Financial Fitness Formula™ (FFF) is a comprehensive program designed to empower solopreneurs and small business owners like Crystal Waddell.

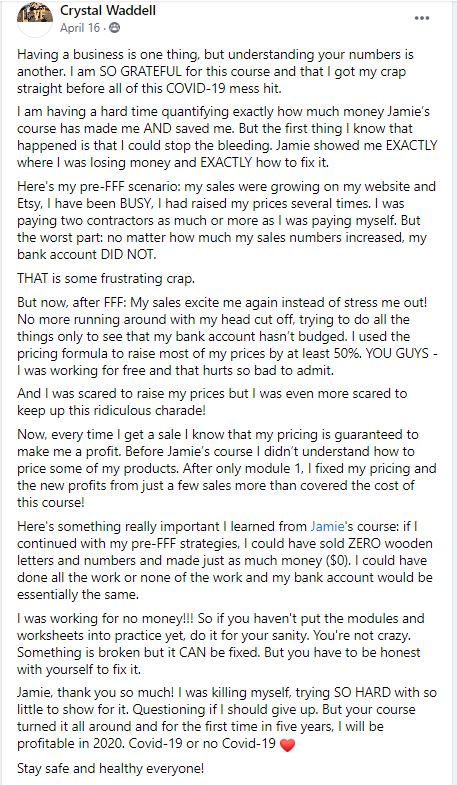

The success story of entrepreneur Crystal Waddell started when she experienced a profound transformation through FFF.

Crystal, founder of Collage and Wood, turned her business from a struggling venture into a profitable and fulfilling enterprise.

Background of a Humble Beginning

Before FFF, Crystal’s business, specializing in handmade giant wooden letters and photo collages.

She was making sales but not profits.

Despite the growing business, her bank account remained stagnant.

She was unable to pay herself, leading to frustration and a search for solutions.

Discovery and Decision to Join Financial Fitness Formula™ with Jamie Trull:

Crystal discovered FFF through Jamie Trull and was drawn to its promise of financial clarity and profitability.

Initially, she thought it was a different course.

Crystal soon realized FFF was precisely what she needed in her entrepreneurial journey.

Initial Expectations and Transformational Insights:

Crystal expected FFF to guide her in setting up business finances and understanding profit margins.

However, the program exceeded her expectations.

Financial Fitness Formula™ provided her with tools and insights that were transformative.

A significant moment was when she used a unique spreadsheet from Jamie to adjust her pricing strategy.

In that moment, she realized that she had been working for free for five years.

Overcoming Limiting Beliefs in the Business World:

Financial Fitness Formula™ helped Crystal overcome her fear of raising prices.

She learned the importance of valuing her time and effort, leading to strategic price adjustments across her product offerings.

Result and Impact:

The results were immediate and significant.

Crystal’s sales increased, and she started making profits, allowing her to quit her teaching job and pay herself a salary.

She felt empowered and fulfilled, seeing the tangible rewards of her hard work.

Expansion and Sustainable Growth:

Crystal gained a deeper understanding of business finances, learning about strategic reinvestment and balanced spending.

This knowledge helped her make data-driven decisions and set personalized financial goals, ensuring long-term sustainability.

Navigating Challenges in Her Entrepreneurial Ventures:

Equipped with the skills and knowledge from FFF, Crystal was better prepared to handle challenges like the COVID-19 pandemic.

Her focus on profitability and sound financial planning enabled her business to adapt and thrive.

Conclusion:

Crystal’s journey with Financial Fitness Formula™ is a testament to the program’s ability to transform businesses.

By gaining a better understanding of pricing, profit margins, and sustainable growth, Crystal turned her passion into a profitable venture.

Her experience highlights the value of FFF in empowering entrepreneurs to achieve financial success and work-life balance.

Testimonial for the Results in Her Own Business:

“FFF was the best investment I ever made for my business. Jamie’s formulas, guidance, and genuine care have made all the difference. I’m excited for the future as I continue to apply the lessons from FFF.” – Crystal Waddell, Handmade Artist and Maker

Learn More From Other Successful Entrepreneurs:

Discover more about Financial Fitness Formula™ and join the waitlist for exclusive offers and updates on our next enrollment.

