate open invoices/estimates in FreshBooks (use this as a cleanup moment).

- Set up online payments (card/ACH) and invoice reminders.

- Create projects and migrate unbilled time (or start fresh).

- Run a test invoice and a quick mini-reconciliation to confirm everything flows.

If you want white-glove help, FreshBooks can match you with a certified pro.

Decision Framework: 10 Questions to Clarify Your Fit

- Do you sell services (bill time, milestones, retainers) or products (inventory, POs)?

- Will you do the books (at least initially), or will a pro own them?

- Do you need time tracking and project billing baked in?

- How complex is your sales tax situation?

- Do you need inventory or advanced job costing right now?

- How many users need access? (Owners, team, accountant)

- Do you rely on mobile tasks (time, receipts, invoicing on the go)?

- Do you need classes/locations and granular segment reporting?

- Do you prefer a simple UI or advanced features (with training)?

- What’s your budget for software today—and in 12 months?

Score yourself:

- Mostly services + DIY + time/projects + simplicity = FreshBooks

- Mostly products + complex reporting + inventory/sales tax + accountant-led = QuickBooks

FreshBooks Plans: What to Know

- FreshBooks Plus (or higher) is my recommended minimum for most businesses because it unlocks Balance Sheet reporting and full double-entry accounting.

- FreshBooks Light can be okay if you’re ultra-simple, but you’ll outgrow it fast.

👉 Check current FreshBooks plans + promo: https://www.jamietrull.com/freshbooks

QuickBooks Plans: What to Know

- QBO tiers climb in price as features unlock (time tracking, inventory, classes, more users).

- The value sweet spot for many small businesses is often the Plus tier—enough power without going Enterprise-level.

👉 Not sure which platform fits your stage? Use my comparison hub: https://www.jamietrull.com/accounting

Budgeting & Growth: Think in Phases

Your accounting system should match your current complexity—not a hypothetical future five years from now. If you’re a solo service provider today, FreshBooks lets you move quickly and keep clean data.

As you add offers or complexity, reassess annually.

Likewise, if you’re already juggling SKUs and warehouses, skip straight to the horsepower you need in QuickBooks.

FAQs

Is FreshBooks “real” accounting?

Yes. It’s double-entry accounting (choose Plus or higher for full financial statements including a Balance Sheet).

Can my accountant still work with FreshBooks?

Absolutely. More pros are FreshBooks-certified every year, and many accountants will work with whatever you choose.

Does QuickBooks work for service businesses?

Yes—but you might end up paying for features you won’t use, and you’ll need to climb the learning curve.

Can I switch later?

Yes. But switching costs time. Choose based on your next 12–24 months to minimize churn.

Which gets me paid faster?

Both support online payments. FreshBooks’ invoicing + reminders + time-to-invoice flow often shortens the cycle for services.

My Plain-English Recommendation

- If you’re service-based and want an accounting tool you’ll actually use—not avoid—start with FreshBooks. You’ll send better invoices, including recurring invoices, track time cleanly, and keep your books tidy with less effort.

👉 Grab the current FreshBooks promo: https://www.jamietrull.com/freshbooks

- If you’re product-based or know you need inventory, advanced reporting, classes, complex sales tax, or a big app stack, go with QuickBooks and (ideally) work with a pro to set it up right.

👉 Compare platforms & deals: https://www.jamietrull.com/accounting

Pick the one that matches your business today, supports your growth for the next couple of years, and won’t make you dread bookkeeping.

That’s how you stay informed, organized, and profitable—without the overwhelm.

I’m a partner with both QuickBooks and FreshBooks. If you sign up through my links, I may receive a commission—at no extra cost to you. As always, I only recommend tools I truly believe in and use with my community.

This article is for educational purposes and not individualized financial, legal, or tax advice. Talk with your accountant or advisor about your specific situation.

This transcript was generated from the video for your convenience, but it may contain typos or slight errors due to the transcription process. For the most accurate and complete information, we recommend watching the full YouTube video.

QuickBooks Versus FreshBooks: Which Leading Accounting Software Is Right for You?

I love a good comparison video, and if you’re confused about whether you should go with QuickBooks or FreshBooks, this video is for you. Now these platforms may sound similar.

They’re both accounting platforms, but they’re actually geared towards very different types of people.

And as with any software choice, if you choose the wrong one, it could cost you time, money, and create lots of frustration.

Hi everybody. I’m Jamie Trull, CPA, turned financial educator for small business owners, and today we’re gonna dive into all things FreshBooks versus QuickBooks so you can make the best decision for you.

Now, I’m actually a partner with both of these companies, but I want you to pick the one that makes the most sense for you, and that’s why I’m creating this video.

And make sure to stay with me until the end because at the end of this video, I’m gonna tell you about the one main mistake that I see business owners make when it comes to choosing [the best] accounting software and how to avoid it so that you don’t waste time and money switching over later.

