There is no denying it, we live in the age of the side hustles.

The internet and specifically social media have made it possible to earn extra income in a million different ways, and I’m here for all of it. As someone who works primarily with women (and a woman myself!) I’m super supportive of any avenue that allows us to contribute financially to the family in a flexible way that frees us from the shackles of a typical 9 to 5 (or should I say 8 to 6, am I right?). According to Forbes Magazine, 57 million workers are part of the “gig economy.” Side hustles are becoming more and more commonplace, especially among women, as we try to balance work and home life.

While it’s fantastic that these opportunities exist, not everyone who side hustles is prepared for all that comes with running a business.

Oftentimes this results in “accidental entrepreneurs” – people who weren’t necessarily looking to start a “business” per se, but did want the opportunity to earn more income in a less traditional way. Perhaps they start out walking neighborhood dogs or selling for a brand mostly just to fund purchasing their own products.

However a solopreneur starts, they still have to navigate the tricky world of record-keeping and taxes, which is often overwhelming and confusing.

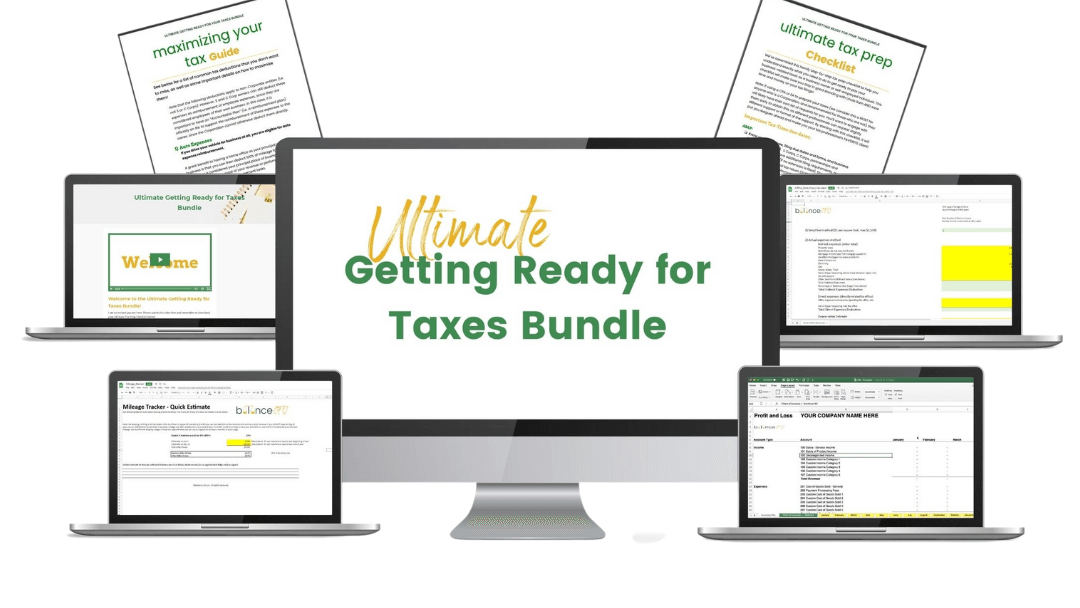

If your numbers are a mess then I’ve got you! The Ultimate Getting Ready for Taxes Bundle is your pain-free roadmap through tax season! It’s all you’ll need to get your business finances ready for taxes…without missing deadlines or deductions! Learn about it here. Our ultimate tax bundle has what you need to understand self employment tax, income tax, and how to track your business income.

Given this group of business owners is most likely to DIY vs. work with a professional, one of the primary ways that these solopreneurs often get their information on topics like tax deductions, etc is through others in their network who are doing the same thing. This often leads to “telephone-esque” advice-giving and overall misinformation. Most of the time the spread of this misinformation isn’t malicious; it’s well-meaning but uninformed.

For example, I’ve seen direct sellers conclude with 100% certainty that off-the-rack workout clothes are a write-off, because the product they sell is related to weight loss and they take pictures of themselves in the workout clothes – therefore it is advertising. As great as it would be if that were true, the IRS has specifically concluded this is not the case, as the clothes can also be worn outside of work.

However, tax deduction myths like this continue to permeate the side hustle world.

The other bad advice I hear repeated regularly is that it is best to maximize your deductions to the point where you don’t have to pay income taxes, often resulting in a loss as business write-offs exceed income. This is especially prevalent in the freelance community, and leads to folks proudly declaring that they “got their income down to zero” so they don’t owe any taxes.

In other words, they didn’t make any money.

Sure – you don’t have to pay income tax, but that isn’t a win when YOU DON’T MAKE ANY MONEY! Ultimately breaking even on your tax return means that you worked for free – something I’m sure few would admit they are interested in doing.

The other reason to avoid spending money on excessive deductions just to reduce your taxes is that you may trigger an IRS rule called the “Hobby Loss” Rule.

Essentially, this rule says that if you don’t make a profit for 3 out of 5 years of business, the IRS can designate that your “business” is actually a hobby.

Why is this a bad thing?

Well, with a business, you can write off all of your expenses against your income and therefore lower the income base that your taxes are calculated against. When you have a hobby, you STILL have to claim all of the income you received on your tax return and pay taxes on it, but you CAN’T write off ANY of your expenses against that income.

Yikes.

How do you avoid the dreaded Hobby designation?

- Get advice from reputable sources regarding what is actually deductible and what is not;

- Spend your money wisely, and don’t use the “it’s a write-off” excuse to spend excess money that isn’t giving you a return on investment;

- Keep in mind that keeping good financial records, separating business and personal, and having robust business processes that show you are actively trying to make a profit (like budgeting and forecasting), will all help you to overcome an IRS Hobby designation.

In general, treat your business like a business and avoid the temptation to take inaccurate advice from well-meaning (albeit unqualified) friends…or friendly-looking strangers on the internet.

Why listen to me? I’m a Certified Public Accountant, and financial statements are my love language. Put down the IB Profen, I know all the tricks of the trade to save you precious time and headaches!

Check out my Ultimate Getting Ready for Taxes Bundle here and you’ll have all the resources you need to pull together an accurate Profit and Loss Statement, make the most of your tax deductions, and stay on the IRS “nice” list (because NO ONE wants to be on their naughty list!).

For more information and a community where you can ask questions and connect with others, please join the Facebook community Financial Literacy for Women Business Owners. And learn more about me, Jamie Trull on my website.