In today’s fast-paced entrepreneurial world Quickbooks Solopreneur has emerged as a competitive option for small business owners, freelancers, and side hustlers to stay on top of their finances.

Without the right accounting tools, managing expenses, tracking income, and preparing for tax season can feel overwhelming.

This is where QuickBooks Solopreneur comes in—replacing QuickBooks Self-Employed and offering a more modern solution for independent professionals.

But is QuickBooks Solopreneur the right fit for you? In this guide, we’ll explore the product’s features, its benefits, and potential limitations.

Whether you’re a solopreneur, freelancer, or small business owner, this blog will help you decide if QuickBooks Solopreneur is the ideal tool for your business—or if you’d be better off with other options like QuickBooks Online or more cost-effective alternatives such as my Profit & Loss Template.

Before making a decision, be sure to explore all your accounting software options at jamietrull.com/accounting, where you can compare QuickBooks with other platforms to find the best fit for your business needs.

Stop Guessing: Which Accounting Tool is Actually Right for You? 👇

QuickBooks Self-Employed: A Legacy Product

For years, QuickBooks Self-Employed was the go-to solution for freelancers and solopreneurs who needed simple bookkeeping software.

However, as the market evolved and small business needs grew more complex, QuickBooks Self-Employed began to show its limitations.

It lacked certain features like double-entry bookkeeping, a balance sheet, and robust reporting capabilities—critical for businesses that are scaling or managing more complex finances.

QuickBooks Solopreneur was introduced as a response to these growing needs, offering improvements over the older Self-Employed version while aiming to cater to modern-day solopreneurs.

If you’re wondering whether QuickBooks Solopreneur is right for your business, you can compare it with other accounting software options at jamietrull.com/accounting to make an informed choice.

What is QuickBooks Solopreneur?

QuickBooks Solopreneur is the replacement for QuickBooks Self-Employed, tailored for independent professionals who need a simplified, yet powerful solution to manage their business finances. With improved features such as double-entry bookkeeping, in-person payment capabilities, and enhanced sales tax tracking, QuickBooks Solopreneur aims to fill some of the gaps left by its predecessor.

However, while Solopreneur offers more advanced features than Self-Employed, it still lacks key elements necessary for more complex business models, like balance sheet capabilities and full report customization.

To see if this software fits your needs, check out the full comparison of QuickBooks Solopreneur with other options on my accounting comparison page.

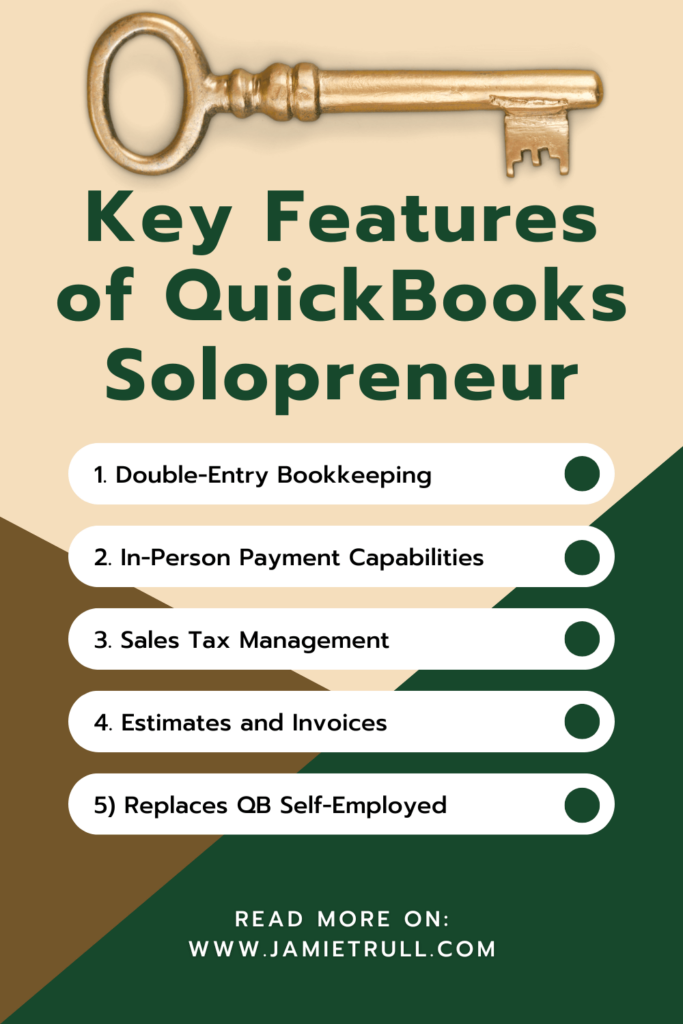

Key Features of QuickBooks Solopreneur

QuickBooks Solopreneur brings several new features to the table that make it an attractive option for small business owners, freelancers, and side hustlers. Here’s a breakdown of its key features:

1. Double-Entry Bookkeeping

One of the biggest upgrades from Self-Employed is the introduction of double-entry bookkeeping. This is a more accurate method of accounting that ensures all transactions are recorded in two places, making it easier to catch errors and maintain organized financial records.