Importantly, I don’t just make content about accounting platforms. I actually use them.

FreshBooks and QuickBooks: My Experience as a Partner and User

So like I said, I’m a partner with both companies and I’ve been a partner with QuickBooks and a user of QuickBooks online for years.

And I’ve made lots of content on this channel, specifically about QuickBooks Online.

But I love experimenting with new tools.

And when my audience asked me for about the millionth time to look at various different alternatives to QuickBooks, I said, you know what?

That sounds like fun.

So I’ve actually been doing my bookkeeping in multiple different systems this year so that I can accurately compare and contrast who those systems are best for and bring this type of content to you.

What Is the Difference Between QuickBooks and FreshBooks?

So first, let’s talk about what they are.

So I see QuickBooks as kind of like the Swiss Army knife of accounting software.

It’s powerful, fully featured. And customizable, but it can also sometimes be a little bit overwhelming, especially if you’re not super familiar with bookkeeping.

Now, FreshBooks on the other hand, I see as something that was really designed for simplicity. It’s really ideal for service providers, creatives, freelancers.

Who want something user-friendly, but that is still professional and meets their needs.

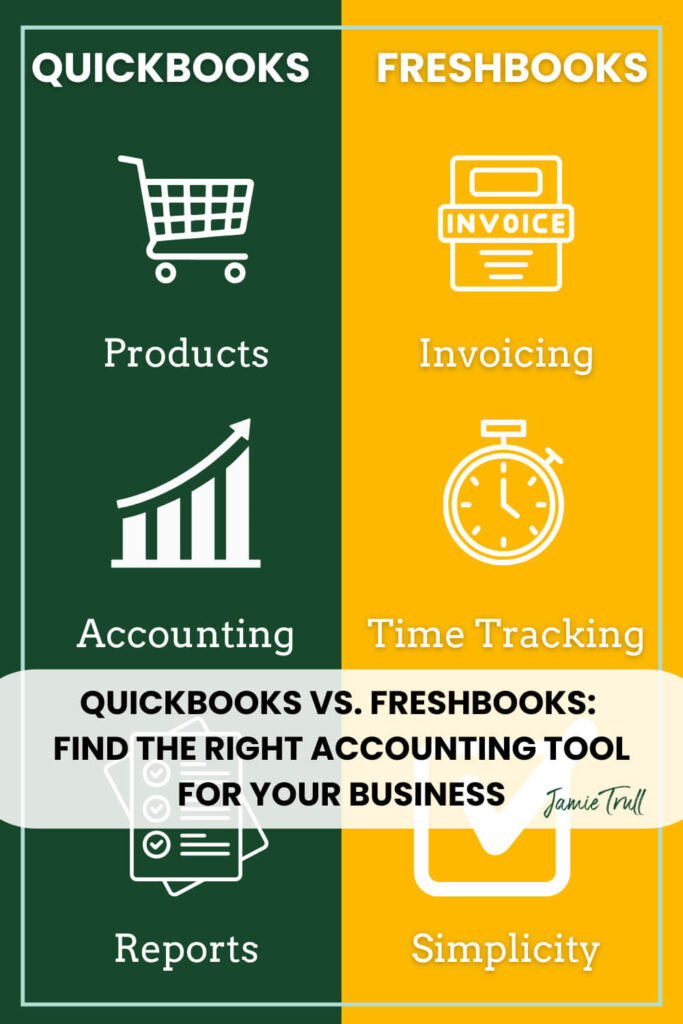

Accounting Tools and Daily Features Compared

Now let’s talk features and these are the things that you’re gonna be using on a daily basis.

And they really do differ between these accounting platforms.

Obviously both of these is going to be able to create your tax time reports, like a profit and loss, and track all of your income and expenses.

That’s kind of a given with accounting software, but accounting software these days does a lot more than just that, so you really wanna look at the features and figure out how they fit your needs.

Invoicing in FreshBooks vs QuickBooks

So in terms of features, let’s talk about. Invoicing. Both do have invoicing capabilities.

FreshBooks has really built their invoicing for service-based businesses, and I really love that they have simple, polished invoices and lots of automation options for reminders and things like that.

QuickBooks also has invoicing, but if you need invoicing for, say, product-based businesses, it is going to have more to support those of you who are selling physical products now.

Expense Tracking and Bank Reconciliation

Expense tracking and bank reconciliations.

I’d say both do this well.

Now QuickBooks is gonna offer a little bit more customization and more direct bank connections, but I would say that FreshBooks is actually quite a bit easier to learn.

And I’ve also found it to be way less error prone than QuickBooks.

Time Tracking for Independent Contractors and Creatives

And now time tracking. One thing I love is that this is built right into every level of FreshBooks, so you don’t have to be on a higher plan.

