We’ve got the Profit and Loss Statement Template Self Employed business owners find easy to use and implement.

After years of speaking with small business owners, we know that managing your finances as a self-employed entrepreneur can be overwhelming, especially if you’ve been procrastinating.

But with the right tools, you can get everything organized in less time than it takes for your Uber Eats delivery to arrive!

This guide will walk you through how to set up an easy profit and loss (P&L) statement, so you can monitor your business finances effectively, without needing expensive software.

Why You Need a Profit & Loss Statement (P&L)

A P&L statement helps you track income and expenses over time. While tax season is one reason to create it, your P&L should also be a tool for business insights, helping you spot trends, improve profitability, and make informed financial decisions throughout the year.

For entrepreneurs with simple business models, this solution is faster and more affordable than software like QuickBooks. Plus, having your finances organized will help you avoid missing deductible expenses when filing taxes.

How to Set Up Your P&L in Minutes

Step 1: Use a Customizable Template

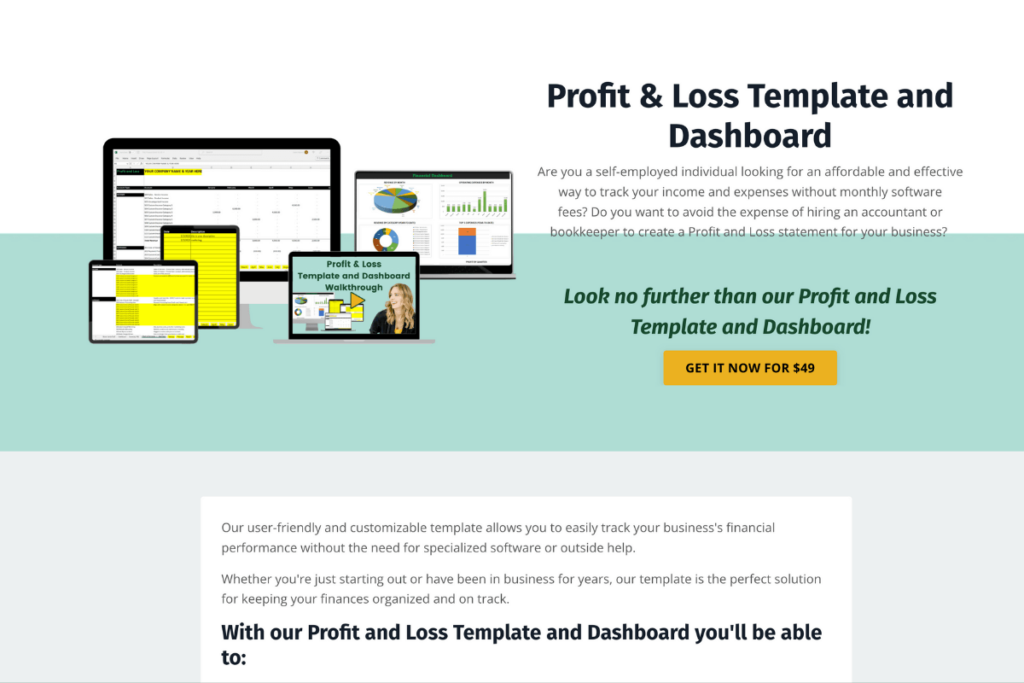

You can create your P&L statement manually in Google Sheets or Excel, but if you prefer a quicker solution, try Jamie Trull’s Profit & Loss Template and Dashboard. It offers pre-built formulas, reconciliation tools, and a dashboard to visualize your business insights—all for a low, one-time cost.

Step 2: Input Your Chart of Accounts

A chart of accounts helps categorize your income, direct costs, and operating expenses. Customize it to match your business model. For example:

- Income Sources: Product Sales, Freelance Services, Etsy Revenue

- Direct Costs: Materials, Vendor Payments

- Indirect Expenses: Utilities, Marketing, Software Subscriptions

Tip: Keep a numbering system for these categories to stay organized and simplify reconciliation.

Stop Guessing: Which Accounting Tool is Actually Right for You?

Inputting Monthly Transactions

Each month, input your transactions directly into the template. You can:

- Manually add transactions by typing descriptions and amounts.

- Upload a CSV file from your bank or credit card account to bulk-copy transactions, saving time.

Make sure to:

- Use positive numbers for income and negative numbers for expenses.

- Track where each transaction occurred (e.g., a specific bank or credit card account).

Reconcile Your Accounts for Accuracy

Reconciliation ensures your records match your bank and credit card statements. The template allows you to:

- Enter the starting balance of your accounts.

- Input monthly balances from your statements.

- Check for differences between your records and the actual bank balance.

This step ensures that no transactions are missed or double-counted, giving you confidence in your final numbers.

Use the P&L Dashboard for Business Insights

The real power of this template lies in its dashboard feature. It auto-generates charts to give you a snapshot of:

- Monthly income trends

- Top-selling products or services

- Major expenses

- Seasonality patterns (e.g., which months are most profitable)

This makes it easier to plan for the future, monitor cash flow, and strategize for growth.