While this is a crucial improvement, the lack of a balance sheet means that businesses relying on tracking assets, liabilities, and equity won’t fully benefit from this feature.

If you need a solution with full balance sheet and reporting capabilities, you may want to consider QuickBooks Online or explore other platforms on jamietrull.com/accounting.

2. In-Person Payment Capabilities

For solopreneurs who receive payments directly from clients, QuickBooks Solopreneur now offers in-person payment options. Using a QR code system, users can quickly collect payments from clients without needing a separate payment processor.

If your business is growing and you want to evaluate other options, check out the accounting software comparison on my site to explore platforms that can scale with you.

3. Sales Tax Management

QuickBooks Solopreneur introduces sales tax tracking, allowing solopreneurs to calculate, collect, and report sales tax on transactions. This is particularly useful for small product-based businesses.

However, for those managing larger inventories or selling in multiple jurisdictions, more robust sales tax management may be required. Be sure to compare your options at jamietrull.com/accounting.

4. Estimates and Invoices

QuickBooks Solopreneur allows users to send estimates alongside invoices. This feature is great for contractors or service providers who need to provide job estimates before securing a contract.

Missing Features in QuickBooks Solopreneur: A Dealbreaker?

While QuickBooks Solopreneur introduces some positive features, there are still critical elements missing that may make it unsuitable for some small business owners:

1. No Balance Sheet

Despite the double-entry bookkeeping feature, QuickBooks Solopreneur does not generate a balance sheet. Without this, solopreneurs can’t track assets, liabilities, or equity, which is essential for businesses managing loans or purchasing equipment.

For a more complete financial picture, explore QuickBooks Online or other platforms at jamietrull.com/accounting.

2. Limited Customization

Customization in QuickBooks Solopreneur is limited. The platform pre-selects your chart of accounts based on your business type, but you won’t have the flexibility to add or adjust accounts as needed.

If you require more control over your financial data, consider my Profit & Loss Template for a customizable and cost-effective alternative.

3. No Receipt Capture

In QuickBooks Self-Employed, users could easily snap photos of receipts and upload them into the platform. Unfortunately, this feature is absent in QuickBooks Solopreneur, making it harder to stay organized.

For more powerful tools or alternative options, compare platforms at jamietrull.com/accounting.

4. No Tags

Tags, which allowed users to categorize income and expenses more flexibly, have also been removed in QuickBooks Solopreneur.

Comparing QuickBooks Solopreneur with QuickBooks Online

If QuickBooks Solopreneur seems too limited, consider upgrading to QuickBooks Online. Here’s a breakdown of some key alternatives:

1. Quickbooks Online Simple Start

For businesses that need more features, Simple Start includes balance sheet capabilities and better customization options.

2. Essentials

Essentials adds payroll management and time tracking, making it ideal for businesses with employees or contractors.

3. Plus

QuickBooks Online Plus offers inventory management, project tracking, and advanced reporting features. This tier is perfect for businesses planning to scale.

Compare these options and others at jamietrull.com/accounting.

Alternatives to QuickBooks Solopreneur: A More Affordable Option?

If QuickBooks Solopreneur seems expensive or limiting, you might consider my Profit & Loss Template. It’s a one-time purchase that offers greater flexibility and customization without the ongoing monthly costs.

For solopreneurs with simple business models, this is an excellent alternative to subscription-based software.

Final Verdict: Is QuickBooks Solopreneur Right for You?

QuickBooks Solopreneur fills an important gap for solopreneurs, freelancers, and side hustlers who need to track basic income and expenses. However, its missing features—such as the lack of a balance sheet, limited customization, and the absence of receipt capture—may make it unsuitable for businesses with more advanced needs.

For those planning to grow or needing more detailed financial reporting, QuickBooks Online or a more customizable solution like my Profit & Loss Template might be better options.

Before making your decision, be sure to compare all your accounting software options at jamietrull.com/accounting.

Affiliate Disclosure: Jamie Trull is a QuickBooks affiliate and may receive a commission if you choose to purchase through the links provided. Jamie personally uses and loves Quickbooks Online for her own business and would not recommend anyone who she has not fully vetted and tested herself.