Video Transcript, Inspiring Stories of Business Success: Jamie Trull and FFF Alumni Crystal Waddell:

This transcript has not been edited or reviewed for accuracy and may contain errors or discrepancies from the original spoken content.

The transcript is offered for informational purposes only and should not be considered a definitive record of the event. We do not guarantee the accuracy, completeness, or reliability of the information provided in this transcript. Any reliance you place on such information is therefore strictly at your own risk. All current Financial Fitness Formula™ timelines and offers can be found at jamietrull.com/fff .

I’m like, I know. Hi, everybody. Jamie here. Hope everybody’s doing well, you guys. I have another special guest today, so this is another kind of off time pop-up time. So while you guys join, I’m just gonna say the normal things that I always say today is what I don’t even know, it’s Thursday, January 21st.

I finally kind of have my days, it felt like Friday when I woke up. I don’t know. It’s Thursday, January 21st. I’m Jamie Trull. I am live currently right now in my Facebook group, financial Literacy for Women Business Owners. Come on over and join us. If you’re not there, I’m on my business page and we’re live on YouTube as well.

So wherever you’re joining from, say hi. Say hey, tell us where you are watching us from as you join. So I see some people joining, so that’s great. So tell, also, tell me that you can hear me because I’m always worried that I can hear you, if that matters. Yeah, we can just talk. It’s fine if nobody else can hear us.

So today we’re doing something a little bit different. Today we’re gonna be talking about my Financial Fitness Formula™ program, which you guys closes today. Today is the last day to get into the program. So I wanna make sure that everybody knows today’s the last day. So if you’ve been thinking about it, if you’ve been on the fence, I want you here and I want you guys to come ask me any questions that you have and I’ll take any questions toward,

toward the end. So, yes, it’s 1 1 21 21, Christina. Yes. That I do like that. The numbers person in me. Really, really, that makes me happy. So, Financial Fitness Formula™ is my program to take complete control of your business finances. If you are a solopreneur, if you are a small business owner, and you wanna get your head around kind of the strategic and cash management sides of your business.

So what I mean by that is really being able to put your CFO hat on, like confidently, act as your own CFO, know your profit margins. Know what price you should be charging for your products or services. Knowing what you have to spend, right? Like how much money you have to spend in order to still be able to pay yourself what you wanna pay yourself and grow your business in the way that you wanna grow your business.

So those are all the things that we do. All these people right here have signed up for this round of FFF, and we are super, super excited to have them. So Crystal is here joining me. I don’t know if anybody saw a couple of days ago, I had Ashley on, so Ashley was here. She was a Financial Fitness Formula™ founding member as well. So is Crystal. And I think Crystal, you’re like the original. Yeah, I’m the og. I just wanna make sure the number one of all time, I’ll always remember, because the first time I sold a digital course, right? I put it out into the world and you know, any, anybody, anybody here,

let me know. If you’re a digital course creator and feel this, but you just wait really, probably any, any, any business. You’re in that first, you’re like, is anyone gonna buy it? Right? Like I’ve put, I poured my heart and soul. Is anyone gonna buy this thing? And then literally, I mean, it was less than five minutes that we had the,

the cart open. Crystal buys the buys the cart, and I was like, okay, people are gonna buy this. So I will always, always remember it’s kinda like the first dollar you earn. Like it, I don’t know how you do that with digital dollars, but if I could, I would. Yeah, I’ll send A picture of your face. Framed on my wall.

I can probably send you a picture of me. Yeah.

