You might think that Quickbooks Self Employed makes sense for your business.

At the onset it looks good. I mean, it’s QuickBooks brand, and it’s the cheapest option.

As a self-employed business owner, I know you want to take managing your finances from complex and time-consuming to simple and fast.

But there are numerous tools and software available in the market that might be a better fit for your business than Quickbooks Self Employed.

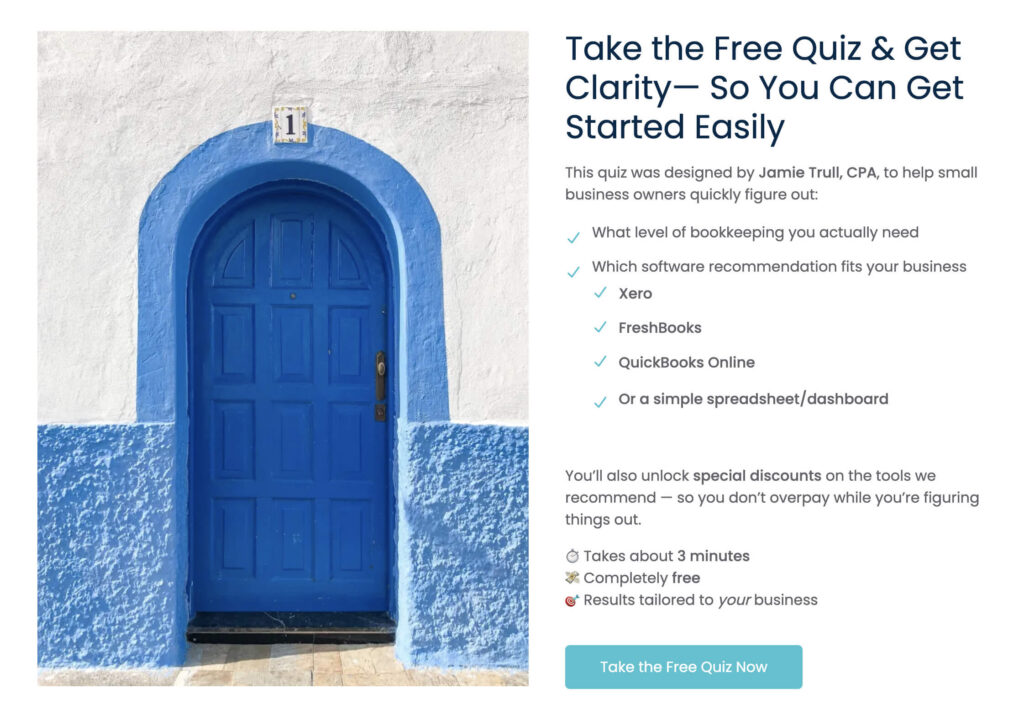

QuickBooks, Xero, or FreshBooks? Get Your Custom Recommendation.

While Quickbooks Self-Employed has been a popular choice among self employed and independent contractor small business owners, it may not be the best option for everyone.

In this vlog post, I will provide an overview of Quickbooks Self Employed, along with its biggest cons.

Additionally, I will suggest an alternative that I recommend instead. Whether you’re starting Quickbooks from scratch, trying to migrate it yourself, or find a Quickbooks freelance specialist.

Take a moment to look past any Intuit Quickbooks Self Employed discounts and compare the features of other QuickBooks products.

Let’s get started and talk about how Quickbooks works!

Transcript has been edited for readability.

The case against Intuit Quickbooks for self employed business owners

Hi everyone!

I’m Jamie Trull, CPA and Financial Literacy Coach, and today I’m gonna be doing a little bit of a deep dive into QuickBooks Self-Employed and specifically talking about a few of the reasons that I don’t recommend it.

Now, do I think that QuickBooks Self-Employed can work for a certain subset of people?

Yes, I do.

But even for that subset of people, I still recommend other options and I’m gonna tell you a little bit about why.

Quickbooks Online vs QuickBooks Self Employed

I do recommed QuickBooks Online. A Quickbooks Online account is a separate product from Quickbooks Self-Employed.