This transcript is provided in its original format. Any errors or inconsistencies in grammar or wording are part of the natural conversation and should be excused as such.

QuickBooks Solopreneur vs. Self Employed: Which Is Right for You?

QuickBooks Self Employed is no longer. So what have they replaced it with? The answer is QuickBooks Solopreneur.

But what is this version all about and is it right for you?

In this video, I’m going to be breaking down all the differences between the old Self Employed version and this new Solopreneur version so you can decide if it is the right thing for you.

If you’re new to this channel, hi, I’m Jamie Trull, CPA and profit strategist.

On this channel, we’re talking all things small business finances, including the tools and resources you need to run a healthy and profitable small business, so please make sure to subscribe.

QuickBooks Self Employed vs. QuickBooks Solopreneur—What’s Changing?

Now, if you’re already on QuickBooks Self Employed, you get to keep your subscription.

This is not an automatic changeover to QuickBooks Solopreneur, at least not right now.

So Self Employed does still exist for those who are already on a subscription. But for anybody new signing up, the only option you’re going to have now is either one of the QuickBooks Online products, which I talk about in other videos, or you’re going to be able to choose QuickBooks Solopreneur.

Now, if you’ve watched any of my previous QuickBooks videos, you probably know that QuickBooks Self Employed has not been my favorite QuickBooks product.

I highly recommend QuickBooks Online, and I have some special discount codes on my accounting page if you want to jump into QuickBooks Online.

But has QuickBooks Solopreneur changed my opinion? Let’s jump into it.

Key Features of QuickBooks Solopreneur

I scoured the internet to figure out what the differences were between these two versions.

Honestly, the information available wasn’t super helpful—it just says that Solopreneur is built on the success of Self Employed.

It offers easier setup, improved transaction management, and added flexibility.

That all sounds great, but it’s a little vague. So, I dug deeper to find a full feature comparison between the two, which also included Simple Start, the lowest version of QuickBooks Online.

I won’t bore you by going through every single difference, but I will tell you about some key differences between Self Employed and Solopreneur—some good, and some not so great.

Double-Entry Bookkeeping—A Big Step Forward?

One thing that caught my eye is the claim that Solopreneur uses double-entry bookkeeping. This is a huge improvement over Self Employed, which did not offer true bookkeeping.

However, here’s the kicker: even though they use double-entry bookkeeping, there is still no balance sheet.

That’s right, no balance sheet!

If you’re going to have double-entry bookkeeping, you need a balance sheet to get the full picture of your finances.

This is a major drawback, especially for those who have assets or debts that they need to track. If you need a balance sheet, Solopreneur is not for you.

You’ll want to stick with QuickBooks Online instead.

New Features That Are a Win

There are some new features in Solopreneur that I really like.

You can now accept in-person payments through the app using a QR code, which is great for side hustlers and small businesses.

There’s also new sales tax capability, which is essential if you’re selling products in person and need to collect and remit sales tax.

Plus, you can now send estimates to your clients, which is a nice feature that Self Employed didn’t offer.

A Few Downsides to Keep in Mind

But with every good change, there are also some downsides.

One major loss from Self Employed to Solopreneur is the removal of receipt capture.

This feature was incredibly popular and allowed users to attach receipts to their transactions for easy record keeping.

If you want receipt capture, you’ll need to use QuickBooks Online instead.

Another missing feature is tags. Tags help you organize your income and expenses, and they were available in Self Employed but are no longer part of Solopreneur.

Lastly, Solopreneur is still extremely limited in terms of customization.

You can’t really customize your chart of accounts or run detailed reports.

For those who need more flexibility or plan to grow their business, I wouldn’t recommend Solopreneur.

You’re better off starting with a more customizable platform like QuickBooks Online, which you can find on my accounting page.

Is QuickBooks Solopreneur the Right Fit for You?

Overall, QuickBooks Solopreneur has its place, but it’s really geared towards side hustlers, 1099 contractors, and very simple business models with no employees.

If that sounds like you, Solopreneur might be a good option.

But if you plan on growing your business, you should consider QuickBooks Online, which offers more flexibility, scalability, and customization.

Alternative to QuickBooks Solopreneur—My Profit & Loss Template

If you’re a solopreneur and you find that QuickBooks Solopreneur still seems like an overcomplicated or costly option for you, consider my Profit & Loss Template.

It’s a much simpler, cost-effective tool that allows for more customization than Solopreneur and eliminates the monthly subscription fees. You pay once and can use it for years to come!

For more information on the best accounting software options, visit my accounting page. There, you can compare software platforms and find the best solution for your business.

We’ve got more accounting tips you might like: