financial literacy coach & Profit Strategist

Jamie Trull

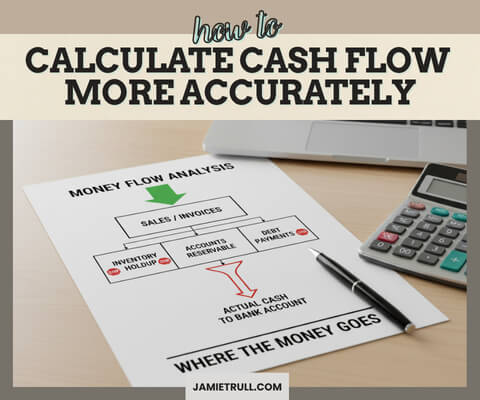

You’re booking clients. Revenue is growing. But your bank account is still whispering “nope.” If that sounds painfully familiar, you are not alone. The truth? Revenue ≠ profit, and profit ≠ cash in the bank. Until you build a simple, reliable cash management system, your business will always feel like a high-stress juggling act—no matter […]

read now

Ready to automate invoicing because you’re tired of sending invoices at midnight, chasing late payments, and wondering which clients still owe you? Thankfully, there’s a better way. Invoicing can be 90% automated with the right setup. So you spend less time billing and more time building your business. In this guide, I’ll walk you step-by-step […]

read now

Your cash flow vs profit scenario: your P&L says you’re profitable… but your bank account says “yikes.” If that sounds familiar, you’re bumping into one of the most misunderstood truths in business: profit and cash flow are not the same thing. Understanding the difference (and managing both) is the line between constant money stress and […]

read now

Relay just rolled out a tiered pricing model for 2025*—and if you bank on Relay (or you’re Profit First-curious and want multiple business bank accounts), you’ll want to know what changed, what didn’t, and how to choose the right tier without overpaying. I’ve used Relay for years because it makes cash management and envelope-style banking […]

read now

The Best Business Budgeting Tool for Team Spending Control (BILL Spend & Expense Review) Feeling buried under receipts, reimbursements, and “who spent what?” surprises? You’re not alone. As your team grows—especially if you’re remote—old-school spreadsheets, manual reimbursements, and shared credit cards start to crack. Enter BILL Spend & Expense (formerly Divvy by BILL): a modern, […]

read now

If your revenue looks great but your bank account doesn’t… your profit might be hiding in plain sight. In this guide, I’m breaking down the 5 most common places where small business owners quietly lose profit—and exactly how to fix each one so you can put more money back in your pocket. 💸 You’ll learn: […]

read now

QuickBooks versus FreshBooks: which one is right for YOUR small business? If you’re a freelancer, coach, consultant, agency owner, or creative entrepreneur, you’ve probably heard both names. But while they’re both “accounting software,” they’re designed for very different users and workflows. Choose the wrong one and you’ll pay for features you don’t use (or miss […]

read now

Hiring a remote employee or managing team members across state lines in 2025? This guide breaks down exactly what small business owners need before they hire remote workers—legally and financially. From multi-state registrations and payroll to remote onboarding, you’ll learn how to protect your business from fines, unexpected taxes, and HR headaches. You’ll learn: ✅ […]

read now

Think Profit First has you covered? Not quite. If you’re still running your business from one account—or even if you’ve set up the classic Profit First buckets and feel like something’s still missing—this is the guide I wish I’d had years ago. I’m Jamie Trull, CPA & financial educator. I’m a huge fan of systems […]

read now

Are you tired of trading hours for dollars in your service-based business? In this exclusive interview, I (Jamie Trull, CPA & financial educator) sit down with successful online course creator Amy Porterfield—online course royalty and creator of Digital Course Academy (DCA)—to answer the burning question: Can an online course really replace your 1:1 client work […]

read now