I’ll take one and I’ll put it on my wall. Well, of fame. Yeah. So I wanted to get Crystal on here for anybody who’s thinking about FFF to tell her story. ’cause Crystal Story is one of my favorite stories. I just love it and I love just chatting and hearing,

hearing all about you, crystal, and what you do. So first of all, I’m gonna, I’m gonna pass it over to you, crystal, and I’m gonna ask you to give us just a little bit of a background on yourself and your business. Okay. Well, my name’s Crystal Waddell. I own a handmade business called Collage and Wood, where I make giant wooden letters,

numbers, names, giant photo props, and mainly photo collages for athletes. So when I met Jamie, my photo collages and everything, they were selling pretty well. I had a, I had a good price point on those. I didn’t know why I was making money with those, but I knew I was making money with those. But after a couple of years,

I was watching my sales grow up, go up, my revenues go up, and I was watching my bank account stay the same. And every month I was paying other people to help me and I couldn’t even pay myself. It was like, what in the world? You know? So there’s nothing more frustrating than working your butt off and then sending money out to other people and not even giving it to yourself.

So when Jamie had mentioned she was, you know, launching this course, I was like, absolutely, I need that. And I thought it was something different. I thought it was like, how to set up your business finances, you know? And I don’t know why I thought I needed that then. Yeah. And I probably still need it,

whatever. And I got that one too. So, but I remember emailing you or sending you a message and just saying, Hey, is this gonna be in the course? And you’re kind of like, no, it’s actually like this.

I’m like, well, I bought it anyway, so I’m excited. And it just changed my life because day one,

I think I found out why I wasn’t profitable, and it was the most painful thing in the world. And I’m not kidding. I think I cried. I think I cried. You felt That’s what you said. I was like crying and in shame, you know, because I realized, and I don’t know if I’m going too far ahead, but I realize in the first like five seconds of Jamie’s course why I wasn’t profitable.

And I realized I could sell like hundreds of thousands of numbers at the price that I was selling them at. Or I could sell zero and I would make the same amount of money. Yeah. Oh my Gosh. I, I love that part of your story, crystal, because I think that it is the case for a lot of business owners where they feel like I’m putting in so much effort and work,right?

I’m doing all of these things and I’m selling, I’m, I’m making, people are buying the thing I have to sell. Yeah. And I’m working so dang hard and I’m growing my top line, like I’m growing my revenue, but like, what is going on? Why can I still not take money outta my business to really like, pay myself and use it in my personal life?

And you get to that point of like, is this worth it? Like, is all the work I’m putting in, would I be better off like going down and getting, you know, down the street at like, the market, like what, why, why am I putting all of this effort into it? And oftentimes it’s something that we love and so we hold onto it and we’re like,

no, but I love doing it and I wanna do it. But absolutely. And I think that that your story, you know, is, is something a lot of people really do deal with. And I love your story too, that you’re like, I didn’t even know what I was really getting. I just wanted the thing that you were selling.

Like that’s my favorite, that you were just like, well, I mean, you bought in five minutes, so you couldn’t have read the entire sales. Well, I don’t, I don’t remember how I felt when you talked, but I was just like, this girl knows what I’m going through. Yeah. You know, and I was like, there was just something about what you talked about,

just like understanding like what your profit margins were or whatever. And I thought, you know what? I need some help with that. Because here’s the thing, I wanted to run Facebook ads, but I had at least enough intelligence to know that even if my Facebook ads were successful, it was gonna scale what I was doing. Yes. And what I was doing was not right,

something was wrong. So I was like, okay, maybe Jamie can help me fix this problem so that I could scale and not like kill myself. Because I was like, Ooh, something’s not right. And, And I think that that’s the thing, like the scaling piece, right? Is where we get to, right? Where you’re like, okay,

I wanna scale this business, but if I scale this at this level, you know, it, it’s not really gonna get me where I want to go. And so that’s why I think a lot of times doing this work, before we put all this effort into scaling a business, you wanna scale a healthy business, right? Yes. When you scale a healthy business,

that is the dream. That’s the dream. When you scaling not financially fit business, it’s just gonna mean you’re working even harder and still not seeing massive success, that like come to fruition. So I think we always, we chase the top line, we’re like, oh, I just need more revenue. I just need more customers, right? I need more clients.

When you chase clients and you don’t have a healthy business set up from your a profit margin perspective, from what you’re spending money on, from how you’re investing in, into your business, right? Then it’s not gonna be successful when you scale it, more revenue’s not gonna help you. It’s just gonna burn you out. Right? Oh, I know.