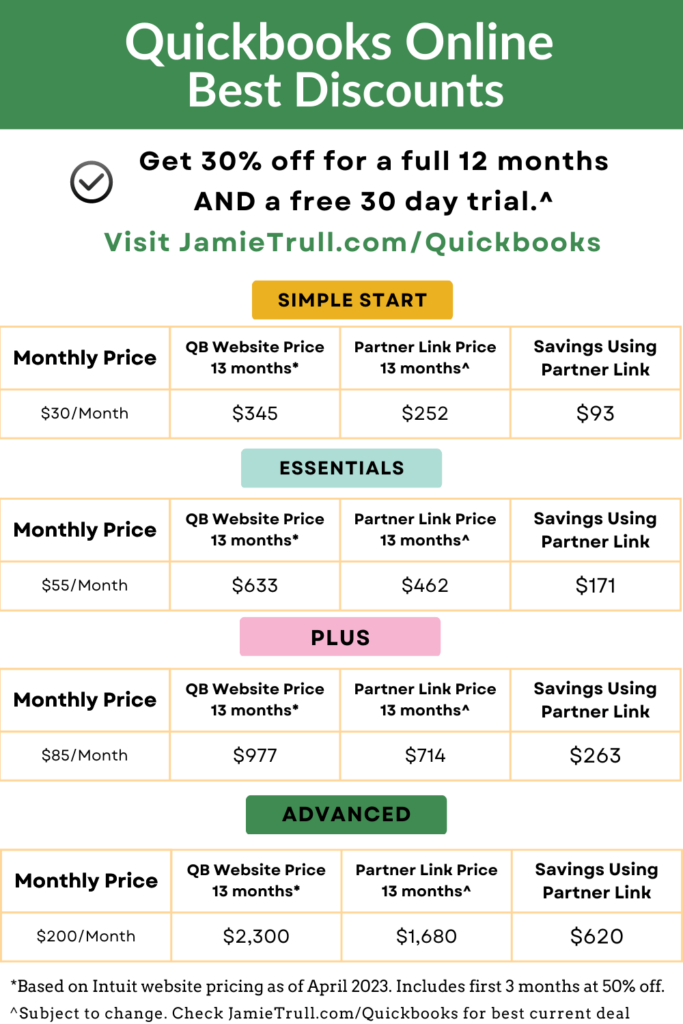

I have some specific QuickBooks Online deals that I’ve worked out directly with them.

So you could check out my specific QBO deals, which typically are better than what you can get on the direct QuickBooks website, especially considering my deals are for an entire year and include a free trial.

[Get all of the details on that in this blog about what to use instead of Quickbooks Desktop Premiere!

QuickBooks Premier Reviews were excellent and many business owners are lamenting this phase-out! But we’ve got a round-up of options for you!]

So go check out JamieTrull.com/QuickBooks to see the current best accounting software deal that I have available for QuickBooks Online account products.

You will notice that QuickBooks Self-employed is not on there, and that is because I don’t really recommend it- for a lot of reasons.

How does Quickbooks Self Employed work?

So first and foremost, if you’re thinking about QuickBooks Self-Employed, you’re probably thinking about it because you’re looking for something that is affordable, right?

You’re looking for the most affordable way to be able to keep up with your finances, and maybe you’re transitioning from desktop software.

But there are other ways to do that on an affordable basis if you don’t need the functionality within a system like QuickBooks or want to pay for professional services.

The reason I don’t recommend QuickBook Self-Employed (QBSE): is that it isn’t a full accounting system.

Quickbooks Self Employed is a glorified spreadsheet.

And I say that with all the love in my heart for spreadsheets.

So you’re paying monthly for a glorified spreadsheet that you will be using, and it’s a spreadsheet a small business owner can’t even customize.

There isn’t additional functionality that makes it a true accounting system.

If you want something simple and cheap, a better option is my P&L Template and Dashboard.

QBSE is not double-entry bookkeeping.

You may not notice that as an end user, but as an accountant, that’s super important.

If you’re gonna bill yourself as an accounting system, then you need to be doing actual accounting, which is double-entry bookkeeping.

This means that every time there is one effect of a transaction, you will have an equal and opposite effect somewhere else.

You may have revenue and business expenses that run through your P&L, and that’s what QuickBooks Self-Employed is tracking.

But they’re not tracking your cash balances or your asset and liability balances.

There is no Balance Sheet to be found anywhere within QuickBooks Self-Employed.

It does not exist because they aren’t tracking anything that would relate to your Balance Sheet.

This means: you don’t have any visibility into what your company’s worth if you’re using QuickBooks Self-Employed.

Tax preparers also don’t like it for this same reason.

I actually have a Self-Employed tax bundle that I’ve put together.

It includes a great P&L Worksheet, plus other awesome tools and training on all things finance.

It basically does the same thing as QuickBooks Self-Employed.

But there is no monthly recurring cost associated with it, and it’s more customizable to your needs.

So I would check that out!

The tax bundle also includes tax savings tools like:

- a mileage tracker (to maximize mileage tax deductions. This mileage tracking is essential for accurate deductions on Schedule C),

- a home office tracker (for home office-related business expenses. NOT personal expenses!)

- and lots of other amazing expense tracking and tax savings tools to get you ready for tax time no matter what time of the year it is!