Make Tax Time Easier

Keeping an updated P&L ensures you’ll have all the information ready for tax season. Accountants love clients who hand over organized records—and you’ll avoid missing out on deductions like:

- Home office expenses

- Business mileage

- Utilities shared between personal and business use

If tax time is approaching, use this tool to quickly get your P&L in shape. You’ll be ready to file taxes accurately, without scrambling at the last minute.

Final Thoughts: Simple Yet Powerful Financial Tracking

Whether you’re just starting out or want to move away from costly software, this easy P&L template is perfect for self-employed entrepreneurs with straightforward needs. It not only helps during tax season but also provides critical insights to grow your business.

Ready to simplify your finances?

- Grab the Profit & Loss Template and Dashboard now!

- Watch this in-depth video walkthrough for step-by-step instructions: Easy Profit and Loss Statement for Self-Employed

With this tool, you’ll stay on top of your finances and make better business decisions all year round!

Watch the full video Easy Profit and Loss Statement for Self-Employed

The following is a modified transcript formatted for readability. Formatting adjustments have been made for clarity. Please note that any spoken errors, filler words, or conversational quirks may occur.

If you’re self-employed and you typically put off organizing your finances because you’re worried it’s going to take you forever, then you’re in the right place! Today, we’re going to talk about how to get your finances organized in less time than it’ll take for your Uber Eats delivery to arrive.

I’m Jamie Trull, CPA and financial literacy coach for entrepreneurs. Today, we’re diving into something I’m super passionate about your profit and loss statement—and more importantly, how to get organized fast.

If you’re someone who has put off bookkeeping or getting everything in order because it seems overwhelming, don’t worry. I’ve got a system that can have you organized in less than an afternoon.

Who Should Use This System?

This approach works best for:

- Self-employed entrepreneurs

- Simple business models without complex needs

- Those who don’t need the bells and whistles (or monthly fees) of bookkeeping software like QuickBooks Online

If you just want something professional, easy to manage, and more useful than a simple list of expenses in Google Sheets, this is the right solution for you.

Step 1: Use a Template to Create Your P&L

You can design your own spreadsheet if you’re savvy with Excel or Google Sheets, but if you prefer something ready to go, you can grab my Profit & Loss Template and Dashboard. It’s a one-time purchase—no ongoing subscription—and it provides everything you need to track income, expenses, and profitability easily.

Step 2: Input Your Financial Data

The goal is to generate a clear profit and loss statement with just a few inputs. Here’s what the template offers:

- Monthly tracking: Easily input income and expenses for each month.

- Account reconciliation: Compare your bank accounts and credit card statements directly within the template.

- Dashboard insights: Visualize your business performance through automatic graphs and reports.

Once you’ve entered your data, the system will automatically calculate your profit or loss—giving you a snapshot of where your business stands.

Customize Your Chart of Accounts

Every business is unique, so it’s crucial to customize your P&L categories.

- Income: Track multiple revenue streams, like product sales, freelance work, or platform-specific income (e.g., Etsy).

- Cost of Goods Sold (COGS): These are direct costs tied to what you sell.

- Operating Expenses: These cover the indirect costs of running your business, such as software subscriptions, advertising, or insurance.

Pro tip: Keeping a numbering system helps everything stay organized.

Entering Monthly Transactions

Each monthly tab in the template can hold up to 500 transactions. You can enter these manually or:

- Download a CSV file from your bank or credit card.

- Copy and paste transactions directly into the sheet.

Make sure incoming money is recorded as positive and expenses as negative—otherwise, your P&L won’t make sense.

Bank and Credit Card Reconciliation

One of the perks of using software like QuickBooks is reconciliation. But with this template, you can reconcile right inside your spreadsheet! Just:

- Input your opening balances for each bank or credit card account.

- Enter your ending balances from the latest statement.

- Check the differences column to identify any discrepancies.

Pro tip: If a personal transaction accidentally runs through a business account, categorize it as “Owner Pay” to avoid confusion.

Using the Dashboard for Business Insights

Beyond tax preparation, your P&L should help you make business decisions. This template provides an easy-to-read dashboard that displays:

- Monthly income trends

- Top expenses

- Profitability by quarter

- Revenue by category (to see what’s selling best)

This visual data will help you plan for seasonal fluctuations, identify key income streams, and track expenses that may be eating into your profits.

Real-World Example: Jan’s Jewelry and More

To demonstrate the power of this template, I’ve entered sample data from a fictional jewelry business called “Jan’s Jewelry and More.” By reviewing her monthly trends, Jan discovered which months were profitable and which required better cash management. Her dashboard insights helped her plan promotions and reduce expenses in low-income months.

Summary: Why This System Works for Entrepreneurs

This easy P&L system is ideal for self-employed entrepreneurs and small business owners with simple operations. It helps you:

- Stay on top of finances without paying for expensive software

- Avoid missing deductions by staying organized year-round

- Make smarter business decisions using visual data from the dashboard

Whether you’re just starting or looking to simplify your bookkeeping, this template offers everything you need to manage your finances efficiently.

Grab the Template Today

If this sounds like the solution you need, grab the Profit & Loss Template and Dashboard today!

Need more guidance? Watch the full tutorial video here:

Easy Profit and Loss Statement for Self-Employed

Stay ahead of your finances and run your business like a pro. Thanks for joining me—don’t forget to like and subscribe for more financial tips! See you next time.