Yeah. Oh, I know girl. I know. So tell me how it was.

You went through, we have a module specifically on pricing. So what Crystal’s talking about is, I have a module where you work through your profit margins on your different products or services. And I have a spreadsheet where basically it tells you like,

you’re, you’re priced well or you’re not. Right? And so I think that’s probably where you saw, okay, here I have an issue here, right? I have something that I need to fix. Well, I’ll say that you had me at spreadsheet because I love spreadsheets, you know, so I was like, oh, there’s a spreadsheet somewhere.

But there was, there was one part in particular that really grabbed my attention because earlier in the year, probably one a month or eight weeks prior to hearing about your course, I had heard someone talk about raising your prices. So the sad thing is, I am still so ashamed, so ashamed, guys. Okay. No shame. No. Okay.

I had already like raised my prices, you know, so as much as I wasn’t making money by the time I took your class and took your course, I had already raised my prices. So I’m like, how much money was I losing? You know? At least I had raised my prices to the point I was breaking even. But you had an exercise where,

you know, you talked about like, you could sell so many at this price and so many at a higher price, and so many at an even higher price. And you know, even though you sold less, you would still make as much or more. And when I worked through that, that’s when I had the epiphany that, oh my gosh,

I could sell zero and make what I’m making right now. If I raise my prices to this, I can, you know? So it gave me like this visual representation of the changes that I needed to make. And it was powerful. Like, I’m not saying I stayed up all night and changed my prices and I had this, this was in my Etsy shop and my website.

So I was up until probably three 30 in the morning changing every single listing, which was like 300 listings Yeah. With Etsy and everything in my website. And I was like, dang it, if I don’t sell another wooden number the rest of my life, hey, at least I have more time with my son. You know? Yes. Yes.

I love that so much. Yeah. So that I, that is why I think sometimes we think, okay, but if, if I raise my prices, nobody’s gonna buy. Right? And, and that’s the fear we have. Like, oh, we’re gonna price ourselves out. And I do talk about, right, it’s not all about just raising prices,

it’s about determining are your prices correct to begin with? Then if not, what can you do? And there’s various different things that you can do. I walk through you that through that with you in the program of like, here are your options if you’re not at healthy profit margins. Right? Right. And also, how do I raise my prices in a way that is still going to be able to,

you know, sell. Right? Because if you price yourself completely out and nobody buys, it’s a problem. When you raised your prices, what happened? Crystal, did people buy, Well, this is what’s so funny, because I think part of your advice is like, maybe you should, you know, increase your prices over time. But I was like,

oh heck no, I’m not working for free anymore. You know? So again, I was like, look, if I don’t sell anything, so what, I doubled my prices overnight on basically everything. Like even my collage prices were, I went up, you know, a certain percentage or whatever, and my sales, my sales went up, you know,

they went up on everything. And the other thing is, the first time I got a sale, and I knew like, am I gonna cry right now? That’d be ridiculous. Okay. But the first time I, yeah, I do It all the time. I do it all the time. If I don’t cry, if I go a month without crying on a Facebook Live,

I’m actually a win. Yeah. Well, I need to cry more. That’s part of like my goals for 2021. But when that first sale came through at the, the margin that I knew I was actually making a profit, it was the first sale I’d had in five or six years of being in business where I knew for sure I had made a profit.

Yay. You’re Breaking my streak. Yeah. Yeah. I mean, it’s powerful stuff. And I’ll tell you like, I’m really proud of myself that like, I truly wasn’t in it for the money, you know what I mean? Like, I love my business, I love helping people, I love celebrating people and being in on their celebrations, but it was getting to the point of like,

look, this is, you know, really interfering with my ability to do other things in my life, and I need there to be an incentive, you know, of profit in here. So when I, oh yeah, somebody said something about Etsy sellers, I think they’re right. But I just, I realized that, oh my gosh, you know,

like, I don’t have to worry about losing money anymore. Jamie gave me this Formula, I plugged my numbers in and I loved when people sent me stuff for custom work because I was always like, oh, maybe I’ll just charge, you know, five or $10 extra or whatever. But I plugged it into the Formula you had. And it also took away that like,

emotional thing that I had of like, I hope I don’t offend them with my price, you know, or whatever. Because, and I’ve had pri I’ve had people who’ve asked me for custom work since then that I put it in the calculator and I tell ’em what the price is and they’re kind of like, no, that’s not what I’m looking for.