However, QuickBooks is going to require that you be on a higher plan or have a separate tool for time tracking and time tracking for projects in FreshBooks is actually built specifically for creatives and freelancers, making it really functional and easy to use.

The cool thing is that you can bill your time to a project and then add it to an invoice with just the click of a button, which I think is a super cool and useful feature because I liked them so much.

I actually did a deep dive into some of the invoicing and project tracking capabilities in FreshBooks.

So if you wanna see more behind the scenes and actually see me demo how that works, definitely go check out this video next.

Accounting Reports and FreshBooks Plans

Now let’s talk about reports.

Now both of them have robust reporting, although if you go with FreshBooks, I do recommend that you go with at least FreshBooks Plus in order to get full financial reports, including a balance sheet.

So in order to get that double entry bookkeeping, you will want to be on the plus version of FreshBooks or higher.

While FreshBooks light might be sufficient for really simple businesses or just getting started as you grow, you’re likely going to need more extensive reporting than what you can get in light.

And with QuickBooks Online, all of the different levels are going to come with all those general accounting and financial reports.

So there’s tons of different reports that you can run in QuickBooks.

User Experience: FreshBooks vs QuickBooks

So that’s features. And as you can see, they’re built for specific audiences.

So it really just depends on what you need.

Now let’s go to user experience. I would say FreshBooks is sleek and simple.

Well, QuickBooks is powerful, but with a learning curve. So think of it like this.

FreshBooks is like a shiny new iPhone?

Well, QuickBooks is more like a DSLR camera. Both are amazing and have great picture quality, but one of them is easier to just pick up and use.

While people often complain about the learning curve of QuickBooks, FreshBooks is a lot easier for the end user to get the hang of without having to do lots of trainings.

FreshBooks Pricing Compared to QuickBooks

Onto pricing, and this is an important one, FreshBooks is going to tend to be more affordable with similar features.

Like I said before, it includes things like time tracking or estimates in most plans and can really scale with you.

On the other hand, QuickBooks has been increasing its prices steadily over the years. In fact, I just got yet another notice that they’re going to be increasing their price this year.

Now, in my opinion, QuickBooks Plus is actually the best bang for your buck when you’re looking for features. But it does come at a higher price point than all of the FreshBooks plans.

Accountant Access and Choosing the Right Software

So what’s that one big mistake I see all the time?

Well, it’s choosing a software based on name recognition rather than how you actually run your specific business.

Now, if you’re a business that sells goods or products, if you’re well versed in accounting, or if you’re gonna be working with a bookkeeper who will be doing your accounting for you, then QuickBooks online may be a match for you.

Because of its popularity, it is number one in the marketplace right now.

In the US it is the easiest to find an accountant or bookkeeper who knows how to use QuickBooks.

However, I am finding that FreshBooks does have a growing number of bookkeepers and accountants who are familiar with it.

If you’d prefer to use an accountant who is certified in FreshBooks, FreshBooks can actually help connect you to one based on your needs.

Setting Up and Managing Your FreshBooks Account

And if you are going to be doing your own bookkeeping, then you wanna make sure to pick a system that’s going to work for you.

If you do choose down the line to outsource that later, more than likely you will be able to find a certified professional in any accounting software that you choose.

So all in all, it really depends on your business and what is most important to you.

But if you are a service-based business, a coach, a freelancer, a creative FreshBooks is actually built for you.

So again, just because QuickBooks is all over the place, make sure that you’re choosing based on what actually makes the most sense for your type of business.

How to Switch from QuickBooks to FreshBooks

Now if you are thinking, you know what, actually, I think FreshBooks may be a better choice for me, but I’m currently on QuickBooks and the idea of switching is really scary.

Then don’t worry. I got you.

I actually made a video of using my own books as an example of how to move from QuickBooks into FreshBooks and you can do it in under an hour.

So make sure to check that video out as well.

Final Thoughts on FreshBooks vs QuickBooks

Now, if you found this video helpful, please, please, please make sure to hit the like and the subscribe button so that you don’t miss out on any future videos.

I talk a lot about various tools and comparisons and tutorials, so definitely make sure you’re subscribed.

And I also happen to negotiate some of the best deals out there.

So if you decide you want to sign up for FreshBooks, for example, then definitely go check out jamietrull.com/freshbooks, where as of right now, you can get 90% off for four months.

Now that is limited time. It may change.

But go to that website and see what you can save on FreshBooks if you sign up with my link.

More Accounting Software Comparisons Beyond Freshbooks Quickbooks

Now, if you’re still deciding and you are a person that wants to analyze it a little bit more, before jumping into anything, you can go check out my comparison of multiple different accounting softwares over at jamie troll.com/accounting.

Or I even have a decision tree that walks through what might be best for you based on your specific situation.

Now let me know in the comments what system are you currently using for your accountant and are you currently considering switching?

And what questions do you have?

Thanks again for joining me, and I will see you next time.