Okay, so let’s jump to the second reason that I don’t think QuickBooks Self-Employed is the best version of QuickBooks.

Quickbooks Self Employed won’t grow with you.

What I really like about QuickBooks Online products like QB Simple Start Essentials or even Plus is that they will grow with small businesses.

(QuickBooks Simple Start Free Edition has some limitations, but hey, it’s free!)

You can continue to change between those different accounting software versions if you need to.

You can start out with Simple Start and move up if you need to (or move down if you don’t need all the functionality of the version you start with).

And that’s a simple upgrade that you can do. It doesn’t require you to reinvent the wheel or start over in a whole new system.

However, most people don’t know that QuickBooks Self-Employed is a completely different platform than QuickBooks Online.

It’s not even part of the same product.

Maybe you are in a spot in the beginning of your business where QuickBooks Self-Employed really is sufficient.

But then you go to try to upgrade because maybe you decided to elect to be an S Corp or perhaps you hired some employees.

(For recommendations on payroll for small business, read our blog on the Best Payroll Provider For a Self-Employed Individual and Small Business Owners.)

Or you just have additional functionality in reporting that you need.

Are you ready for S Corp tax deadlines? Find out more here! ⬇️

You cannot easily upgrade to the next level of Quickbooks.

So that’s something really important.

If you have any of the QuickBooks Online products like QBO Simple Start vs. Essentials, or Plus, you can move between those fairly seamlessly without any issue.

However, that is not the case for QuickBooks Self-Employed users.

Once you’re on it, you have to start completely over if you wanna work on one of the other QuickBooks products.

And the third reason that I do not recommend QuickBooks Self-Employed is because you can’t customize it.

I love a customized chart of accounts.

Those are the accounts that you are going to be putting all of your expenses and quarterly taxes and sales tax into.

You basically get what QuickBooks Self-Employed gives you, and that’s it.

And for me, a person that loves data and data analysis, I love to create what my P&L should look like, right?

I don’t want something cookie-cutter.

I want something that’s really gonna help me make decisions within my business.

And QuickBooks Self-Employed just does not give you that customization.

However, when you jump into QuickBooks Online, you absolutely can customize to your heart’s desire and so can your accountant.

There’s just so much more functionality to create for self-employed individuals. You can track different streams of business income within different business accounts.

There’s just a lot more tracking reporting capabilities. Again, it’s something that you can grow with.

QuickBooks Self-Employed is really bare bones as far as what it offers.

In the past, one of the draws to QuickBooks Self-employed was the fact that they had an automatic mileage tracker already built in, right?

That you would have mileage tracking that was part of that self-employed app.

That did not previously exist in QuickBooks Online, but now it does.

So QuickBooks Online now has that same ability to track mileage automatically, or you can use an offline mileage tracking spreadsheet if you want to.

However, that’s no longer a draw for QuickBooks Self-Employed.

So many of you are probably considering QuickBooks Self-Employed because it’s economical.

Let’s talk a little bit about price because I wanna show you a couple of things.

Now, of course, prices and promotions are going to change over time.

Right now I’m gonna show you pricing as of when I’m writing this, but obviously this can change at any point in time.

So check out the website for current pricing details.

But we’re gonna jump into a little bit of actual math here to see what makes the most sense for a self-employed business owner.

I want to look at this specifically for the next 13 months.

And the reason I do 13 months is because I have preferential pricing that lasts for 13 months.

So we’re gonna compare the cost using my preferential pricing versus the sticker price.

Let’s compare what’s on the website currently right now as the QuickBooks sale for each of the different versions.

So you can make the best decision for you.

I have put what the per-month sticker price is and the web sticker price.

Now, almost always, QuickBooks is going to offer you a discount of some sort.

Usually for the first three months that you sign up.

Usually, you can get that Quickbooks discount or a free trial, but not both when you sign up directly through the QuickBooks website.

So these are the current sticker prices.

However, when we take a look at what’s currently on their website, QuickBooks is currently offering 50% off for the first three months. You can choose this OR a free 30-day trial on their website.

Sometimes it’s 30%, sometimes it’s 50%. However, right now it’s 50% for the first three months.

I’ve put the discount in the chart below for the first three months and then the other 10 months, because remember we’re looking at 13 months.

So when you look at it this way, yes, QuickBooks Self-Employed looks quite a bit cheaper than QuickBooks Simple Start.

So I can see why people would go with Self-Employed instead of Simple Start.

However, I still recommend Quickbooks Online Simple Start over Quickbooks Self Employed.

The way to get the best deal on Quickbooks Simple Start (or any other Quickbooks Online subscription product) is to use my specially negotiated partner link to join and get a special discount.