And I’m like, Hey, I’m great with that because I don’t wanna volunteer. So I appreciate, you know, that it’s upfront and it’s just a, it’s, it’s an objective way to look at it and know that I’m making money and I’m still being of great service to the people who need what I have. So I love all of this so much.

Like I just love that. I just, the idea of that’s what I’m worth. Like that’s what my product is worth objectively. Right, right. Like, we’re always like, charge what you’re worth. What the heck does that mean, you know? Yeah. But it gives you an objective way to value what you’re worth. And I think a lot of people who do,

who are doing the work themselves, right? Like this happens to handmade sellers all the time. Yeah. Where you’re doing the work yourself or any kind of service business really where you’re, you know, involved. We often don’t, don’t really value the time that we’re putting in. And the problem is when you don’t do that, if you grow enough,

right? We go back to the scaling problem. If you grow enough and you get so many sales that you hire someone, well now you’re paying them more than you’re paying you. And you’re like, hang on, this doesn’t make any dang sense. And now I’m not making anything worst. It’s The worst. The worst. It’s the worst. And it’s so much easier when you have an objective way to say,

no, this is, this is, this is the Formula that I use in order to figure out what in the world I need to charge. And yeah, then, and like you said, if they don’t, if they say no, you’re like, okay, that’s then I don’t have to put in work for something that’s not gonna make me any money.

Right. And to your point on, I think we all are, that place where it’s, it’s not, is it all about profit? No, it’s not all about profit. Is is a for-profit business somewhat about profit? Yes. Because if you don’t make profit, you’re giving your time and your energy, right? Like you’re giving your time and your,

that’s taking away from, like you said, time to spend with your son. I get that 120% right? If I’m going to be spending time doing something, I want there to be some kind of a return on it that it makes sense for my family, for me to be spending the time on that thing. Yes. Do I love impacting people?

100%. Would I do it completely for free, giving away the amount of time that I do? No, I wouldn’t because I value my time. I can’t. Right. It’s not sustainable. I wouldn’t be married if that was the route that I took. Right. Well, so Can I add one more thing about that? Okay. So when I raised my prices,

particularly on these photo props, I make these giant 2021 photo props. I should have grabbed one and just brought it over here. But anyway, sometimes I have photographers who buy year after year. I’ve been selling ’em from 2000 or since 2017. So this one photographer that bought the 2019 last year, she emailed me this year before she bought the 2020.

She’s like, I just wanted to check and make sure that I was reading this right because like last year I paid 50 and this year it’s a hundred. And I was like, oh yeah girl. I wasn’t making any money, I just told her the truth. I was like, I can’t give these things away, you know.

I’m shipping ’em across the world. So, and she was like, okay. You know, I mean she knew. Yeah. Like these people knew. They were like when they got ’em, I mean, they’re so awesome and big. Oh, you wanna see one? I’ll grab one. Hold on just a second. So big people are like,

yeah, we totally knew that you were undercharging, but if you’re gonna give it away, we’re gonna take it. You know? Exactly. So Exactly. Your best seller will be the one that you don’t charge any money for because everyone’s like, how the heck, okay, I’m gonna get it on this deal. Right? So that’s what we tend to do.

Yeah. Alright. I love those so much you guys. I know we need to like, we need more room. Yeah, I love those. Were great for photo props. I need to, I need to order myself one of those for some reason. Fun. You know, they’re super fun. So anyway, I just want to just encourage anybody out there who is struggling with,

you know, growing their business and raising their prices to do it. You have to, you have to make that choice, you know? And that was the choice I made that day. Jamie, I mean, I’m in tears and I was like, this might be the day I lose my business. You know, this might be the day that it’s over.

And I realized I never had a business, I had a hobby that I loved and, you know, people enjoyed working with me, but it wasn’t a business. Yeah. So, And I think that that’s the case for so many people like the hobby thing, right? Because the point, right? If we’re, if you’re a business,

I’m gonna talk specifically from I r Ss perspective ’cause I’m a nerd accountant, but a business where you claim your expenses and you do all this is for profit, right? If you consistently are not making profit, number one, the IRSs eventually can come and reclassify you as a hobby, which sucks you guys, I’m just gonna tell you when the IRS tells you you’re a hobby,

i e you have not made a profit in three outta the last five years, and therefore you’re not a for-profit business. Now, you can’t deduct any of your expenses either against your income. So that is not a fun thing to run into. But I think so many people get in that, and it’s fine if you, if you have a hobby and you don’t care if you make money,

okay? But be real about that because I think most people, if you’re doing it, you probably want to be making some money to, to have some kind of compensation for the time and effort that you’re putting into it, right? We, we, it doesn’t have to be impact or profit, right? The best and most sustainable businesses have both.

That is you’re gonna make a better impact too. The Other reason people need to learn from you is because I have someone I love very much, and I’m not gonna say the person’s name because I love and appreciate the advice that they’ve given me for business. But one thing that they had said early on that just kind of stuck in my head was break even.

So I was always thinking about break even and not profit. And then the other piece of advice that I got that was in direct opposition to what you said, and I now buy into what you said for sure was that, you know, you might as well spend the money because you’re gonna get taxed on it at the end of the year. So you never wanna make a profit.

Yeah. But that’s what I’ve always heard from like the most successful entrepreneurs that I knew, you know, that I talked to at that level. And the sad thing is, and I wanna just give a heads up to anybody, if you take that approach and that, and, and one day you go to retire, you Medicaid or whatever is based on your income.

So while you may have been breaking even for all those years and not shown a profit, so you didn’t have to pay taxes, well guess what? Your monthly check from the government, 65, 70 years old and beyond is based on what you reported. Yeah. So you didn’t save that money. Yeah. That’s social security. So, yeah, exactly. So that’s something that hits people later in time when they take that approach.

Also, if you go to buy a house, right? And you’re like, well, I’ve got, I’ve got $200,000 in revenue, but if you showed a $5,000 profit that they’re going off that, that’s your income. Right? And I think a lot of people realize that in the covid world too, where they’re trying to get these loans, like the PPP loans,

for example, which were based off of profit, and they’re like, wait, but I made a bunch of money. And they’re like, no, you didn’t. Yeah, you got taxed on that $5,000. That’s your payroll. That’s how much you can really take outta your business and pay yourself. Right? A lot of people, and I know a lot of solopreneurs that follow this,

where they’re just like, I’d rather spend the money so I don’t have to pay the taxes. That’s not the route. It’s all about maximizing your profit and saving for your taxes. And that’s what I’ll teach you how to do in the program. So we’re talking all about the pricing piece and that was just, that’s literally one module. Oh yeah. One Module that we’re talking about here.

That’s part of FFF. The whole thing goes through, we go through mindset around money because lord knows we need to go through mindset, right? Huge to get rid of that shame, right? We need to, we need work through the mindset stuff. We need to set those goals, but we also go, we go through pricing and profit margins.

Yes. But we go through costs, right? Like how do we look into our costs? How do we know what we should spend? What should we be spending money on versus not? Right? Right. There are some times that it is good to invest in your business. How do you know when you should do that versus not creating a profit plan?

And I’ve changed some things around this time, so I’m really excited to have Crystal go through it again, because we have a different type of profit plan that you can create where you actually apportion out parts of your profit to, to the different pieces of things that you, the different things that you want to accomplish, right? So like Profit first, It’s,

it’s got some similarities to profit. Okay. You could actually use it with Profit first. Okay. But it’s a little bit different. So it, it is a little bit different in how, in how we roll it out, but you can use it along with Profit first, i e opening up different bank accounts and things like that. You don’t have to do that.