Right, my link offers 30% off for an entire year plus a free trial.

To make it a little easier to see the savings, I’ve done a price comparison in the chart below.

You can see that Quickbooks Simple Start now is quite a bit more comparable to Self-Employed from a pricing perspective.

Of course, these prices are subject to change, so click on my partner link to see the most updated pricing.

We’re only talking about an additional $20 over a 13 month time period. And you’ll be getting a whole lot more for that price!

Now, it is true that once that 13 months is up, you are gonna be paying the monthly sticker price for that specific version.

But I still think that it is worth it to you to be able to do Simple Start and then have it be able to grow with you.

Additionally, you can see that our Quickbooks discounts pretty much always are going to be better in the long term than what you’re gonna get off of the website directly from QuickBooks.

Regardless of which version of Quickbooks Online you choose…

Take a look at the different deals that I have going on right now at JamieTrull.com/QuickBooks.

So hopefully you found this video helpful if you’re trying to decide between QuickBooks Self-Employed and something else.

Hopefully, I gave you a little bit of food for thought.

I do recommend QuickBooks Online products.

I do think that they are very robust and they’re something that can grow with you.

So you can check out some of my other articles about QuickBooks.

My favorite is Plus because of all the capabilities that it gives you.

However, like I said, you can start with the lowest and upgrade whenever you need to if you’re getting QuickBooks online.

Frequently Asked Questions About Quickbooks Self-employed

What is the difference between QuickBooks and QuickBooks Self-Employed?

QuickBooks Online is an accounting software that can be used by small businesses of any size, while QuickBooks Self-Employed is designed specifically for freelancers, independent contractors, and self-employed individuals.

Most people want to know: is QuickBooks self-employed worth the headache? No, it’s not.

What about Quickbooks Self Employed with Turbotax? Still, no.

We find QuickBooks Self-Employed lacking, even though it appears to have features specific to tracking expenses, calculating taxes, and organizing invoices for a Quickbooks sole trader and sole proprietors.

QuickBooks Online, on the other hand, has a broader range of accounting features and is designed for businesses that have employees, and inventory, and can grow with your business.

Can QuickBooks be used for self-employed people?

Yes, QuickBooks customers can be self-employed individuals, freelancers, and independent contractors to manage their business finances. QuickBooks Self-Employed has features like mileage tracking, invoicing, and tax calculations that are useful for sole proprietors.

However, self-employed individuals can also use the standard version of QuickBooks Online to manage their finances if they prefer access to a wider range of accounting features.

What are the disadvantages of QuickBooks Self-Employed?

While QBSE is a popular accounting solution for self-employed individuals, it has some limitations and disadvantages, including:

- Limited features: While QBSE has features tailored for self-employed individuals, it doesn’t offer the same range of accounting features as the standard version of QuickBooks.

- No double-entry accounting: QBSE uses a single-entry accounting system that simplifies accounting tasks but lacks the accuracy and complexity of double-entry accounting.

- No inventory management: QBSE doesn’t have inventory management features, which may be a disadvantage for self-employed individuals who sell physical products.

- Limited users: QBSE is designed for sole proprietors and has limited access for multiple users.

- No time tracking: QBSE doesn’t have time tracking features, which may be a disadvantage for self-employed individuals who bill by the hour.

- No ability to grow with your business: If you want to upgrade to Quickbooks Online, you can’t just upgrade your subscription. You have to completely start over in a new system, which is a real pain.

Do you have to pay for QuickBooks Self-Employed?

Yes, QBSE is a paid subscription service that requires you to pay a monthly or annual fee to access the cloud-based platform.

The cost of the subscription varies depending on the plan you choose and it typically comes with a free trial period to test out the service before committing to a payment plan.

QBSE also requires payment for any additional features and services beyond the basic package.

Can Quickbooks be used for personal financial management?

Yes, QuickBooks can be used to manage personal finances. You can keep track of your finances, manage spending and earnings, plan for retirement, and more.

With QuickBooks, you can easily connect to your bank accounts and credit card accounts to track spending over time in one place. You’re also able to set up categories so that you know exactly how much money is coming in or out each month.

Additionally, QuickBooks offers allows users to manage their budget by setting up alerts when something goes over a desired threshold such as bills due or the amount spent on groceries in a single month.

By tracking all these factors using this accounting software, it’s easy to get an overview of your overall financial health. Which makes it easier than ever before to make informed decisions about how best to use your hard-earned money.

This post may contain affiliate links, which means I may earn a small commission if you make a purchase through these links at no additional cost to you (in fact, using our links can typically SAVE you money). We appreciate you supporting our small business by using our links!