I give you other options as well because I know the different bank accounts is, is a lot, but we wanna make sure you’re prepared, right? Like right, you got taxes, you are putting money towards, you wanna put money towards retirement or date debt, pay off or reinvesting back in your business business, how much do you wanna reinvest back in your business?

How much do you wanna pay yourself? Right? So we work through that and make it a really, a really personalized plan for you. And then we do a forecast, and that’s new this year too, crystal, we didn’t have the forecast Added it. So then once you kind of get all of that in place, you have your, your profitability figured out,

then you can forecast out and be like, oh my gosh, this is where I can be in three to five years. Right? Here’s, it gives you that roadmap of, okay, I wanna make a million dollars, how the heck do I get there? Because that’s a lot of times, I mean, I’m making up a, it might be any number that you have in your head,

but, you know, whatever that is, it can, it can give you the path to getting to the place that you wanna go. So I’m really, really, really excited. Can I tell you why I love that so much? Yeah. Okay. So the other thing that I realized the first time I went through it was like I was nowhere near the point I needed to be to do this full-time.

So it made me just like, like you said, I had the mindset shift and just reimagine, okay, what do I need to do? What do I have to, you know, kind of go back and take a look at before I can make this leap for myself or whatever. So hearing you say that is just so perfect because I feel like,

I don’t even know if it’s been a year yet, but I’m already in such a better place that I feel, feel like having that tool is just gonna be so critical to making the transition, you know? So. Yeah, absolutely. So Crystal’s gonna be going back through it with us, right? You’re gonna come back, come through it with us,

but it, but there is so much in Financial, Fitness, Formula you guys, so if you’re on the fence, definitely ask. No, I’m kidding. What? Yeah. Crystal says, do it, just jump, it’s gonna be great. It’s an investment, right? It’s an investment. And what an investment means is it’s gonna turn into more money later,

right? If you put the work into it, and I do streamline it. So would you say from a, I get a lot of people asking, is it gonna be overwhelming? Is there, is it gonna take hours and hours and hours to do the program? What would you say to that, Crystal?

I don’t think it took hours and hours; I don’t remember the level of time it took. I just know the, the impact it’s had on my life.

Love that. So that’s it. Yes. You know, So, So it’s worth it is what you’re saying. Yeah. It’s worth it. I, if you wanna be honest and take an honest look, I mean, most of us are not gonna be able to have somebody give us this type of insight into our business,

you know, because a lot of times we don’t know what, like analytics or whatever to look for to measure what’s going well or what’s not, you know? So that’s why what you’ve taught me is so valuable. And I mean, my gosh, everything that you’ve taught us just this year in your group, you know, like I have been amazed.

I’ve heard people talk about like, you know, give value, give value, give value, but I mean, I passed on the knowledge that you gave us in the group about, you know, applying for different things or whatever, and I help family members, you know, get help from PPP or the EIDL or whatever, you know, like money that they actually don’t have to pay back now for whatever reason.

And so, like, you have just been such a blessing to so many of us, you know, like to me it’s a no brainer. I’m glad that I already did it because I’m that much further ahead, you know, like, but you know, it’s, you’re a blessing Jamie and you really did. You changed my life, you changed my business and you kind of restored hope.

I was at a point where I didn’t, you know, again, I didn’t know whether I had just wasted, you know, four or five years of my life and you gave me hope that I could continue my dream. Yeah. So thank you. You, You’re doing it to me again, crystal. Aw. You didn’t Gimme the tissues wording before we jumped on here.

That is so kind of you to say that’s, that’s, that is my goal in all of this is whatever I am doing, whether it be helping people navigate the challenges of covid, whether it be helping them really just take control of their business finances and just master them and have a plan for themselves that they can really like, keep and have a sustainable business that they love,

right? Yeah. All of that. Like, I am just, I, I want to give everything into everything that I do. Like I, I I want to help people just get to that place. And so thank you. Yeah. It’s very, And you can feel it, you know, you can feel it. And I think we all have our favorite brands or whatever,

and one of the reasons why we love them so much is because we feel cared for. You know, and you do that, you do that well. So You are so, you were yeah, really too sweet this morning. So that was Crystal’s story. I am gonna have to go like, have a, have a whole cry here in a minute in the bathroom,

but I just love hearing stories like yours, crystal, where, and, and like we, and this was all pre Covid, right? You went into Covid. Oh yeah. And we didn’t know that was coming. We had no idea what was coming down the line. And so I’m glad that you were in that program last year and I think now we know.

We don’t know, we know, we know that something is coming; we don’t know what it will be or when it will be. We know that things happen and so the more we can be prepared in our business for those things to happen. Can you ever be a hundred percent prepared for something like a huge pandemic? Probably not. But can you be a heck of a lot more prepared maybe than in the past?

Yes. And that’s what I wanna help you do. You know, girl, I gotta share this with you though, you know? ’cause I mean, the difference with Covid hitting and anything else that could come up is yes, she is very amazing, Stacy, is that I’m not crippling myself. You know, it’s one thing for Covid to come in and cripple your business,you know, I’m foreseen or whatever, it’s another thing for me to set my prices so low that I can’t even make money, you know? Or for me to feel guilty about raising my prices so I’m not volunteering. So that was, that was a huge thing. Like, and I don’t know if we said this already, but I made more money last year.

I made more profit last year than I did in previous years. And that was with Covid. You know, people still needed what they needed. They wanted what they wanted. They had some extra funds, you know, sometimes due to the stimulus or whatever. Some people weren’t as impacted as others. But thankfully, you know, my business still grew,

but I didn’t stop myself. And that was because you showed me how to, you know, run a business. That, that, I love that sentiment, right? Like Covid, you could have something can come in and, and that you like outside forces that can come into your business and wreak havoc. We all know that. But it’s a matter of what can you do on the inside,

like you said, to make sure that you aren’t also contributing. You are, you are, you are not, you know? Yeah. Freaking having your own business, just, you know, by way of, of decisions that you’re making. So I just love your, I just love you. I love you in general, right? Like you’re my OG forever,

crystal, I’m the wall. Like you need to make a collage. This is what I want. I want you to make me a collage of your face. I’m gonna buy it at the right price, right? I wanted FFF, it’s all crystal faces. Oh that’s fun. That’s what I want. That’ll be unique. One of a kind. Yes.

Yeah, yeah. Exactly. Exactly. So thank you. Thank you for coming and sharing your story. Everybody who’s wondering about FFF, I did include the link, Jamie Trull dot com slash buy. You can go check out all the information, all the other things that are in it in addition to getting into profit margins and things that we’ve talked about here.

Ask me any questions you guys that you have, I am around, you can email me, let me know what you wanna know about the program. Like I said, doors closed tonight and they’re not gonna be opening again anytime soon. So people keep asking me when, I really don’t know when we’re opening it. It’s been a year, right? So Crystal was part of my program a year ago.

It’s been a year. So I don’t know when we’re gonna open the doors again because we’re all gonna be walking through this together. This is a program that we go through over a 12 week period now. We have a private Facebook group and everything, a community of people that are gonna walk through this together and I’m gonna be there twice a week to do q and As and things like that.

I know Crystal was on so many of those Q and as absorbing all the things. I remember her being there. So there’s lots and lots of things that you’ll be able to get out of it. We also are doing Community Pods this, this time, which I think will be really fun. We’re putting, like trying to get similar businesses together as we can to create community pods that can get together and walk through and,

and work through some of these challenges together so you can have other handmade sellers in a group together walking through how it applies to them and how, how they are making changes in their own business. So anyway, you guys, thank you for joining us. Crystal, thank you for joining us. Thank you for making me cry like a couple of times is awesome.Thank you Jamie, you guys, I love you so much. And you guys go check out the program, Jamie terrell.com/bye and I hope to see you over there. So have a wonderful rest of your day everybody. Bye guys.